11+ Accounting Financial Statement Analysis Examples to Download

Accounting is the ultimate way of jotting down all the transaction information in a systematic way that it can communicate well. Accounting statements are a numerically described document that is less likely to be understood without proper details. That is why it needs to be summarized along with some verbal connotation details on the transaction details.

Financial statements are not much different from accounting statements. Financial statement analysis studies and tries to gain an understanding of different financial and non-financial aspects of the company or the organisation. This study is conducted taking the details from the financial reporting periodically. Such a study helps to make different decisions for the company’s future performance.

What is Financial Performance?

Financial performance is never derived deliberately company stakeholders and management have to add some value to it to make the company perform well. A company employs different corporate financial methodologies to make the organisation potential enough to generate revenues as expected by the management and the planners.

11+ Accounting & Financial Statement Analysis Examples

1. Standard Financial Statement Analysis Example

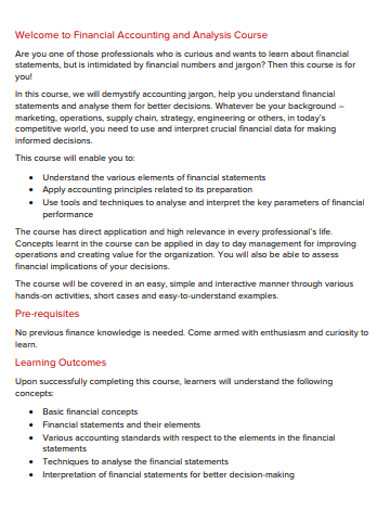

2. Basic Financial Accounting Statement Analysis

3. Financial Accounting Statement Analysis for Entrepreneurs

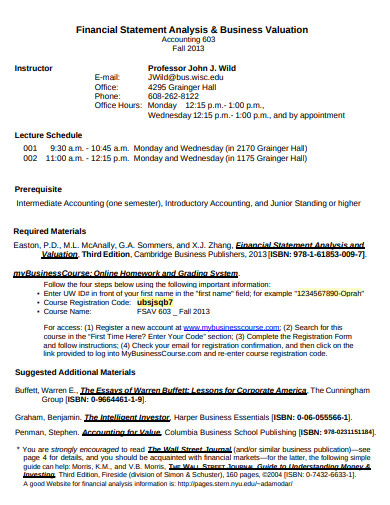

4. Advanced Financial Statement Analysis Example

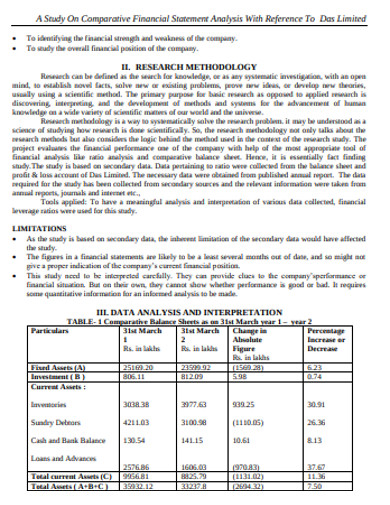

5. Comparative Financial Statement Analysis Example

6. Simple Financial Accounting Statement Analysis

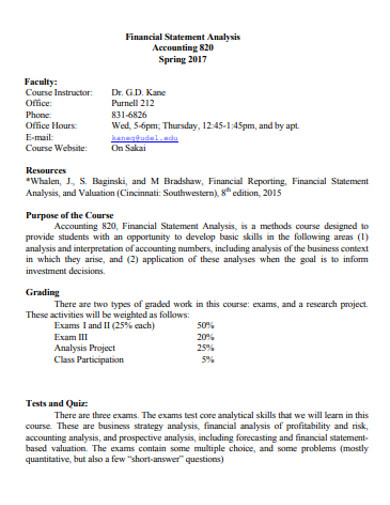

7. Financial Accounting Statement and Analysis Course

8. Financial Business Statement Analysis Example

9. Financial Assets Statement Analysis Example

10. Financial Statement Analysis in DOC

11. Financial School Accounting Statement Analysis

What are the Main Components of Financial Statement?

Every company mainly uses three financial statements to specify monitor their accounts for managing the projects and describing details to the stakeholders. This practice builds a high level of trust and dependency among the stakeholders. The three statements have similarities among themselves following description can make it more clear to you.

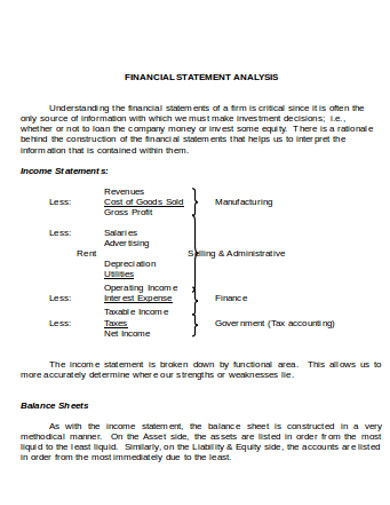

1. Balance sheet

2. Income Statement

The income statement specifies the details of the revenue generated after deducting all the expenses and liabilities and calculating the net profit and loss.

3. Cash Flow Statement

How to produce Effective Accounting and Financial Statement?

The mentioned steps can be useful to produce an effective Accounting and Financial statement analysis.

Step 1: Study the Industry

While analysing the financial statement of the industry or the organisation a detailed study of the several activities needs to be taken into the examination. You can apply different techniques and tactics for its study that looks fit for the study

Step 2: Study the Organisational Strategies

The different strategies employed by the organisation needs to be studied and identified to take reference and help in future analysis. As it can direct you on many financial summary processes to design the statement jotting all the details.

Step 3: Study the Past Financial Statements

An organisation’s past financial statements have a lot to teach in the other investment. The financial statements are the numerical message and figures that can give you ideas on different aspects of the business. Thus studying past financial statements of the firm can help you to what to do and what not to do in your next project.

Step 4: Study Current Asset and Liability sources

The financial statements should equally detail the contemporary asset capital productions and contribute to the firm’s net worth and the subtotal amount of liabilities.

Step 5: Prepare the Final Statement Draft

Observing and studying all the data and details of financial figures you the final draft of the financial statement can be designed. It should add the details of all the sales, purchase, production, lending, investment, etc details in the statement.

What are the Methods of Framing Financial Statements?

Normally two methods are used for financial statement analysis; one includes the horizontal and vertical method, and the other includes several ratios.

Horizontal Analysis:

This analysis derives and compares the data and information from the different past financial statements and studies them to conclude at the end.

Vertical Analysis:

In this sort of analysis, the data or each line item is calculated mad stated as some percentage of the gross sales or any other item. And every line item is listed as the percentage of the total income.

There are different sorts of ratios used to calculate in analysing the financial statements which minutely gives you insight about your business and trade assets and liabilities.

Efficiency Ratios:

- This ratio studies annual inventory turnovers, calculating the frequency of the earned or collected accounts data. With this ratio, the measurement of creditors being paid with their dues is done, and assets are shown being used to generate revenues.

Liquidity Ratios:

- This technique is used to communicate if an organisation is paying its debts instantly by converting the assets into cash. It describes and communicates the pay-ability of liabilities. It also focuses on deducting inventory by the available contemporary assets to pay the contemporary liabilities.

Solvency Ratios:

- Solvency mainly deals with how a business pays its long term responsibilities and obligations with the help of the equity amount for covering the debts. It also graphs the assets brought by the taken debts.

Profitability ratios:

- The profitability ratio is used to study if the company or the organisation is their investment into profit and which sources were most effective in the profit-making process. It studies the returns that assets are providing and generating. It also studies the returns of the equity by seeing if the assets are used properly.