Corporate Finance Essentials

Corporate financial management is a practice inside the corporations composed of several financial principles that are applied to create and maintain different functions and aspects of the firm. The financial condition of the firms should be sound enough to generate more revenues. Though conditions are not the same always about the financial status that is why a proper management plan is required to make and keep functioning balanced.

9+ Corporate Financial Management Examples in PDF | DOC

1. Corporate Financial Management Example

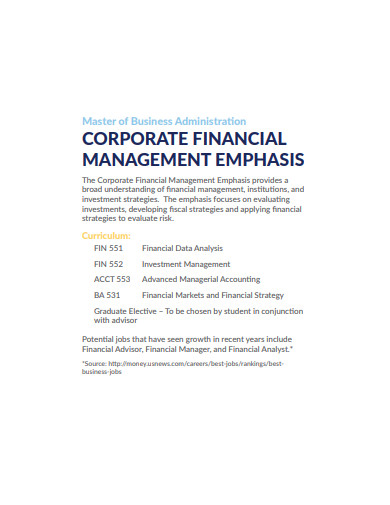

2. Corporate Financial Management Emphasis

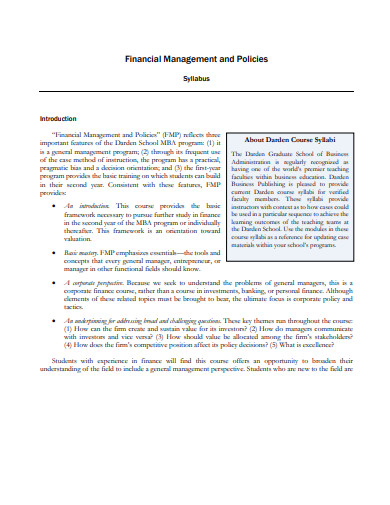

3. Corporate Financial Management and Policies

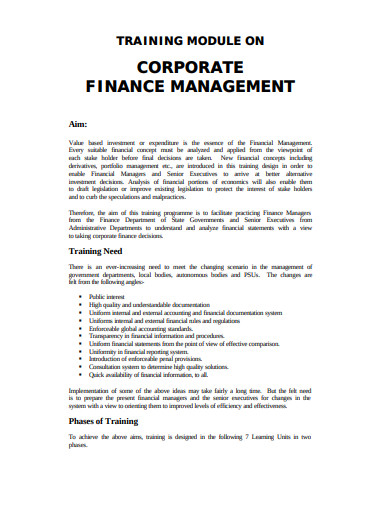

4. Training Module on Corporate Financial Management

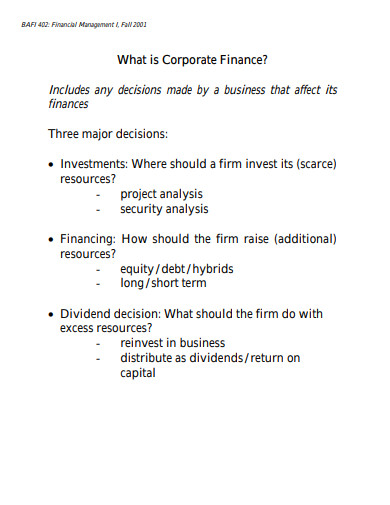

5. What is Corporate Finance in Financial Management

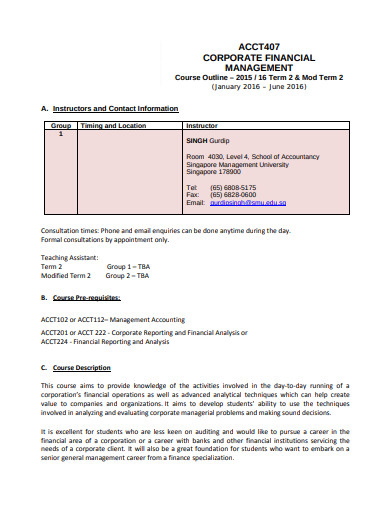

6. Corporate Financial Management Course Outline Example

7. Effect Of Corporate Governance On Financial Management

8. Financial Management vs Corporate Governance

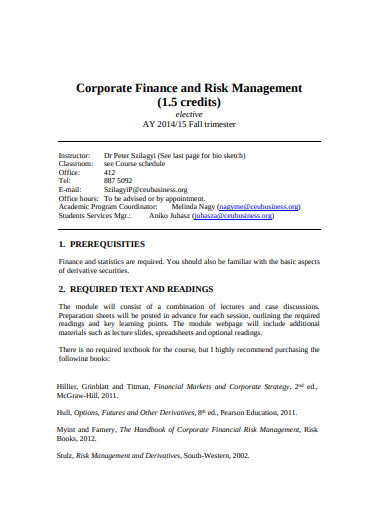

9. Corporate Finance vs Risk Management

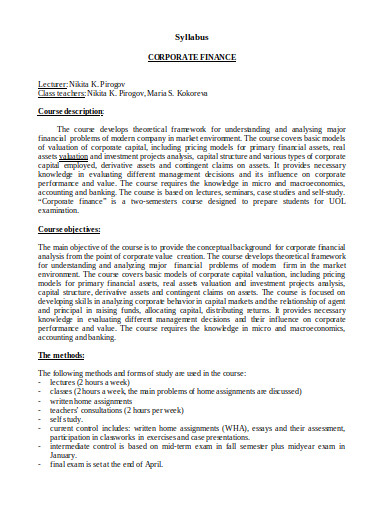

10. Corporate Finance Management Syllabus Example

What Does Corporate Finance mean?

Corporate finance refers to several financial activities and responsibilities that a firm needs to conduct and play. This mainly includes capital, investments, profits, revenues, equity, etc. Proper management of this can help in making proper decisions for the trade and its development. It helps to decide and directs how to invest money and pay the debts. Such management should decide the shares that the shareholders must receive and contemporary assets, liabilities, financial statement control.

One of the main concepts that must be understood to understand financial management is to understand the following.

Debit Capital:

Corporations normally take debts from the other sources to utilize them for the growth of the business. The debt capital needs to be returned respecting the interest of the party that they have imposed on the debt. The corporate finance management should keep a good eye on its management unless the firm would be liable to sell its collateral assets to pay the debt at the end.

Equity Capital:

Corporations might need to sell their shares to cope with the needy areas in the business if there is no upward trend in the company values. Such activities can help to avoid negative developments and gain higher returns from the investments. It can also attract more and more investors towards the corporation as positive nad progressive is sold at a high rate.

Preferred Stock:

Preferred stocks are normally considered as hybrid instruments as it might retain a combination of features. Thought rated by many credit rating companies it doesn’t have the high ratings as it doesn’t offer the same guarantee and interest payments from the bonds.

Capital Investments:

Capital investment is a practice of capital budgeting that decides and identifies the aspects of the business that needs investments. It estimates the future possibility of returns and profit in the business and spends accordingly. This study and speculation need to be done carefully to take the proper decision.

Capital Financing:

This practice is responsible for outsourcing the capital either as debt or equity. A corporation doesn’t spend only its capital in the business but it asks the lenders for their investment, banks for a loan, etc. The financing needs to deal with such activity.

Short-Term Liquidity:

Short term liquidity refers to the instant management of immediate and current assets and liabilities along with the current cash flow. It focuses on to carry forward the continue projects and tasks.

What is Finance Management?

Financial management is the work of planning, controlling, organizing several financial conditions and responsibilities. Using the capital to generate revenues and buying assets. Some proper and systematic financial management plan helps to navigate its functioning.

Scope of Financial Management

1. Investment decisions for capital budgeting and working capital decisions. Where the former is an investment in fixed assets the latter is the investment in current assets.

2. The financial decision is another scope in this sort of management that is based on collecting capital from different sources.

3. The dividend decision is taken by the manager to distribute the Net profit among the shareholders. Apart from sharing the profit, the manager should also decide and retain profit that is required for the enterprise and its expansion.

Different objectives of Financial Management

1. To manage the procurement, controlling financial resources, allocations, etc.

2. To keep the fund supply regular and constant.

3. To make sure returns are distributed to the shareholders adequately out of the Net profit and market price shares.

4. To make sure that the procured funds are being utilized at the maximum rate to generate maximum revenue.

5. To make sure that the investment is done at the secure stocks so that chances of loss is less and profit is more.

6. To have a proper plan and strategy the manage the financial and capital transaction and status. It should be sound and strong enough so that it doesn’t get affected by paying the debts.

Financial Management Functions

1. The financial manager in your firm needs to estimate all the financial requirements of the firm adequately that depends on the future programs, policies and expected costs and profit.

2. Shaping the capital structure and investment timeframe depending on the equity capital a company possesses and the funds it will raise.

3. Choosing the sources of funds are many like, issuing the shares and debentures, loans, and by public deposits drawing.

4. Investment in secure ventures to get maximum and assured profit with less loss.

5. Dividing the profit to the shareholders and keeping some for future enterprises.

6. Controlling the several liabilities, paying the expanses of the firm, and maintaining the stocks, new purchases, etc.

7. Controlling the finances and capital by investment strategy planning, ratios analysis, financial forecasting, profit and loss control, etc.