Expense Voucher

If you have been in the corporate world long enough, you’ve probably experienced being sent away on a business trip which may entail that you use your personal money for the expenses. However, the amount you have spent during your trip will be reimbursed by your company if you are able to show them a proof of expense. You may also see meal vouchers.

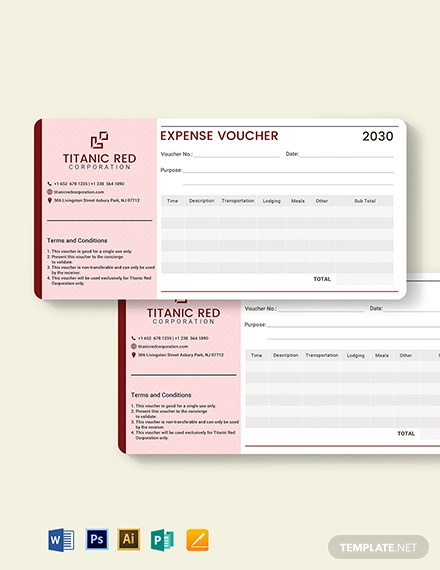

Expense Voucher

Daily Expense Voucher

Cash Expense Voucher Example

An expense voucher is a reliable, formal document that can help you show the financial department of your company the amount that they owe you for the business trip.

Office Expense Voucher

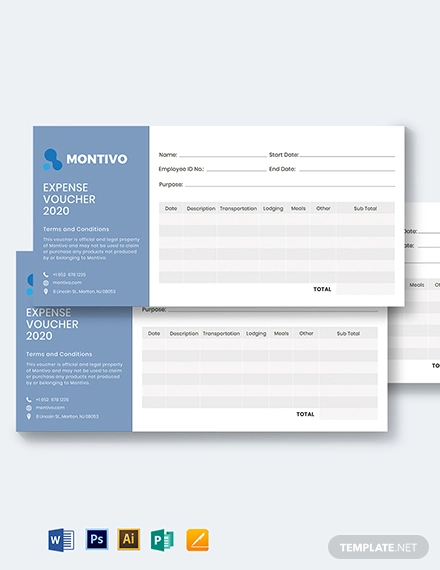

Business Expense Voucher Template

Free Expense Voucher Template

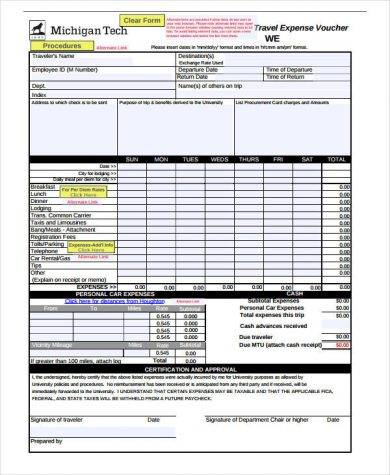

Travel Expense Voucher

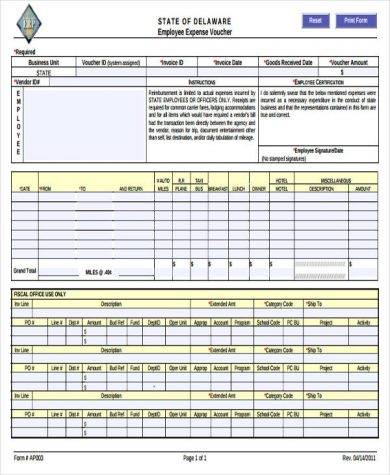

Employee Expense Voucher

Vouchers serve as proof of a series of transactions that are worth a specific amount of money. Since they serve as evidences of a performed service, people tend to consider the word voucher as synonymous to receipts. Vouchers may also come in three different forms. You may also see receipt vouchers.

1. As a proof. As mentioned, this is the main role that vouchers play. They serve as a trail that financial departments can follow to track expenditures.

2. As a written record. Since voucher are written documents, they can serve as tangible proofs of a completed transaction. They are also reliable in making sure that all fiscal matters are recorded properly.You may also see summer vouchers.

3. As a written authorization. Vouchers also entitles the holder to the amount of money written on the voucher he holds (cash voucher), or to an amount of money the holder can spend on future transactions (credit voucher).

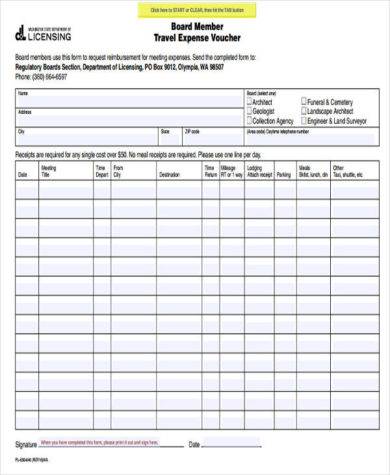

Board Member Travel Expense Voucher

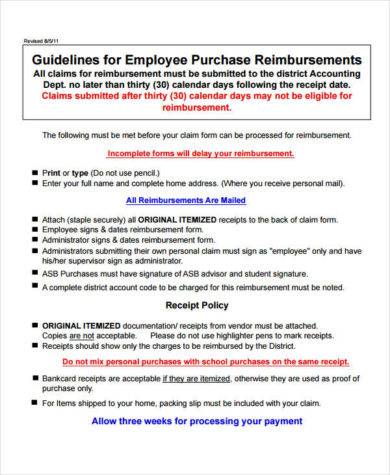

Purchases Expense Voucher

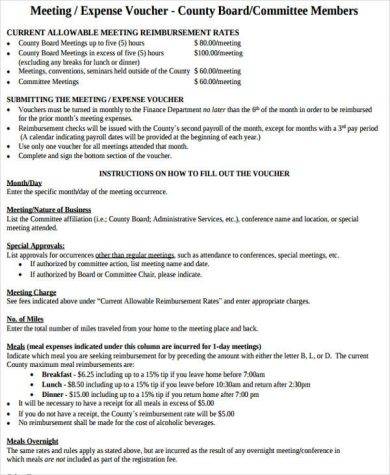

Meeting / Expense Voucher

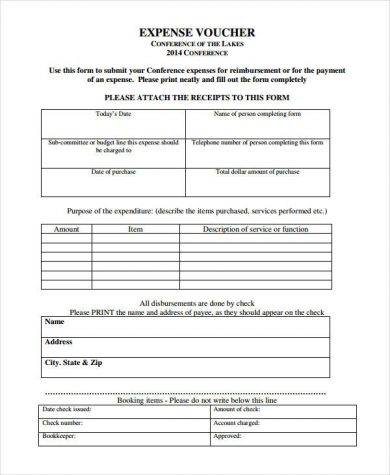

Expense Voucher Printable

What Are Written In An Expense Voucher

Since expense vouchers are considered a financial documentation, there are certain important information that should not be missing from it to be considered factual.

1. Name and address of the company.

If this expense voucher is for the use of your company only, this information is for formality’s sake. However, for vouchers with transactions from wider areas, this detail is necessary to be able to give credibility to the document.You may also see payment vouchers.

2. Date.

The exact date, month, day, and year, should be clearly provided.

3. Voucher Number.

All vouchers have serial numbers to make it easier to keep track of them in the company’s accounting books. This can also make every voucher recognizable from the hundreds of other vouchers that look exactly like each other. You may also see free vouchers.

4. Information about the credited.

Of course, the document should include to who the company owes the money to, the name and the address. It should also include the exact details and purpose of the payment

5. Revenue Stamp.

Companies often have policies that when the transaction or amount owed reaches $5001, a revenue stamp should be provided. It is important to note that documents can only be deemed legal with the presence of revenue stamps, which makes this aspect of thee document absolutely necessary.You may also see prize vouchers.

6. Proof of Amount Received.

There should be some sort of proof that will accompany the payment process. For example, if the transaction was done in cash, then signatures, along with the full amount details, are mandatory.

7. Signature of the company’s representatives

In cases like this, the accounting department is responsible for providing necessary information for the payment process. It is important that at least one member of the company signs the vouchers that belongs to them. After further verification, a company head, or anyone with similar position, should co-sign the document.You may also see business vouchers.

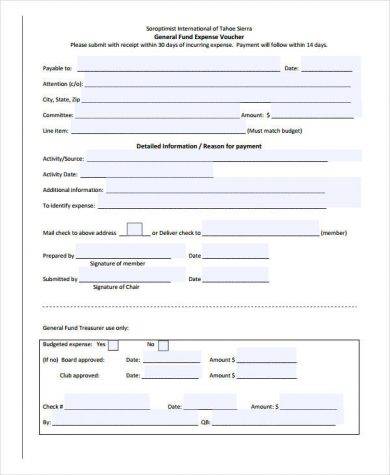

General Fund Expense Voucher

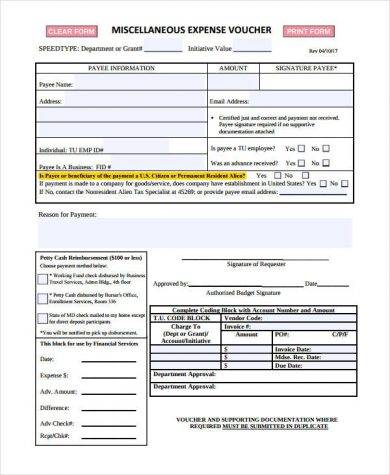

Miscellaneous Expense Voucher

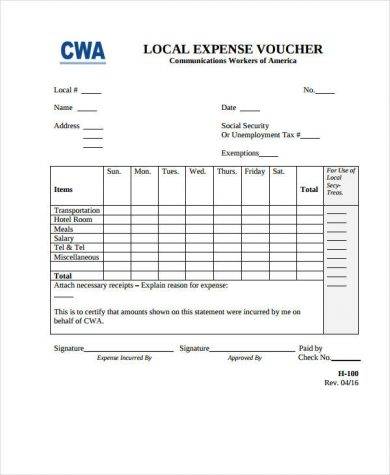

Local Expense Voucher

Hope Expense Voucher

Types of Vouchers

1. Payment.

This type play the most basic purpose of vouchers which is to serve as proofs of transactions by cheque or cash.

2. Receipt.

This type of voucher is released whenever a customer makes a purchase. These are necessary to help the business keep a record of transactions made. You may also see food vouchers.

3. Purchase.

Vouchers for purchase are basically just an evidence that the customer has taken the products or services he has purchased with him.

4. Sales.

These serve as inventories to prove to the customer that the transaction is not fictitious. It’s more like an evidence of the business’s legitimacy.You may also see marketing coupons.

5. Contra.

These vouchers are tasked in passing on the contra entries. A contra entry is simply what you call the transfer of funds from one entity to another.

6. Journal.

This voucher is used when the transaction is done neither through cash or cheque. This option is pre activated by the purchaser. Journals are where the transactions will be recorded which, later on, will be transferred to the ledger.You may also see thank you vouchers.

7. Adjustment Vouchers.

These vouchers keep track of the changes in the market or business stock.

8. Loss statements.

These vouchers help in identifying the losses that have occurred.

Vouchers have two main classifications: the cash vouchers and the transfer vouchers.

1. Cash Vouchers.

These are the basic over the counter transactions. It is further divided into two:

- Credit Voucher is a document that serves as an evidence of a transaction in the form of payment cards before the system can have the time to post the invoice on the company’s records. These include receipts from sales, investments, assets, and even debtors.You may also see printable vouchers.

- Debit Voucher include paying for goods, paying of debts, and even cash expenses.

2. Transfer Vouchers.

Basically every non-cash transaction is under transfer vouchers.

Important Tips To Remember About Vouchers

1. Vouchers must be prepared by the company for any sort of payment.

2. Vouchers should have all the necessary details, especially the signature of whoever’s in charge. This will legalize your voucher for documentation.You may also see discount coupons.

3. Every business should have a voucher register where all voucher transactions are listed in numerical order.

Disadvantages of Vouchers

Additional printing expenses. If you really look at it closely, printing and even distribution will not be that much of a burden to a business. However, for small, startup establishments, this additional financial responsibility will only serve as a liability.You may also see fitness vouchers.

Vouchers have limits. Unfortunately, vouchers cannot be used to purchase every need of every consumer, which means that the number of services it offers is limited. Some of its services may not also prioritize the main needs of every basic consumer. Also, there is a possibility that the consumers do not like the goods they can purchase with their vouchers, or that they think they could do better. So, in the end, they will still go back to cash.You may also see business coupons.

Vouchers is not for everyone. As aforementioned, for staring businesses, vouchers may only give them financial problems, which means that these merchants may be hesitant to be a part of the growing number of companies that have embraced vouchers. Plus, if they do participate, they may make redeeming vouchers difficult because of the hesitation of actually giving them away.You may also see cash receipts.

Vouchers can also be used in connection to certain day to day commodities such as food, which means that it is not limited to the transfer of income, which can further mean that it can cater to different, although not all, customer types. Despite the disadvantages, vouchers continue to prove itself useful. Embracing the use of it in your company is a big leap that would only mean your business is growing. You may also see spring vouchers.