Elements of Comparative Market Analysis

A Business market analysis is an assessment conducted to evaluate the overall condition of a market, including its value, volume, and its nature or environment. It is usually conducted in order to identify the factors affecting a market’s condition, as well as the strategies or resources needed for a market to grow and develop.

Comparative market analysis (CMA) is the term given to the process of examining the prices of similar properties sold in the same location or area at present. Real estate agents typically conduct comparative market analysis in order to determine the comparable prices, and a few feature differences of such properties, especially when dealing with sellers or buyers.

Free Market Analysis Example

Importance of a Comparative Market Analysis

A comparative market analysis enables a real estate agent to determine the differences of similar properties with regards to its features and pricing. This allow him/her to make adjustments for the identified differences between the sold properties and the ones being purchased (at the moment) in order to obtain and offer a fair selling price for each property. Upon obtaining this information, a real estate agent will be able to impart the information to both the seller and the buyer.

At times, a comparative market analysis can be conducted by an individual who plans to sell his/her property. A comparative market analysis an individual in identifying the value or selling price of his/her property, using the prices of similar properties in his/her area as basis. This gives the individual an overall idea of the property’s fair market value assures the seller that his/her property is being sold at a fair selling price. At the same time this keeps the buyer confident that he/she the property is not overpriced, reducing the chances of overpaying.

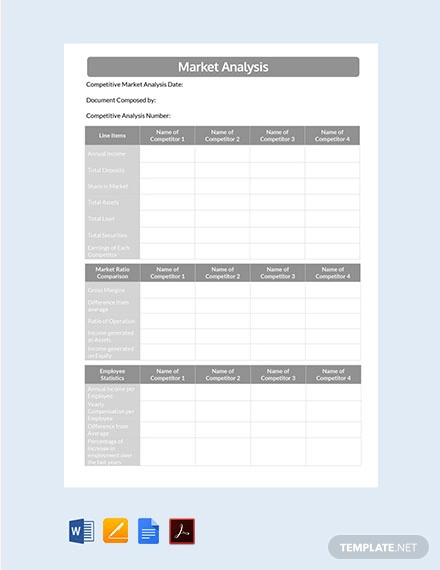

Elements of a Comparative Market Analysis

A comparative market analysis example is an effective tool to ensure that the price of a property matches its quality. A comparative market analysis therefore needs to be effective in order to meet the expectations of both the seller and the buyer. Here are the basic elements one needs to know in order to make a comparative market analysis effective.

- Market area knowledge and expertise. You need be knowledgeable about the different properties in your area, including the smallest details which might be the reason why prices differ.

- Collection of similar properties to be compared. A careful collection of properties to ensure that you get to compare properties which are close to identical. This makes making adjustments easier.

- Price adjustments for property differences. Learn how to properly make price adjustments for the differences your find in each property.

- Evaluation of market competition. Do a market analysis to another market listing the same properties and their prices. With this, you will be able to evaluate how such market assign prices for each property.

- Presentation of results in an understandable manner. Not everyone understands the technicalities you might include in your presentation, so make sure to present in a way your readers can easily understand.