18+ Revolving Credit Examples to Download

A lot of things in life are very expensive and will require the person to create a large dent in their bank and savings account. One of the ways to mitigate this and save one’s budget is to avail and use the revolving credit model of payment.

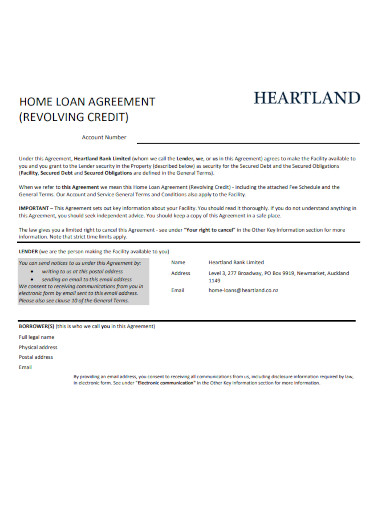

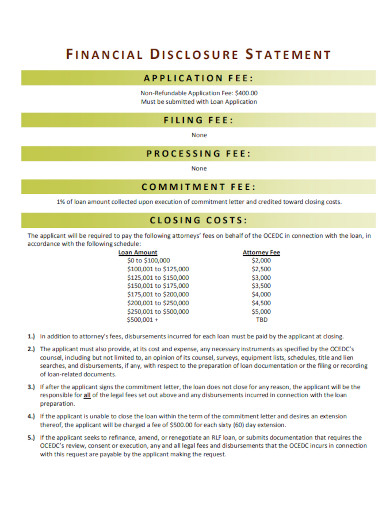

1. Home Loan Agreement Revolving Credit

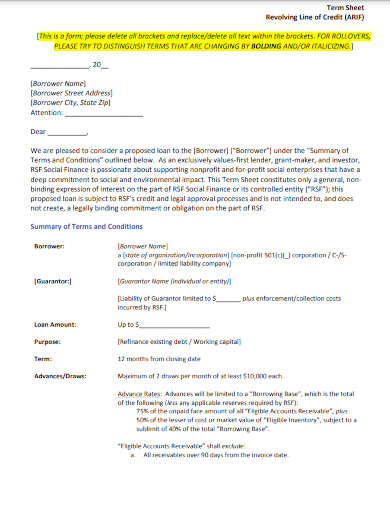

2. Term Sheet Revolving Line of Credit

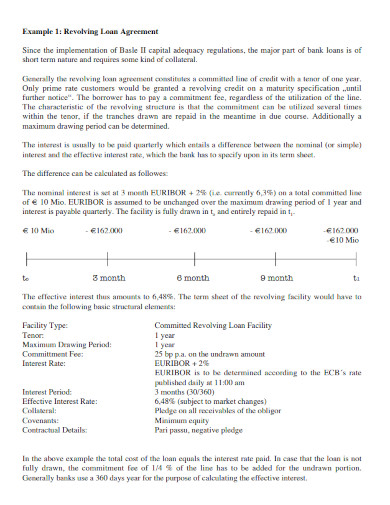

3. Revolving Credit Loan Agreement

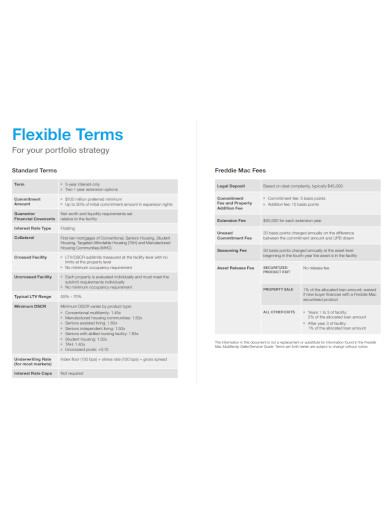

4. Revolving Credit Facility Term Sheet

5. Revolving Credit Agreement Example

6. Sample Revolving Credit Agreement

7. Revolving Credit Subordinated Loan Agreement

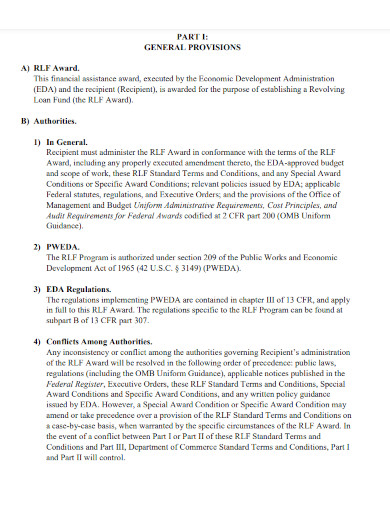

8. Community Development Revolving Credit Loan Fund

9. Revolving Credit Loan Fund Application

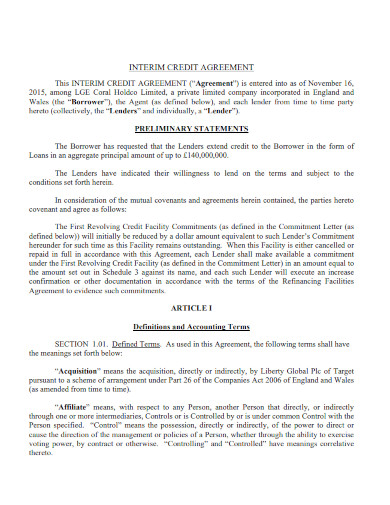

10. Revolving Interim Credit Agreement

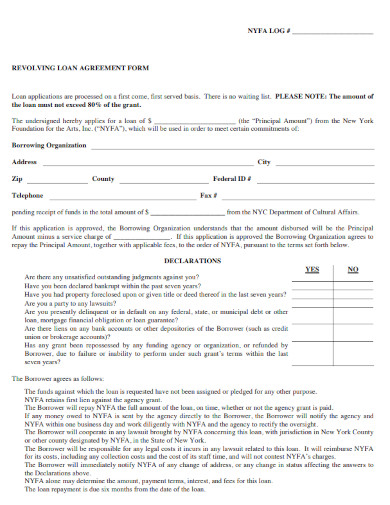

11. Revolving Credit Loan Agreement Form

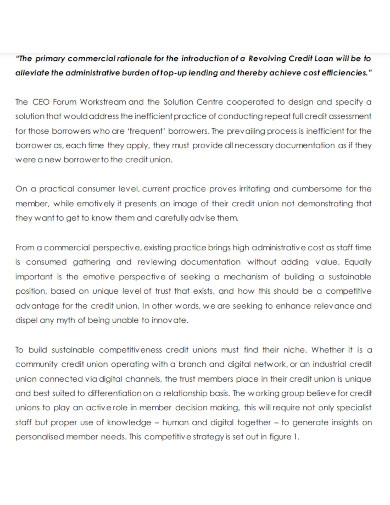

12. Revolving Credit product for Credit Unions

13. Revolving Credit Loan Terms

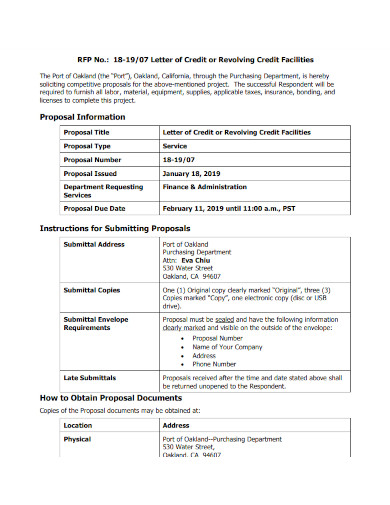

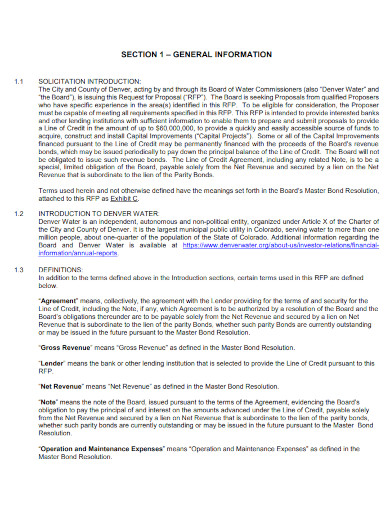

14. Revolving Credit Request for Proposal

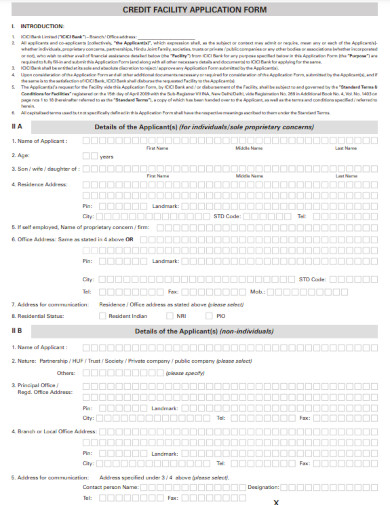

15. Revolving Credit Facility Application Form

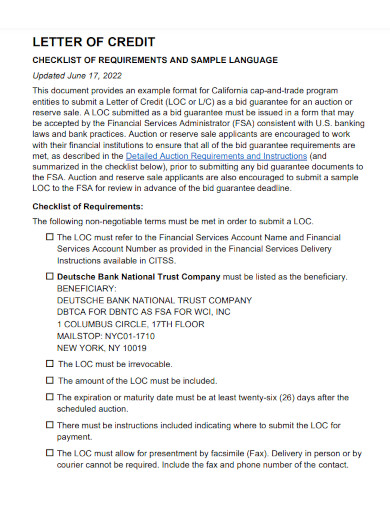

16. Revolving Credit Letter Template

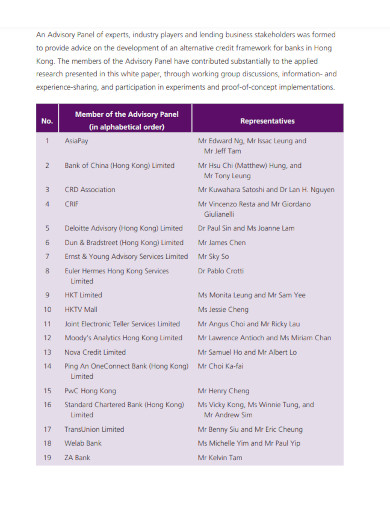

17. Revolving Alternative Credit Scoring

18. Line of Revolving Credit Request for Proposal

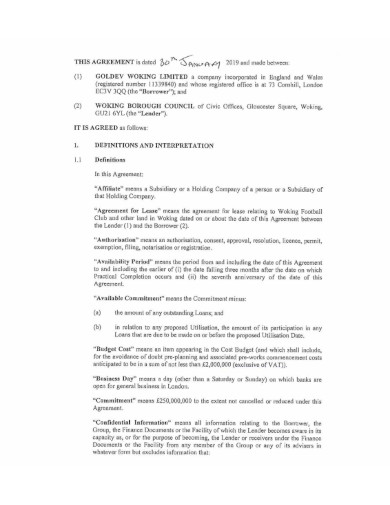

19. Revolving Credit Loan Facility Agreement

What Is Revolving Credit

Revolving lines of credit provide individuals and companies with a continuous source of credit they may draw from frequently without needing to submit a new application without a specific purpose or context. Some revolving credit deals are centered around a specific service like home improvements and the development of a community. If you want to learn more about revolving credit, then you may read the articles and examples named Revolving Credit Facility Term Sheet, Example of Revolving Credit Agreement, Revolving Credit Subordinated Loan Agreement, and Revolving Interim Credit Agreement.

How To Avail a Revolving Credit Without a Specific Purpose

The revolving credit model of payment allows the person to borrow the full amount needed to pay for a specific product or service without needing to pay the whole cost immediately. This cost will be split into various proportional payments that are scheduled and properly paced across a specific timeframe. Just note that the amount you have to pay is subject to interest and might increase the amount of money you owe over time.

Step 1: Obtain a Credit Card or A Personal Line of Credit

The first thing you must do is to obtain a credit card from a bank as this will be used as one of the main methods in the availing of revolving credit. Alternatively, you may obtain a personal line of credit from an unsecured source. Just be sure that the revolving credit facility you are choosing can be trusted and is legitimate, not only that but you must also check the terms stated in the revolving credit.

Step 2A: Make the Purchase with the Credit Card

You must make the purchase with the credit card you have availed from the bank. Just be sure to select the installment plan of the shop you are using the credit card

Step 2B: Use the Money Loaned from The Personal Line of Credit

If you don’t have a credit card and are using a personal line of credit instead, you must instead use the money that was loaned to you. Just note the amount you have to pay and be sure to pace it out properly.

Step 3: Pay Back the Loan Using the Revolving Credit Model

The most important part of the loan is the part where you will pay back what you owe through the revolving credit model. Be sure to pay it at the right time as having a loan is a very tedious and stressful process the longer it goes on.

FAQs

Is it good to have revolving credit?

With revolving credit, you can take out loans up to a predefined amount as needed and then settle the debt once you have the money. Revolving credit enables a person to get a certain item to pay for at a later time with some repercussions if it is used appropriately. Revolving credit is the greatest option if you want the freedom to use it month after month without having a clear goal in mind. This means that if you are strapped for cash but are confident you can pay at the right time, it will be a good way to minimize the amount of money you will have to spend.

What is the effect of revolving credit on one’s credit score?

Your FICO credit score, which is the number most lenders use, may be impacted by any credit you utilize. The impact will depend on how you handle the credit and might be either favorable or unfavorable. Your credit score will rise if you have revolving debt that has been paid in whole. However, opening too many revolving credit accounts too quickly may not only reduce the average age of your credit but also give lenders the impression that you may be in need of further credit.

What is a revolving credit facility?

With a revolving credit facility, you may borrow money, utilize it to fuel your business, pay it back, and then borrow it once again when you need it. This facility serves as the borrower’s revolving loan broker. It is one of several adaptable funding options available in the current alternative finance market.

Revolving credit is a type of loan that allows the person to obtain a specific sum of money without needing to pay all the loaned money in a single go. Instead, the person will need to pay the loan in installments, freeing up some of the space in the person’s budget and bank account.