10+ Call Option Examples to Download

A good investment requires interconnected strategies and techniques. One of these techniques allows the investor to use call options to buy stocks at a specific price without any outside factors affecting said price.

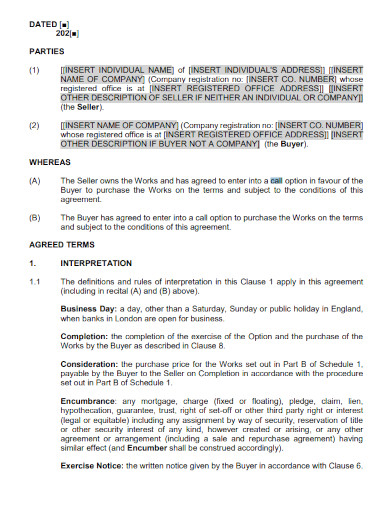

1. Call Option Agreement Template

2. Call Option Deed Template

3. Call Option Agreement Approval Form

Call Option Investor Rights Agreement

4. Cross Call Option Agreement

5. Final Call Option Agreement

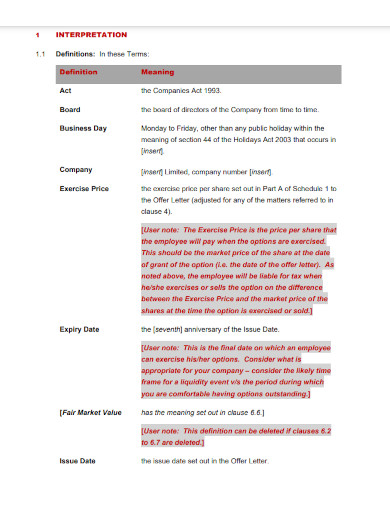

6. Share Call Option Plan Terms Template

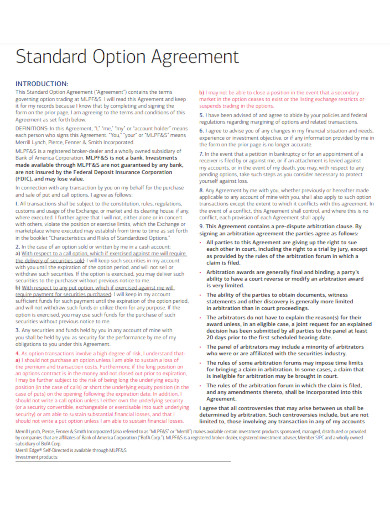

7. Standard Call Option Agreement

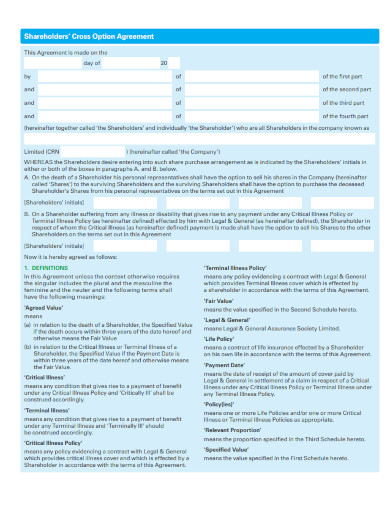

8. Shareholders Cross Call Option Agreement

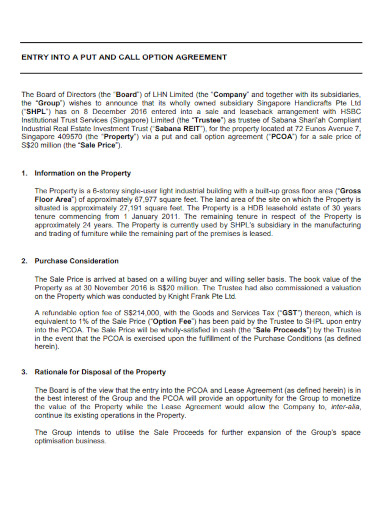

9. Entry Into Put Call Option Agreement

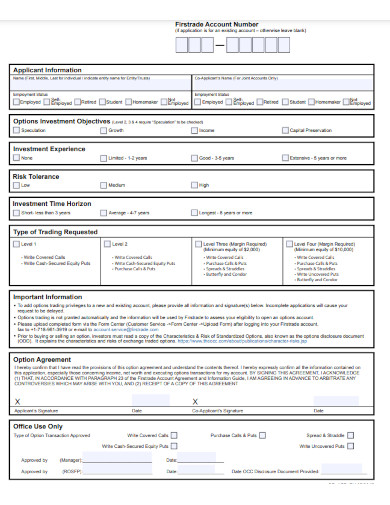

10. Call Options Application and Agreement

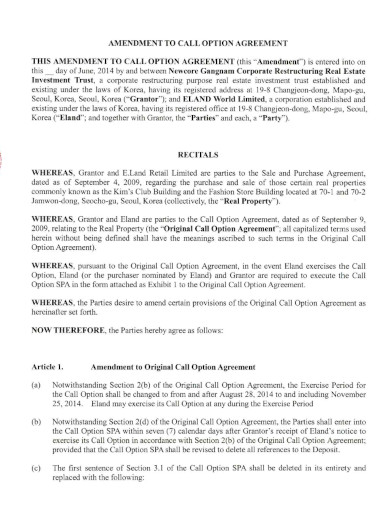

11. Amendment to Call Option Agreement

What Is a Call Option

A call option is a stock-related agreement or contract between the investor and the stock market. The call option agreement allows the investor to buy the stock at a specific and set price called a strike price. The investor will need to pay a specific price called a premium to obtain this specific contract.

How to Select the Correct Call Options

A call options agreement is a contract that is made between the investor and the stock market. The standard call options agreement can succinctly present the data needed to check if the investor can make the correct call. This makes it important to know how to select and choose the correct call options in the market.

1.) Define Your Investment Objective

Begin by defining your investment objective, this will set the precedent of how much money you will invest and use in the call option. Not only that but the investment objectives can also be used to determine the viability of your investment.

2.) Determine the Volatility and Compare it with Risk-Reward Payoff

After defining your investment objective, you must determine the volatility of the stock market you want to invest in. Then you may compare and use the volatility to gauge the risk-reward payoff of your investment.

3.) Create a Strategy

When you have finished determining the volatility and have compared it with the risk-reward payoff, try to create a strategy that uses the data created from the step before. This will help create a strategy that will serve as the base of your actions when it comes to call-and-put options.

4.) Establish the Option Parameters

After you have created a strategy, you may now establish the call options parameters. This parameter will help check if the call option is viable in the current situation.

FAQs

Call vs. put options; what is the difference between call and put options?

Call options are stock contracts that allow you the right to buy the stock at a specific strike price. These call options will also have a specific expiration date that the person will have to meet if they want to buy the specific stock at the indicated strike price. The person is not obligated to buy the stock, as the call option is an opportunity that is presented through the payment of a fee called the premium. Put options are stock contracts that allow a specific person to sell their stock at the indicated strike price. Like call options, put options have a specific expiration date that is shorter than the expiration date of the call option. The person using the put option will also have to pay a specific fee to avail of the usage of the put option but is not obligated to sell the stock before the expiration date. Call options are long-term contracts that allow the person to buy the stock during a specified period, while put options are short-term contracts that allow the person to sell their stock during a specified period.

What happens when a call option hits the strike price?

When the call option hits the strike price, then the call option will become useless. This is because the call option is a contract that allows the person to buy the stock at the strike price. This means that the call option just becomes useless as the price to buy the stock is 1:1, which makes the call option obsolete. The person can sell their call option to try to subsidize the premium they had paid for the contract, as a way to recoup their loss due to the premium.

What happens if I don’t sell my call option?

The call option is the right to buy a specific stock at a set strike price. This right will only be available to the person at a specific timeframe both long and short term. If you don’t sell your stock at the specified timeframe then you just lose out on the right to buy the stock through the call option. This is because the call option is not a mandatory obligation. The only thing you will lose out on is the price or premium you paid to obtain said call option. This means it is up to you to gauge the viability of the call option.

A call option is a contract that a person can buy that gives them the right to buy a stock at a specific strike price. This call option allows the person to buy the stock at the strike price without it being affected by outside factors. Therefore, if used properly the call option allows the person to buy the stock at a better price to resell for an even higher profit.