10+ Merger Agreement Examples

Entrepreneurs would do almost anything just to survive the very competitive world of business. The common thing that they would do is to get into a consolidation process known as merger and acquisition (M&A). It is the integration of two business organizations’ shares, shareholders, and other assets to produce a successful brand. Just like other business undertakings, getting involved with such an affair requires a roadmap, as well as a written company business plan and deal to allow partakers to make amendments if necessary. If you’re looking for a reference to know more about the deal, our article and examples below are perfect for you!

10+ Merger Agreement Examples

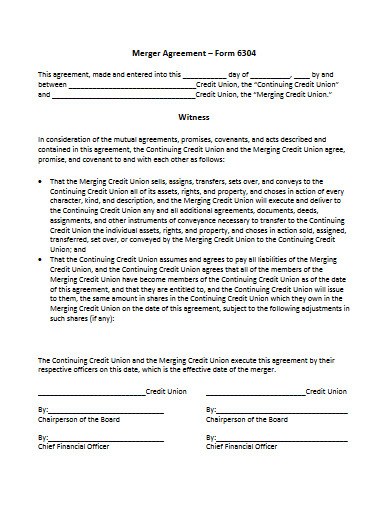

1. Merger Agreement Template

2. Agreement and Plan of Merger Template

3. Merger Agreement Form

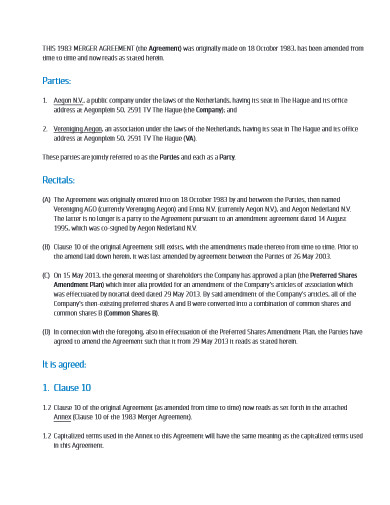

4. Amended Merger Agreement

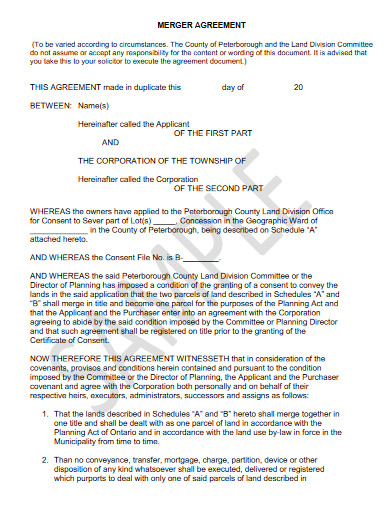

5. Planning Merger Agreement Template

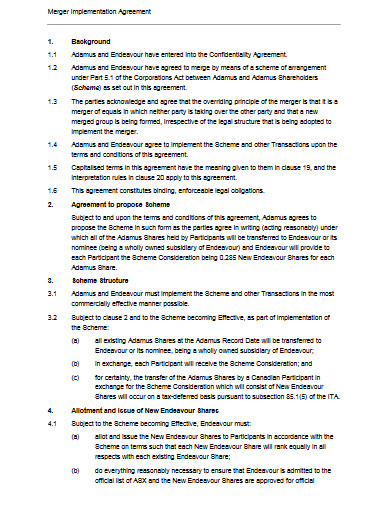

6. Merger Implementation Agreement

7. Workers Merger Agreement

8. Draft Merger Agreement

9. Format of Merger Agreement

10. Agreement and Plan of Merger

11. Employees Merger Agreement

What Is a Merger Agreement?

A merger agreement is a legal document that binds two organizations to share resources and assets to form a new and stronger brand. According to Marshall Hargrave of Investopedia, this type of business also occurs when the participants want to gain a market share, extend to a new market segment, and expand market reach. The same source mentioned that the activity is sometimes called the “merger of equals.” This is because the said participants who decide to partake in the activity are equal in almost all business aspects, specifically regarding the operations, customers, and size.

Horizontal and Vertical

There are five major types of mergers. They consist of the congeneric, market extension, conglomerate, vertical, and horizontal. The latter two are popular among investors because they help them achieve their financial goals earlier than other strategies. A horizontal merger happens when two companies with the same line of products or services and the same market fuse under single ownership. On the other hand, a vertical merger occurs when an organization buys the other to expand its capability in the most efficient manner. A good example of this is when a certain manufacturer decides to buy one of its supplier’s business to gain the advantage of producing its very own raw materials.

How To Create a Merger Agreement?

When creating a merger agreement, you need to have knowledge about writing contracts or agreements. Aside from that, you also have to understand how technical writing works to ensure that your document balances technicality and simplicity. But, you don’t have to worry all about those because we have our outline of guidelines ready to walk you through in completing your task.

1. State the Main Purpose

Not all people truly understand what a merger is. But even if we do, it is in the standards that all people who take part in a merger agreement have to define its main function. With that being said, your first task is to give out the statement of purpose. This should discuss the very reason why the document’s production is a must.

2. Name the Participants

Don’t forget to mention the names of the participants in your first section. Not only those, but you also have to provide their complete addresses, as well as give out the date when the agreement is signed and made effective.

3. Set Out the Terms and Conditions

After the first section, proceed with setting out your agreement’s terms and conditions. You have to discuss the sharing of different business aspects, such as liabilities, employment, intellectual properties, taxes, legalities, business operations, product or service prices, and other important considerations. You also have to include in this part the list of activities and its corresponding activity schedule. In addition, the payment schedules and details must be included, but only if applicable.

4. Provide Representations and Warranties

Both parties have to show their devotion physically. This is why you must ask them to present their representations and warranties. In this section, you have to detail all the things that the parties will offer to guarantee their commitment to the planned undertaking. These could take the form of money, properties, and others.

5. Create an Escrow Clause

Obviously, merger agreements involve money, like the security deposit or earnest money. This is to ensure the commitment of both parties in the planned agreement. However, this process will require the service of an escrow or a third party that keeps track of the agreement’s progress. Once the escrow agreement specifications become successful, the entrusted money can be released to the appointed benefactor.

6. Secure Classified Information

Every agreement contains confidential information. And so, you have to incorporate a non-disclosure agreement (NDA), data confidentiality agreement, or a mutual confidentiality agreement in your document. This will protect sensitive information according to the parties’ stipulations.

7. Prepare Termination Clause

The next and last thing that you have to prepare is the termination clause. This should detail the circumstances in which the agreement should be terminated and the appropriate actions that must be taken. This section should go along with the parties’ dispute resolution policies or termination policies and procedures.

FAQs:

What is a congeneric merger?

A congeneric merger is a type of merger in which multiple companies share business operation resources and production strategies to create a new product line. Once the new product has been successfully developed, it will be added to one of the company’s product lines. This type is also called a product extension merger.

What is a conglomerate merger?

A conglomerate merger is another type of merger in which two completely different companies combine to share the shareholders and create synergy. These companies would most probably also differ in terms of industry and geographical factors.

What is a market extension?

A market extension is a type of merger where two companies with the same products but different markets consolidate to extend both of their market advantages.

Even with so many benefits, many entrepreneurs still doubt the merger. The reason behind it is because there were too many instances where the activity failed because of carelessness. But thanks to those who made mistakes, business people are wise enough to get everything documented. A perfect example would be the production of a merger agreement that not only protects businesses but also guides them in their business endeavors.