9+ Stock Sale Agreement Examples

Usually, large, stable companies would offer shares of stock to the public. The stock signifies ownership in a corporation and represents a claim on the entity’s assets and earnings. This means that the holder of a stock has a portion of ownership interest in the company. You may also see service agreement examples.

For example, if you will buy a certain number of shares of Google, then partly, you became an owner of Google and thus, you are entitled to receive a portion of its earnings. Isn’t that great? But before you can enjoy this benefit, your purchase of stock must be made legal and formal through stock sale and purchase agreement. More discussion with regard to stock sale purchase agreement can be found in the succeeding sections.

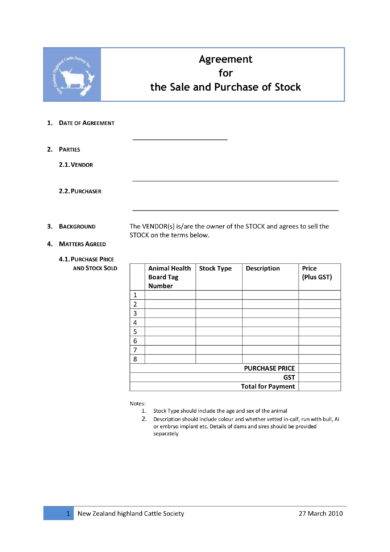

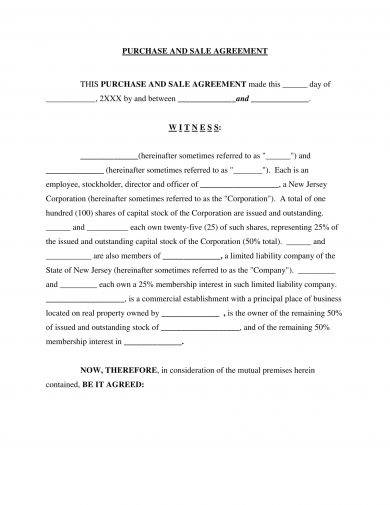

Agreement for Sale and Purchase of Stock Example

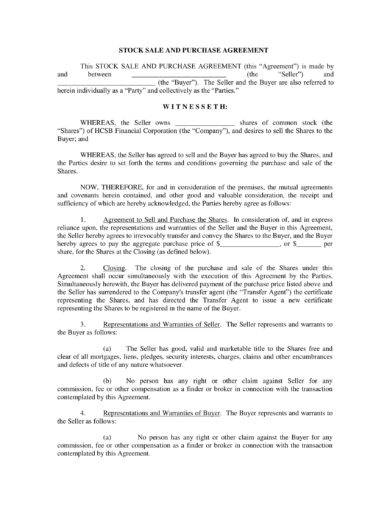

Basic Stock Sale Agreement Example

Community Rehabilitation Company Stock Sale Agreement Example

What Is a Stock Sale and Purchase Agreement?

This is an agreement that sets forth and finalizes all terms and conditions related to the purchase and sale of the shares of a company. It covers the following sections:

1. Interpretation

In the first part of a stock sale agreement, an interpretation must be written. Additionally, in the interpretation, it must include the definitions for all the major terms used in the overall body of the agreement. This is to render the agreement comprehensive to both parties involved. A comprehensive agreement is a must to avoid misunderstanding between the parties.

2. Sale and Purchase of Stock

Usually, this section includes the terms and conditions of the sale and purchase of stocks. This section also itemizes the important information with regard to the stock such as the purchase price, any purchase price adjustments, the purchase price allocation for tax purposes between the seller and the buyer, dispute resolution mechanisms, closing date, and deliveries. You may also see management agreement examples & samples.

3. Representations and Warranties of the Seller

In this section, it provides that all the general statements that the seller are signing off to be true. This presents the authority and capacity of the seller; the binding agreement that is to be executed and delivered by the seller; SEC reports; title to share stating the seller is the lawful, record, and beneficial owner of all of the shares; free and clear of any liens, claims, agreements, charges, security interests, and encumbrances whatsoever.

4. Representation and Warranties of the Buyer

This section provides that all the simple statements that the buyer are signing off to be true. It states that the buyer has all requisite power, authority, and capacity to enter into the agreement, disclosure stating that the buyer has reviewed the SEC reports and is aware of the company’s business and financial condition, and investment representations.

5. Matters Related to Employees

In this section, it states and provides terms on how employee benefits and any accrued bonuses are to be handled post transaction. This is to ensure that everything is clear to the parties involved and to avoid future confusion or misunderstanding with regard to the basic agreement.

6. Indemnifications

This section provides the complete details on all indemnifications to be provided by either the seller or buyer to each other for any costs that may arise post transaction resulting from conditions that existed prior to the deal closing. This is important so that the parties involved will know ahead what are their indemnifications in case of unperceived mishap. You might be interested in business agreement examples.

7. Tax Matters

This section will clarify any special tax treatment that either the seller or the buyer may be entitled to. Usually, there is a tax expense involved in the purchase or sale of stock, and this must be included in the discussion on the agreement to prevent misunderstanding between the buyer and seller. You may also see partnership agreement examples.

8. Governing Law

In this section, it must be stated that the agreement shall be construed, interpreted, and enforced in accordance with, and shall be governed by, the laws of their corresponding state or country without reference to any applicable choice or conflicts of laws principles.

9. Counterparts

It must be stated in this section that the standard agreement is executed in any number of counterparts, if any, and by the several parties in separate counterparts, each of which shall be deemed to be an original, and all of which together shall constitute one and the same. There are a lot of ways in which you can present this statement, but just make sure it is comprehensible to both parties.

10. Further Assurance

Lastly, you can include a further assurance section in your agreement that specifies that the parties shall execute and deliver to other party such further instruments of assignment, transfer, conveyance, and confirmation and take proper action upon the request of other party in order to fulfill the purposes stated in the commercial agreement.

Comprehensive Stock Sale Agreement Example

Minimalist Stock Sale Agreement Example

Mobile Telesystems Stock Sale Agreement Example

Plain Stock Sale Agreement Example

Basic Types of Stock

There are a lot of types of stocks or shares based on the nature of their issuance and based on the powers and benefits it gives to the holder of such stock. However, generally, there are two main basic types of stocks namely, preferred stock and common stock.

1. Preferred Stock

Generally, this type of stock does not have voting rights but has a higher claim on assets and earnings than the common shares. Owners of preferred stock, also known as preferred stockholders, receive dividends before common shareholders and have priority in the event that a company goes bankrupt and is liquidated. They are given the priority to receive dividends first before the common stockholders. You may also see what is a business agreement.

2. Common Stock

Usually, this type of stock entitles the owner to vote at shareholders’ meetings and to receive dividends. Majority of stocks is issued in this form. Owners of common stock, also known as common stockholders, get one vote per share to elect the board members, who oversee the major decisions made by management. This may yield higher returns than almost any other investments. You may also like simple agreement letter examples.

The classes of common stock are as follows:

1. Blue Chip

These are usually issued by a nationally recognized, well-established, and financially sound company. These companies sell high-quality and widely accepted products and services, and they are known to still be profitable in the face of adverse economic conditions, which helps to contribute to their long record of stable and reliable growth. You may also check out business agreement letter examples.

2. Growth Stock

This type of stock is a share in a company whose earnings are expected to grow at an above-average rate relative to the market. It usually does not pay a dividend because the company would prefer to reinvest retained earnings in capital projects. The investors for this type of stock choose these stocks based on the potential for capital gains and not on the dividend income; hence, it is risky. You might be interested in subcontractor agreement examples.

An example of a type of industry offering growth stock is the technology industry.

3. Emerging Growth Industry

Companies providing this kind of stock are those companies in which their businesses are formed around a new product or idea that is in the early stages of development. Oftentimes, an emerging industry consists of just a few companies and is centered around new technology. So typically, these stocks are only few and they are, in nature, risky. You may also see agreement letter for payment examples.

4. Income

This type of stock is issued by mature companies with high dividend yield and few prospects for growth or diversification. These are typically utility companies and can also be blue chip companies. As common stocks are naturally risky, it is expected that in this type of stock, there is a risk involved in order to receive a fruitful reward or return, hence the term “risk-return trade-off.” You may also like marketing agreement templates and examples.

5. Cyclical

This is an equity security whose price is affected by the ups and downs in the overall economy. Simply stated these stocks rise and fall with the business cycle. This relates typically to companies that sell discretionary items in which consumers can afford to buy more of in a booming economy and cut back on during a recession. You may also check out roommate agreement examples.

6. Counter-Cyclical or Defensive

This is a type of stock in which the underlying company belongs to an industry or niche with financial performance that is negatively correlated to the overall state of the economy which will affect the movement of the price of the stock in a direction that is opposite to the general economic trend. This means that appreciation occurs during times of recession and depreciation in value occur in times of economic expansion. You might be interested in how to write a separation agreement.

7. Speculative

In this type of share, the investor believes that its market price will immediately rise, hence, speculative. It has a high degree of risk, such as a penny stock or an emerging market stock. But still, many traders are drawn to speculative stocks because of their higher volatility which creates an opportunity to generate greater returns in exchange for a greater risk. You may also see consignment agreement examples.

Simple Stock Sale Agreement Example

Stock Sale and Purchase Agreement

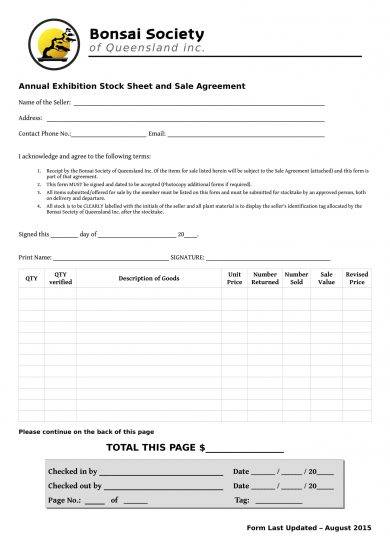

Stock Sheet and Sale Agreement Example

Recap

If you want to be a part owner in a huge company, especially those that you think could no longer be bankrupt but can surely thrive and be profitable in the future years, you can purchase a number of its shares. The sales-purchase transaction must be in a simple agreement called stock sale and purchase agreement.

This general agreement covers different sections which are basically as follows: interpretation, sale and purchase of stock, representations and warranties of the seller and buyer, matters related to employees, indemnifications, tax matters, governing law, counterparts, and further assurance.

Stocks can also be categorized mainly into two: common stock and preferred stock. There are a lot more categories of stocks that denotes different rights by the holder, but the above two are the main types. Furthermore, common stocks classified into different classes which are the following: blue chip, growth, emerging growth industry, income, cyclical, counter-cyclical or defensive, and speculative. You may also see agreement examples.

Overall, there are a lot of advantages that the holder of a stock can benefit depending on the type of stock that he or she is holding.

Lastly, don’t miss to check out the examples and templates of stock sale agreement given in the above section.