11+ Debt Management Plan Examples to Download

Addressing all the terms of an outstanding debt must be recorded accordingly. If you want a written agreement that can put together all the details about the specified transaction, then developing a debt management plan through the help of an agency that is an expert in credit counseling will be highly beneficial on your part.

A debt management plan is the agreement that is used to specify all the items that a creditor and a debtor has agreed upon. Just like scope management plan examples, debt management plans also differ from one another depending on the scope of the transaction, the weight of the debt of a person, and the conditions that a debtor is bound in. If you want to create a debt management plan, you can refer to the downloadable examples that are available for you to browse through and thoroughly observe in this post.

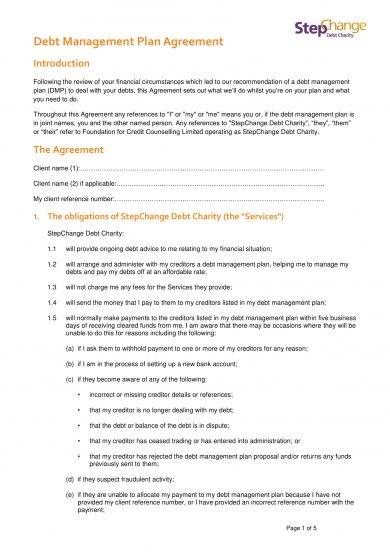

Debt Management Plan Example

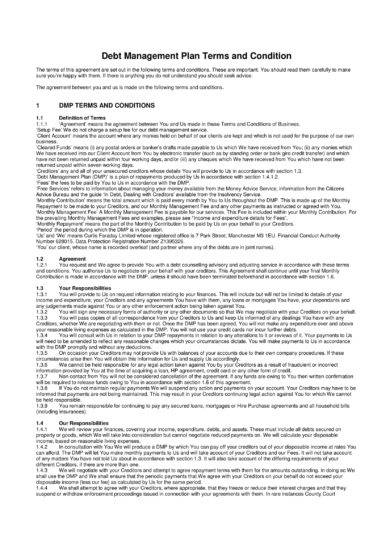

Debt Management Plan Terms and Conditions Example

Debts Management Plan Guide Example

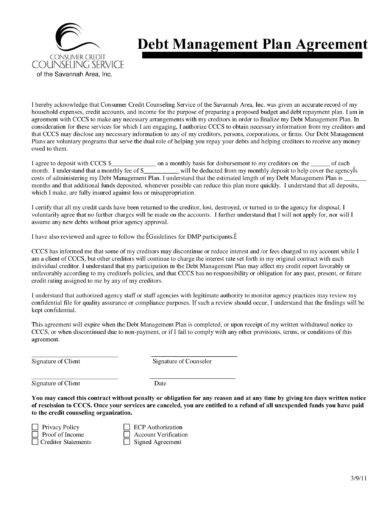

Detailed Debt Management Plan Agreement Example

Using Debt Management Plan with Professional Recommendations and Expert Advice

Different kinds of management plans are created for specific purposes, objectives, and reasons. As an example, a change management plan is created to guide shifts and changes that will be applied in a process, a transaction, a program, or an activity. A debt management plan, on the other hand, is made to help people who are in debt.

A great debt management plan can help consumers, who find it hard to be free from debts, in a lot of ways. If you feel that you are struggling to ensure that all your payments will be made on time or if you just have a list of debts to pay, then maybe it is already time to consider to use a debt management plan. There are different entities who can provide you with a debt management plan. You may also see communication management plan examples.

With this, it is already your responsibility to ensure that you will trust a credible service provider like a group of debt management plan specialists or a credit counselor. Here are some ways on how you can use a debt management plan while consulting professionals for their recommendations and advice:

1. Think of ways on how you can pay your debts in the best and most realistic way possible. You can consolidate all your debts as one of your options. Your debt management plan must present the terms and conditions of debt consolidation as you need to be consistent with the payments that you will make or you will have the potential to lose any property that you have involved in a consolidation program. You may also like quality management plan examples.

Moreover, professionals must give their insights on whether you are equipped and prepared to undergo debt consolidation in any program or form.

2. A credit counselor is one of the best options when it comes to getting help for debt management. If you want a debt management plan that is fit for your current condition, then it is essential for you to trust your money management and budget allocation to a professional. It will still rely on you to follow and execute your financial decisions but getting help from credit counselors can also shift the way you look into your spending and debt management. You may also check out data management plan examples.

3. Enroll yourself on debt management plan services. There are several organizations that have this particular kind of program.

Aside from ensuring that they will pay your debt in a timely manner, proper budgeting of your expenses and the like can be observed. However, you have to make sure that you will first research about the debt management plan services and programs as well as the entity who offers them so that you can validate the credibility of both the service provider and the services they offer. You might be interested in performance management plan examples.

Strategies for Paying Off Debt With Debt Management Plan Example

Debt Management Plan Protocol Example

Debt Management Strategy and Plan Example

Can Debt Management Plans Really Be Helpful?

Most management plans allow organizations and businesses to properly manage, develop, and evaluate certain processes, activities, programs, and transactions. This is also how debt management plans work. A debt management plan helps an individual to pay his or her debt based on their ability to do so. Hence, different factors must be considered when creating and using this document.

If a debt management plan will be created with keen observation and proper planning, then it can have higher chances of successes in relation to the possibility of an individual to be debt-free. Here are some of the advantages and benefits that you can experience if you will enroll in an effective and efficient debt management plan:

- A debt management plan can calculate the amount that you need to allot for your debts. Considering your budget and your expected expenses, a debt management plan can present you with a realistic and attainable amount that you can allocate for debt payment every month or every particular time period.

- A debt management plan can help you arrange and prioritize all your debts. In this manner, you can assess which debts are essential to be paid first.

- A debt management plan can make it easier for you to work off your current debts. Moreover, debt management plans can provide you with options on how you can pay your debts in the fastest, easiest, and most effective way possible. You may also like what is a cost management plan?

- A debt management plan may help you get the trust of some creditors. If you will enroll in a debt management plan, there are chances when interest rates can be lowered and other kinds of fees can be removed or be waived. However, be reminded that this is a situational basis and does not always happen all the time. You may also check out project plan examples.

- A debt management plan will enable you to have a more efficient way of paying your debts. Debtors usually just deposit the money to the debt management plan service provider and all the other processes will already be taken cared of by the organization. This means that paying loans, balances of credit cards, and/or other kinds of debts can be easier. You might be interested in risk plan examples & samples.

- A debt management plan can guide you when it comes to making logistical decisions related to your debts. This way, you can properly manage not only your debts but also the way you use your funds.

- A debt management plan can give you access to professionals who can counsel you with what you need to do. Hearing the recommendations of professionals can help you a lot when making sound decisions about your debt payment and debt management. You may also see risk management plan examples.

Medium Term Debt Management Strategies and Action Plan Example

Debt Management Plan Fact Sheet Example

Money Management Plan for Expenses and Debt Payments Example

Debt Management Plan Agreement Example

Tips in Making and Using an Outstanding Debt Management Plan

Always ask your credit counselor especially if there are items in the action plan or other content of the debt management plan that are unclear to you. Do not hesitate to clear any inquiries that you have. It is best for you to ask questions so that you can get the actual and accurate answers from professionals.

Aside from this, here are more suggestions, guidelines, and tips that you can incorporate in the planning, creation, development, and usage of a debt management plan:

- Know how monthly payments are determined. You have to be critical when reviewing a debt management plan as it will affect not only your debts but also the amount of money that you can use for your finances right now and in the future. You may also see behaviour management plan examples.

- Make sure that you will be given updates about your debt payment and management. Keep track of your debt management plan progress and ensure that you will have access to your account and the transactions that are done by the management who offered their services to you. You may also like crisis management plan examples.

- Ensure that your creditors already have the debt management plan in their hands and that they have already accepted the terms and other content of the document. You should continue personally paying your creditors if there are still no official response about this matter so you will not be charged with late fees and other additional charges. You may also check out time management plan examples.

Keep in mind that debt management plans may look the same in terms of how they are formatted but there are actually different information that may be included within them. Hence, have a specific debt management plan that is fit for your needs and do not just rely on the references that are readily available online.

Try creating or using a debt management plan now.