30+ Premium Examples to Download

Introducing our Premium service, a step above the rest, designed to elevate your experience to new heights. Enjoy exclusive benefits and personalized support that cater to your specific needs. As a valued member, you will receive a Certificate of Appreciation recognizing your loyalty and commitment. Never miss an update with our Reminder Email for Renewal, ensuring continuous access to our premium offerings. For any inquiries or assistance, our dedicated team is just a call away at our UK Phone Number.

What is Premium?

Premium is a high-quality, exclusive service offering enhanced features and personalized support for a superior user experience. It includes unique benefits such as a Certificate of Appreciation and Reminder Email for Renewal notifications.

Examples of Premium

- Exclusive Content Access: Members get early or exclusive access to new content.

- Ad-Free Experience: Enjoy content without interruptions from advertisements.

- Priority Customer Support: Get faster responses and personalized support.

- Extended Warranty: Longer warranty periods for products or services.

- Exclusive Discounts: Special discounts not available to regular users.

- Certificate of Appreciation: Receive a personalized certificate recognizing your loyalty.

- Reminder Email for Renewal: Automated emails to remind you of subscription renewals.

- Free Upgrades: Access to the latest features and versions without extra cost.

- Customizable Options: Tailor services to fit your specific needs and preferences.

- Invitations to Special Events: Exclusive access to events, webinars, or workshops.

- Higher Storage Limits: Increased storage capacity for your data.

- UK Phone Number Support: Dedicated phone support with a UK number for quick assistance.

- Early Product Releases: Be the first to try out new products or features.

- Enhanced Security Features: Additional security measures to protect your data.

- Free Shipping: Complimentary shipping on all orders.

- Premium Content: Access to high-quality, exclusive articles, videos, or courses.

- VIP Access: Priority entry to events, clubs, or other exclusive venues.

- Personalized Recommendations: Customized suggestions based on your preferences and usage.

- Monthly Gifts: Receive special gifts or rewards each month.

- Access to Beta Programs: Participate in beta testing for new products and features.

Premium Customer Service Examples

- 24/7 Support: Round-the-clock customer assistance available at any time.

- Priority Queuing: Fast-track service ensuring minimal wait times.

- Dedicated Account Managers: Personal representatives managing your account and needs.

- Multilingual Support: Assistance available in multiple languages.

- UK Phone Number: Direct phone support with a dedicated UK number.

- On-Site Assistance: In-person support visits for resolving complex issues.

- Live Chat: Immediate help through real-time online chat with representatives.

- Follow-Up Calls: Regular check-ins to ensure ongoing satisfaction and address any concerns.

- Personalized Solutions: Customized assistance tailored to individual customer requirements.

- Exclusive Access to Experts: Direct access to industry specialists for advanced support.

Premium Marketing Examples

- Behind-the-Scenes Content: Giving premium customers access to exclusive content.

- Priority Customer Service: Offering faster and more personalized customer support.

- Loyalty Programs: Rewarding premium customers with points or perks for their continued patronage.

- Exclusive Webinars and Workshops: Providing premium customers with educational opportunities.

- Concierge Services: Offering personal shopping or assistance services to premium members.

- Enhanced Product Features: Providing additional features or services not available to standard users.

- Subscription Boxes: Curating exclusive boxes of products for premium members.

- Direct Mail Campaigns: Sending personalized, high-quality mailers to premium customers.

- Special Access to New Products: Allowing premium customers to test new products before launch.

- Premium App Features: Offering enhanced functionalities in mobile apps for premium users.

- Exclusive Content Libraries: Providing access to a repository of high-quality, exclusive content.

Premium Products Examples

- Luxury Cars: High-end brands like Rolls-Royce, Bentley, and Ferrari.

- Designer Clothing: Fashion from designers like Gucci, Prada, and Chanel.

- High-End Electronics: Premium gadgets such as the Apple iPhone Pro series and Samsung’s QLED TVs.

- Gourmet Foods: Exclusive items like truffles, caviar, and artisanal cheeses.

- Luxury Watches: Timepieces from brands like Rolex, Patek Philippe, and Audemars Piguet.

- Exclusive Wines: Fine wines from renowned vineyards like Chateau Margaux and Dom Pérignon.

- High-Performance Sports Gear: Premium equipment from brands like Nike, Adidas, and Wilson.

- Luxury Skincare: High-end beauty products from brands like La Mer, Dior, and Estée Lauder.

- Exclusive Travel Experiences: First-class flights, luxury cruises, and bespoke vacation packages.

- Designer Furniture: High-quality furniture from brands like Herman Miller, Knoll, and Restoration Hardware.

Premium Brand Examples

- Rolex: Renowned for luxury watches.

- Louis Vuitton: Iconic fashion and leather goods.

- Apple: High-end electronics and gadgets.

- Tesla: Premium electric vehicles.

- Gucci: Designer clothing and accessories.

- Mercedes-Benz: Luxury automobiles.

- Chanel: High-fashion, perfumes, and beauty products.

- Lexus: Premium cars known for comfort and innovation.

- Dior: Designer fashion and high-end cosmetics.

- Hermès: Luxury goods, including handbags and scarves.

Premium Pricing Examples

- Nespresso VertuoLine: Coffee machines priced higher than standard models for convenience and coffee quality.

- Montblanc Meisterstück Pen: Premium writing instruments with a higher price due to craftsmanship and materials.

- Chanel No. 5 Perfume: Iconic fragrance with a premium price tag due to brand heritage and quality.

- Patek Philippe Nautilus Watch: High-end watch with premium pricing for exclusivity and precision.

- Dyson Airwrap: Advanced hair styling tool priced higher for innovative technology and performance.

- Moët & Chandon Dom Pérignon: Premium champagne with a higher price due to quality and brand prestige.

- Yves Saint Laurent Tuxedo: Designer clothing with premium pricing for style, fit, and materials.

- Patagonia Down Jacket: High-quality outdoor apparel priced higher for durability and performance.

- Mercedes-Benz S-Class: Luxury sedan with premium pricing for advanced features and comfort.

- Blue Apron Premium Meal Kits: Gourmet meal kits priced higher for premium ingredients and recipes.

- Nest Learning Thermostat: Smart home device with a premium price for energy efficiency and smart features.

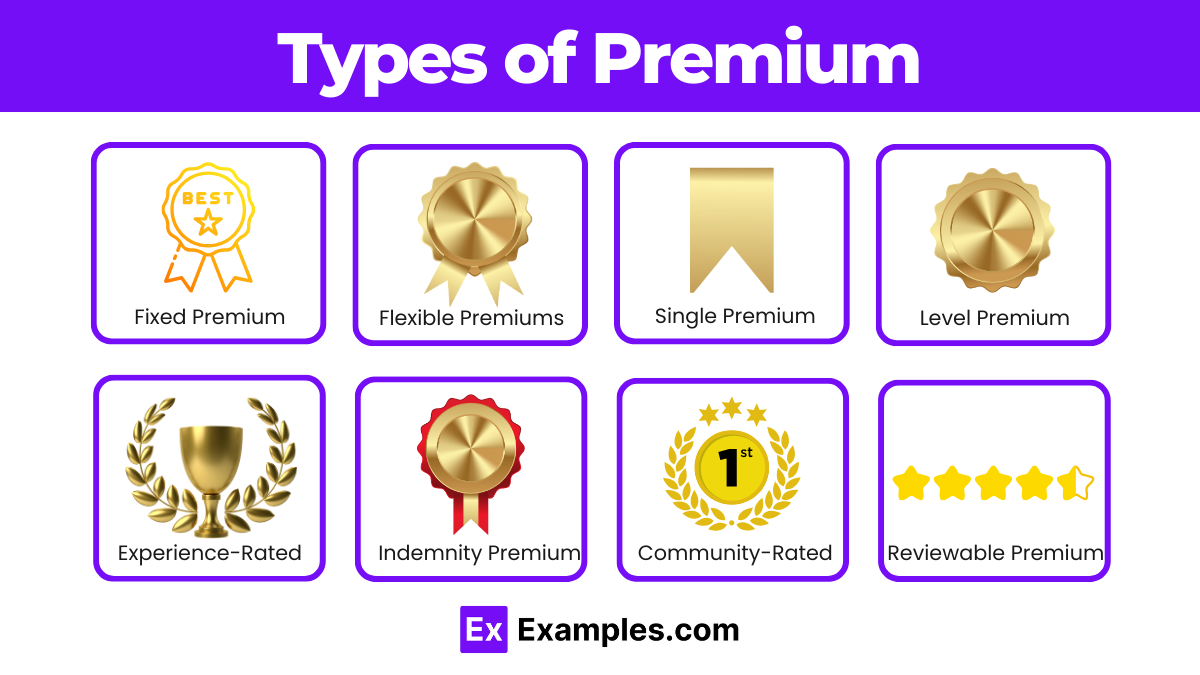

Types of Premium

Fixed Premiums: Fixed premiums remain constant throughout the policy term. This type of premium is common in term life insurance and health insurance policies.

Flexible Premiums: Flexible premiums allow policyholders to adjust their payments based on their financial situation. These are often found in universal life insurance policies.

Single Premium: A single premium is a one-time lump sum payment for the entire policy period. This is common in some life insurance policies and annuities.

Level Premium: Level premiums are a type of fixed premium that remains the same over the entire term of the policy. This is typical in whole life insurance.

Stepped Premium: Stepped premiums start lower and increase over time, usually annually. This is common in term life insurance and some health insurance policies.

Reviewable Premium: Reviewable premiums can be adjusted by the insurance company at certain intervals, usually based on claims experience or changes in the insurer’s costs.

Guaranteed Premium: Guaranteed premiums remain the same for a specified period, providing stability and predictability. This type is common in some health and life insurance policies.

Indemnity Premium: Indemnity premiums are related to indemnity insurance, where the premium amount is based on the value of the item or risk being insured.

Experience-Rated Premium: Experience-rated premiums are determined based on the policyholder’s claims history and risk profile. Common in group health insurance and workers’ compensation.

Community-Rated Premium: Community-rated premiums are based on the collective risk of a group rather than individual risk. Common in health insurance plans offered by employers.

Importance of Premium

1. Ensures Coverage

Financial Protection: Premiums ensure that policyholders receive the financial protection they need in case of unexpected events such as accidents, illnesses, or property damage.

2. Enables Access to Services

Health Insurance: Premiums enable policyholders to access necessary medical services, treatments, and medications without incurring prohibitive out-of-pocket costs.

3. Supports Insurance Operations

Claims Processing: Premiums fund the administrative costs of processing claims, ensuring that policyholders receive their benefits promptly and efficiently.

4. Facilitates Risk Pooling

Spreading Risk: Premiums allow insurance companies to pool risks from a large number of policyholders. This distribution helps mitigate the financial impact of claims and ensures stability within the insurance system.

5. Encourages Responsible Behavior

Risk Reduction: Policyholders who maintain safe practices and minimize risks (e.g., driving safely, maintaining property) may benefit from lower premiums. This encourages responsible behavior.

6. Economic Stability

Business Continuity: For businesses, paying premiums ensures continuity and stability by protecting against significant financial disruptions caused by unforeseen events.

7. Compliance with Legal Requirements

Legal Compliance: In many cases, paying premiums is necessary to comply with legal requirements, such as mandatory auto insurance, workers’ compensation insurance, or health insurance mandates.

Benefits of Premium

1. Financial Protection

Comprehensive Coverage: Regular premium payments ensure continuous coverage, offering peace of mind and security against various risks.

2. Access to Quality Healthcare

Medical Services: Premiums for health insurance grant access to quality healthcare services, including doctor visits, hospital stays, surgeries, and medications.

3. Legal Compliance

Avoid Penalties: Many types of insurance, such as auto and health insurance, are legally required. Paying premiums ensures compliance with legal mandates and avoids penalties and fines.

4. Risk Management and Reduction

- Lower Premiums: Insurance companies may offer lower premiums to policyholders who take proactive measures to reduce risk, such as installing safety devices or maintaining a healthy lifestyle.

5. Economic Stability

Financial Stability: Paying premiums helps individuals and businesses maintain financial stability by protecting against significant losses that could disrupt personal lives or business operations.

Advantages and Disadvantages of Premium

| Advantages | Disadvantages |

|---|---|

| Financial Protection: Provides a safety net against unexpected events such as accidents, illnesses, natural disasters, and theft. | Cost: Regular premium payments can be a significant financial burden, especially for individuals or businesses with tight budgets. |

| Access to Quality Healthcare: Ensures access to medical services, treatments, and medications. | Inflexibility: Fixed premium payments do not allow for adjustments based on changes in financial situations. |

| Legal Compliance: Helps meet legal requirements for mandatory insurance, avoiding penalties and fines. | Complexity: Understanding and managing different types of premiums and policies can be complicated. |

| Risk Management and Reduction: Encourages proactive measures to reduce risk, which can lower premiums over time. | Potential for Increase: Some premiums, like stepped or reviewable premiums, can increase over time, making budgeting difficult. |

| Economic Stability: Provides financial stability by protecting against significant losses. | Upfront Cost: Single premiums require a large initial payment, which can be a barrier for some. |

| Customization and Flexibility: Allows policyholders to tailor coverage levels to their specific needs. | Policy Lapse: Failure to pay premiums can lead to policy lapse, resulting in loss of coverage. |

| Peace of Mind: Reduces stress and anxiety by providing reliable financial protection. | Lack of Immediate Benefits: Premium payments do not provide immediate financial returns, unlike other investments. |

| Investment and Savings: Certain policies accumulate cash value or provide retirement income. | Higher Initial Cost: Level premiums might be higher initially compared to other types. |

| Support for Beneficiaries: Life insurance benefits ensure financial support for loved ones. | Variability: Experience-rated premiums can vary significantly based on claims history. |

| Innovation and Service Improvements: Supports the development of new insurance products and services. | Community Rating Issues: Healthy individuals may subsidize higher-risk members in community-rated policies. |

| Community and Social Benefits: Contributes to shared risk pools, benefiting the wider community. | Indemnity Premiums: Can be expensive for high-value items and require accurate valuation. |

| Global Benefits: Provides international coverage for expatriates and travelers. | Administrative Overhead: Part of the premium goes towards administrative costs and not directly towards coverage. |

What is an insurance premium?

An insurance premium is the amount paid for coverage under a policy, similar to fees in an IT maintenance contract.

How is a premium calculated?

Premiums are calculated based on risk factors, coverage amount, and policy terms, much like pricing a real estate listing.

What is a fixed premium?

A fixed premium remains constant throughout the policy term, ensuring predictable payments, similar to a fixed-rate call option.

Can premiums change over time?

Yes, some premiums can increase or decrease based on risk factors, similar to adjustments in an IT maintenance contract.

What is a flexible premium?

Flexible premiums allow policyholders to adjust payments, much like the flexibility in a call option.

How often are premiums paid?

Premiums can be paid monthly, quarterly, or annually, similar to payment schedules in an IT maintenance contract.

What happens if I miss a premium payment?

Missing a premium payment can result in policy lapse, akin to losing a real estate listing due to non-compliance.

Can I get a refund on my premium?

Refunds depend on the policy terms, similar to cancellation clauses in a call option contract.

What affects the cost of my premium?

Factors include coverage amount, risk, and policy duration, much like pricing factors in an IT maintenance contract.

Do premiums vary between insurance companies?

Yes, premium rates vary by insurer, similar to varying fees in different IT maintenance contracts.