Salary vs Income – Meanings, Differences, Examples, Usage

In personal finance discussions, terms like “salary” and “income” often emerge, both crucial for understanding one’s financial standing. Despite their apparent similarity, these terms hold subtle differences that can significantly impact one’s financial planning and overall budgeting strategies. While both salary and income denote the money one earns, their nuances lie in the scope and sources of earnings.

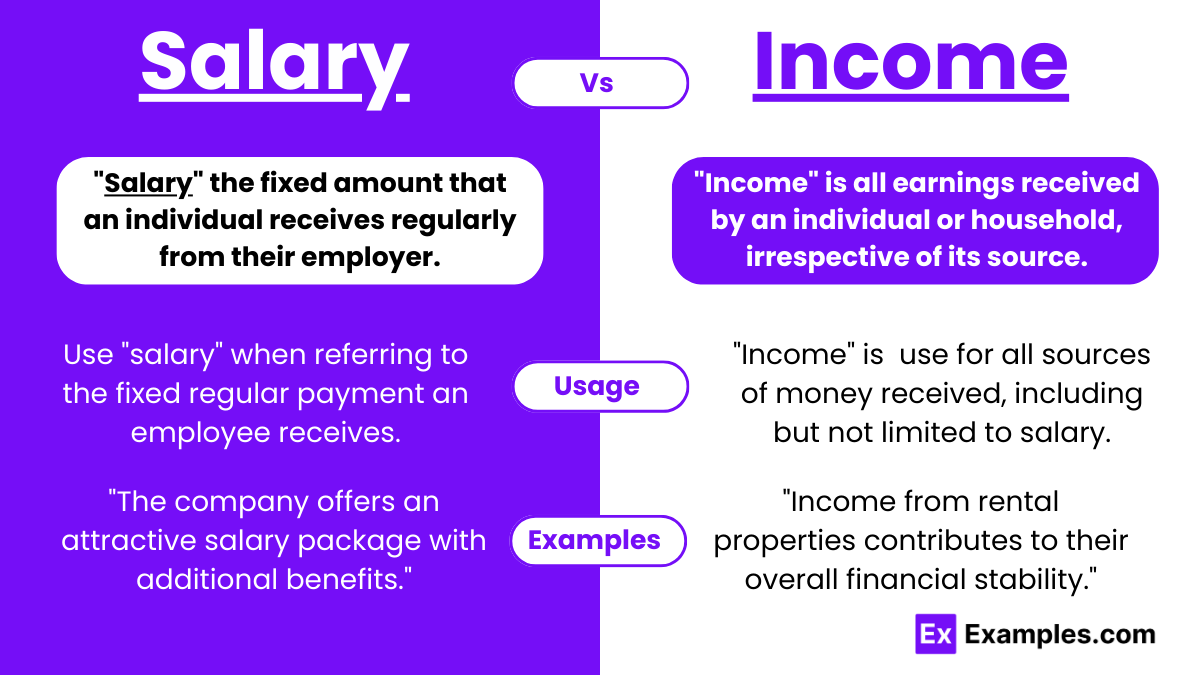

Salary and Income – Meanings

- Salary: Refers specifically to the fixed amount of money that an individual receives regularly from their employer in exchange for the work performed. Salaries are typically agreed upon in advance and remain consistent over a specified period, often monthly or annually.

- Income: Encompasses all earnings received by an individual or household, irrespective of its source. Income is a broader term that includes not only salary but also additional earnings from investments, rental properties, side hustles, and other sources.

Summary

“Salary” refers specifically to the fixed regular payment an employee receives from an employer for work performed, usually on a monthly or yearly basis, associated with stable, white-collar positions. On the other hand, “income” is a broader term encompassing all sources of money received, including salaries, but also extending to earnings from investments, rental properties, and other sources.

How to Pronounce Salary and Income

Salary: Pronounced as /ˈsæləri/, this two-syllable word emphasizes the initial “sal” with a soft “a” sound followed by a clear “ri” at the end.

Income: Pronounced as /ˈɪnkʌm/, this one-syllable word begins with a crisp “in” sound, followed by a short “come,” stressing the overall earnings of an individual.

Differences between Salary and Income

| Aspect | Salary | Income |

|---|---|---|

| Definition | Fixed amount paid by an employer for work performed. | All earnings received by an individual from various sources. |

| Source | Mainly derived from employment. | Includes earnings from employment, investments, rentals, etc. |

| Stability | Generally stable and predictable. | Can vary depending on multiple income streams. |

| Variability | Often remains consistent over a specified period. | Subject to fluctuations based on different income sources. |

| Tax Treatment | Usually subject to income tax deductions at source. | Subject to taxation, including various sources of income. |

| Dependency | Relies on employment agreement with an employer. | Can be diversified across multiple sources. |

How to Remember the Difference between Salary and Income

Think of “salary” as a specific type of income. Salary is like a piece of the income pie – it represents the portion of your earnings that comes from your job or employment, usually paid on a regular basis. Income, on the other hand, is the entire pie, including not just your salary but also any other money you receive from investments, rental properties, or other sources. So, whenever you hear “salary,” think of it as a slice of your overall income pie.

When to Use Salary and Income

Usage of Salary

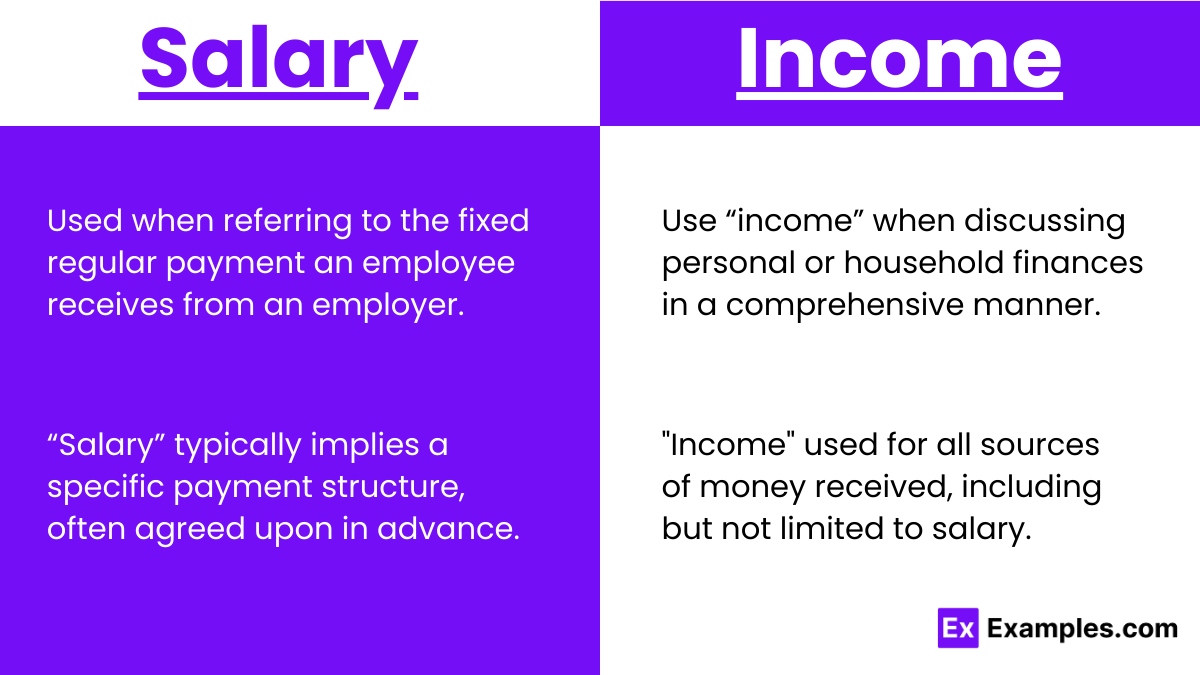

- Employment Compensation: Use “salary” when referring to the fixed regular payment an employee receives from an employer in exchange for work performed. This term is commonly used in the context of formal employment agreements where there is a predetermined amount paid on a monthly or yearly basis.

- Specific Payment Structure: “Salary” typically implies a specific payment structure, often agreed upon in advance, where the employee receives a fixed amount of money at regular intervals, such as monthly or bi-weekly. It is associated with positions that are paid on an annual basis rather than hourly.

- Professional Context: Use “salary” in professional contexts when discussing compensation for white-collar or salaried positions, such as office jobs, managerial roles, or positions in professional fields like medicine, law, or engineering. It denotes a level of stability and predictability in income.

- Tax and Legal Documentation: “Salary” is the term often used in tax and legal documentation to describe the earnings received from employment. It may be reported on documents such as pay stubs, employment contracts, tax forms.

Usage of Income

- Broad Financial Term: “Income” is a broader term that encompasses all sources of money received, including but not limited to salary. It includes earnings from various sources such as employment, investments, rental properties, business profits, government benefits, etc.

- Comprehensive Financial Assessment: Use “income” when discussing personal or household finances in a comprehensive manner. It includes not only earnings from employment but also passive income, dividends, interest, capital gains, and any other monetary inflows.

- Taxation and Financial Planning: “Income” is the term often used in tax laws and financial planning discussions to determine tax liabilities, eligibility for tax deductions, and various financial calculations. It serves as a basis for assessing an individual’s or entity’s financial standing and obligations.

- Social and Economic Discussions: In social and economic discussions, “income” is used to analyze and discuss patterns of wealth distribution, poverty levels, income inequality, and economic indicators such as per capita income or median household income. It provides a broader understanding of economic well-being beyond just earned salaries.

How to Use Salary and Income

Using Salary

- As a noun: “Salary” refers to a fixed regular payment, typically paid on a monthly or biweekly basis, that an employee receives for their work. For example: “She earns a high salary as a software engineer.”

- As a verb: “To salary” is a less common usage, but it can be used to describe the act of paying someone a salary. For example: “The company will salary its employees on the last day of each month.”

Using Income

- As a noun: “Income” refers to all the money a person earns, usually from various sources such as employment, investments, or business activities. It encompasses not just a fixed salary but also bonuses, dividends, rental income, etc. For example: “His income from freelance work supplements his salary.”

- As a verb: “Income” is not typically used as a verb in standard English. Instead, you might use phrases like “earn income” or “generate income.” For example: “She earns income from her investments.”

Salary and Income – Examples

Examples of Salary

- “The company offers an attractive salary package with additional benefits.”

- “She earns a competitive salary as a software engineer.”

- “His annual salary review resulted in a significant pay raise.”

- “John negotiated a higher salary for his new position, allowing him to better support his family.”

- “The company offers competitive salaries to attract top talent in the industry.”

Examples of Income

- “In addition to her salary, she earns income from freelance projects.”

- “Their investment income surpassed their salary earnings this year.”

- “Income from rental properties contributes to their overall financial stability.”

- “In addition to her salary as a teacher, Sarah earns extra income by tutoring students in the evenings.”

- “The couple’s investment income from their diverse portfolio provides them with financial security in retirement.”

Synonyms

| Term | Synonyms |

|---|---|

| Salary | Wages, earnings, pay |

| Income | Earnings, revenue, proceeds |

Exercise

Fill in the blanks with either “salary” or “income” to complete the sentences accurately.

- She negotiated a higher _______ for her new job.

- Their investment _______ provides passive earnings.

- His monthly _______ covers his living expenses.

- The family’s diversified _______ streams ensure financial security.

- The company offers competitive _______ to attract top talent.

Answers

- salary

- income

- salary

- income

- salaries

FAQ’S

Is Salary an Example of Income?

Yes, salary is a type of income. It represents the earnings received from employment, typically paid on a regular basis, such as monthly or yearly.

What is Considered Your Salary?

Your salary is the fixed regular payment you receive from an employer in exchange for work performed. It’s usually agreed upon in advance and paid at regular intervals.

What Type of Income is Your Salary?

Your salary falls under the category of earned income. It’s the money you receive for the work you do as an employee, reported on tax forms like W-2.

What are the 3 Main Types of Income?

The three main types of income are earned income (e.g., salary), passive income (e.g., rental income), and portfolio income (e.g., dividends from investments).

What Type of Salary is Good?

A good salary varies depending on factors like industry, location, and individual circumstances. Generally, a salary that meets your financial needs and offers room for growth is desirable.