15+ Payment Certificate Examples to Download

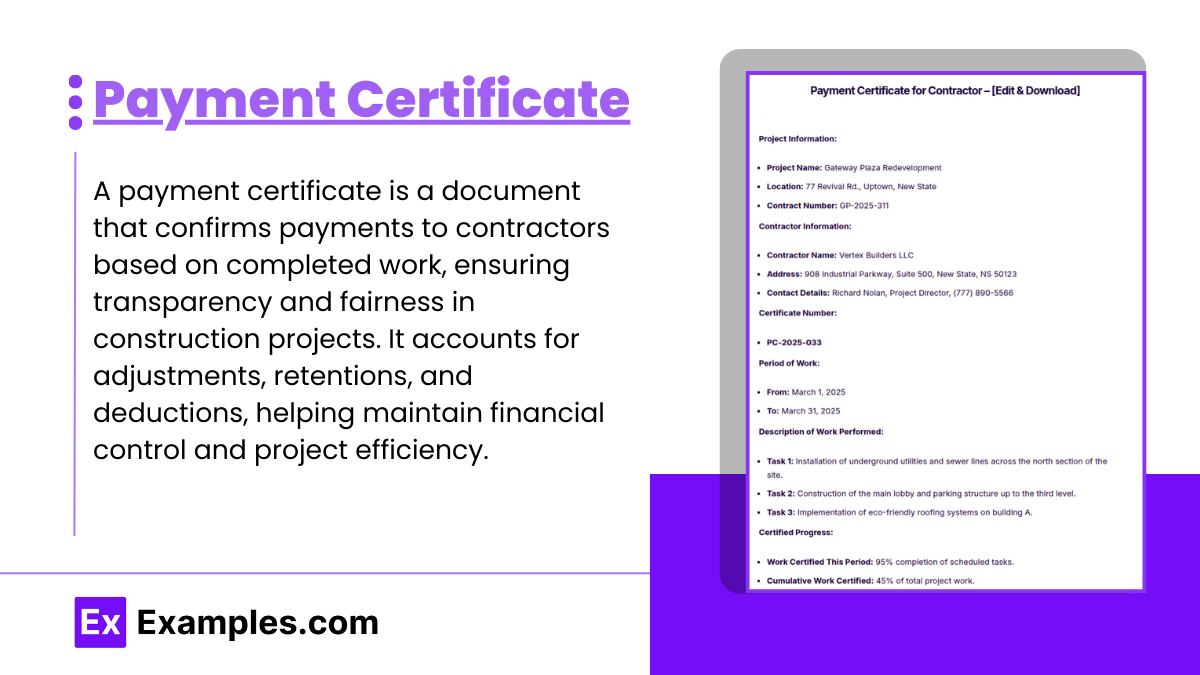

A payment certificate is an essential document used primarily in the construction industry to manage and confirm payments due to contractors and subcontractors. It serves as a formal recognition of the work completed in accordance with the terms of a contract, specifying the amount that the contractor is eligible to receive at various stages of a project. This certificate acts as a safeguard, ensuring that payments are made fairly and transparently, reflecting any adjustments for previous payments, retentions, or deductions for unresolved work.

Industry professionals can benefit from using certificate templates to design and issue standardized payment certificates quickly and efficiently. Additionally, leveraging a professional certificate maker ensures that each payment certificate is well-formatted, accurate, and easy to verify. Understanding the role and management of payment certificates can significantly enhance the financial control and workflow of construction projects, making it a critical tool for industry professionals.

What is Payment Certificate?

Payment Certificate Examples Bundle

Payment Certificate Format

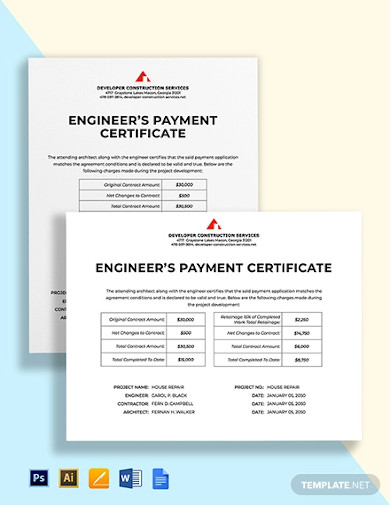

Project Information

Includes details such as the project name, location, and contract number.

Contractor/Subcontractor Information

Contains the name, address, and contact details of the contractor or subcontractor being paid.

Certificate Number

A unique identifier for each payment certificate issued.

Period of Work

Specifies the time frame during which the covered work was performed.

Description of Work

A brief description of the work or services provided during the period.

Amount Due

Lists the total amount due for the period, including any adjustments for previous payments, retentions, or deductions.

Certifier Details

The name and signature of the person authorized to issue the payment certificate, often the project manager or contract administrator.

Date of Issue

The date on which the certificate was issued, which is important for payment scheduling and record-keeping.

Payment Certificate Example

Project Name: Eastside Bridge Construction

Location: East River, Riverside City

Contract Number: EC-2023-045Contractor Name: ABC Construction Ltd.

Address: 123 Construction Way, Riverside City, RC 45678

Contact Details: John Doe, Project Manager, (123) 456-7890Certificate Number:

PC-2023-120Period of Work:

January 1, 2025, to January 31, 2025Description of Work:

Completion of the foundational work including excavation and laying of the base layer for the bridge.Amount Due:

$250,000

This amount includes adjustments for previous payments and deductions for required corrections.Certifier Details:

Certifier: Jane Smith, Contract Administrator

Signature: [Signature Jane Smith]Date of Issue:

February 5, 2025

Payment Certificate Examples

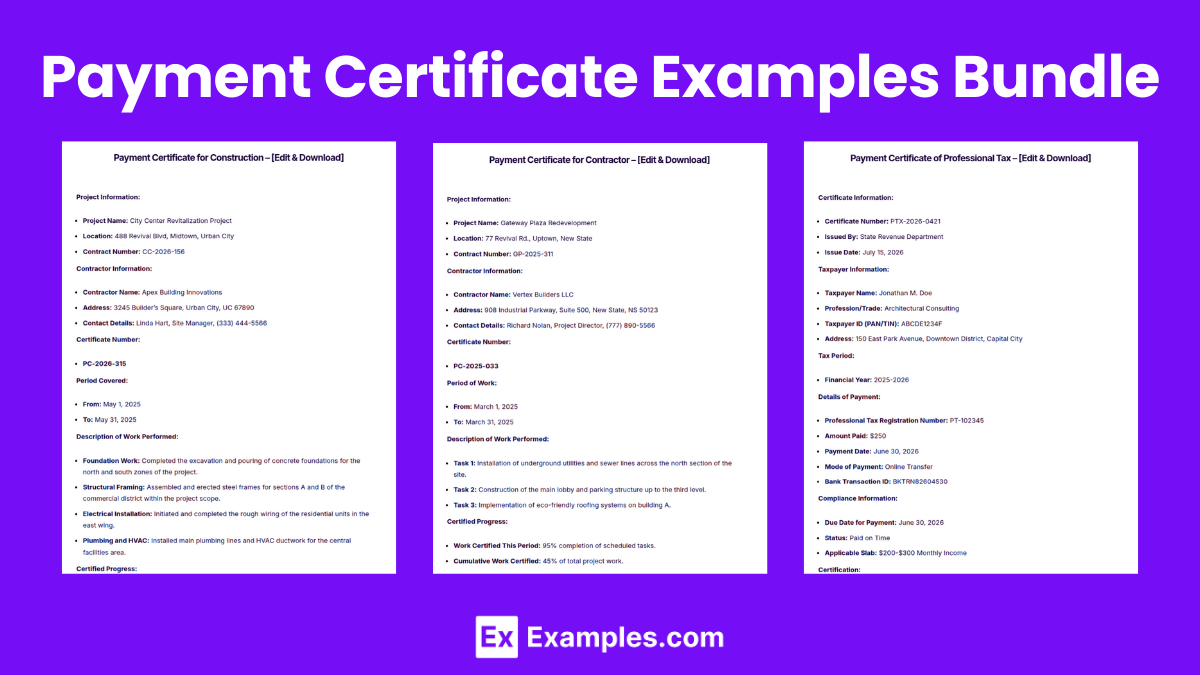

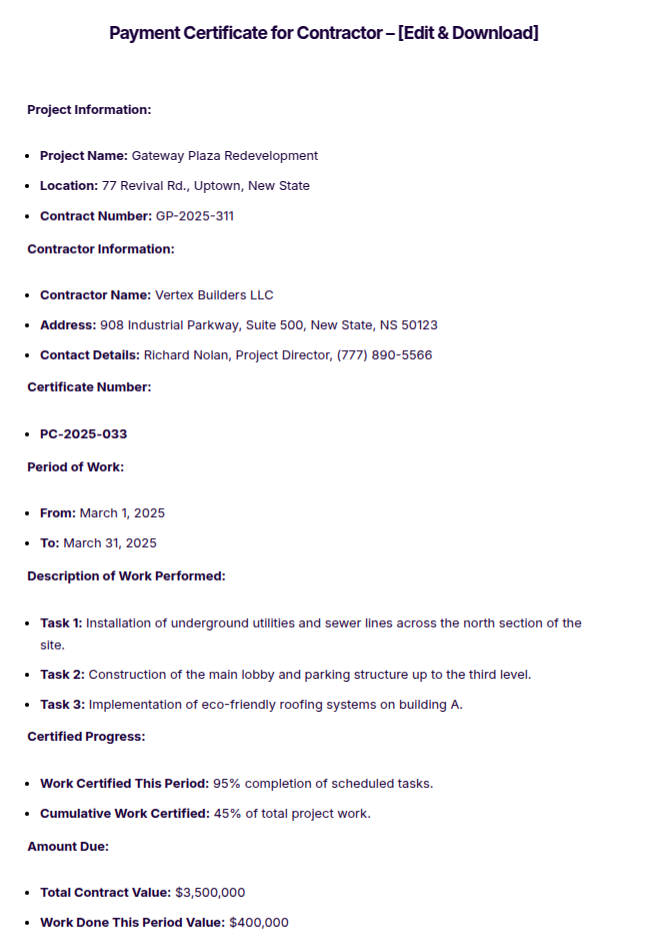

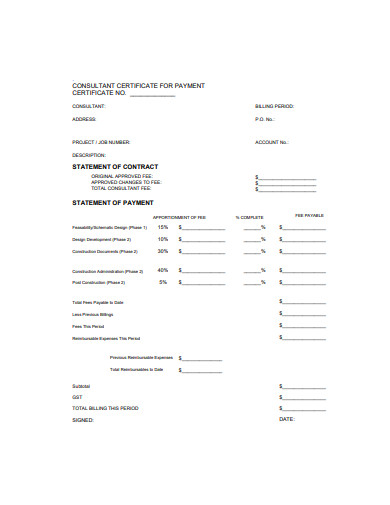

Payment Certificate for Contractor

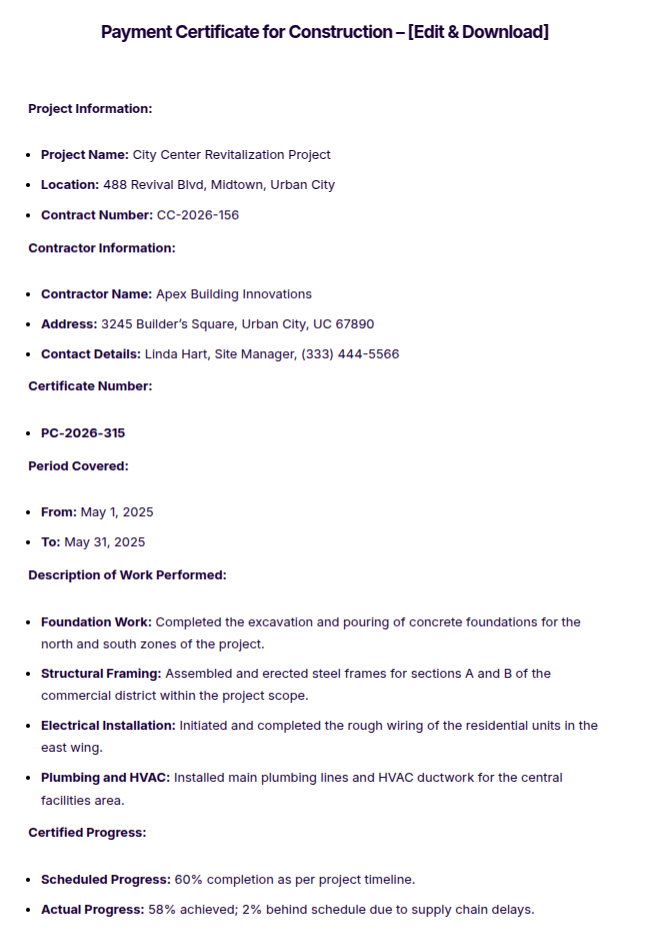

Payment Certificate for Construction

Payment Certificate of Professional Tax

More Examples on Payment Certificate

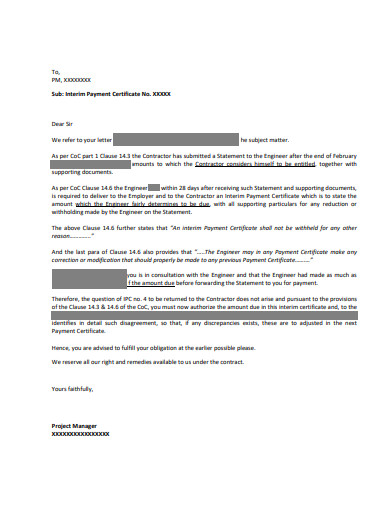

- Military Payment Certificate

- Interim Payment Certificate

- Pension Payment Certificate

- Tax Payment Certificate

- Prescription Payment Certificate

- Jbcc Payment Certificate

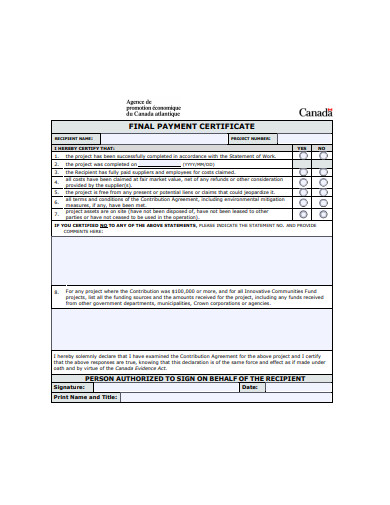

- Final Payment Certificate

- Entrusted Payment Certificate

Payment Certificate Template

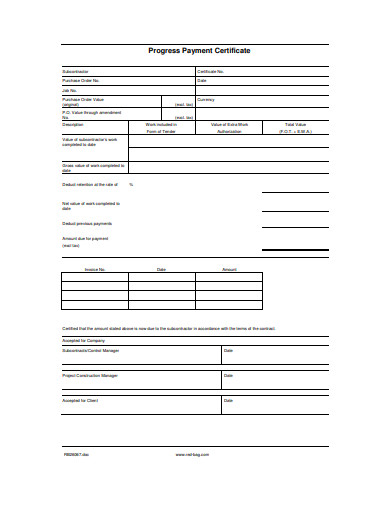

Progress Payment Certificate

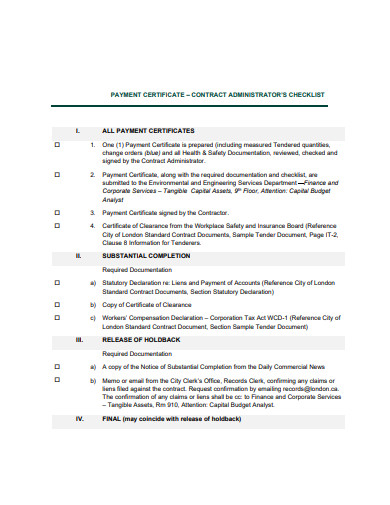

Payment Certificate Example

Final Payment Certificate

Sample Payment Certificate

Payment Certificate Sample

Payment Certificate vs Invoice

| Aspect | Payment Certificate | Invoice |

|---|---|---|

| Definition | A document used mainly in construction that certifies the amount due for work completed as per a contract. | A document issued by a supplier to request payment for goods or services provided. |

| Purpose | To authorize and detail payments due to contractors or subcontractors based on contract terms and conditions. | To bill a client for products sold or services rendered, detailing amounts owed. |

| Issued By | Usually issued by a project manager, architect, or contract administrator. | Issued by a vendor or service provider directly to the customer. |

| Based On | Based on contractual agreements, completion of certain milestones, and inspection approvals. | Based on the delivery of goods or services as agreed in purchase orders or contracts. |

| Content | Includes details like project information, period of work, description of work, amount due, and certifications. | Includes product or service details, quantities, unit prices, total amount, and taxes. |

| Use Case | Common in the construction industry and other project-based engagements. | Used across all industries for sales transactions. |

| Payment Terms | Payment terms are typically linked to project milestones and completion stages. | Payment terms may include prompt payment discounts, net payment terms, etc. |

| Legal Weight | Acts as a formal certification that contractual obligations have been met for the period in question. | Serves as a legal request for payment and can be used as proof of debt in legal cases. |

| Frequency of Issuance | Issued at predefined stages or milestones of a project. | Issued at the time of sale or immediately after service provision. |

How to Create a Payment Plan to Gain the Customer’s Confidence

- Transparent Terms: Clearly outline the payment terms, including the total amount due, installment sizes, due dates, and any interest or fees. Transparency in these details helps build trust and prevent misunderstandings.

- Flexibility: Offer flexible payment options that cater to different financial situations. Allow customers to choose from various plans, such as monthly or quarterly payments, to accommodate their cash flow.

- Simple Process: Ensure the payment process is easy to understand and execute. Utilize straightforward methods for making payments, such as online portals, direct debit, or mobile apps, which can enhance the user experience and satisfaction.

- Regular Communication: Maintain open lines of communication throughout the duration of the payment plan. Send reminders before each payment is due, and provide easy access to customer service for any queries or issues.

- Incentives for Early Payment: Encourage early payments by offering incentives such as discounts or waiver of fees. This can motivate customers to pay off their balances sooner and can enhance your relationship.

- Clear Documentation: Provide customers with detailed agreements and receipts for every transaction. Proper documentation of all interactions and payments not only increases transparency but also provides both parties with records for future reference.

How to Create a Payment Certificate

- Gather Project and Contract Details – Include essential information such as project name, contract number, contractor details, work period, and location to ensure clarity and proper documentation.

- Assess Work Completed – Verify and evaluate the completed work based on contract terms, milestone achievements, or agreed progress percentages before certifying payment.

- Calculate Payment Amount – Determine the total amount due, including previous payments, retentions, deductions, and applicable taxes, ensuring transparency in financial transactions.

- Use a Standardized Format – Structure the certificate with sections for work descriptions, payment details, authorized approvals, and dates to maintain consistency and compliance.

- Obtain Necessary Approvals – Ensure that the document is reviewed and signed by the authorized certifier, such as a project manager, contract administrator, or financial officer.

- Distribute and Record the Certificate – Send the payment certificate to the concerned parties, including contractors, accountants, and financial departments, while keeping a record for future audits and references.

Tips for Creating a Payment Certificate

- Detail All Relevant Information: Include comprehensive project details such as project name, location, contract number, period covered, description of work, and payment period. This ensures clarity and serves as a complete record of what the payment is for.

- Verify Work Before Issuance: Ensure that all work or services listed in the payment certificate have been completed satisfactorily and inspected, if applicable. Verification should be done by someone authorized to approve the work, such as a project manager or site engineer.

- Use a Standard Template: Adopt a standardized template that complies with industry standards or legal requirements. This helps maintain consistency in documentation and makes it easier for all parties to understand and process the certificate.

- Clear Breakdown of Costs: Provide a clear breakdown of costs, including any deductions, retentions, or additions. This transparency helps prevent disputes and facilitates quicker payment processing.

- Include Authorization Signatures: Ensure that the payment certificate is duly signed by the authorized certifier. A signature validates the certificate, formalizing the approval for payment and providing a legal basis for the transaction.

FAQs

What is the concept of a payment notice?

A contractual document received by the payer under a building contract is known as a payment notice. On the due date for payment, the party serving the note finds the expected amount. The payer, the architect, the project manager, or another specified person can provide this information.

What is a payment certifier, and how does it work?

A payment certifier is an architect, engineer, or any other individual named in the contract or subcontract as the person in charge of payment certification. If the payment certifier agrees that the contract or subcontract is complete, a certificate of vital completion must be issued.

Can you hand over cash to a contractor?

Paying contractors cash is not illegal. In-cash remains a viable payment option. You will pay the contractor in cash if you have it on hand.