20+ Lease Agreement Examples to Download

There are times when we need something, a land, building, or property, but we either fall short of money or do not intend to acquire the property and only use it for a specified period of time. We feel like it is convenient to only lease a property and it might be for a lesser cost. Hence, nowadays, we can always see properties for lease for the owners of those properties know that there are still many people who are looking for such properties. You may also see Franchise Asset Purchase Agreements

- 13+ Consignment Agreement Examples

- 35+ Printable Agreement Examples

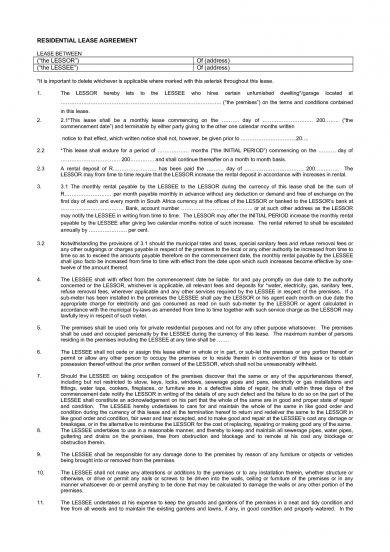

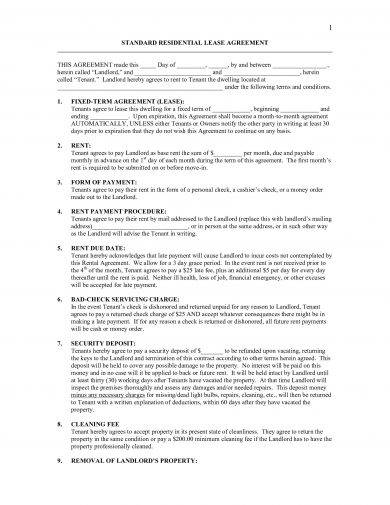

Short Term Lease Agreement

Vehicle Lease Agreement Template

Commercial Lease Agreement

Master Lease Agreement Example

Before the lease term commences, there must be an agreement that is valid and binding between the lessor, the legal owner of the asset, and the lessee, the one who promise to lease the asset in exchange of a certain sum of money. This is what we call lease agreement.To give you examples, the next section provides you several examples of lease agreements. Check them out now. You may also be interested in these agreements as well. You may also see Business Associate Agreement

Property Lease Agreement Sample

Hunting Lease Agreement Example

Option to Lease Agreement Example

Restaurant Lease Agreement Example

Commercial Lease Agreement

Vehicle Lease Agreement

Land Lease Agreement Template

What Is a Lease Agreement?

Before entering into a lease agreement, you must at least have a basic knowledge with regard to lease agreement so you will have an idea what your rights and privileges are and how you account the lease in your accounting books. Furthermore, basic knowledge is important so you will understand the terms stated in the lease agreement that you will be signing for a lease.You may also see separation agreements.

In this section, the basics and fundamentals regarding leases are discussed. We do hope that this will somehow help you before you enter a lease agreement.

In layman’s term, a lease agreement is sort of a contract binding the lessor and the lessee for the use of property. In accounting, as per International Financial Reporting Standards or IFRS, specifically IFRS 16, “lease is a contract, or part of a contract, that conveys the right to use an identified asset for a period of time in exchange for consideration.”You may also see contract examples.

This applies to all leases other than the agreements for the following:

1. Minerals

2. Oil

3. Natural gas

4. Other regenerative resources

5. Films

6. Videos

7. Plays

8. Manuscripts

9. Copyrights

10. Patents

This does not apply as the basis of measurement for the following:

1. Property that is being held by lessees that are accounted for as investment property using the fair value model

2. Investment property under operating lease provided by the lessors

3. Biological assets under finance lease held by lessees

4. Biological assets under operating lease provided by the lessors

In case if the right to use an identified asset is bundled together with agreements to provide goods or services, for example, maintenance arrangements for items of plant or machinery, then the non-lease components should be identified and accounted for separately under the relevant accounting standards for such non-lease components.You may also see roommate agreements

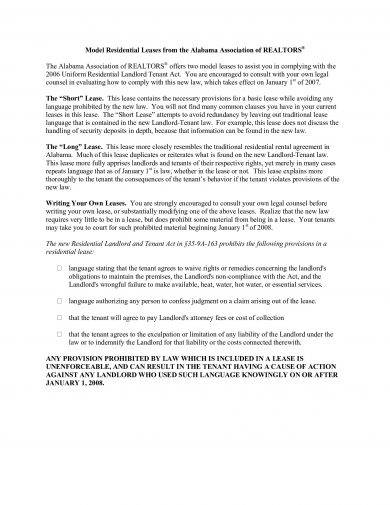

Alabama Realtor Residential Lease Agreement Example

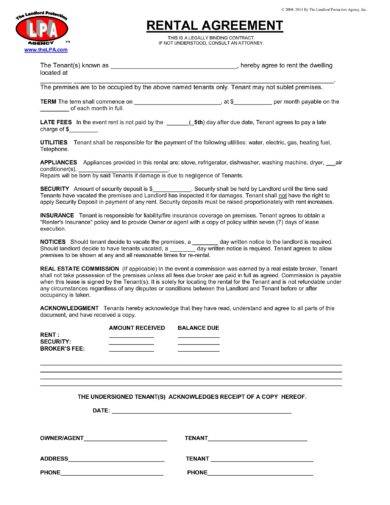

Basic Rental Agreement Example

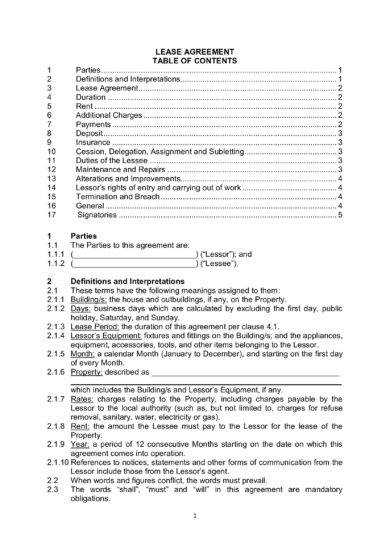

Lease Agreement for Immovables Example

Exemptions

There were exemptions with regard to the requirements for it to be qualified under the account title, lease, and these are as follows:

- Low-value assets

- Short-term leases with a term of 12 months or less

These exemptions were accordingly being constantly updated and reviewed, just like any other accounting standards, in order to ensure that the costs of the implementation do not outweigh the benefits. Because of this, there might be a possibility of creating a lease with a term of 12 months or less which can be renewed to result in a longer lease term in practice. However, the renewal must be reasonably certain before optional lease periods can be included in the calculations. This is said to be a certain aspect where significant judgment may be required.You may also see simple agreement letters

Classification of Lease

Leases, as per International Accounting Standards or IAS 17, Accounting for leases, can be classified as either finance lease and operating lease.

1. Finance Lease

In a finance lease, there is a substantial transfer of all risks and rewards by the lessor. This will give rise to asset and liability recognition by the lessee or a receivable by the lessor. The lease should be classified as a finance lease when any other of these criteria are met:

1. The asset ownership is transferred to the lessee by the end of the lease term.

2. The lessee has a purchase option to buy the leased asset.

3. The lease term covers the major part which is 75% or more of the remaining economic life of the asset being leased.

4. PV+GRV>FV – The present value (PV) of all the lease payments plus guaranteed residual value (GRV) is greater than the fair value (FV) of the asset being leased.You may also see sales agreements.

5. The leased asset has no alternative use following the lease term.

Other criteria may include the following:

The lessee is entitled to cancel the lease.

- Gains or losses from the fluctuations in the fair value are born by the lessee.

- The lessee can continue the lease at a rent that is substantially lower than the market rent.

There are two measurements associated with the lessee at the commencement date of a lease which are the lease liability and the right-of-use asset.

- Lease liability. This refers to the PV of the lease payments discounted at the discount rate, the rate implicit in the lease when the rate is determinable; otherwise, the rate to be used should be the incremental borrowing rate.

- Right-of-use asset. This refers to the amount of lease liability plus lease payments made prior to the commencement of the lease plus initial direct cost minus lease incentives.You may alsosee Non-compete agreements

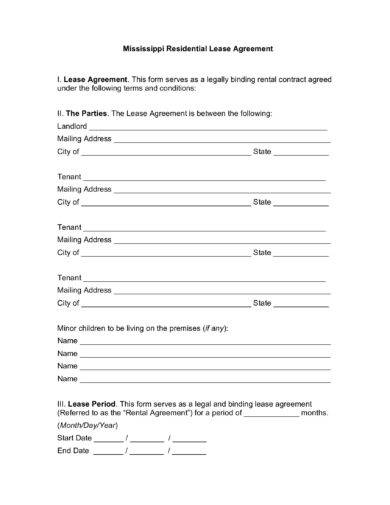

Mississippi Standard Lease Agreement Example

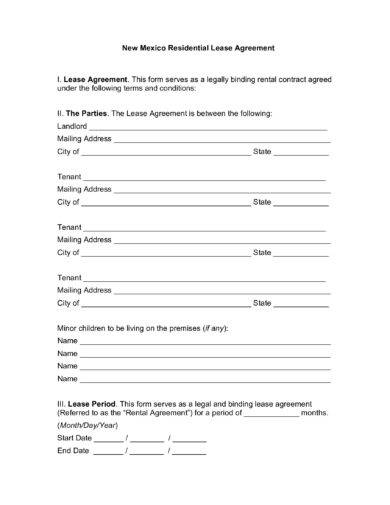

New Mexico Residential Lease Agreement Example

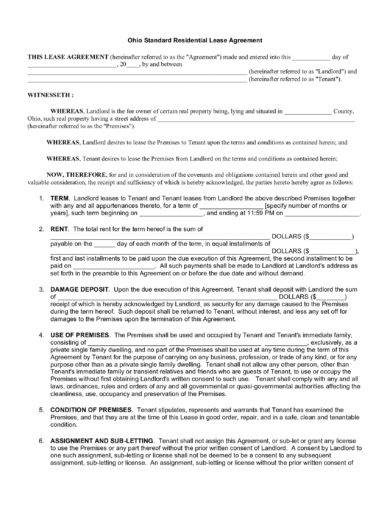

Ohio Standard Lease Residential Agreement Example

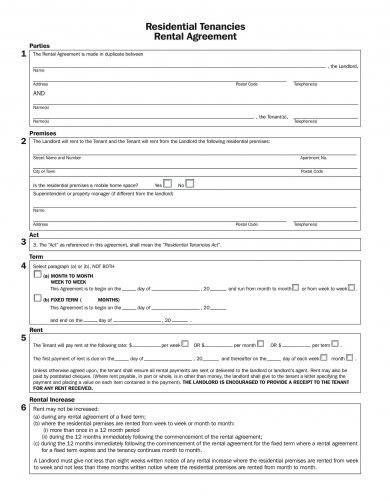

Residential Tenancies Rental Agreement Example

The following should be recognized in the records of the lessee over the term of the lease:

1. Amortization of the right-of-use asset

2. Amortization of the interest of the lease liability

3. Variable lease payments

4. Impairment of the right-of-use asset

The accounting for a finance lease involves the following steps:

1. Recognition of the finance lease. If a lease meets criteria presented above needed to qualify for accounting as a finance lease, then you must record the present value of all lease payments as the cost of the leased asset.

2. Recording of the interest expense. When the lessee makes lease payments to the lessor, a portion of each payment must be recorded as interest expense.You may also see management agreements.

3. Finance lease depreciation. If you are the lessee, you must calculate the related depreciation expense for the amount of the leased asset which can either be a straight-line depreciation or any other type of accelerated method of depreciation. In computing for the useful life of the asset for the depreciation, it is the period over which lease payments are made.

4. Dispose of asset. At the date of disposal of the asset at the end of its useful life, the asset and accumulated depreciation accounts must be reversed and any gain or loss on the disposal must be recognized.You may also see partnership agreements.

Operating Lease

All the other leases that are not finance lease can be classified as an operating lease. It allows for the use of an asset but does not convey rights of ownership of the asset. It also represents an off-balance sheet financing of assets in which the leased asset as well as the related liabilities of future rent payments are not being recorded on the balance sheet. Examples of assets that are accounted for as an operating lease are real estate, aircraft, automobiles, and other equipment having a long life span.Also take a look at business agreements.

The lessee is responsible to the condition of the leased asset at the end of the lease term, when it is returned to the the lessor, and has an unrestricted use of the asset within the leased term.

Accounting by Lessee

The following should be recognized in the records of the lessee over the term of the lease:

- Lease cost in each period

- Variable lease payments

- Impairment of the right-of-use asset

After the commencement date, the lessee must measure the lease liability at the present value of the lease payments not yet made and must measure the right-of-use asset at the amount of the lease liability with adjustments to the following:

- Impairment of the asset

- Prepaid or accrued lease payments

- Any remaining balance of lease incentives received

- Any unamortized initial direct costs

Accounting by Lessor

The lessor should account for the lease in the following manner:

- The leased asset must be depreciated over its useful life.

- The initial employee-related direct costs of the lease must be deferred. These are costs involved in negotiating the lease, evaluating the lessee, preparing lease documents, and closing the transaction and should be recognized over the lease term.You can also check out management agreements.

In case where the lessor sells the leased asset but retains the substantial risks and rewards of ownership in the property, it should not record the transaction as a sale, but instead, it must be accounted for as a collateralized borrowing arrangement.You may also see service agreements

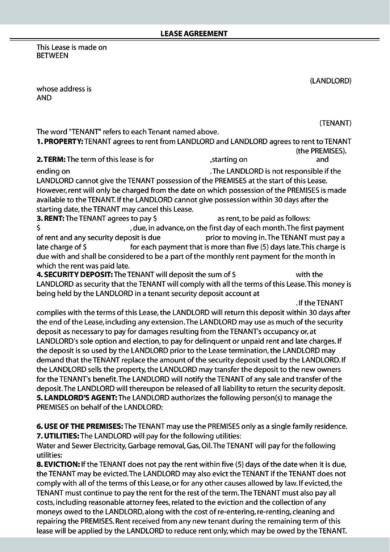

Simple Residential Lease Agreement Example

Standard Lease Agreement Example

Standard Residential Lease Agreement Example

Final Words

Lease agreement is important so that the lessor, the legal owner of the asset, and the lessee, the one who promise to lease the asset in exchange of a sum certain of money, will have a contract that is binding between them for their own protection.You may also see Agreement examples in PDF

Lease can be classified as either finance lease or operating lease. For it to qualify as a finance lease, it must met the basic criteria which are as follows: ownership of the property is transferred to the lessee by the end of the lease term, it contains a bargain purchase option, lease term is equal to 75% or more of the economic life of the leased asset, and the present value of the minimum lease payments equals or is greater than the fair value of leased asset. All other leases not classified as finance lease are directly classified as operating lease.

In case you are one of the parties involved in a lease, the lessor or the lessee, you must make your agreement valid and binding through signing a lease agreement similar to the examples presented in the previous section.You may also see commercial agreements.