Church Budget Examples to Download

Faith doesn’t grant you immunity to financial pressure. Even churches and religious establishments whose foundations are on unwavering trust don’t tread lightly on money issues. That’s why a church budget plays an important role in its operations. It helps them micro-manage their funds and allocate them promptly to their different activities and ministry programs. It also helps them better for unanticipated circumstances that might affect their financial repertoire negatively and cripple their services. Budgeting aids them to make wise decisions and promptly assign funds to their charity works and expansion plans.

16+ Church Budget Examples

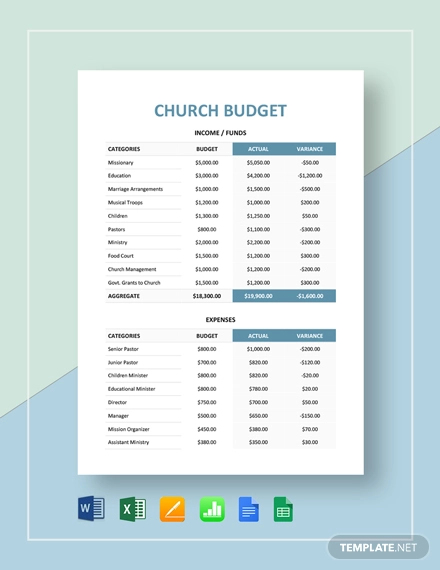

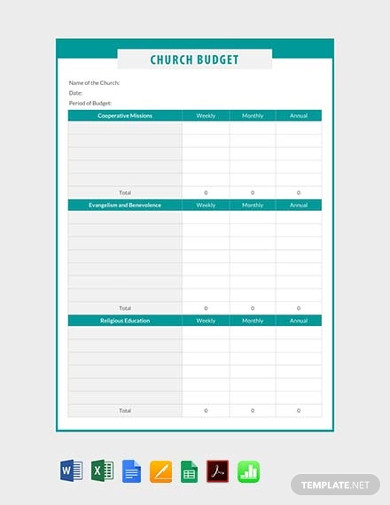

Church Budget Template

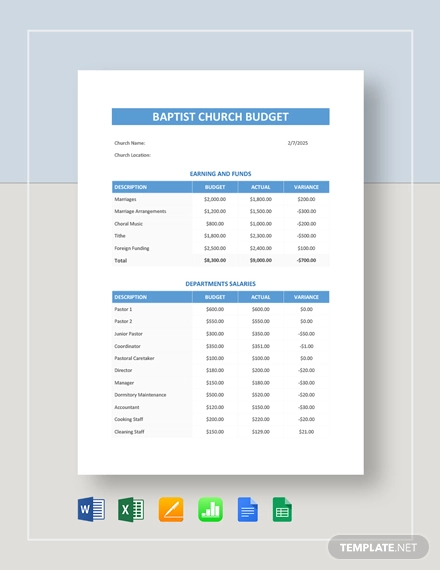

Baptist Church Budget Template

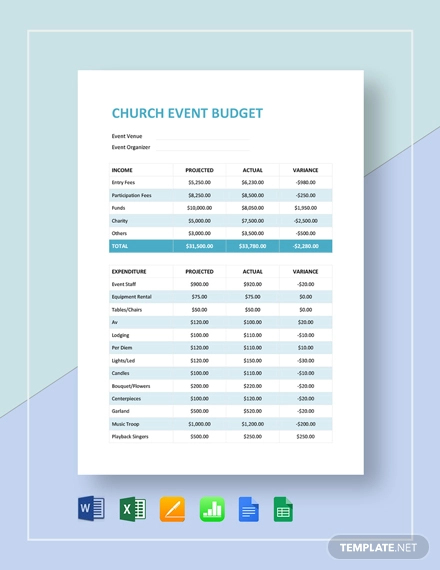

Church Event Budget Template

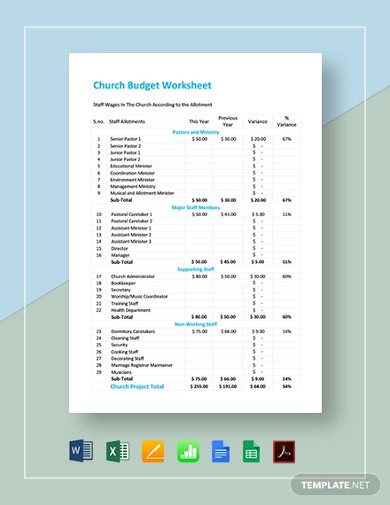

Church Budget Worksheet Template

Small Church Budget Template

Free Church Budget Template

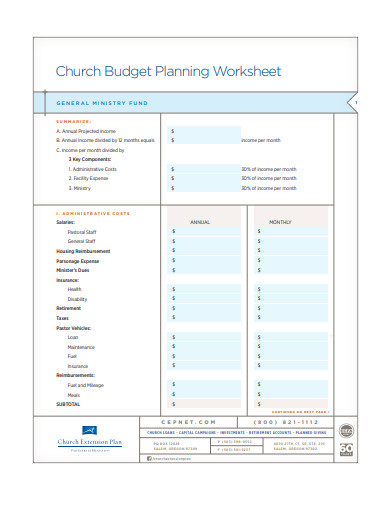

Church Budget Planning Worksheet

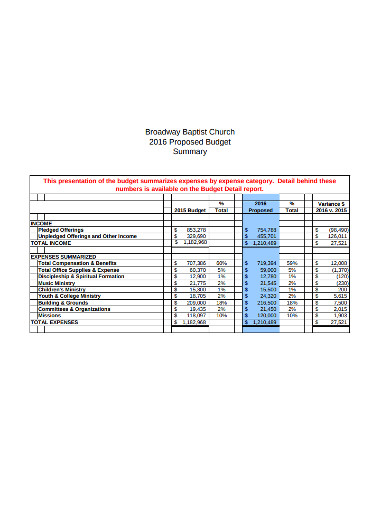

Church Budget Summary

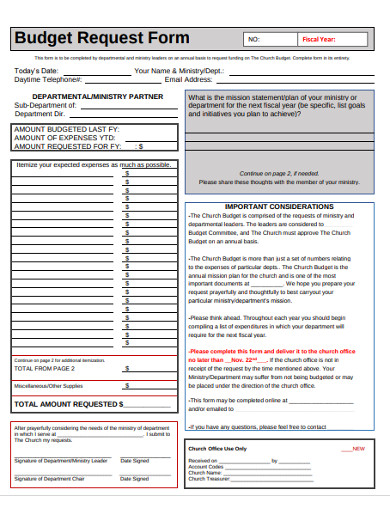

Church Budget Request Form

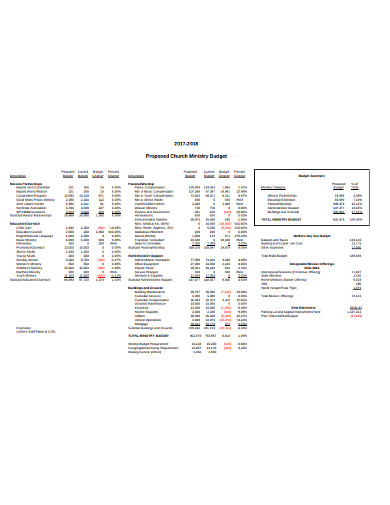

Proposed Church Ministry Budget

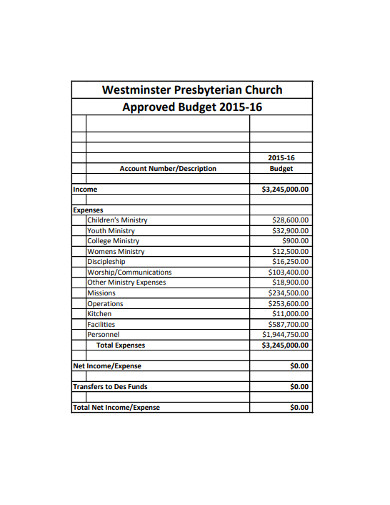

Church Approved Budget

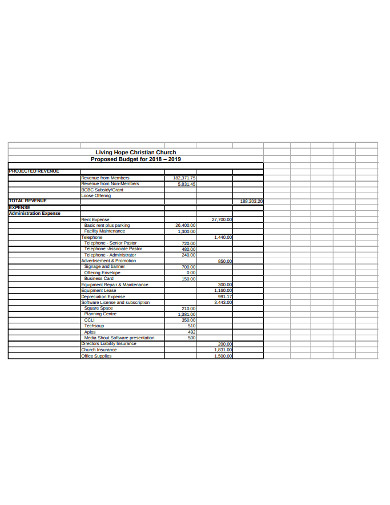

Church Proposed Budget Sample

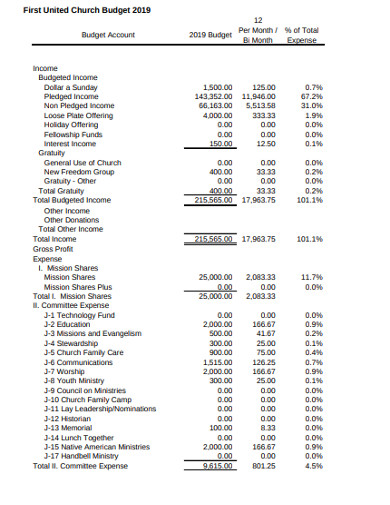

United Church Budget

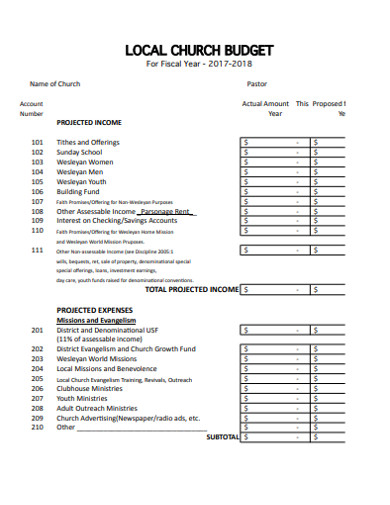

Local Church Budget Example

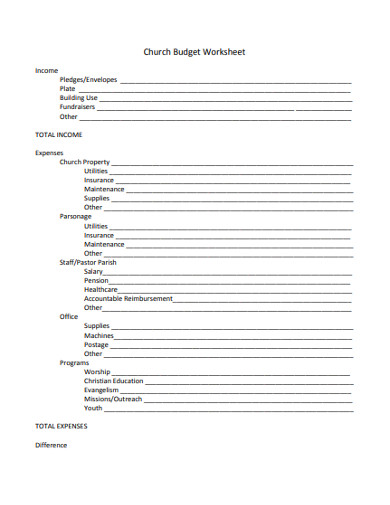

Church Budget Worksheet in PDF

Church Budget Priorities Survey Executive Report

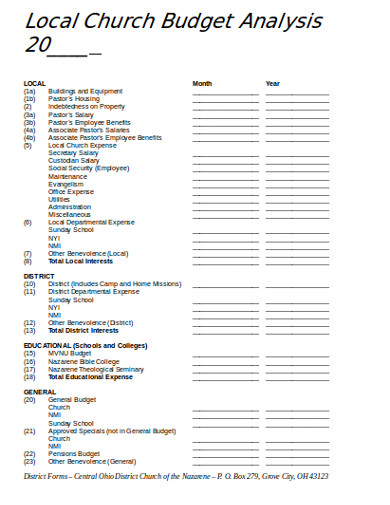

Local Church Budget Analysis

What Is a Church Budget?

A church budget contains all a church’s incoming funds and the outgoing expenses. It’s a financial plan that helps church leaders or their accounting staff determine the flow of their finances. It’s an essential part of their operation because their financial system has a great impact on their congregation.

How to Make a Church Budget

According to The Balance, among the advantages of budgeting include reaching your financial goals, having total control over your expenses, and easily adjusting to any circumstances that might affect your income. Because today’s society relies heavily on money, budgeting applies to everyone and everything, including churches. The right budgeting plan and tool will help them manage their religious affairs more efficiently.

Here are some tips on how to make a church budget?

1. Set a Budget But Remain Flexible

In order to have a more manageable financial planning, you will have to set a definite budget, either on monthly or annually. However, you must remember that your finances rely largely on tithes, sponsorships, and donations. Your church’s income source can be inconsistent. If you choose to set up a budget or allocation for the next weeks or months, remain flexible. Have a goal, but it should be something that you can change according to your situation. Churches thrive on continuous budget adjustments.

2. Categorize Expenses to Different Priorities

When you begin to determine where your money should go, create a set of priority categories that your church expenses need to cover. In most church settings, a church allocates budget for personnel compensation, and facility and equipment maintenance, outreach programs, church ministries, church expansion, and even debt. Classifying your prime expenses budget helps you see the bigger picture when you fill your church budget spreadsheet. This way, you’ll be able to make easy adjustments when finances are scarce.

3. Allocate for an Emergency Fund

Aside from the established categories that you have on your budget breakdown, you would also like to set aside some funding for emergency situations or unexpected occurrences such as fires, floods, and hurricanes that can cause great damage. Even broken drainage or heater needs immediate fixing. This is why it’s essential to keep an emergency fund that you can use for situations like this. That way, you won’t have to dip into your primary needs’ budget to cover the financial toll that the emergency can incur and cause a huge budget hole in your church accounting.

4. Monitor Continuously

You should continuously monitor the status and do a budget analysis. Record your income and your expenses on a monthly church budget. See if the tithes, offerings, donations are enough to cover the month’s spending or if it’s too much to handle. Constant tracking of your cash flow allows you to make informed decisions of what adjustments to do when the season offers low funds and what the church can do for its projects and youth ministries when there’s more. You can make a budget graph and include the results from your financial reports that you can later compile into an annual church budget. Storing documentation of your financial budgets can be a reliable source of reference in the future.

FAQ

What are the different types of church budgeting approach?

The different approaches to church budgeting are zero-based budgeting, annual budgeting, budget to actual, and rolling forecast.

What are the different budget categories?

There are three categories or types of budgets: a surplus budget, a balanced budget, and a deficit budget.

What do you mean by Senator Elizabeth Warren’s 50 20 30 budget rule?

Senator Elizabeth Warren’s book entitled “All Your Worth: The Ultimate Lifetime Money Plan” mentioned the 50 20 30 rule. According to Warren, this rule means that you will take your tax-subtracted income and divide the expenses to 50 % needs, 30% wants, and 20% savings.

Efficient budgeting is an integral that every individual and organizations should practice. This is especially true for churches who cater services not only to its members, but also extend their generosity to the needy. Without a good church budget, there would be strategic planning which can lead to serious complications. Start budgeting today and look for a church budget template that suits your needs among our display of examples. Download now!