13+ Commercial Invoice Examples to Download

Exporting is one factor that increases economic scale. With it, businesses started to build relationships with other organizations across the world. To maintain control over the export transactions, a document commonly known as a commercial export printable invoice is then used to keep track of the export transactions businesses have undertaken.

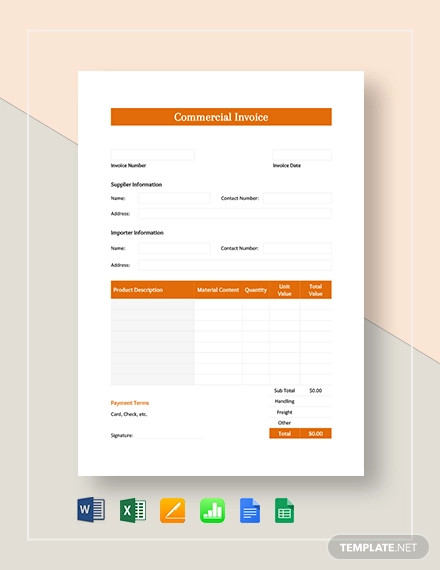

Commercial Invoice Example

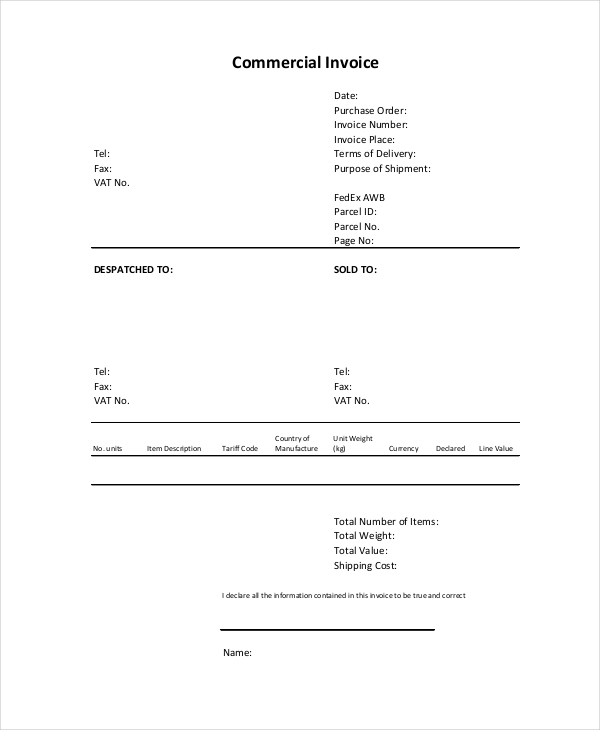

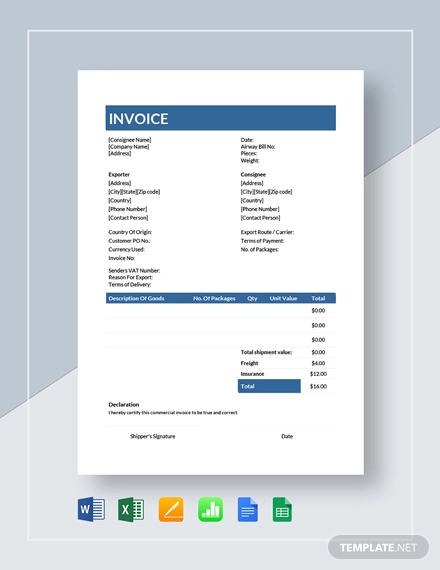

Simple Commercial Invoice Example

Blank Commercial Invoice Template Example

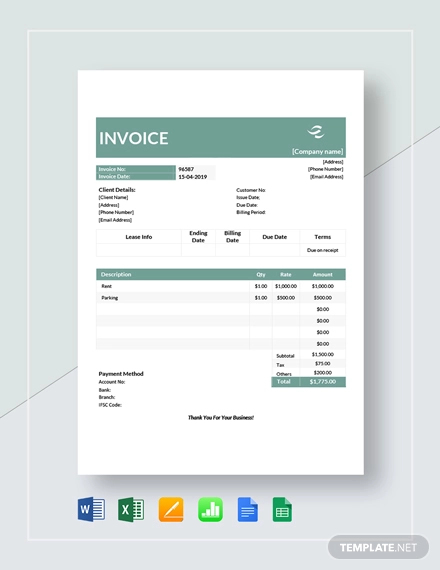

Commercial Lease Invoice Example Template

There are different kinds of invoices like invoice for self-employed, hotel invoice, medical invoice, and many more. What most people don’t know: there are special invoices that businesses make when dealing with international or global transactions. These invoices are called commercial invoices. To know more, check out these samples below.

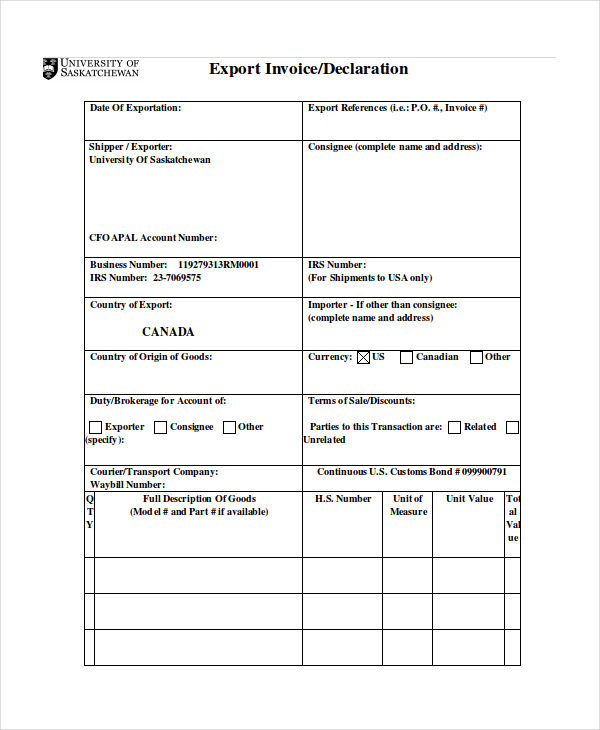

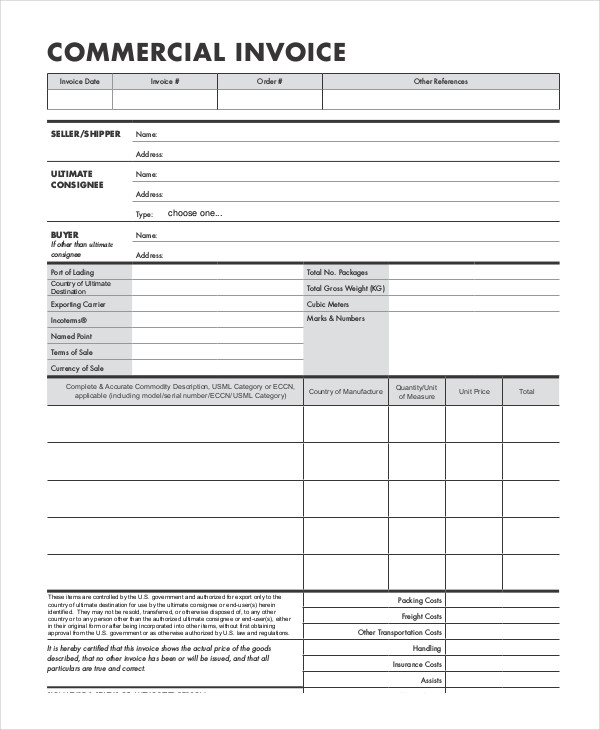

Commercial Invoice Template For Export

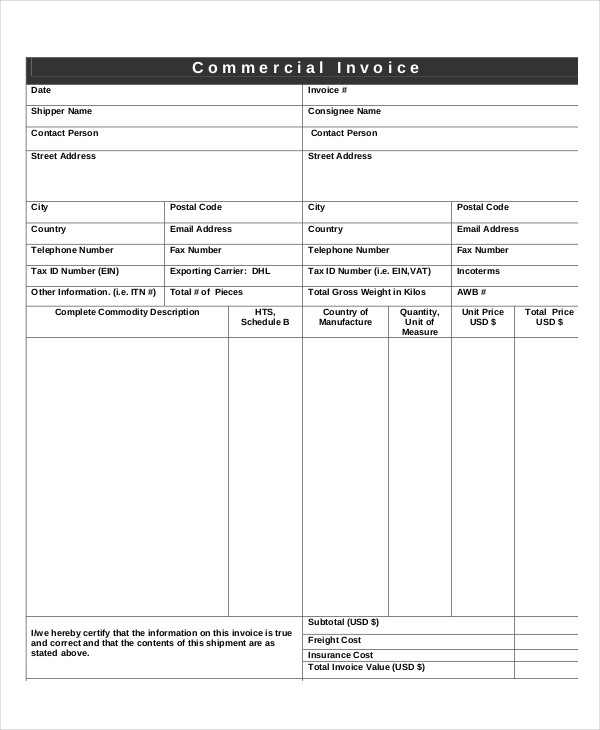

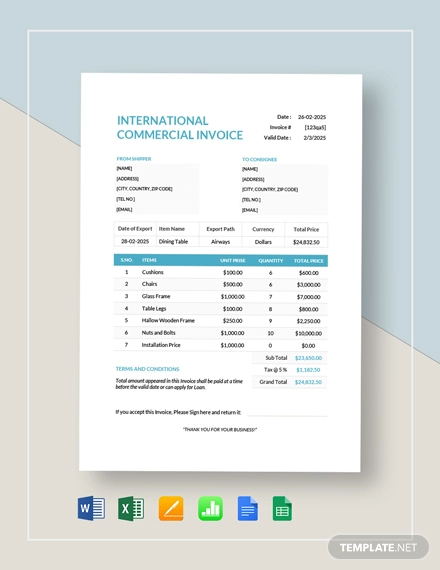

International Commercial Invoice Example

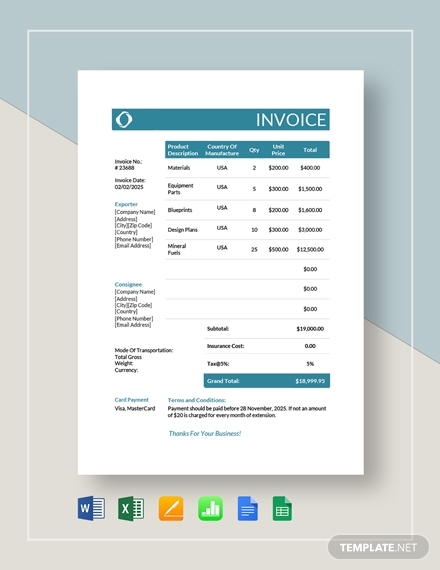

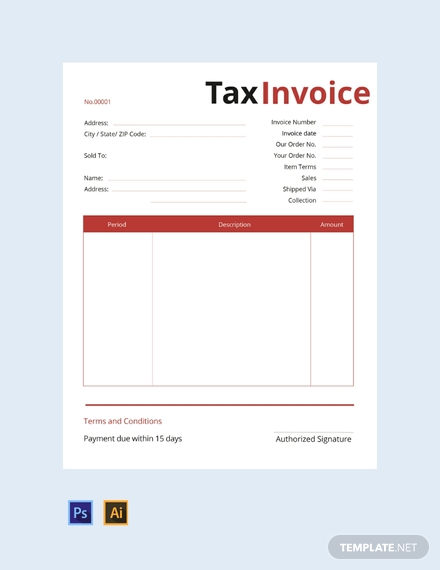

Commercial Tax Invoice Template Example

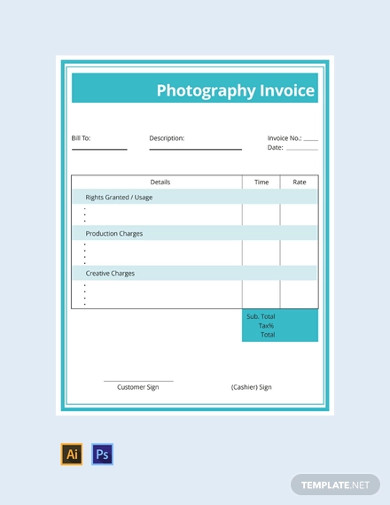

Free Commercial Photography Example

Commercial Export Invoice/Declaration

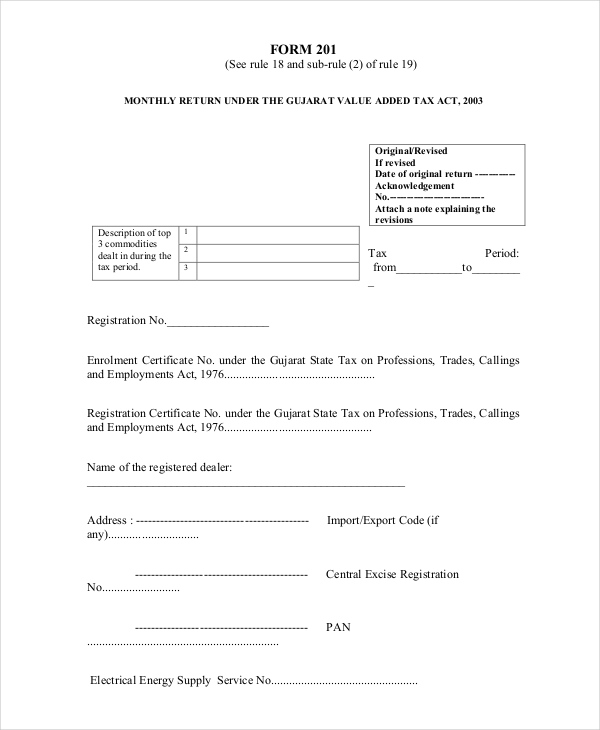

Commercial Tax Invoice (Form 201)

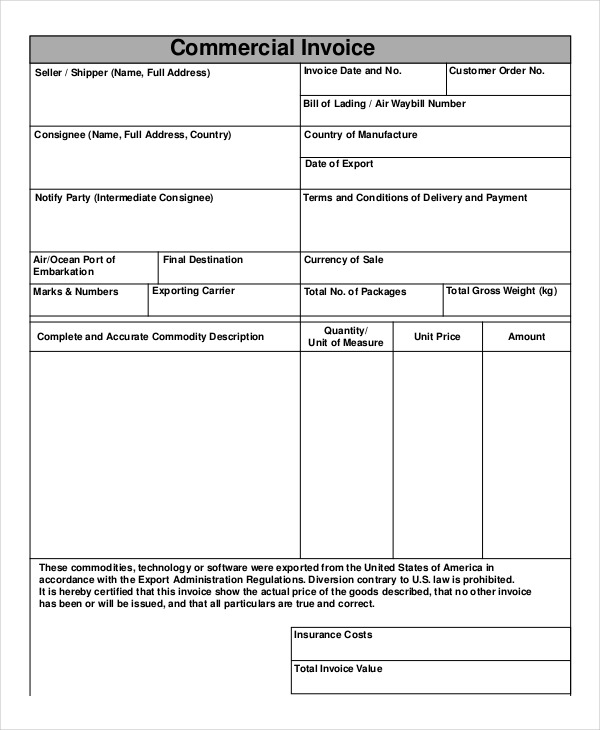

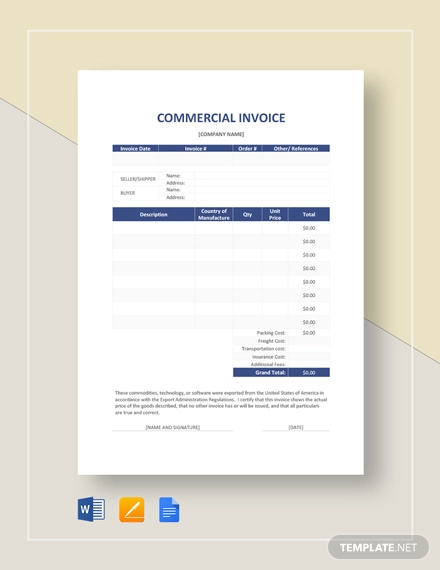

Generic Commercial Invoice

Blank Commercial Invoice

What Is a Commercial Invoice?

A commercial invoice is another type of invoice document that records all the items or products that a person or a company is shipping out of the country. Commercial invoices in pdf are mandated by the government for all transactions involved in selling or buying international items or products. It primarily exists for customs to control imports and exports of the country.

Uses of Commercial Invoice

Just by looking at some invoice samples, we can get an idea what purposes they stand for. But, invoices have different purposes depending on what type they are.

There are two significant uses for a commercial invoice:

- Importation Control. It is crucial for the customs to know what goods are being sent out of and brought into the country to be able to keep an eye on the exchange taking place and its effect on the GDP/GNP. Commercial invoice information includes all of the shipper and the receiver, giving customs full knowledge of the parties involved.

- Valuation. By the use of commercial invoice, customs will be able to evaluate the goods shipped and keep track of the exchange of products, preventing illegal transactions. Through tracking, calculation of tariffs or other commercial terms are made easy.

Commercial Shipping Invoice

Export Commercial Invoice

How to Create a Commercial Invoice

There is no standard format on how to make a commercial invoice form. It is only important for these invoices to show specific information that are needed by the receiver and most importantly by the bureau of customs.

The information needed to be present in a commercial invoice are:

- The buyer and the seller’s complete information, including name, commercial address, and contact details

- Payment invoice Terms and Conditions

- List of all items and a complete description of each item, such as quantity, weight, or volume of shipped item

- The value or cost of each item per unit and its total value

- In case of fortuitous events, insurance, shipping, and other charges must be present

- Calculated tariffs

- Unique invoice or order number, for easy tracking

- Total number of packages

- Signature of shipper accompanied with a date, ensuring shipment was indeed made by the selling party

Importance of a Commercial Invoice

Aside from being mandated by law for tax purposes, commercial tax invoices are created to serve as evidences that importing sale transactions were made. Most importantly, it prevents the exchange of illegal items.

Commercial invoice allows businesses and customs to have full control on the products sold internationally.