4+ Budget Examples to Download

In today’s dynamic world, managing finances is an essential skill for individuals, businesses, and organizations alike. Budgets play a pivotal role in this process, enabling the effective allocation of resources, planning for the future, and achieving financial goals. In this article, we delve into the concept of budgeting, provide a step-by-step guide on creating a budget, address frequently asked questions, and offer insights into the significance of budgeting. Whether you are a seasoned financial planner or new to the world of budgets, this article will equip you with the knowledge and tools, including practical budget templates, necessary for effective financial management.

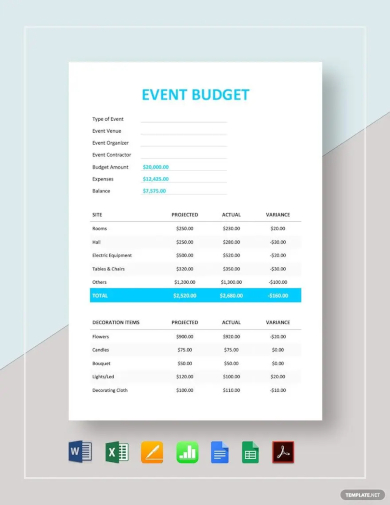

1. Event Budget Template

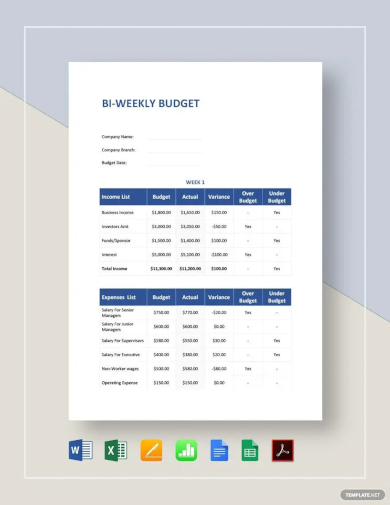

2. Bi-Weekly Budget Template

3. Department Budget Template

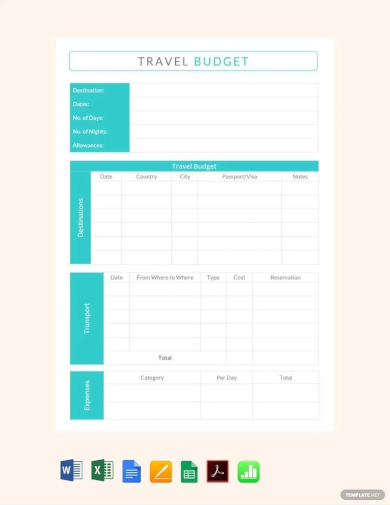

4. Travel Budget Template

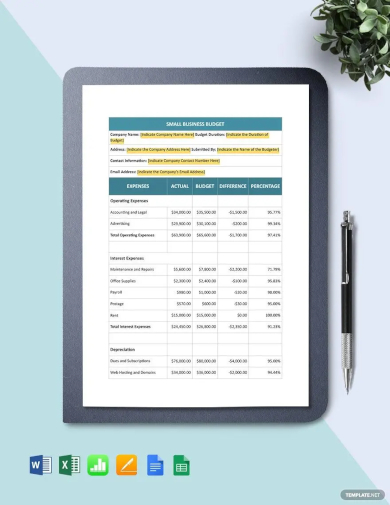

5. Small Business Budget Template

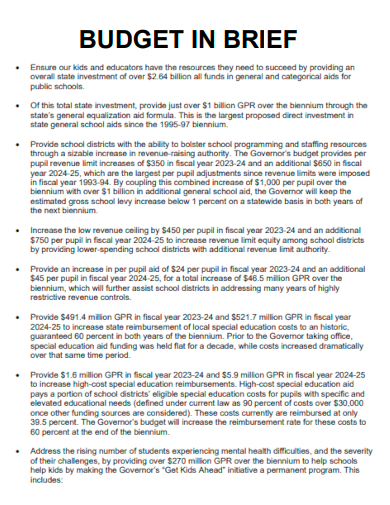

6. Budget in Brief

doa.wi.gov

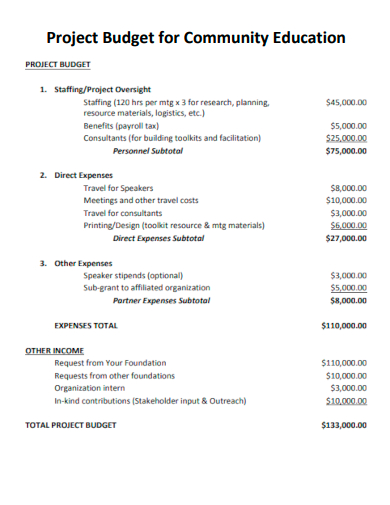

7. Project Budget for Community Education

cnjg.org

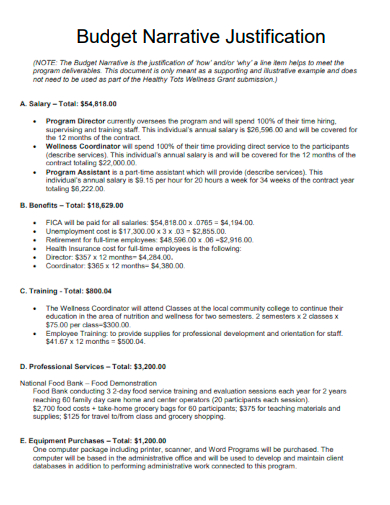

8. Budget Narrative Justification

osse.dc.gov

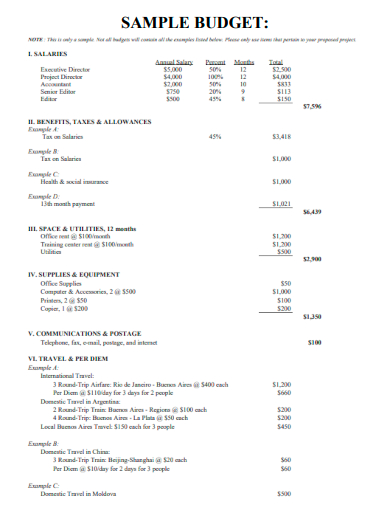

9. Sample Budget

ned.org

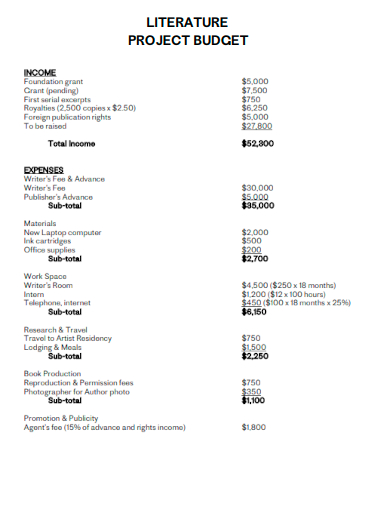

10. Literature Project Budget

creative-capital.org

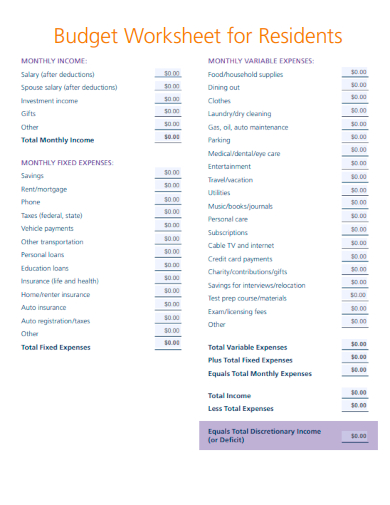

11. Budget Worksheet for Residents

aamc.org

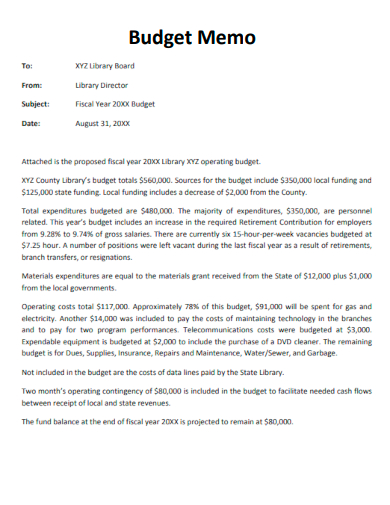

12. Budget Memo

georgialibraries.org

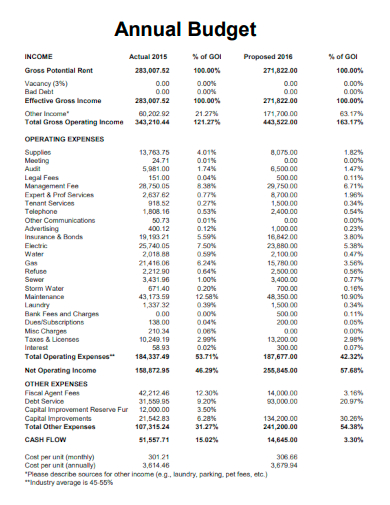

13. Annual Budget

ci.faribault.mn.us

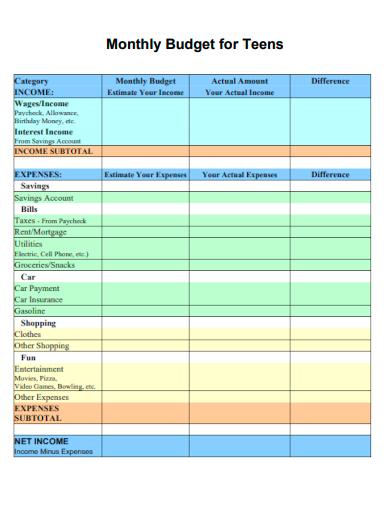

14. Monthly Budget for Teens

fndusa.org

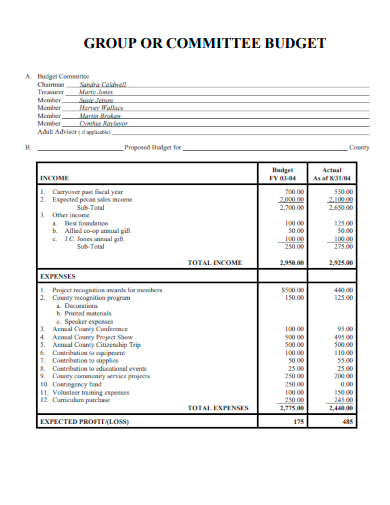

15. Group or Committee Budget

tamu.edu

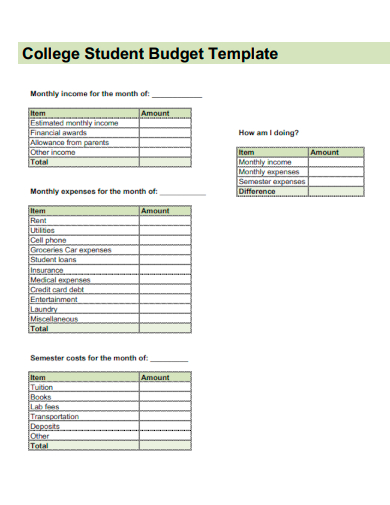

16. College Student Budget

uchicago.edu

17. Example Production Budget

ipic.iastate.edu

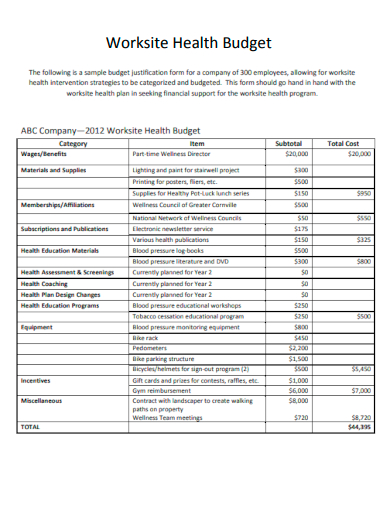

18. Worksite Health Budget

cdc.gov

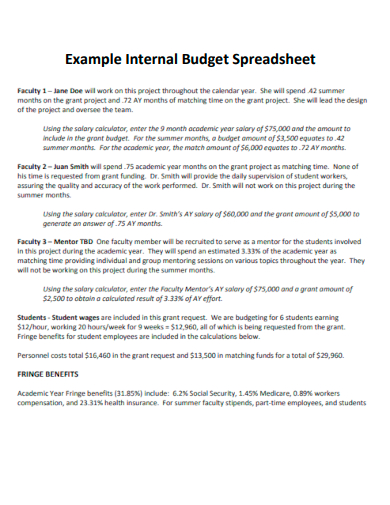

19. Example Internal Budget Spreadsheet

valpo.edu

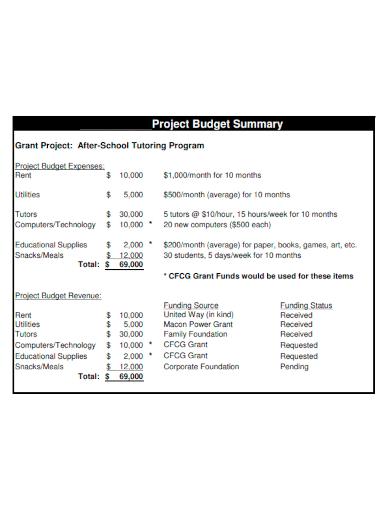

20. Project Budget Summary

cfcga.org

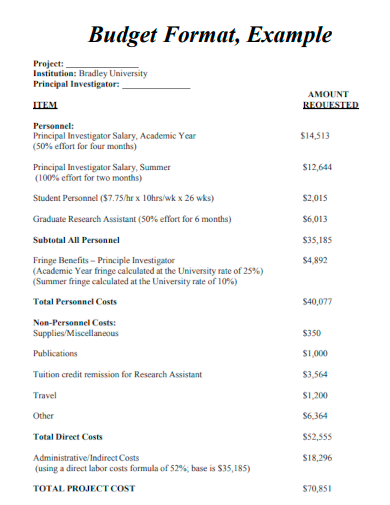

21. Budget Format Example

bradley.edu

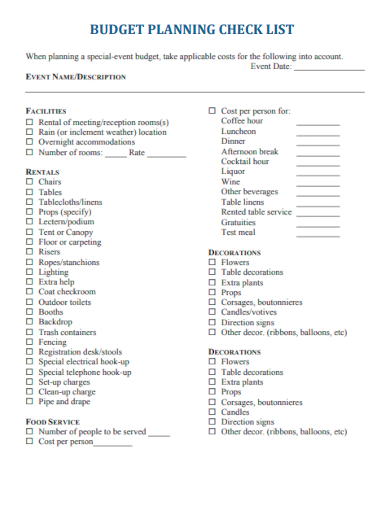

22. Budget Planning Checklist

smith.edu

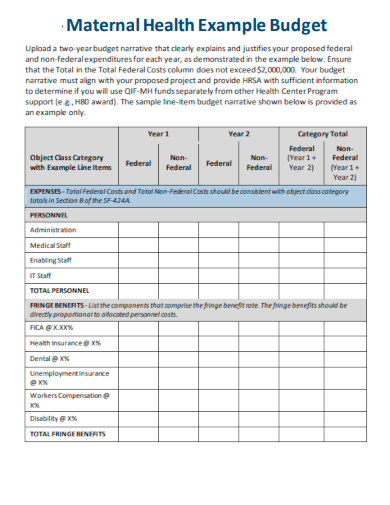

23. Maternal Health Example Budget

bphc.hrsa.gov

24. Formal Budget

cityofml.com

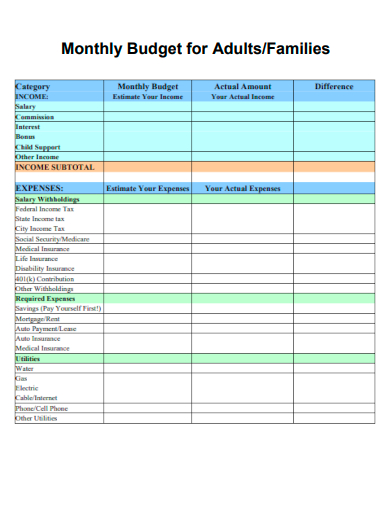

25. Monthly Budget for Adults & Families

dynamicfcu.com

What is a Budget?

Budgeting is the systematic process of creating a financial plan that outlines income, expenses, and savings over a specific period. It serves as a roadmap to track and control spending, ensuring that financial resources are allocated efficiently. By setting realistic financial goals and allocating funds accordingly, individuals, businesses, and organizations can make informed decisions about their expenditures and investments. A well-designed budget empowers individuals to manage their finances proactively, maximize savings, and ultimately achieve financial stability.

How to Create a Budget

Creating a budget might seem daunting, but with a systematic approach, it becomes an accessible and empowering task. By following these step-by-step guidelines, you can develop a comprehensive budget tailored to your unique financial circumstances and goals.

Step 1: Define Your Financial Goals:

Before diving into budget creation, take time to identify your short-term and long-term financial goals. Whether it’s saving for a vacation, paying off debts, or building an emergency fund, clearly defining your objectives will serve as the foundation for your budget.

Step 2: Assess Your Income:

Determine all sources of income, including salaries, side hustles, investments, or any other revenue streams. Compile this information to get a clear picture of your total monthly income.

Step 3: Track Your Expenses:

Review your bank statements, receipts, and bills to identify your regular expenses. Categorize these expenses, such as housing, transportation, utilities, groceries, entertainment, and debt payments. This step will provide valuable insights into your spending habits.

Step 4: Set Spending Categories and Limits:

Based on your expense tracking, establish specific spending categories and assign reasonable limits to each. Ensure that your expenses align with your financial goals, prioritizing essential needs over discretionary spending.

Step 5: Allocate Savings and Debt Repayment:

Make savings and debt repayment a priority in your budget. Allocate a portion of your income toward savings and establish a plan to reduce debt systematically.

FAQs

What is the importance of budgeting?

Budgeting is crucial as it provides financial clarity and control. It helps individuals and organizations make informed decisions, allocate resources effectively, and work towards their financial goals. By maintaining a budget, one can avoid overspending, reduce debt, and build a secure financial future.

Can budgeting help with a fundraising event?

Absolutely! Budgeting is essential for planning and organizing a successful fundraising event. It enables you to estimate expenses, allocate funds to various aspects of the event, and track income and expenditure. By creating a budget for your fundraiser event, you can ensure that resources are utilized efficiently and maximize the impact of your efforts.

What is the significance of a cover page in budgeting?

While a cover page may seem like a small detail, it serves as an essential component of budgeting documents. It provides an overview of the budget, identifies the creator, and includes important details such as the period covered, financial goals, and any significant notes or disclaimers. A well-designed cover page enhances the professionalism and clarity of your budgeting materials.

Budgeting is a fundamental tool for financial management, allowing individuals, businesses, and organizations to navigate the complexities of their finances effectively. By understanding the importance of budgeting, following a step-by-step guide, and addressing common queries, check out 6+ team building proposal examples, 10+ budget examples and templats, 10+ formal writing examples, and in these links, and you are now equipped to take control of your financial future. Remember, budgeting is not just about restricting spending but rather empowering yourself to make informed decisions and achieve your financial goals. So embrace the power of budgeting, along with the resolution to explore various strategies and standard forms, and utilize the services and assets available to you. With a well-crafted budget, you can confidently plan for the future and pave the way toward financial stability and success.