15+ Cash Receipt Examples to Download

A cash receipt is a document given to a customer after a transaction is made. The vendor will also keep a copy of the receipt so he has a record of the goods he has sold. Cash receipts are more important for the vendor because they allow him to know exactly how much is sold and what levels of inventory are needed.

For the customer, cash receipts are important because they are a useful and reliable form of financial record.

Elements of a Good Cash Receipt

Cash receipts are an important official document, which means that they should be issued with care, with the details accurate, and the information true. The next time your company releases a cash receipt or you receive one from your next transaction, make sure that it has these following elements:

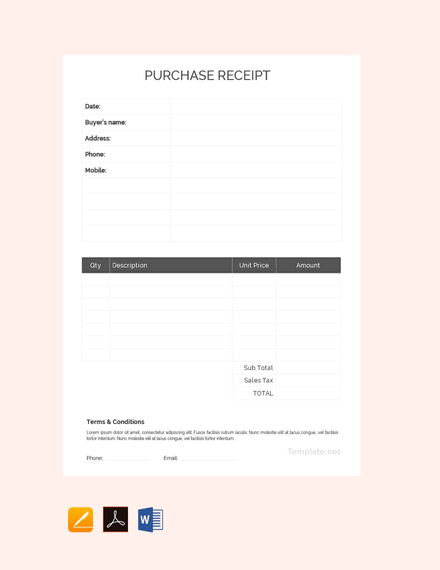

1. Business name and address: At the top of every cash receipt, you should see the name of the business that issued the receipt and its address. Sometimes, you’ll see the name near the bottom of the receipt. It can be anywhere on the receipt as long as the business name and address are clearly displayed so that you know where to go if you have any issue with the transaction.

2. Price, services, or products: A good cash receipt should list exactly what the customer bought and the price of that item beside it. This component will likely take up the majority of the room on the receipt, since it’s basically what issuing the receipt is for, to give a breakdown of the purchases done during the transaction and to serve as a reference for the customer and the vendor to exactly what was brought and sold and correct discrepancies.

3. Subtotal, taxes, and total: At the bottom of the receipt, under the list and prices of goods purchased, there should be a subtotal category with an amount. The subtotal is the total of all goods purchased before taxes are applied. Under the subtotal section should be a taxes section, which will list the amount of tax charged on purchases. Under the taxes portion of the cash receipt should be a total section, which gives the total amount, after taxes, charged to the customer. This is the amount the customer will have to pay.

4. Transaction record: Under the component of the receipt that lists the total should be a section that records how much the customer paid and what change, if any, she received. This is another important component of the receipt because it can be referenced if improper change was given to the customer. A transaction record number should also be in this section of the receipt so the vendor can easily reference the receipt number if he needs to later on.

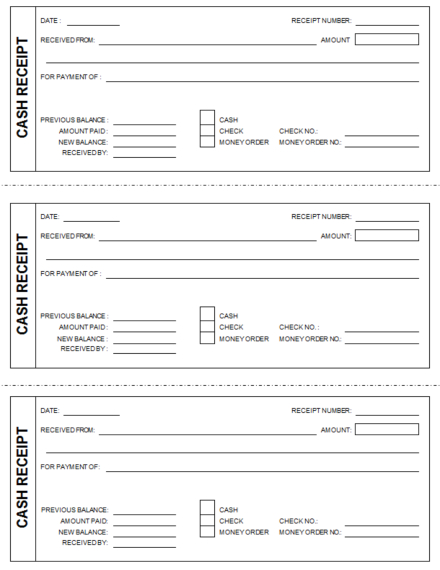

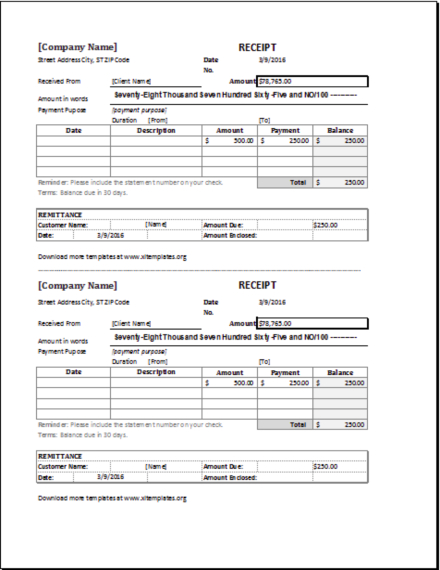

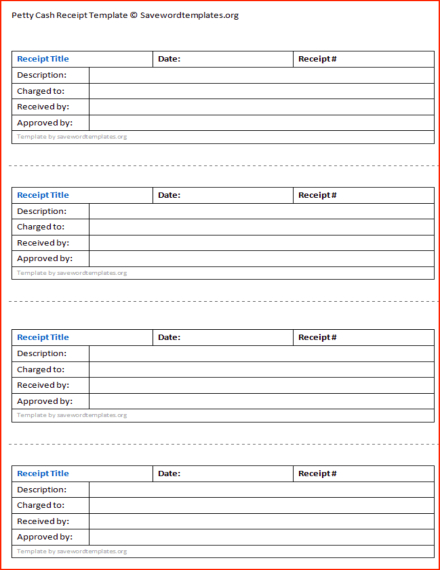

14+ Cash Receipt Templates

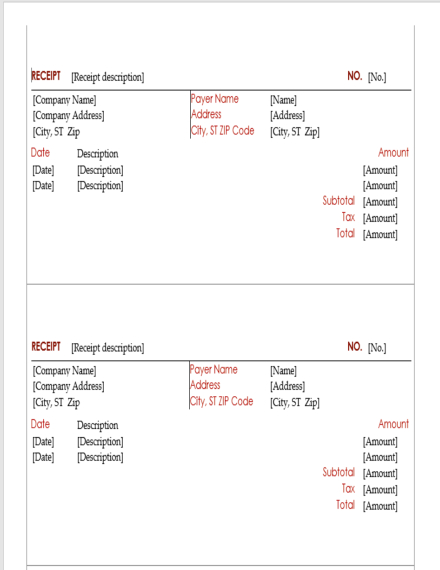

Cash Receipt Template

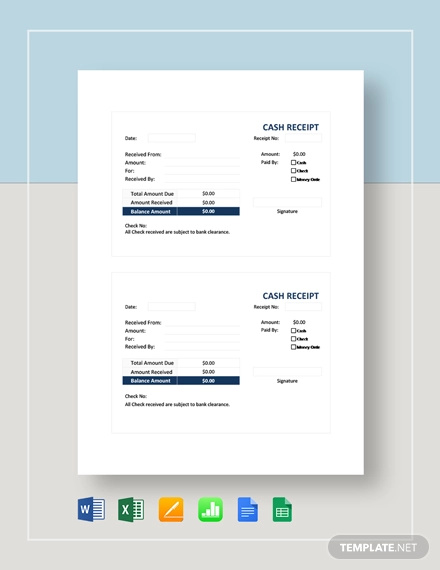

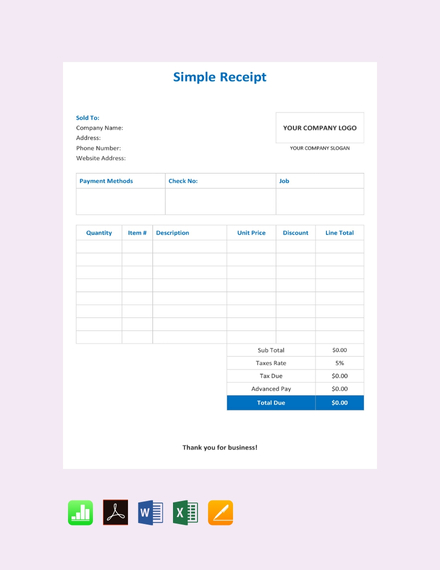

Simple Cash Receipt

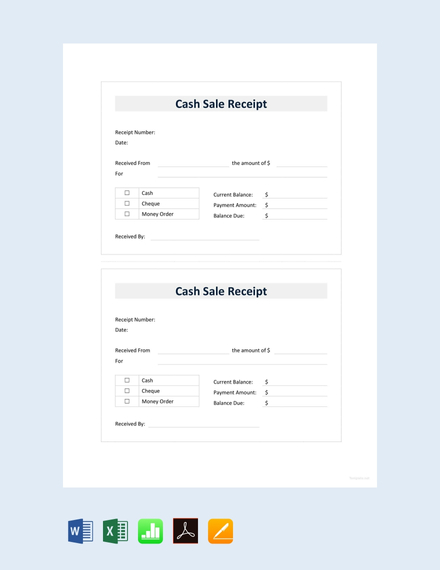

Cash Sale Receipt Template

Cash Receipt Template

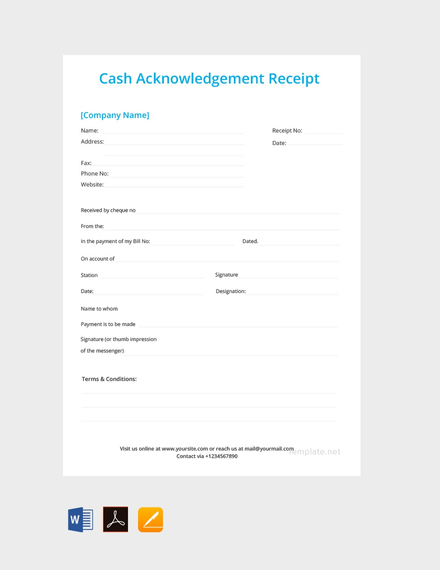

Cash Acknowledgement Receipt

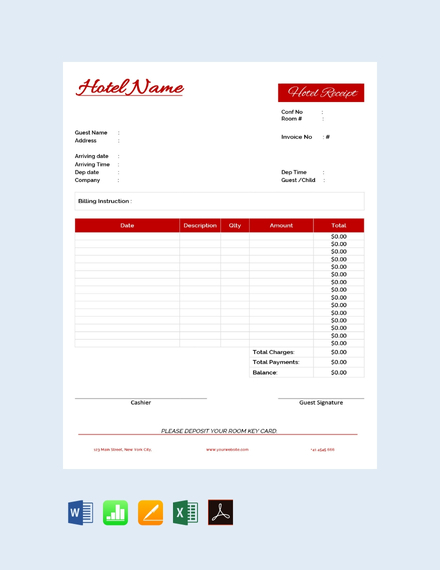

Hotel Cash Receipt Template

Cash Receipt Voucher Template

Sample Cash Receipt Template

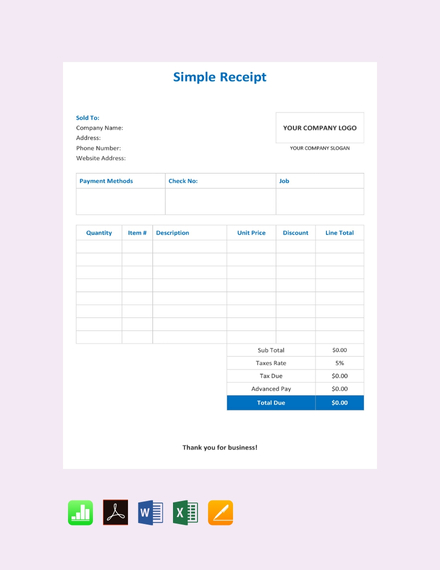

Simple Receipt Template

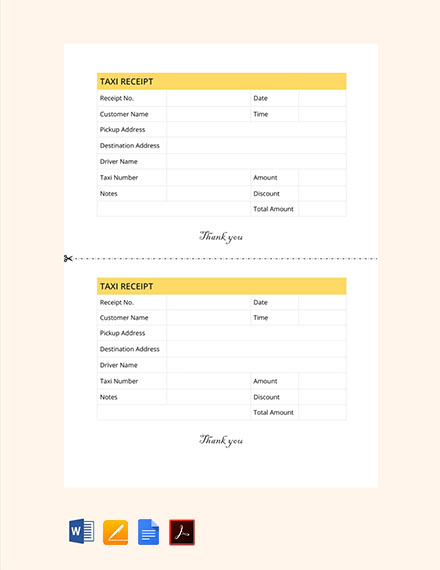

Taxi Cash Receipt Template

Purchase Cash Receipt

Cash Receipt

Sample Cash Receipt Template

Cash Collection Receipt Template Sample

Petty Cash Receipt Template

Cash Receipt Description Template

Simple Tips for an Excellent Cash Receipt Layout

One of the most important things to know when you’re buying and selling goods and services is how to write an excellent cash receipt. Luckily for you, that is exactly what we are going to talk about:

- List each party: Whether you are on the buying end or the selling end of a transaction, the first thing to do is to list everyone involved. The word receipt should be at the very top followed by the seller’s information, such as name and company’s name, contact information, and any other relevant details. Similarly, you also need to indicate all of the relevant information about the buyer. Finally, mark down the date of the transaction and possibly the specific time, depending on what’s being sold.

- List the details of the transaction: The next step is to give every possible detail about the goods or services involved. Make a clear list of the inventory, including the quantity of items, condition of the items, and the price paid for them. A good receipt should also include the method of payment. Payments by check should include the check number, and payments by credit or debit cards should include care type, the last four digits, and, sometimes, even the security code. You should also indicate the number of payments, and if the item was picked up or delivered. If paid in full, the receipt should reflect that too.

How to Create a Cash Receipt

If you are selling or thinking about selling goods or services, you must be aware of what you need to do for your customer to keep a record of the transaction. Below is a guide to take you through what you need to do when you are required to provide a proof of transaction:

1. Recognize the purpose of a receipt: Before you can make an effective cash receipt, you must first understand why you have to. Receipts are important because they will help you keep track of your income for tax purposes. Save all of your receipts, especially if you are running a business, as you may need to show proof of your expenses in your taxes. You should always provide a receipt for your customers if you are running a business, and most businesses will offer you a receipt for your purchases.

2. Make it clear that it is a proof of transaction: Firstly, you need to show that the document you write is intended to be identified as a proof of transaction. You should identify the document at the beginning and write what type of document it is, whether it be a receipt, a tax invoice, or another type of document.

3. Include when the transaction occurred: You are required to include the date of the transaction in your proof of purchase. You can include the time for your own records, but you are not obliged to include anything more than just the calendar date when the transaction happened.

4. Identify the parties in the transaction: In the proof of transaction, you should identify the relevant parties involved in the sale of the good or service. You must include the following information: your company’s name and identity, your company’s business number. Additionally, if the sale was over $1,000 the buyer’s identity must be included in the invoice.

5. Identify the goods or services of the transaction: And finally, a proof of transaction must contain the following information in the document: the goods or services supplied, and the price of the goods or services.

Types of Cash Receipts

There are a few types of cash receipts:

1. Electronically: Many small cash registers contain built-in printers for producing receipts. They also have a software that allows you to program tax rates and codes straight into the register, so all the calculations are done automatically. Also, digital receipts are an option. This method of supplying a receipt is becoming increasingly more popular. Once produced, the receipt is emailed straight to the customer.

2. Paper: If you don’t have software to produce a digital receipt, then a handwritten receipt will work just as well. A receipt book can be purchased easily from stationers and usually offers two copies per receipt—one for the customer, the other for your records. Alternatively, there are plenty of receipt templates that you can download to use. In fact, there are a few awesome examples we’ve posted along with this article. You can also create your own template from scratch.

3. A receipt of payment: In order to process a transaction, the seller of an item will draw up a receipt of payment. The receipt should include a receipt number, the date and the amount received. if the payment was cash, there should be a note that says “cash.” If the payment was check or money order, there should be a record of the check number or money order number. If the payment was through a credit card, the type of credit card used should be noted and the last four digits of the credit card specified.

4. A medical receipt: This is a bill of acknowledgment for a medical purchase, such as medicine, a prescription, or a surgical instrument. A medical receipt should include the diagnosis code, the date of the visit, the consultation time, and the total amount to be paid.

5. A sales receipt: This is the most common type of receipt. You will likely receive one every time you go shopping, and if you run a business, you will give a sales receipt to a customer after you ring in the sales items. The receipt will act as proof of purchase and should include the payment amount, the date of the sale, the name and price of the items, and the name of the person who processed the transaction.

6. A rent receipt: This type of receipt will be issued by a landlord to a tenant. A rent receipt acts as proof of rent payment and should include the landlord’s name, the renter’s name, the address of the rental property, the billing period, the rent amount, and the start date and end date of the rental agreement.

7. E-receipts: If you purchase items online or sell items online, you will receive or create an e-receipt. E-receipts are digital receipts that contain the same information as a payment receipt and act as proof of purchase for items bought online.

Cash Receipt FAQs

What is recorded in the cash receipts journal?

Cash receipt journals are used to record sales of merchandise for cash. Credit sales are not recorded here. They belong in the sales journal. All transactions in the cash receipts journal involve the receipt of cash.

What is the difference between cash receipts and cash disbursements?

Cash disbursement refers to the cash outflow or payment of money to settle obligations such as operating expenses, interest payment for loans and accounts receivables during a particular period in order to carry out business activities. Cash receipts, on the other hand, is just a record when a cash payment has been allocated for the sale of a product.

What is the meaning of cash receipts?

Cash receipts are written documents that are produced by a company each time it receives money in exchange for goods or services. The customer and the company both keep a copy of this document.

Staying competitive in the business industry requires a certain dexterity when it comes to the tiny procedures that make up every transaction that you will be facing on a day-to-day basis. One of these required skills is the ability to create an effective cash receipt since transactions are a necessary part of your survival as a business. Hopefully, this article has helped you understand more about this tool, and that the templates provided will help you get started.