7+ Recurring Payment Agreement Examples

In the past, it was taught to us that the basic needs of a person consist of food, water, shelter, and clothing. Today, healthcare, education, sanitation, and the Internet have been added to the list. Either way, the majority of these necessities are paid by consumers periodically. The Internet, for example, can be gained via subscription and can be paid regularly through friendly payment methods. Included in these methods is the use of credit cards, debit cards, and other options that involve automated databases or systems. However, before an internet provider grants you the authority to become a part of their market, you have to come with a settlement, which is known as a recurring payment agreement. Learn more by taking a peek on our 7+ Recurring Payment Agreement Examples in PDF file format.

7+ Recurring Payment Agreement Examples

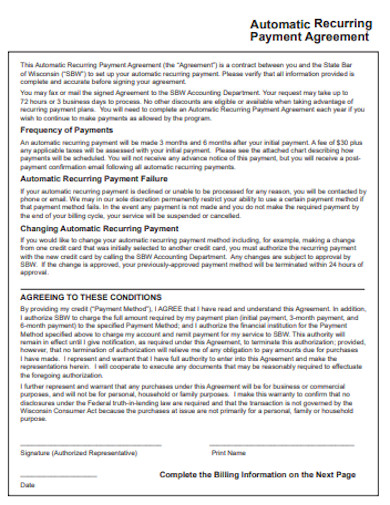

1. Automatic Recurring Payment Agreement

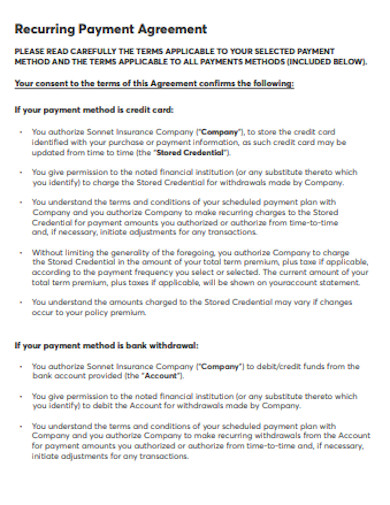

2. Recurring Payment Agreement Example

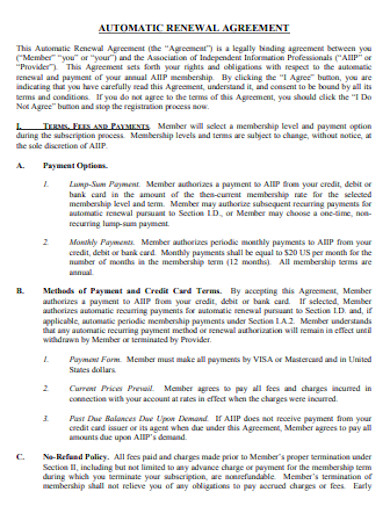

3. Automatic Recurring Payment Agreement Example

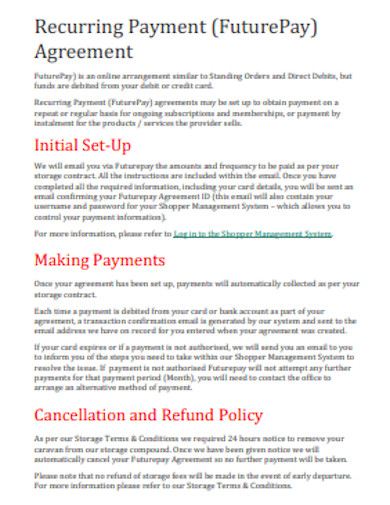

4. Recurring Payment Agreement Format

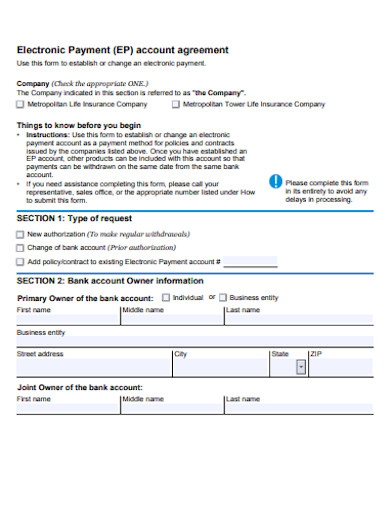

5. Electronic Recurring Payment Account Agreement

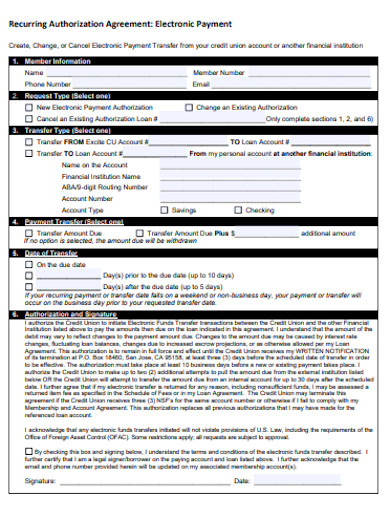

6. Recurring Electronic Payment Authorization Agreement

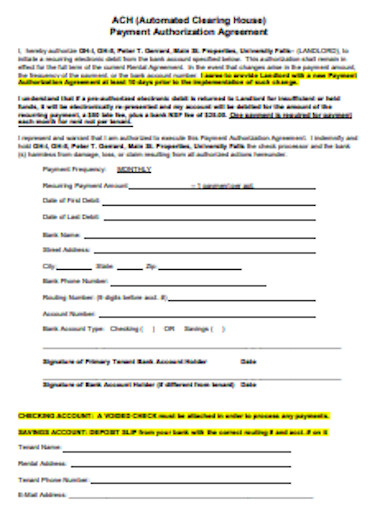

7. Recurring Payment Authorization Agreement Format

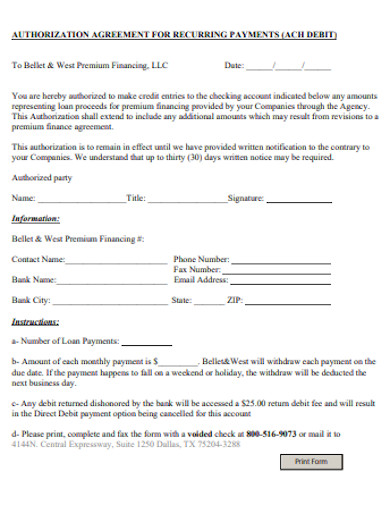

8. Authorization Agreement for Recurring Payment

What Is a Recurring Payment Agreement?

A recurring payment agreement is a settlement that authorizes merchants of goods or services to automatically take the payments of consumers from their bank accounts monthly and as long as their subscription exists. Julia Kagan of Investopedia pointed out that the best benefit that an individual can get through recurring payments is convenience. She elaborated that instead of giving out the billing information repeatedly, a customer can sanction the merchant to keep details on their database. As digital platforms revolutionize, the importance of this type of agreement grows.

Digital Payment Trends

Digital or electronic payments can be categorized into three. These include card payments, bank transfer payments, and E-Wallet payments. Card payments refer to remittances which are done through bank cards like debit and credit cards. In TSYS’s 2018 survey, 54% of 1,222 consumers preferred to use debit cards. Moreover, 26% of the respondents chose credit cards, leaving the remaining 14% and 6% to using cash and other mode payments, respectively. Another digital payment trend is the bank transfer payments, which regards the electronic withdrawal of merchants from the customer’s accounts. The last category is the E-Wallet payment. It pertains to the storing of a customer’s debit and credit card information to his or her mobile phone, making the debit and credit card transactions available without the actual cards but the phone.

How to Create a Recurring Payment Agreement

Whenever there is money involved, we already know how important a document is. With that fact, a recurring payment agreement may be the least likely to be forgotten. In creating the said agreement, you have to make sure that every area incorporated by the standards gets covered. For your convenience, we have set out a list of guidelines and insights to walk you through in achieving a concise agreement.

Step 1: Cite Involved Parties

Recurring payment agreement is participated by a merchant and a customer. It is very important to specify your company and your customer’s name and address to ensure that there will be good proof in case legal disputes occur.

Step 2: Set Payment Conditions

Your recurring payment agreement’s conditions must consist of three things, including the frequency of payments, automatic recurring payment failure, and changing automatic recurring payment. The first condition will cover when the first recurring payment occurs after the initial payment, along with the bill details. The second condition will describe what actions will be done if the transaction cannot be processed for any reason. The last condition gives account to cases when your customer wishes to change some things on your agreement, like credit card information. At the end of this section, get the signature of your customer to signify that he or she understood and agreed on the set of conditions.

Step 3: Get Customer’s Contact and Billing Info

Since customer payment is at stake, you need to have accurate and valid contact and billing information from the customers. For the billing info, the card name, billing address, and phone number is a must-have. If the customer is using a debit or credit card, then you have to know his or her card type, number, expiration date, and security code. Aside from those aspects, a payment authorization should also be included to make sure that you can easily access the customer’s bank account and have a smooth transaction with the bank system.

Step 4: Arrange Purchase and Payment Schedules

The final set of specifications that you have to put into your recurring payment agreement is the purchase arrangement and payment schedules. In the purchase arrangement, you need to describe what type of subscriptions the customer is currently having from your company. You also need to elaborate on the prices and taxes that come with it. In preparing the payment schedules, you have to base them on the exact date when the customer first subscribed to your company plans. It is also in this part where you detail when the subsequent payments are occurring.

FAQs

What do I need to do to stop recurring payments?

You can stop recurring payments in three easy steps. First, call the company which periodically deducts money from your bank accounts, and inform them of your decision. You can also write them a formal letter if you wish to. Second, make your bank or credit union be aware of your decision and tell them, whether through a call or letter, that you are revoking the authorization from the company to conduct automatic payments on your account. Third, you can alternatively plea for a stop payment order to your bank to restrict any electronic payment from your account.

What are the best recurring-billing software platforms for companies?

According to OSI Affiliate, the best recurring-billing software platforms for companies are as follows:

1. Braintree

2. Chargebee

3. Wave

4. Zuora

5. Zoho Subscriptions

6. Wild Apricot

7. ChargeOver

8. PaySimple

9. FuseBill

10. Pabbly Subscriptions

What bills can I put under recurring payment?

Here are some of the bills that you can put under recurring payment:

1. Newspaper Subscription

2. Music Streaming

3. Cable and Internet Services

4. Utilities Bill

5. Cell Phone Bill

6. Video Streaming Services

I think we can all agree on how convenient a recurring payment can be. This is very much true, especially with the increasing popularity of subscription-based digital platforms. But we must never forget that for every pro there is a con. So before you sign any recurring payment agreement, make sure to research.