13+ Real Estate Investment Trust Examples

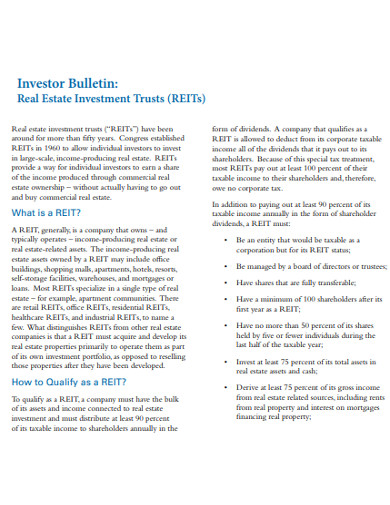

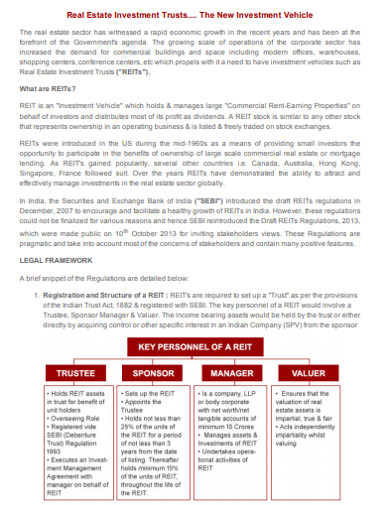

A real estate investment trust or REIT is used to refer to a company that either owns or operates a real estate portfolio and generates income. Earlier, most of the REITs used to focus on one specific real estate area with specialized agents and operators. But there are giant companies too who offer diversified REITs that hold different types of properties. REITs portfolios include properties like apartments. houses, hotels, cell towers, energy pipelines, etc.

What are the different types of REITs?

REITs are classified ion the basis of the business they do and how their shares are being bought and sold.

- Mortgage REITs: This REIT is also known as mREIRTs are exercised by lending capital to the real estate owners and operators directly through mortgages or indirect mortgage-backed securities. The earning to mREITs comes from the net interest margins where interests are too sensitive to be increased by the mortgage-centric focus.

- Equity REITs: Equity REITs may be at common in the market of real estate practice as they buy and manage real estate properties and produces income through renting or leasing out the property.

- Hybrid REITs: This REIT is composed of different properties and mortgage loans in their portfolios. The weighing of the more portfolio or mortgages holdings in this REIT depends on the entity they have invested on.

- Private REITs: This sort of REIT is not registered with the Securities and Exchange Commission (SEC) neither they trade on Nation security exchanges. They work by selling to a particular or some selected investors.

- Publicly Traded REITs: This sort of REITs offer shares that are listed on national security exchanges. In this platform, they buy and sell by individual investors. Trusts of this sort are regulated by the SEC.

- Public Non-traded REITs: Trusts in this sort are also registered and regulated by the SEC but they don’t mark their presence on national securities exchanges. This is the reason behind they are less liquidated than publicly-traded REITs. One good thing about this trust is that they don’t get affected by market fluctuations.

13+ Real Estate Investment Trust Examples & Templates

1. Deed of Trust Example

2. Declaration of Trust Example

3. Trust Agreement Template

What are the Advantages and disadvantages of REITs?

Advantages

1. It is easily bought and sold REITs.

2. REITs can offer better risk-mitigated returns and also offers a stable cash flow.

3. A real estate is effective for your portfolio. You can diversify it with different asset classes which can help you to balance other equities and bonds in the portfolio.

4. You will get transparent data and detail on your business and steady dividends in REITs.

Disadvantages

1. REITs do not offer many capital appreciations as 90% of the income goes back to the investors and you are left only with the 10% taxable income to invest it again to purchase new holdings.

2. Whatever dividends are received from REIT holdings are taxable income. Guaranteeing and ensuring any profit or safety against losses in REITs is not possible.

3. REITs are subject to market risks.

4. REITs require high management and transaction fees.

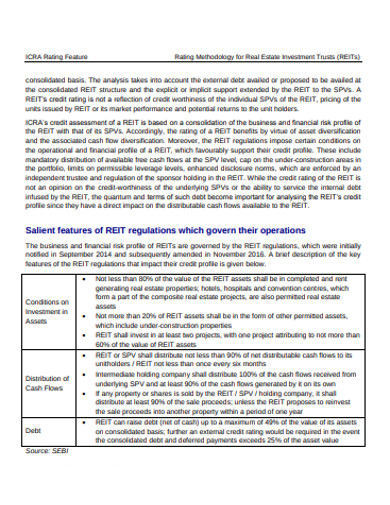

4. Rating Methodology for Real Estate Investment Trusts

If you want to invest in real estate knowing the market, researching the several market conditions, and knowing your competition is important. If you are investing it then along with studying the details making some specific investment goals is important as it can help you to stay on the track. You can make some sense of this instruction referring to this template on methodologies for REITs. Have a look at it and if it looks useful to you grab it today!

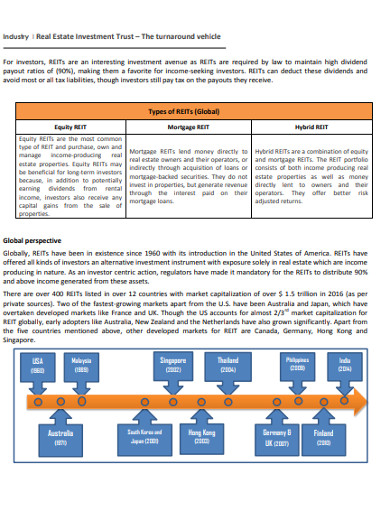

5. Real Estate Industry Investment Trust Example

If you are planning to invest in real estate you should have knowledge about real estate investment agreements. If you don’t have, you should not worry as the example template you see attached here frames different aspects of REIT and description on all of them. This detailed description file can help you to get ideas you want to get. So, check out this template today and frame your REIT blueprint easily with less effort.

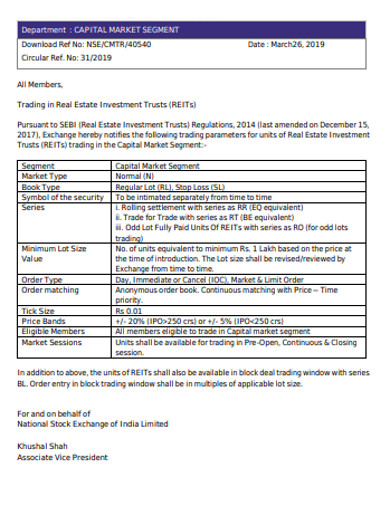

6. Real Estate Market Investment Trust Example

The given sample of the example template frames a detailed description of the REIT structure. You can o this template to understand the structure and base your REIT on it or you can also refer to our other best real estate brochure templates to have other ideas and prepare the best REIT for you. So, try this template today!