9+ Financing Leasing Examples to Download

Leasing is a process of allowing your real estate property or business assets to be used by another party at a cost of something in exchange or some capital. Leasing is done by framing a contract that can absorb all the conditions and requirements of the parties involved in the leasing process. Such contracts and agreements are legal and time-bound of a particular period.

What is Finance and Lease in Accounting?

Lease accounting refers to the assets and capital exchanges between the investor and the company for utilizing them for mutual benefits. In lease accounting both the party involved report and account the details of the leases differently. The lessor is the investor and lessee is the company owner. The lessee has to pay some amount of interest and the main asset value periodically to the lessor as mentioned in the contract. The most common of all the business leases are operating lease and finance or capital lease.

Operating Lease

Operating lease processes a contract that does not give asset ownership right to the lessee but allows to use of it. This lease is often kept off-balance as it states that the leased assets and the liabilities it causes are not the responsibility of the lessor. The details of all these expenses are not added to the company’s balance sheet, it helps to maintain the ratio of debt too equity low. This practice has enabled many firms to unrecord millions and billions of transaction assets and liabilities from the balance sheet.

The establishment of the body named the Financial Accounting Standard Board has passed several rules for public companies on recognizing leases records on the balance sheet if their company existence is not less than 12 months. Operating leases are functioned to meet certain requirements of the Generally Accepted Accounting Principles (GAAP). Companies are asked to test conduct a ‘bright-line test’ that can specify the rental contract should be booked as an operating or capital lease. According to the present GAAP rules, the lease would be considered as a capital lease it does not follow the mentioned characteristics.

- If it comes with the ownership transfer to the lessee at the end,

- If it has a bargaining option,

- If the lease life should not exceed the asset’s economic life.

- If the present value exceeds up to 90% of the market value of the assets.

Capital Lease

Opposite to operating lease, a capital lease is long-term funding in which the lessee is treated as the owner and all the details of the asset and liabilities are recorded in the balance sheet. The term debt is used to mean the capital lease. This lease decreases with time as the lessee keeps on paying the interest and the actual amount in installments. The characteristics of the capital lease include:

- The ownership transfer is common to be transferred to the lessee at the end of the term of the agreement.

- The bargain purchase option allows the lessee to get the asset at a cheaper rate than its actual market value.

- The term has to be equal or over 75% of the estimated life of the asset.

- the asset’s value exceeds 90% over the present value of the lease payment.

- Leased costs and lease payments are shown in the balance sheet.

- Lessee has the right to claim depreciation expense and interest expense.

- Lessee is responsible to pay the taxes, maintenance, etc.

9+ Financing & Leasing in Accounting Examples in PDF | DOC

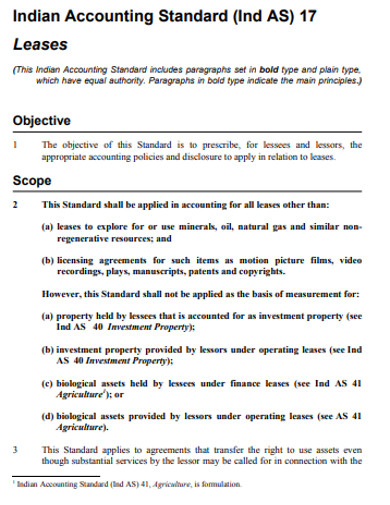

1. Standard Accounting Lease Example

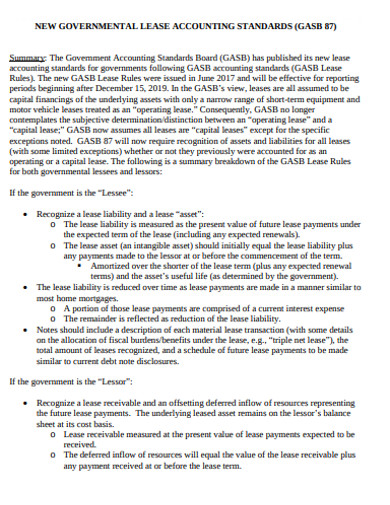

2. Sample Accounting Lease Example

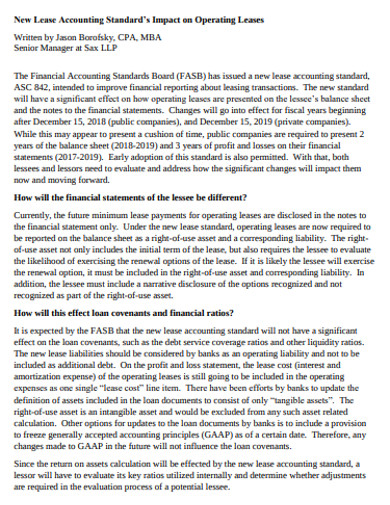

3. Basic Accounting Lease Example

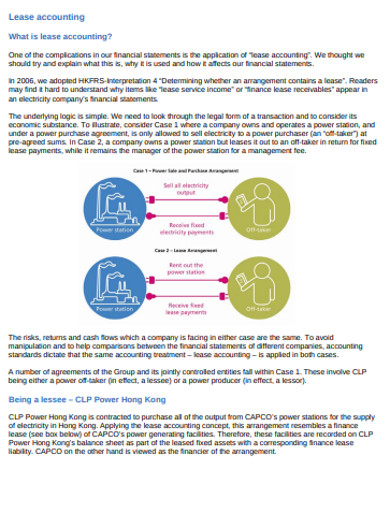

4. Formal Accounting Lease Example

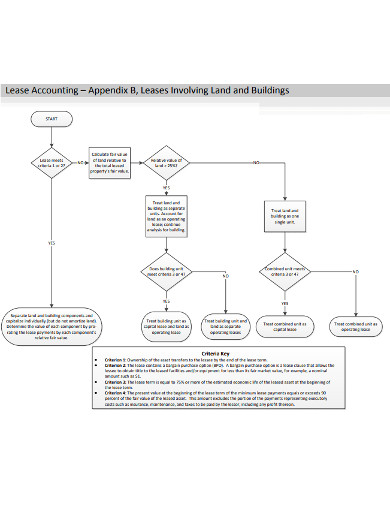

5. Accounting Land and Building Lease Example

6. Printable Accounting Lease Example

7. Simple Accounting Lease Example

8. Accounting Lease in PDF

9. Professional Accounting Lease Example

10. Accounting Lease In DOC

What are the Advantages and Disadvantages of Leasing?

Advantages

Leasing has several advantages to offer that attracts the customer due to the benefits it provides to the customers. The advantages are listed below:

- If its an operating lease the company takes the responsibility to create the expense by obtaining capital funding as the off-balance-sheet financing.

- Flexibility on payment schedules is greater than the loan contracts.

- The lessor and the lesse deal with different tax rates for paying the taxes.

- In leasing, assets are always funded and financed 100%.

Disadvantages

- The most problematic thing in leasing is the financing agency costs problem often.

- In leasing, all the rights are transferred to the lessee that creates moral hazard issues at times, as the lessee doesn’t take specific care of the assets as they are not their own.

- Leasing creates risks of ownership on a different level and if not planned properly then it can become worse.

What are the Difference Criteria for Operating Lease Vs Capital Lease Accounting?

The criteria defined and decided for operating and capital lease accounting are given by the International Financial Reporting Standards (IFRS). It outlines some criteria that help to meet the different attributes of the leases under Accounting Standards for Private Enterprises (ASPE). If any of the following mentioned criteria match with your criteria the lease can be considered.

1. The exposure to have a bargain purchase option in which the lessee has been provided with an option to purchase the price at a lower price than its real price. This option is given only in the beginning period.

2. The timeframe of the lease can not be anything shorter than 75% of its economic life for better benefits and returns.

3. The Net Present Value of the lease payment needs to be at a minimum of 90% against the asset’s real value.