35+ Financial Statement Examples to Download

The best way to determine that your business is in a stable financial situation is by developing a financial statement. This document is a statement analysis that reviews and analyzes the potential progress of finances in your business. By then, you will understand when or what changes you need to take to make the financial health of the business consistent.

35+ Financial Statement Examples

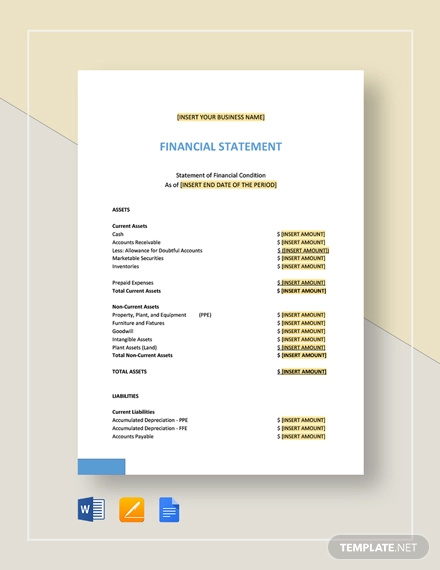

1. Financial Statement Template

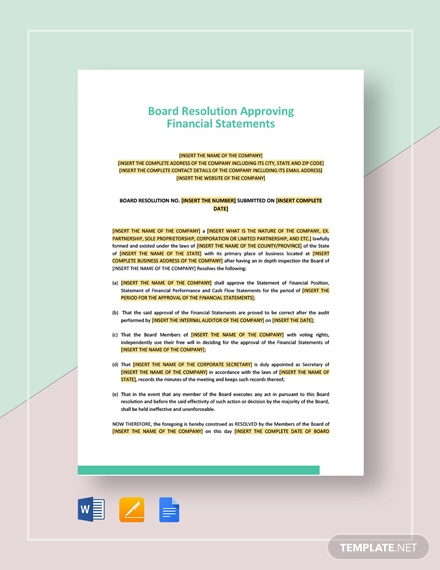

2. Board Resolution Approving Financial Statement

3. Certification Enclosing Financial Statement

4. Request Delay in Providing Financial Statement Template

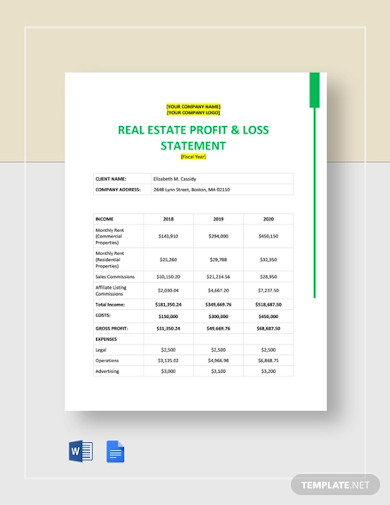

5. Real Estate Financial Statement Template

6. Financial Statement Analysis Template

7. Basic Financial Statement Template

8. Minimalist Financial Statement Analysis Template

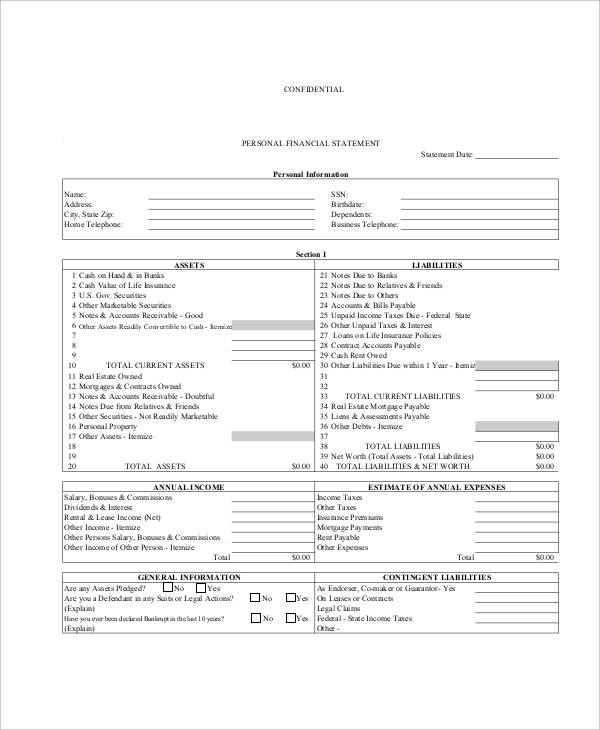

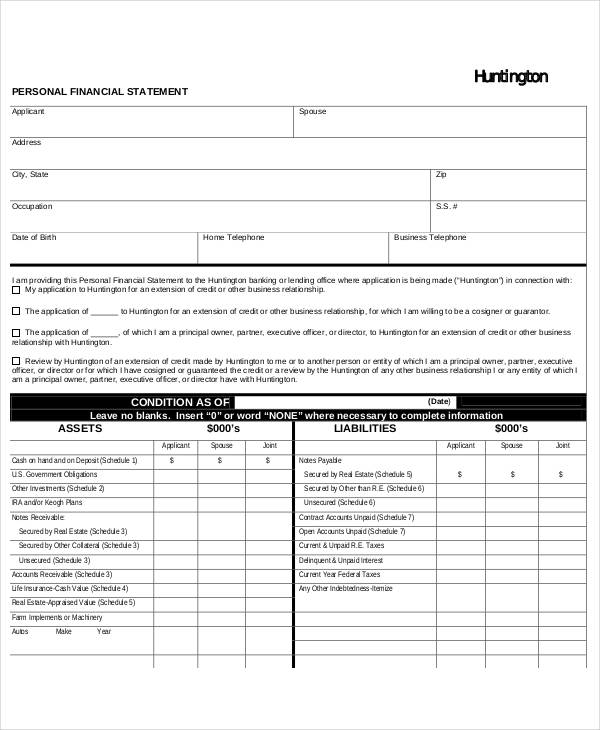

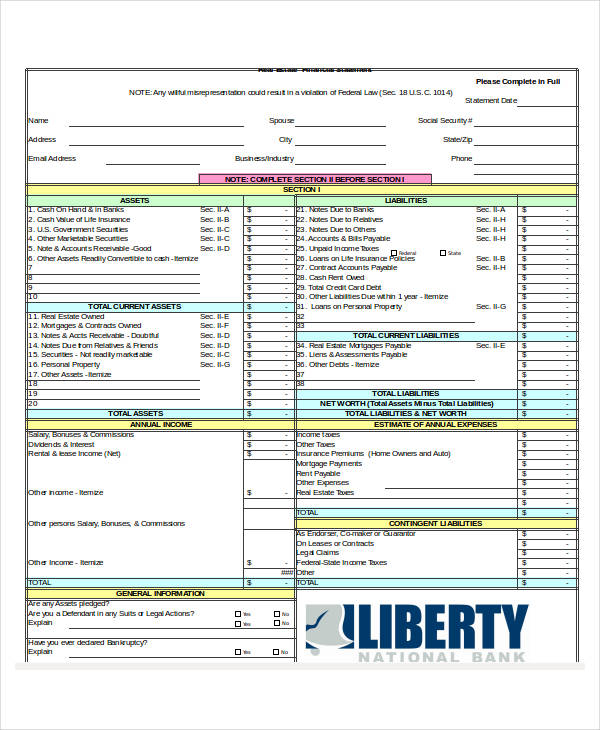

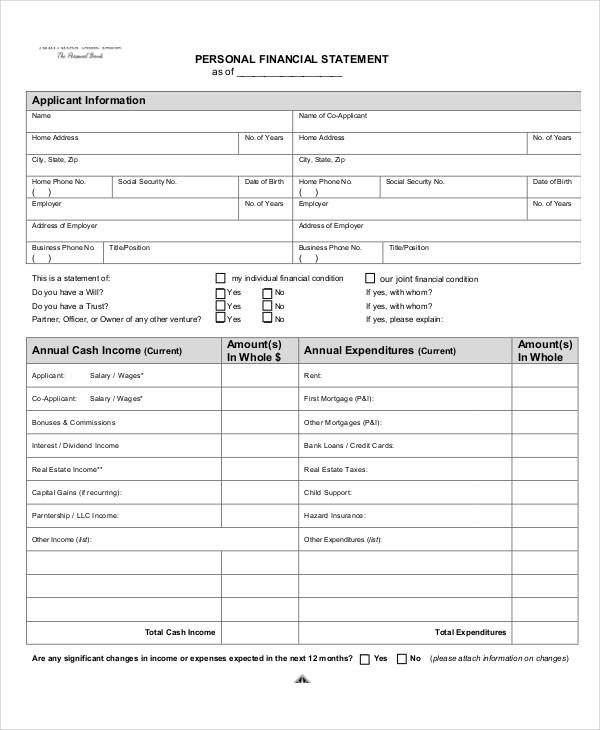

9. Blank Personal Financial Statement Example

10. Free Personal Statement Example

11. Monthly Personal Financial Statement Example

12. Personal Annual Financial Statement Example

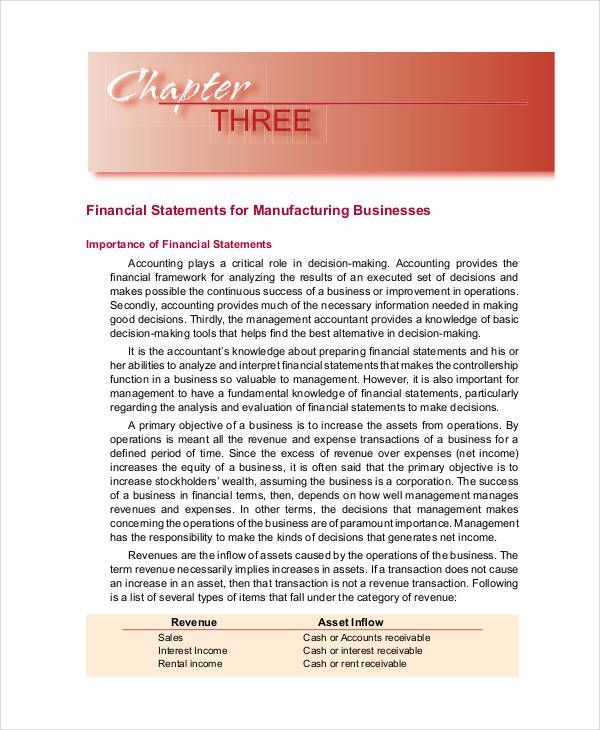

13. Small Business Annual Financial Example

14. Partnership Company Financial Statement Example

15. Partnership Manufacturing Financial Statement Example

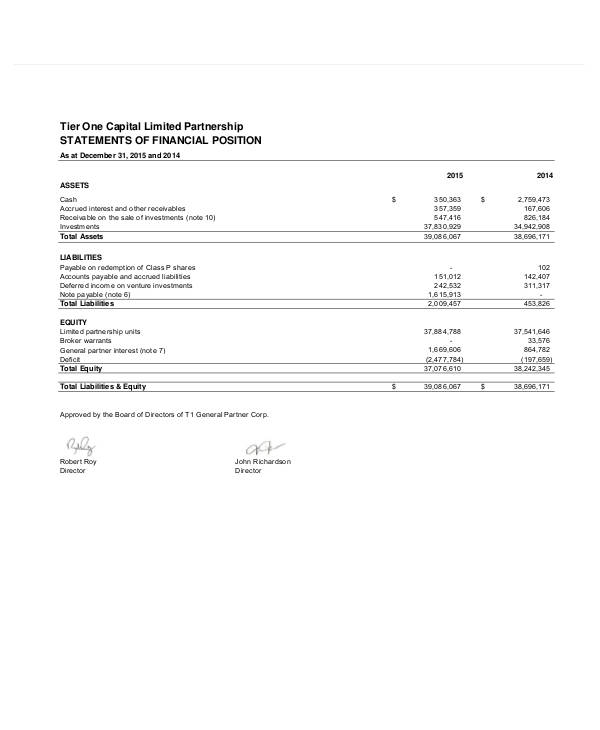

16. Limited Partnership Financial Statement Example

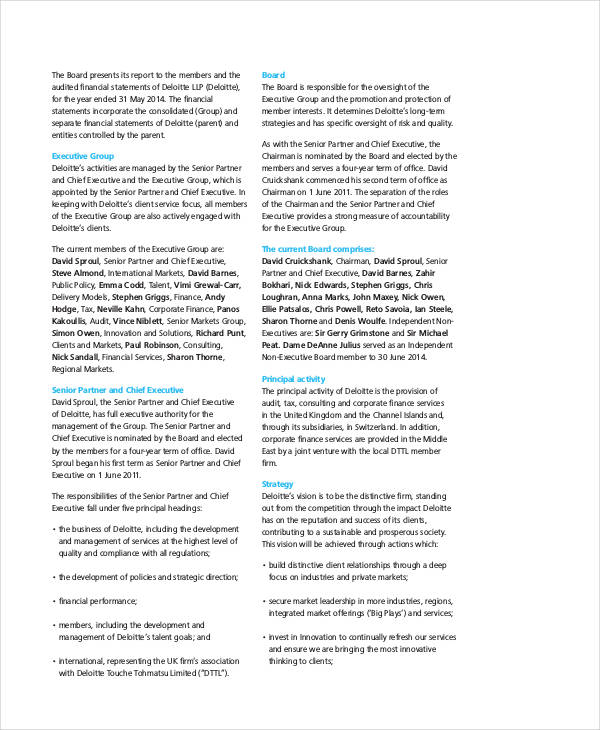

17. Professional Services Financial Example

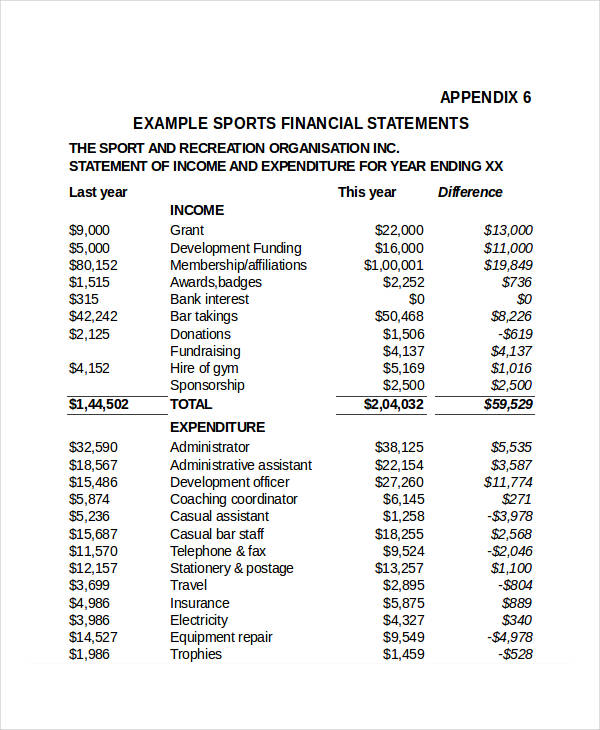

18. Professional Sports Financial Statement Example

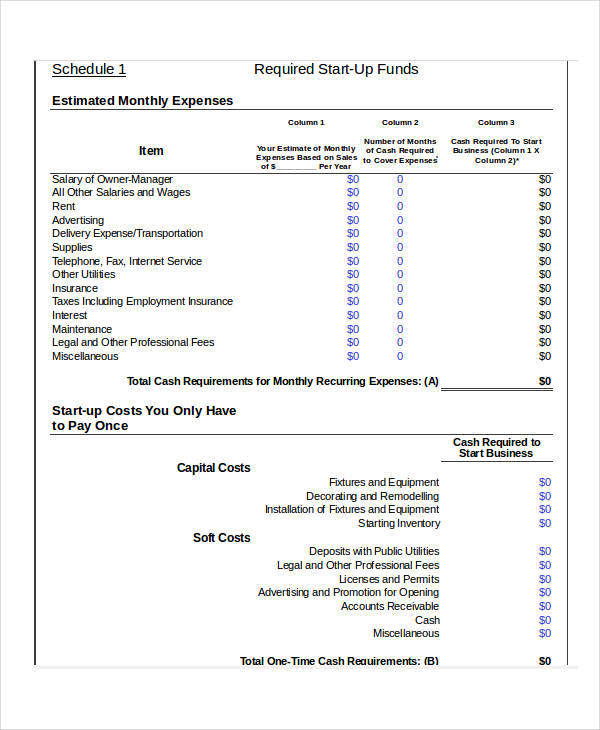

19. Professional Start-Up Financial Statement in Excel Example

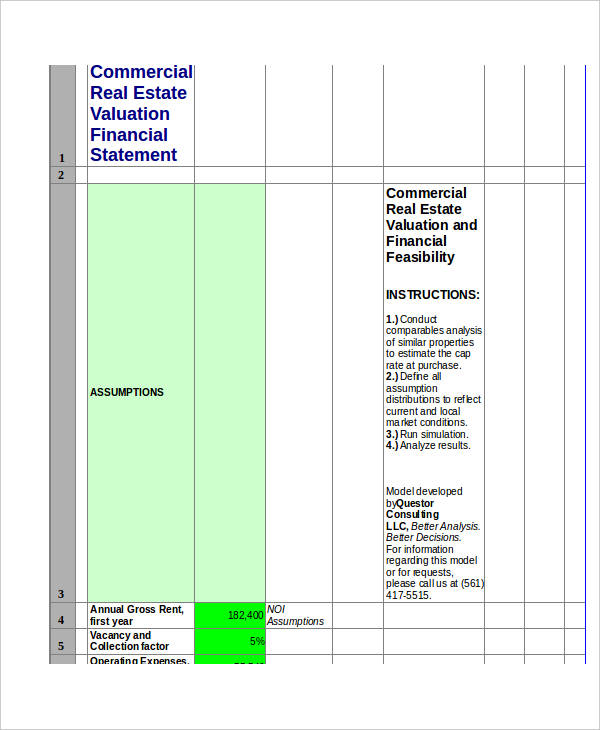

20. Real Estate Company Statement Example

21. Commercial Real Estate Valuation Financial Statement Example

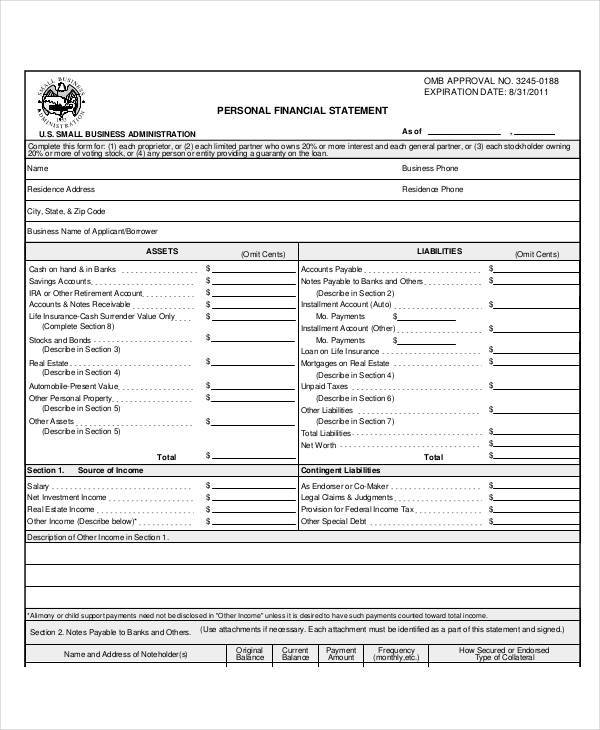

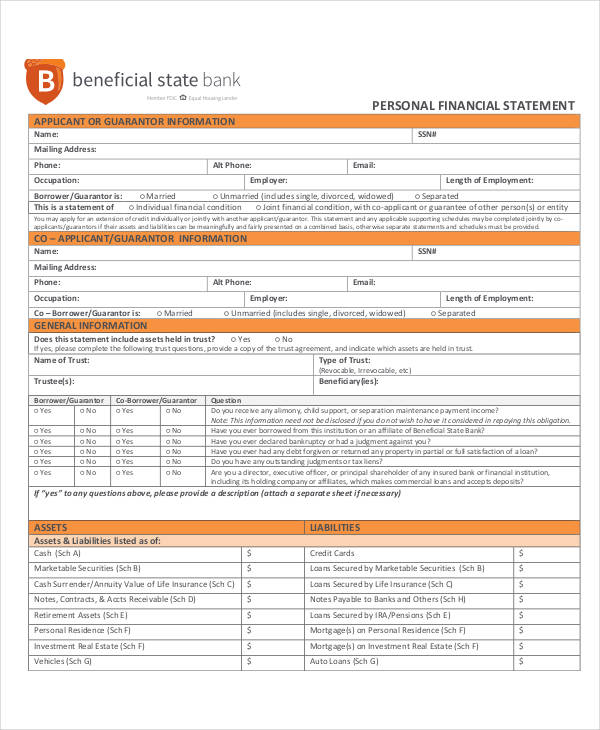

22. Student Personal Financial Statement Example

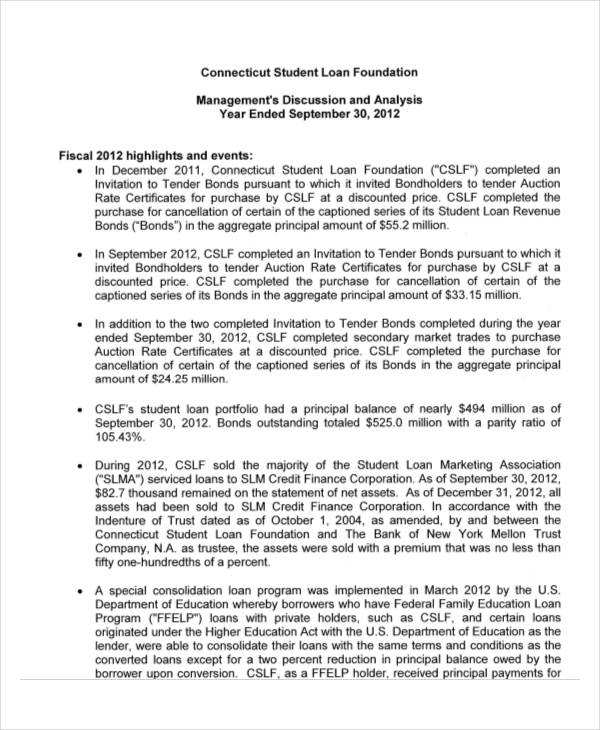

23. Student Loan Foundation Financial Statement Example

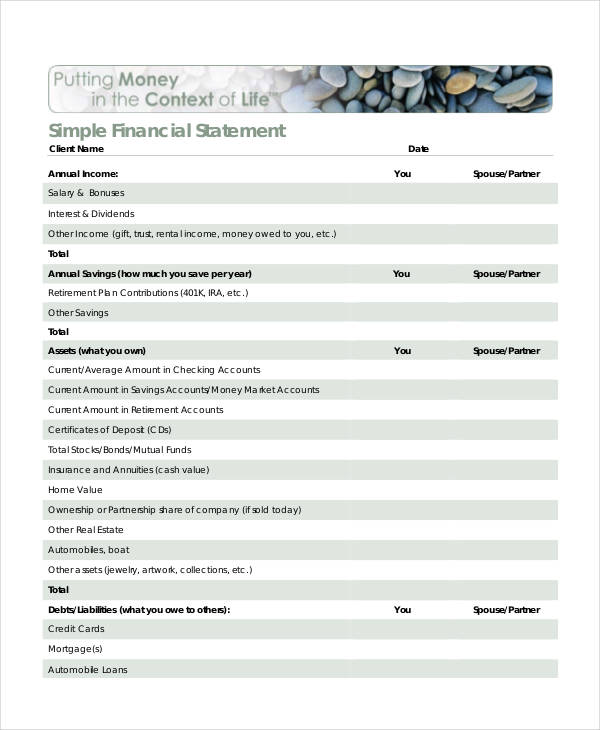

24. Free Simple Financial Example

25. Simple Personal Financial Statement Example

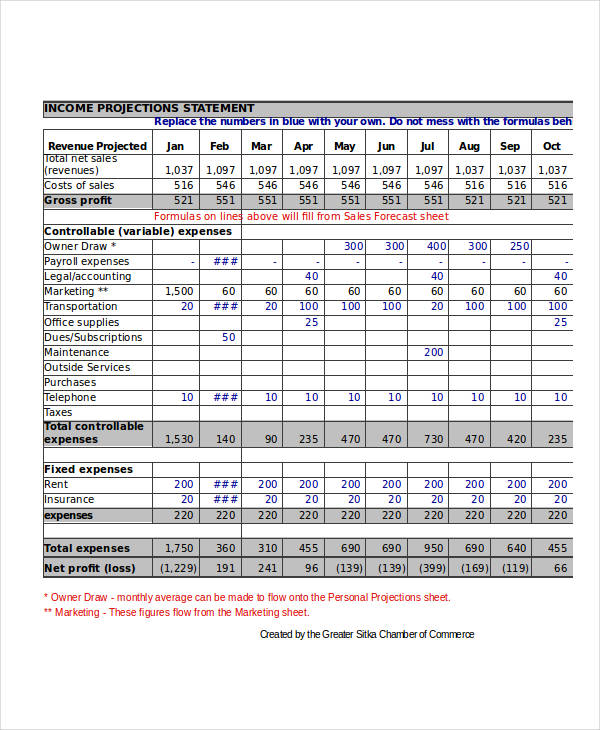

26. Simple Business Income Projections Statement Example

27. Hotel Accounting Financial Statement Example

28. Basic Accounting Income Statement Example

29. Sample Construction Company Financial Statement Example

30. Insurance Company Annual Financial Statement Example

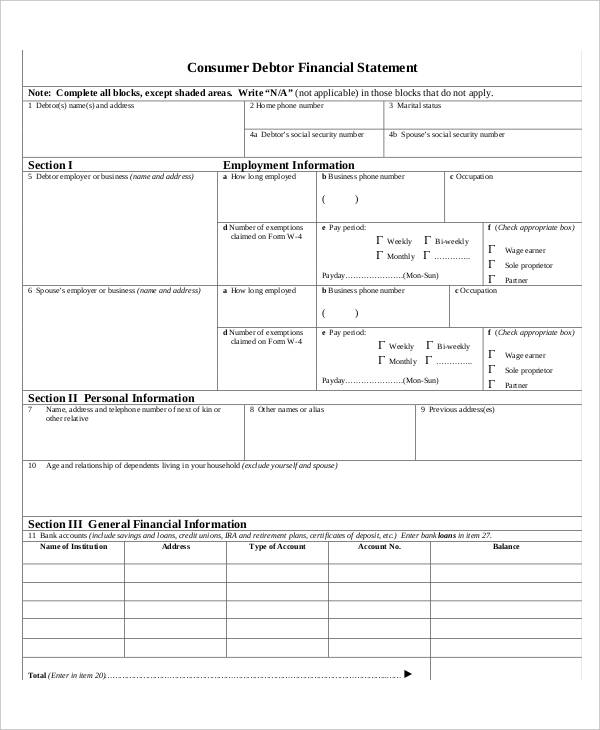

31. Individual Consumer Debtor Financial Statement Example

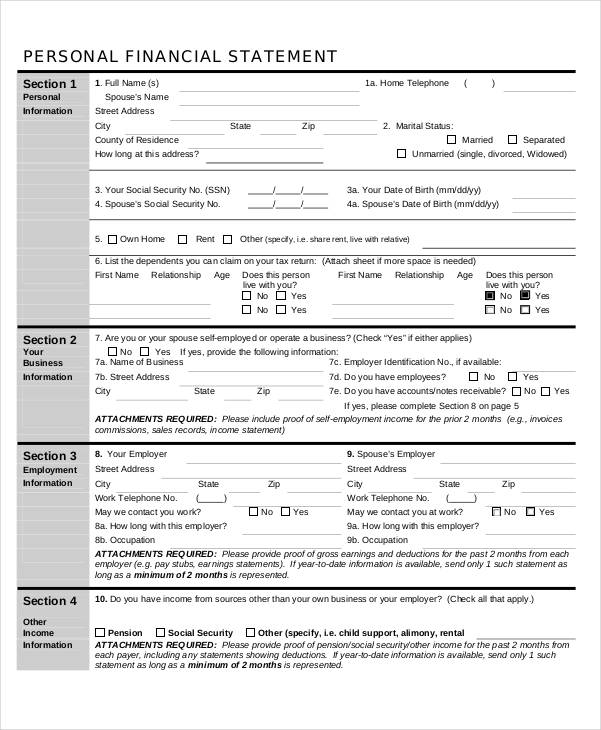

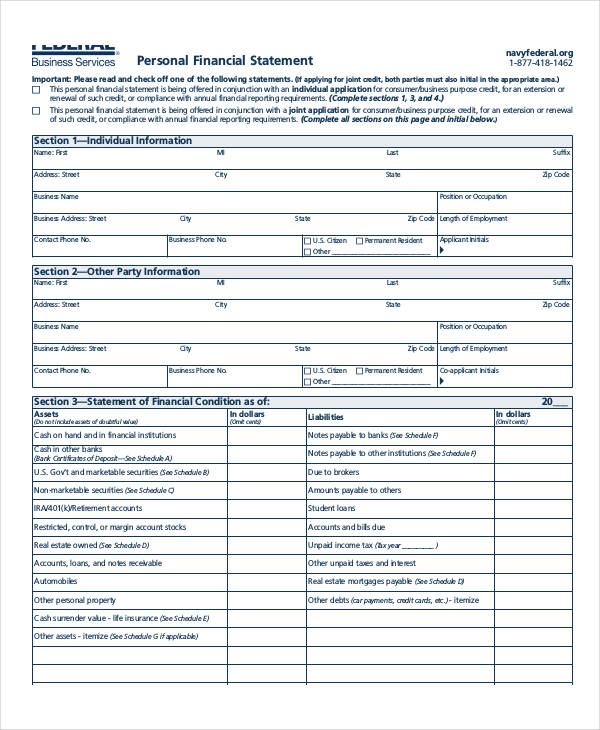

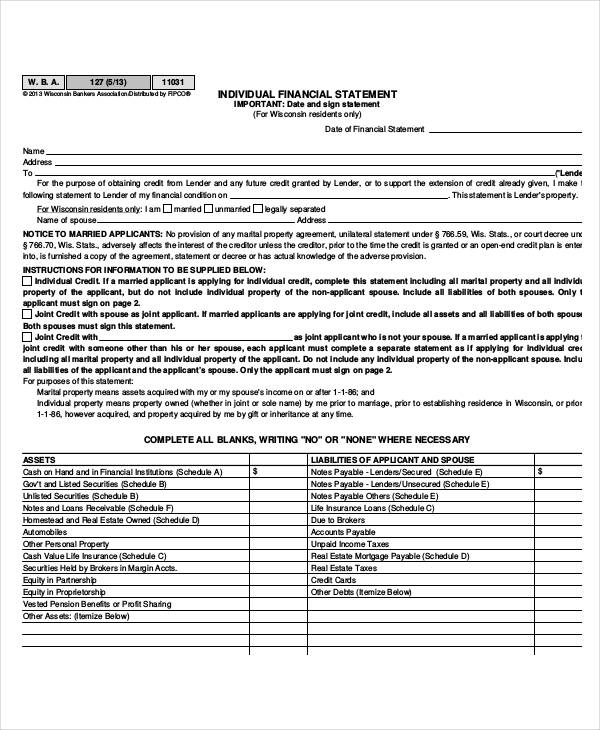

32. Individual Personal Financial Statement Example

33. Free Individual Financial Statement Example

34. Applicants Monthly Financial Statement Example

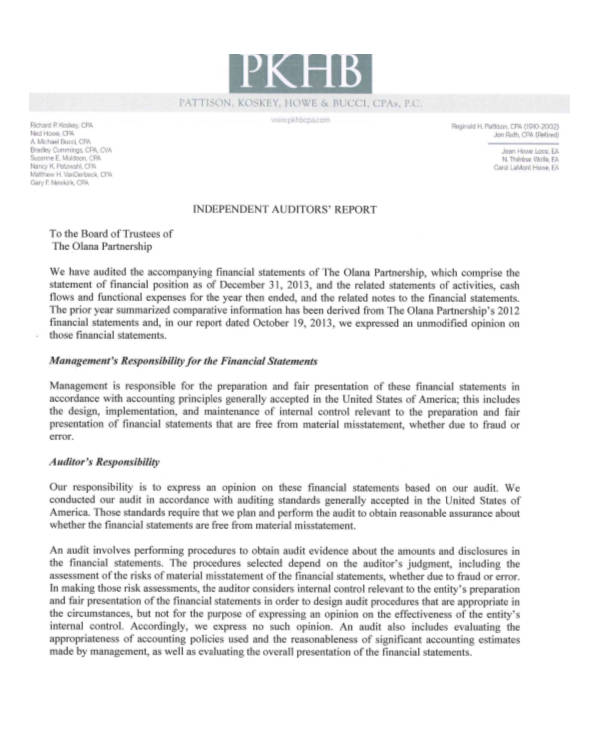

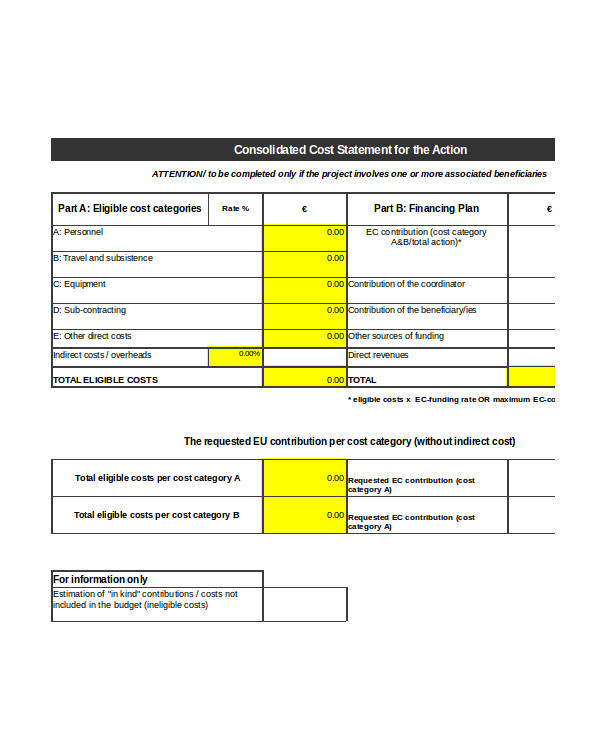

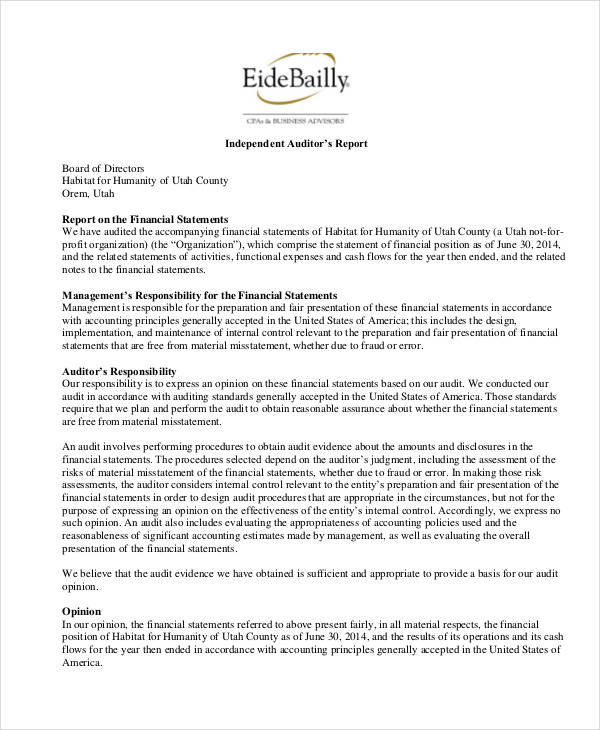

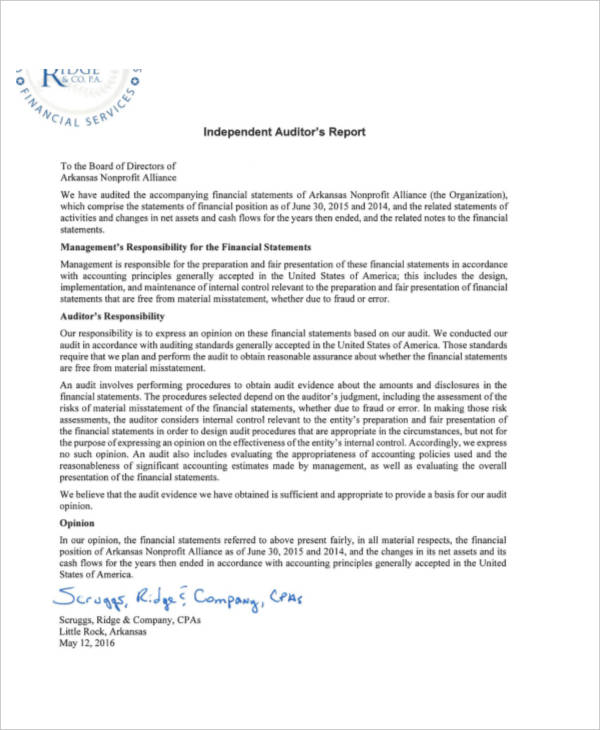

35. Non-Profit Organization Financial Example

36. Audited Non-Profit Financial Statement Example

What is a Financial Statement?

Every business’ mission statement must contain the idea of preparing a financial report. So, when the investors, creditors, and shareholders ask for proof that your business is financially healthy, you can show them your financial statement.

How To Make a Financial Statement

For every established or small business with various projects at once, expect finances come in and out regularly. This is also the reason why making an income statement is complicated. So, without further delay, you can create one now by following the list of tips below.

Step 1: Evaluate the Basic Financial Documents

Fully understanding the financial statement, for instance, enables you to apply this concept. Here, you must review the previous and current financial documents that you have. Gather them and create an analysis. This procedure applies to both private companies and nonprofit organizations.

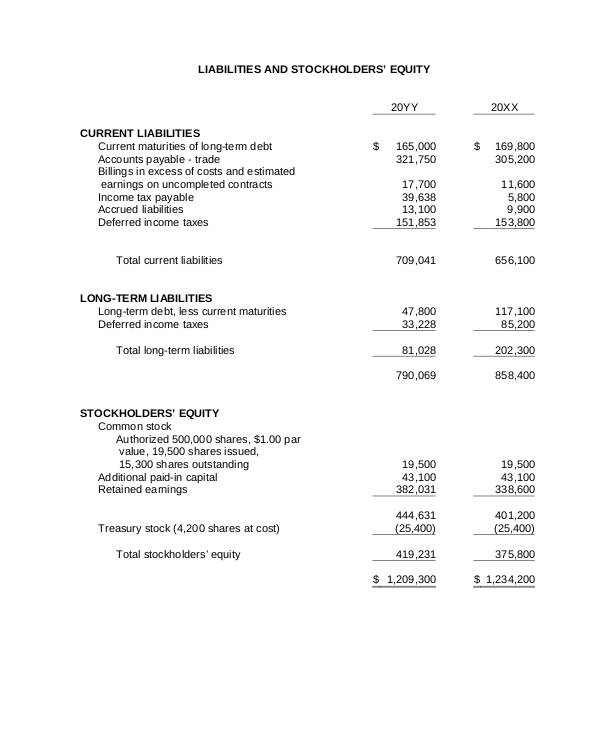

Step 2: Forecast Your Assets and Liabilities

Complete your business statement by marking down the liabilities. These are the common pitfalls that would somehow result in bankruptcy or failure of a business. Add all the items or variables involved in your liabilities. You can make a comparison through a profit and loss statement.

Step 3: Make a Smart Loan Decision

For legal lenders, financial institutions and banks, analysis of financial statement are crucial as well. It helps them create a loan or credit decision that would look and sound useful to their potential borrowers. You can also think of credit risk, bright terms and conditions, interest rate, and maturity assessment that would benefit them with the help of financial statement analysis.

Step 4: Construct the Financial Overview

At this point, you have probably gathered all your resources. You can now start creating an outline in a document. Here, do the basic accounting. Plot all your calculations accordingly. Make a financial statement analysis clear and easy to understand for every user. To do this, limit your Math. Calculate only those items that are necessary. This helps in improving your document and avoiding the clutter.

FAQ’s

What are the three common types of financial statement?

The three types of a financial statement are the balance sheet, income statement, and cash flows.

What is the most significant type of financial statement?

Among the various types, the income statement is the most essential. It helps in showcasing the potential income of the company along with the business plan. Securing the financial condition of a business considerably clean, and rising should be one of the vision statements of a company. So, use these free financial statement examples to help guide you in creating one for your own company today.

Who are the common users of financial statements?

In business, the entrepreneurs and investors commonly prepare a financial document.

What are the importance of a financial statement?

A company income statement provides necessary information about its financial conditions. According to an article published by Small Business Chron, the importance of financial statements impacts various sectors in the industry. It helps in the communication of the outside party’s possible partnership and collaboration. Other than that, basic financial statements are useful in making economic decisions regarding financing and marketing. But more than business, it can be used personal statements when applying for loans or mortgage.

There is so much to learn in business. The finances is every entrepreneur’s way of tracking records on the expenses and income of the business. While you are still unsure of the ways to come up with a comprehensive financial document, avoid doubt by following the tips above. No one can afford any losses. So, start by outlining your assets and liabilities today.