10+ Family Budget Planner Examples to Download

Gaining financial freedom is considered as a great achievement nowadays. One of the steps that can bring you closer to achieving financial freedom is by having a family budget planner. By using a planner as one of your aides in budgeting, you will be able to determine where and how you are going to spend the money that your entire family earns and this will also allow you to save up, stay debt-free, and constantly live just within your family’s means.

Family Home Budget Planner

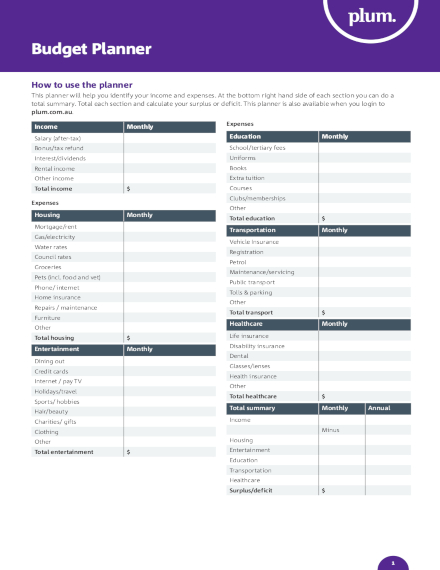

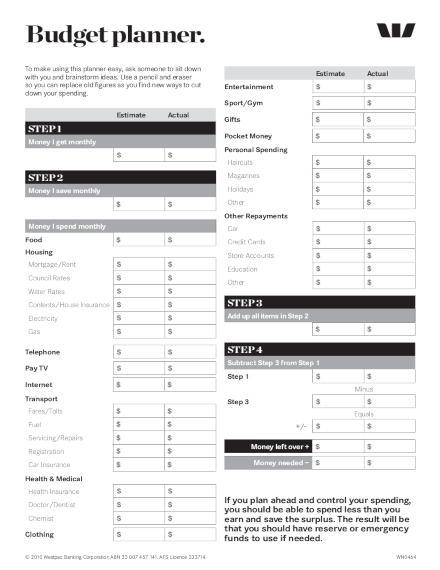

1. Basic Family Budget Planner

If it is still your first time attempting to make a budget planner for your family, make use of this basic family budget planner that will help you start strong. This budget planner enables you to conveniently identify your family’s income and expenses. The categories for the expenses are just basic that you can easily edit it should you wish to make it more specific and fitting for the kind of family budget planner you have in mind.

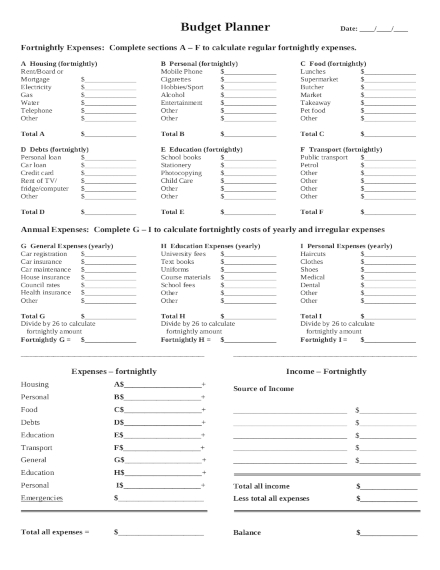

2. Family Budget Planner for Fortnight Expenses

A fortnight is defined as a unit of time that is equal to 14 days or two weeks. Most companies have fortnightly pay periods. If you are currently working for one, you may consider the use of this family budget planner that allows you to budget for your family’s needs and expenses according to the pay your receive every fortnight. This budget planner ensures that your family will still be able to have enough or at least survive until the next payment arrives.

3. Family Budget and Money Management Planner

This family budget and money management planner guides you as you take the first step of controlling your finances. This budget planner will help you in determining your net worth, your cash flow, and both major and minor expenses. But the best of all, this planner will also help you in setting goals that will help you achieve a sound spending and savings plan in the long run in which your family will really benefit from in the future.

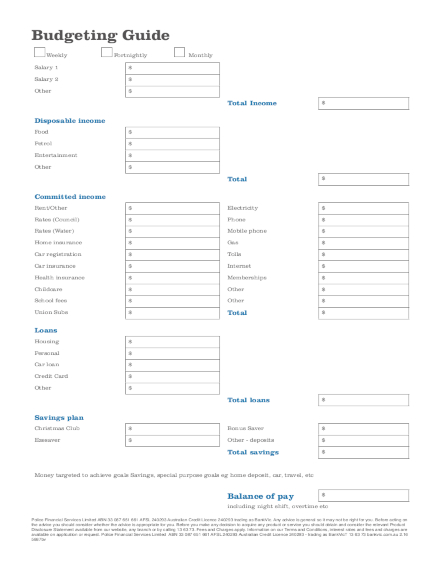

4. Family Budget Planner and Guide

Be guided as you plan for your family’s budget with the help of this family budget planner and guide. You will surely enjoy the rewards of budgeting and better money that you will reap from this budget planner since this provides a disciplined approach on how you get in control with your finances. This budget planner will not only help you in determining the best and realistic financial goals but it will also guide you in actually achieving such goals.

5. Family Budget Planner and Worksheet

This family budget planner and worksheet can indeed help you plan the budget for your family, just like the rest of the family budget planners that we have in this article. This budget planner will definitely help you control your spending and in return, this will also help you save up for emergency funds or contingency funds. The layout of this budget planner is a no-brainer, so if you are still new at family budgeting, rest assured that this budget planner is easy to use.

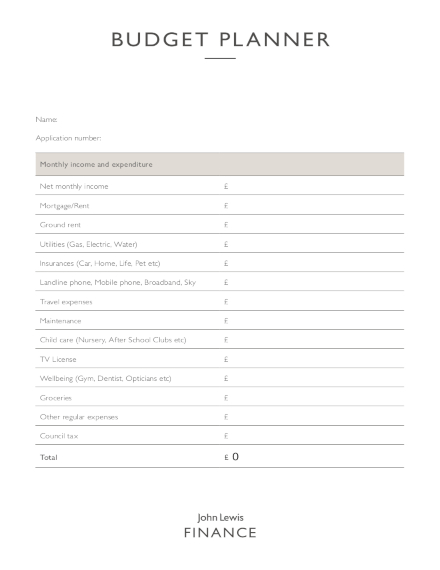

6. Family Home Budget Planner

All the budget planners provided in this article would not work if you have not worked out the total of your bills, spending, and income. Through this family home budget planner, you will be able to easily determine where and how you spend the money that you earn for your family. And eventually, in the long run, you will be able to save up and prepare for various unexpected bills, special occasions, etc.

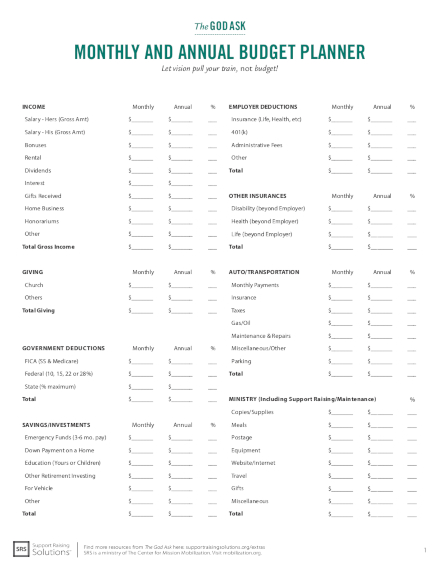

7. Family Monthly and Annual Budget Planner

Look at the bigger picture of budgeting by making use of this family monthly and annual budget planner. Having a budget planner on a daily basis or a fortnight basis can be limiting because it only keeps you focused on that short period alone. However, with this kind of budget planner, you will be able to make a consistent family budget plan for the entire month and you will also be able to have a bird’s eye view of your entire family’s budget plans for the entire year.

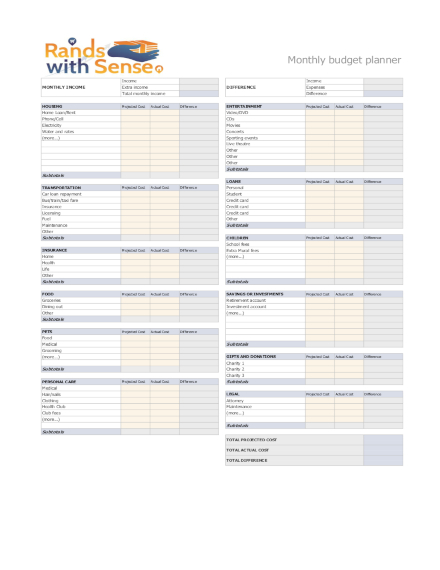

8. Family Monthly Budget Planner

Having a budget plan for the entire year may be tedious and unrealistic for some families and that includes yours. But that is just fine because you can still make use of this budget planner that allows you to determine your ideal, target budget for your family for an entire month. Out of the possible periods that can serve as your basis on how you pattern your budget plan, the monthly basis is perhaps the best one.

9. Simple Family Budget Planner

Do not worry about planning to just start things simple when it comes to planning for your family’s budget. It is in starting things small and simple that will help you in creating a positive habit formation. It will also help you create family budget plans in the future that have a bigger scope and it will include such as your children’s college education and your eventual retirement.

10. Understanding Your Finances Family Budget Planner

The reason why most people do not plan a budget for their family is because they are not aware of the importance of understanding the flow of their finances. Through this budget planner, you will not only be able to plan the budget for your family over a certain period but it will also enable you to have a deeper understanding of your family’s finances. Eventually, you will be able to have greater control over your finances, feel more secure, and have a peace of mind that will eventually lead to the improvement of your entire well-being.

In the event that you will be in need of a budget planner for your family, make sure you check out this article again and make use of the family budget planners provided.