10+ Facility Agreement Examples

Normally, most organizations create or fill up another loan application whenever they need money. The same goes for individual employees who wish to renew their employee credit cards’ credit terms. Undeniably, the process is quite a hassle not just for them but also for the banks, credit unions, or other legal loaning businesses. Luckily, the said businesses took the initiative to offer a demand facility, loan facility, credit facility, and facility usage services. These services allow borrowers to extend their current loans for a certain period rather than creating a new application. But before anyone can avail of the said services, the borrower and the creditor have to make a signed agreement that details the lease’s terms and condition. Learn more through our examples and article below.

10+ Facility Agreement Examples [ Loan, Senior, Credit ]

1. Facilities Agreement Template

2. Restroom Facility Agreement

3. Facilities Use Agreement

4. Central Preparation Facility Agreement

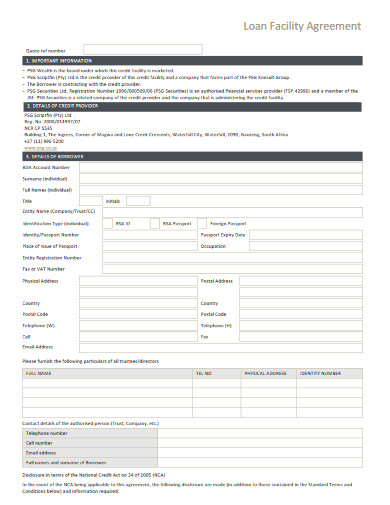

5. Loan Facility Agreement

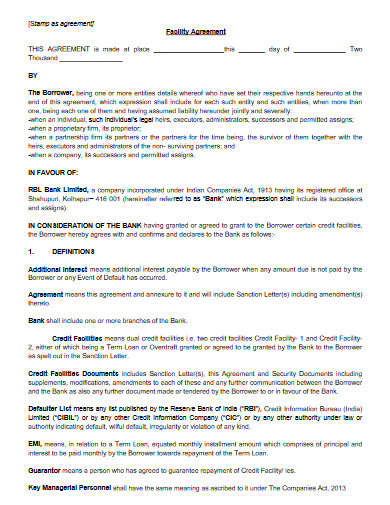

6. Working Capital Facility Agreement

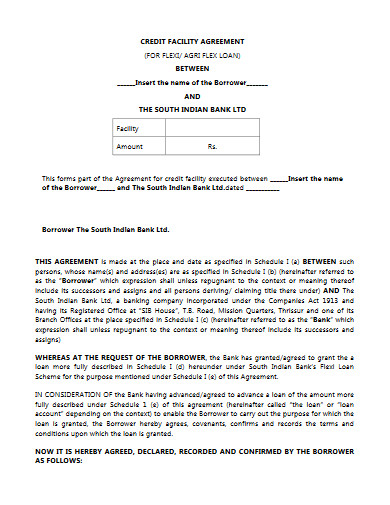

7. Credit Facility Agreement

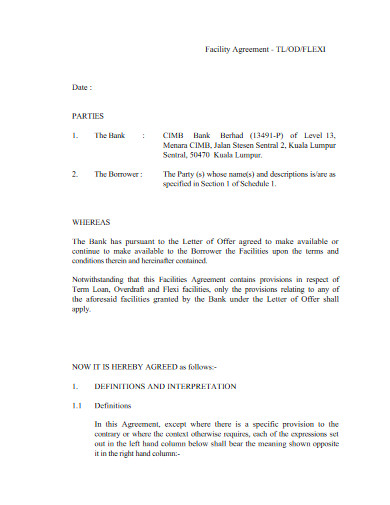

8. Facility Agreement Example

9. Sample Facility Agreement

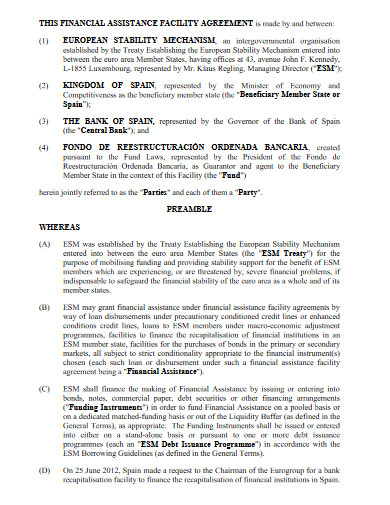

10. Financial Assistance Facility Agreement

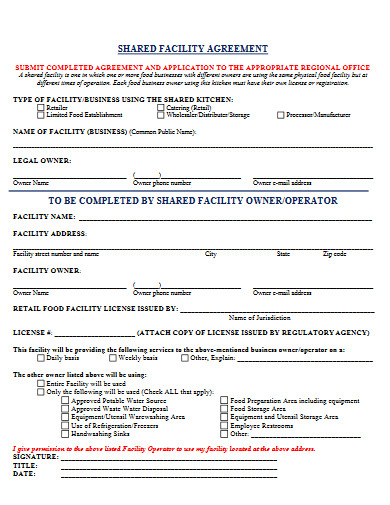

11. Shared Facility Agreement

What Is a Facility Agreement?

A facility agreement is a legal document that details the granting of a borrower a right to a financial assistance program for whatever purpose and a certain period. One of the great perks of this process is that it does not require collateral. In addition, its payment schedule follows that of a recurring payment agreement. At most times, companies get into such an agreement to save themselves from closing down during slow seasons, slow growth, discharging of employees, and other unwanted situations that involve financial complications. Other than that, the common benefit of all agreements, which is the protection from disputes, is very much applicable for this one.

Main Types of Facilities

There are two main types of facilities, consisting of committed and uncommitted. Committed facility refers to the lending arrangement where the borrower and creditor define the terms and conditions thoroughly. On the other hand, the uncommitted facility describes the temporary lending undertaking that does not necessarily need defined terms and conditions. Under the committed facility are the term loans and revolving credit, while the uncommitted facility has overdraft.

Term loans – loans that come with interest rates and maturity dates

Revolving credits – limited loans with no maturity dates

Overdraft – loans whose amount must follow the banks or other financing institutions’ decision criteria

How To Create a Facility Agreement

Financing is an important undertaking that needs proper handling and utmost protection. Writing contracts or agreements, which is one way of putting such activity into safety, has a certain standard that needs to be followed. This will ensure the thoroughness of your document. With our standardized outline below, we guarantee the comprehensiveness of your document.

1. Present Purpose and Participants

The first section of a facility agreement should consist of the statement of purpose and the introduction of the involved parties. Moreover, the purpose must incorporate a brief description of a facility agreement and a statement of how it applies to your planned lending arrangement. In addition, the basic information of the participants, including the legal names and addresses. In doing so, don’t forget to indicate which party is the lender and which party is the borrower.

2. Set the Terms and Conditions

Right after you present the document’s purpose and its participants, you can start setting the terms and conditions. For this section, you have to discuss the following:

– Each party’s duties and responsibilities

– Activity schedule to set a deadline for every task

– Borrowing and repayment mechanics

– The arrangement’s scope of work

– Representations and warranties

– Provisions for more than one lender

3. Give Out Payment Specifications

Most facility agreements have the same stipulations with a recurring payment agreement regarding the payment terms. Here, you give out the full details on the borrowed money, such as the total amount and the repayment schedule.

4. Include Confidentiality Agreement

A non-disclosure agreement (NDA), also known as a data confidentiality agreement and mutual confidentiality agreement, must be part of your document. This gives both parties obligations to protect the sensitive pieces of information in your document’s content. It also includes provisions as to who can access it in your data inventory or how they can avail the details.

5. Prepare Termination Clause

Every agreement has a termination clause where parties enumerate all the possible instances that a facility has to end. Along with the list of the possibilities, you must put into writing the termination policies and procedures, as well as the dispute resolution policy. Making this part concise is important to ensure that the parties get good guidance as to what steps to take in the event of disputes or unwanted events.

FAQs:

What is a line of credit?

A line of credit is a ready-made lending limit that borrowers can use at any time. This arrangement gives borrowers the privilege to take their much-needed money but for a certain amount only. One of its type, the open line of credit, enables borrowers to take the money again upon repayment.

What is a credit score?

A credit score is a number that represents a borrower’s worthiness to get financial assistance. The score is based on the borrower’s credit history where the repayment history, opened accounts, the total level of debts, and other credit-related documentation. The credit score ranges from 300 to 850. The higher the number, the better. The Fair Isaac Corporation’s (FICO) scoring system is as follows:

300-579 – Poor

580-669 – Fair

670-739 – Good

740-799 – Very Good

800-850 – Excellent

What do you mean by commitment fee?

A commitment fee is a term that is commonly used in banking transactions, which refers to the amount charged by lenders to its borrowers. This charged amount is lenders’ compensation for their financial service.

Not all professionals have the financial means to support their respective business plans. Lucky for them, some entrepreneurs are wise enough to turn this kind of issue into a profitable one, lending money in exchange for the same means but in a greater amount. It’s just as American Economist Paul Krugman said, “Debt is one person’s liability, but another person’s assets.” Facilitating this kind of financial assistance program is something that every professional has to make without error, even as soon as the engagement happens. But just in case problems still find their way through, you have to be ready with a facility agreement for protection.