11+ Financial Plan Examples to Download

A financial plan is a necessary document that is created to assure that a company is guided in terms of factors such as monetary resources, financial condition, budget usage, and development plans. Unlike a business marketing plan whose aim is to propose events, branding activities, and new market penetration; a financial plan instead focuses on factors such as fund allocation and operational sustainability.

Financial Plan Template

If you want to stay up-to-date with the financial status or position of your company, you can check out and download this comprehensive “Financial Plan” template. Using this template, you will be able to determine factors such as cash flows, asset values, and much more. This plan template has ready-made effective content that you can personalize to suit your requirements.

Business Financial Plan Example Template

Do not hesitate to download this Business Financial Plan Template if you’re aiming to sort out your finances in a convenient manner. It is perfect to use as it comes with a well-organized structure, and it also has the capability to give you an updated look as to where your business is heading in terms of the financial statement.

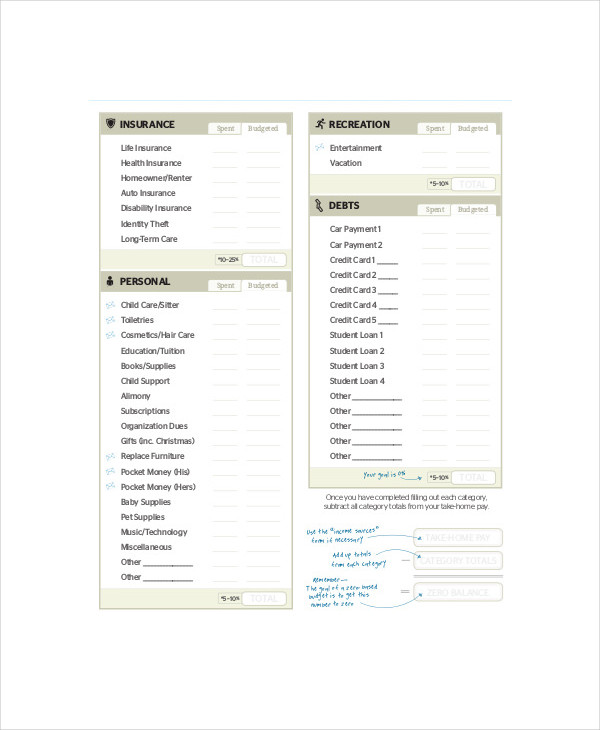

Financial Budget Plan Example Template

If you have no idea on how to create this document, we can provide you with different kinds of financial plan samples and templates. The downloadable examples available in this post can be used as references when making the specified document to assure that you are well-aware of the items that you need to present within a financial plan.

Printable Financial Plan Template

Business Financial Plan

Personal Financial Plan Example

Financial Services Action Plan

One Page Financial Plan

What Is a Financial Plan?

Some of the basic definitions of a financial plan include the following:

- It is a document that describes the current financial state of an entity which is necessary to plot future activities where funding is needed.

- A financial plan can be considered as one of the budget plan examples as it is a tool used by a business to identify variables that can help them layout cash flows and other asset values that they need for future operations.

How Is Financial Planning Important?

Creating a financial plan in business is important for the following reasons:

- A financial plan allows the assessment of free business plan examples especially whether the operational plans of the business are aligned with the money that it can shell out for particular activities.

- Unlike non-profit plan examples, financial plans are centered on assuring that the business can achieve sales quotas and financial stability.

- A financial plan helps businesses to make sure that they are well aware of financial trends and other external factors present in the industry. This can minimize the impacts of risks and threats in the finance department of a company.

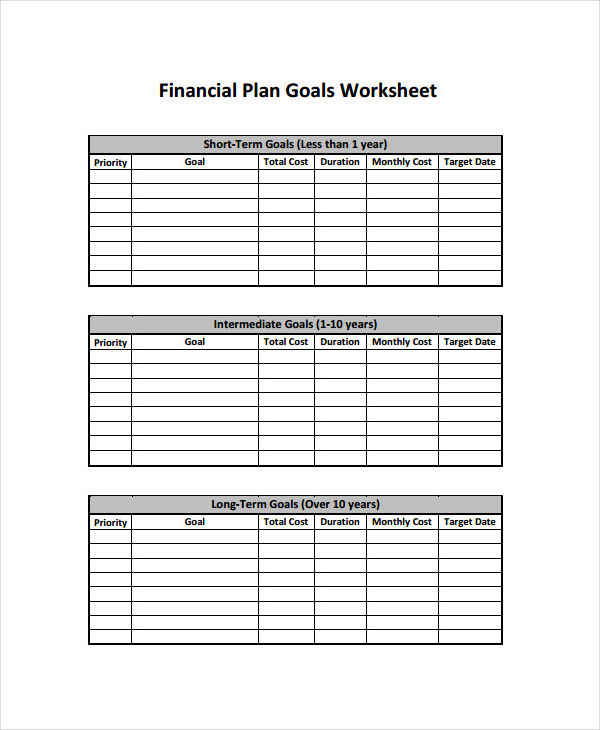

Strategic Financial Plan Example

Comprehensive Financial Plan Sample

Financial Budget Plan

Project Financial Plan

What Is the Difference between a Budget Plan and a Financial Plan?

In a business plan example in PDF, a budget plan more or less cones under a financial plan. However, here are some differences that can be identified to know how these terms are used within a business environment:

- A financial plan focuses on identifying finance efforts which are essential for the growth of the small business and its readiness on future operations, especially concerning budget and finances. On the other hand, a budget plan is created to estimate the company’s revenues and expenses within a particular time period.

- A financial plan is created to have a list of the activities and programs that can be helpful for the development of the way a business gathers and uses its monetary resources. Meanwhile, a budget plan represents the financial position of the business and how a financial plan can be applied in actual money allocations.

Tips and Guidelines in Creating a Financial Plan

Some of the guidelines that you may incorporate in creating a financial plan include the following:

- You may check out existing financial plan templates so that it will act as a guide in making the format of your company’s own financial plan.

- You also need to assure that you will be aware of audit plan examples and accounting plan documents so you can align the content of your financial plan with the mentioned documents.

- Be precise and specific with the amount that you will place in a financial plan up to the last centavo.

These guidelines will allow you to create a comprehensive financial plan that can be used accordingly within a specific operational time frame.