10+ Mutual Fund Examples to Download

A mutual fund is a collected capital from different investors, managed professionally, and invested in a common investment objective of the investors. Mutual funds are invested in different aspects like bonds, equities, market instruments, and other securities.

Even the investors in this funding might be either retail or instrumental by nature who gain profit on their collective investment through a proportionate distribution amongst the investors after calculating the Net Asset Value or NAV.

What are the Different Types of Mutual Funds?

1. Fixed-Income Funds

The main focus of this fund is on the rate of returns like government bonds, debt instruments, etc. Such a fund portfolio is said to generate income through interests and then passes it on to the shareholders.

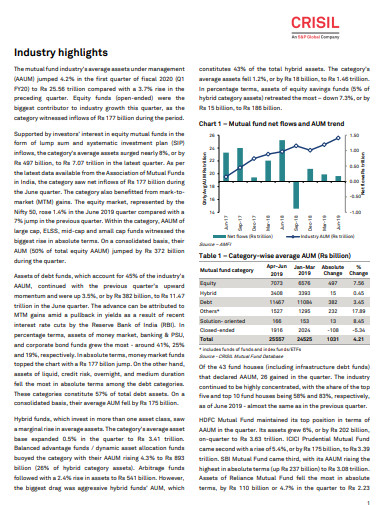

2. Equity Funds

Equity funds refer to the investments in the stocks. Equity funds are themselves can be divided into different categories for the size of the companies they invest in. It can also be categorised on the basis of its approach and its investments either in domestic or foreign equities.

3. Index Funds

the index fund investors believe that the beating market consistently is hard and expensive that is why buying stocks that can correspond with a major market index like Dow Jones Industrial Average.

4. Balanced Funds

Also referred to as asset allocation fund, balanced fund refers to the funds used to invest in both stocks and bonds as it helps to reduce the exposure of risks.

5. Money Market Funds

The money market is a safer place to invest relatively, as it comprises short-term debt instruments, government treasury bills, and other risk-free securities. It doesn’t offer substantial returns so losing your capital is not your tension in this market funds.

6. Income Funds

Income funds primarily invest in holdings and bonds that possess high quality like the corporate bonds to provide interest streams. It aims at providing steady cash-flow to the investors.

7. Global Funds

As the name suggests this fund is invested in foreign assets that means anywhere in the world and thus might include the native country too. These funds can be a well-balanced portfolio, risk-reducing in nature by diversified investments but it also has political risks some sort of volatility.

8. Exchange-Traded Funds

ETFs are in many ways more preferable among the investors as a better investment vehicle to pool capital and plan strategies consistent in mutual funds. Structured as investment trusts they are benefited by stock features for being traded on a stock exchange.

What are the Benefits and Flaws of Mutual Funds?

Benefits

- It focuses on the diversification of funds in different securities that reduce the chances of risks.

- In mutual funding, open-end funds, and unit investment trust shareholders are allowed to sell their holdings back to the funds at an equal price to the net asset value of the holding of the fund.

- In mutual funds, open and closed-end funds hire professional managers to manage their investment portfolios.

- It provides the ability to the common individuals to participate in the investment directly even in the foreign markets.

- Mutual funds services with check writing and convenience.

- These funds are regulated by governmental bodies.

- The transparency of the information in mutual funds helps the investors to have an easy comparison.

Flaws

- investors have to pay different sorts of fees for investing in mutual funds.

- It gives less control over the recognition of gains and over timing.

- the investors can hardly predict the income they can have from mutual funds.

- There is hardly any space for customization in the mutual funds.

10+ Mutual Fund Examples

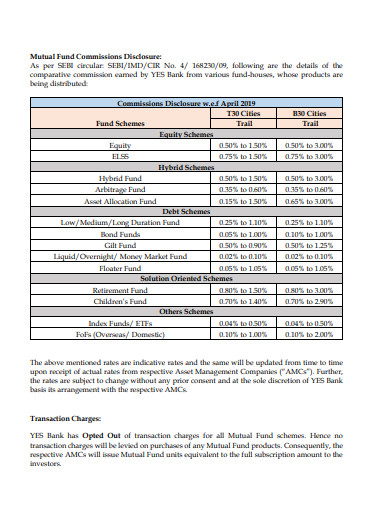

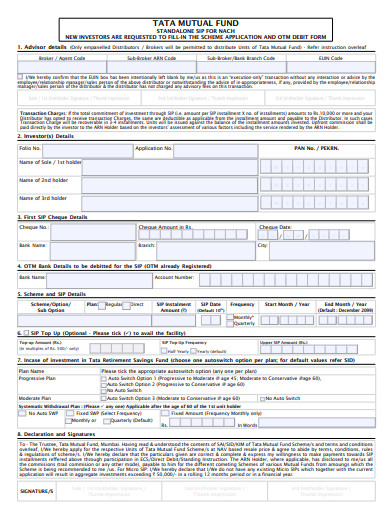

1. Mutual Fund Commissions Disclosure Example

If you have an interest in investing in stocks and mutual funds, it is very important to first know about its different aspects and how it works. If you master in that before investing you would be less likely to face failure in gaining the returns. That is why we suggest you should have a look at the mentioned example template on mutual fund statement on commission disclosure. This template can also serve your purpose of disclosing the commissions on your mutual fund trade. You can have a look at this template and grab it easily if you like it.

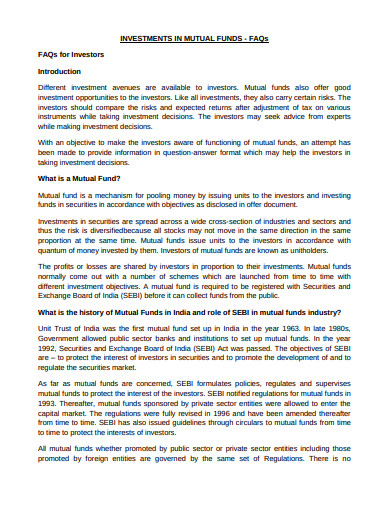

2. Investments in Mutual Funds Example

If you are running a mutual fund company or are interested in investing in mutual fund companies, the given sample of the template might simplify your job. The template frames a proper investment plan covering different aspects and strategies on those aspects in a precise way. You can check the template out before downloading it if you have any doubt in its strategized steps and then choose it accordingly.

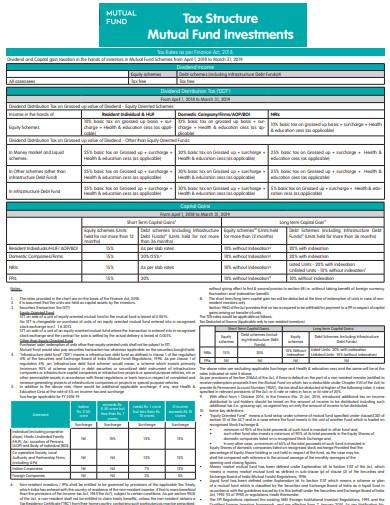

3. Tax Structure Mutual Fund Investments Example

If you are an investor of mutual funds this template should belong to your investment planning documents. Because the template frames all the tax structures on different mutual fund investments. So have a look at the template and be a little more specific on your investment. As you have to just click once to get the template, so try it today!