Budget Analysis for Your Business

Creating a budget plan for your business is a key factor in the company’s development. An insufficient budget may cause the company to take drastic measures with their operations, such as laying off a number of employees in order to cut down costs.

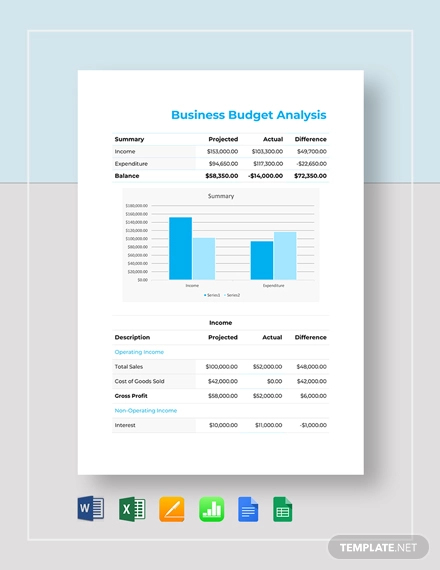

Business Budget Analysis Template

But of course, it’s essential for a company to create a realistic budget. This would mean that a company should refrain from making investments that would not contribute to its growth.

A budget analysis example is a crucial process that is done to evaluate the budget plan made for the company. With a budget analysis, the company may thoroughly analyse existing or potential problems that may affect the company’s financial analysis sector.

What Is Needed for a Budget Analysis?

In making a budget analysis, you need to be aware of your company’s financial behaviour. This would include the company’s total sales analyis and expenses as well as its current cash balance. With this, the company would need to identify the amount of cash that they would need to support various sectors of the company.

To put it simply, the essential information needed for a budget analysis should include the adopted budget of the current year, the proposed budget for the succeeding year, the company’s total revenue and expenditure data, and its recent financial statement. With this, the team responsible for the analysis would need to determine whether the proposed budget is appropriate enough to be implemented.

Why Is Budgeting Important to Your Business?

When you think about it, your budget is actually a tool used for planning. The investment analysis you make may greatly impact various sectors of your company, but may simultaneously help you attain your goals as well. Having a budget will allow you to limit the money you spend on certain operations.

This would ensure that resources are not wasted on items that aren’t necessary to the company’s growth. This would mean that the company would need to be strict with their material resources in order to meet the budget limit. Furthermore, budgeting will also allow the company to closely monitor its financial department.

Tips to Writing a Budget Analysis for Your Business

Writing a budget analysis is a crucial step for any business analyiss. Any major, or even minor, mistake may cause the company its resources. The goal for any business is to maintain sufficient cash for their operations within a given period of time.

- Think of the future. Unforeseen circumstances may greatly affect the initial budget plan. Make assumptions based on possible issues that may take a toll on the set budget.

- Ask for help. Gaining input from financial professionals will help you with your analysis example. After all, a reliable analysis should be based on facts. Uncertainty may lead to negative outcomes.

- Make use of visuals. Graphs and charts may easily present statistical data that will provide a precise and clear view of your analysis.

- Review your calculations. Human error is a common, yet crucial, problem when dealing with numbers. Double check your calculations to ensure that everything is correct.