10+ Deposit Slip Examples to Download

In everything we do, we always make sure that we keep track all of our transactions especially when it comes to dealing with money. When we receive cash, we must have a record documenting that we receive such amount.

On the other hand, when we disburse cash, we must ensure that we have a proof of such transaction. Anything that involves money must be documented for property recording and accounting especially when it comes to a company’s receipts and disbursements. You may also see exit slip examples.

Similarly, when you will deposit a cash to a certain bank, you must see to it that you fill out completely the deposit slip that serves as a copy for the bank of your deposit and your related receipt for the transaction.

Want to take a peek on the examples of deposit slips? Want to have a template for your deposit slips? Below are some examples that you might be interested in. Check them all now. Also try these other slips as well:

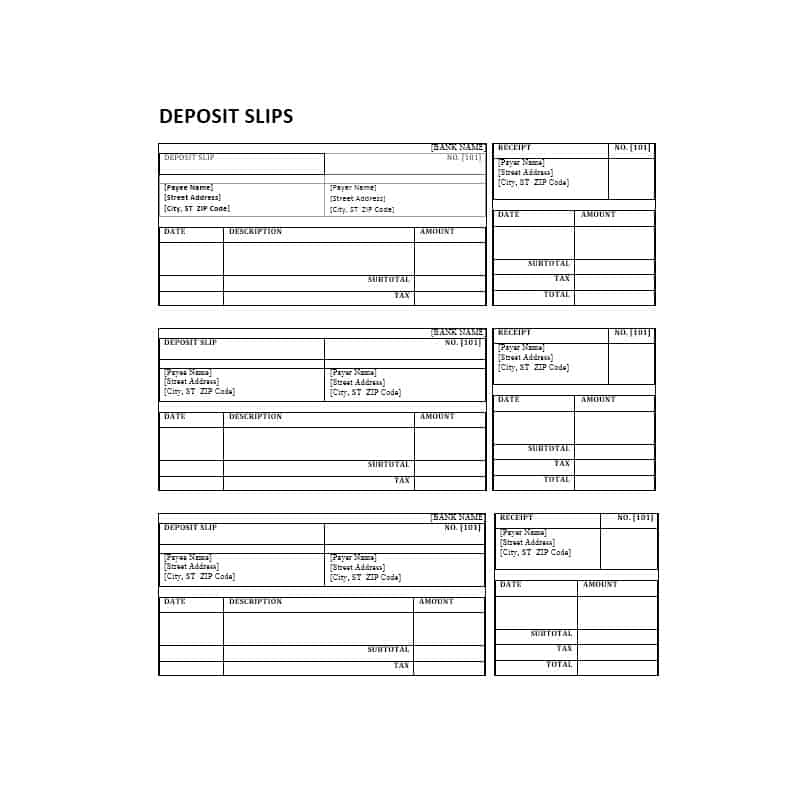

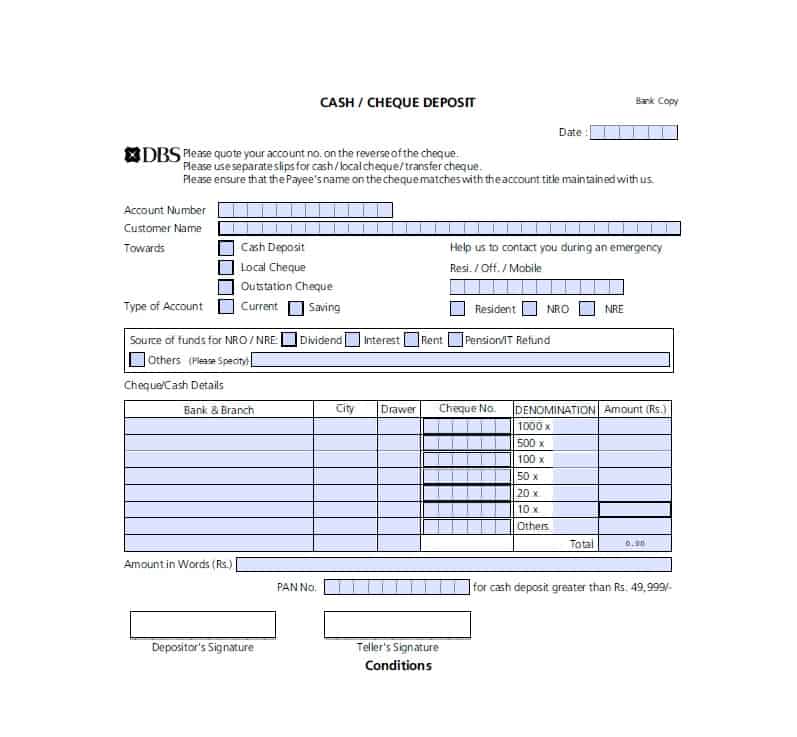

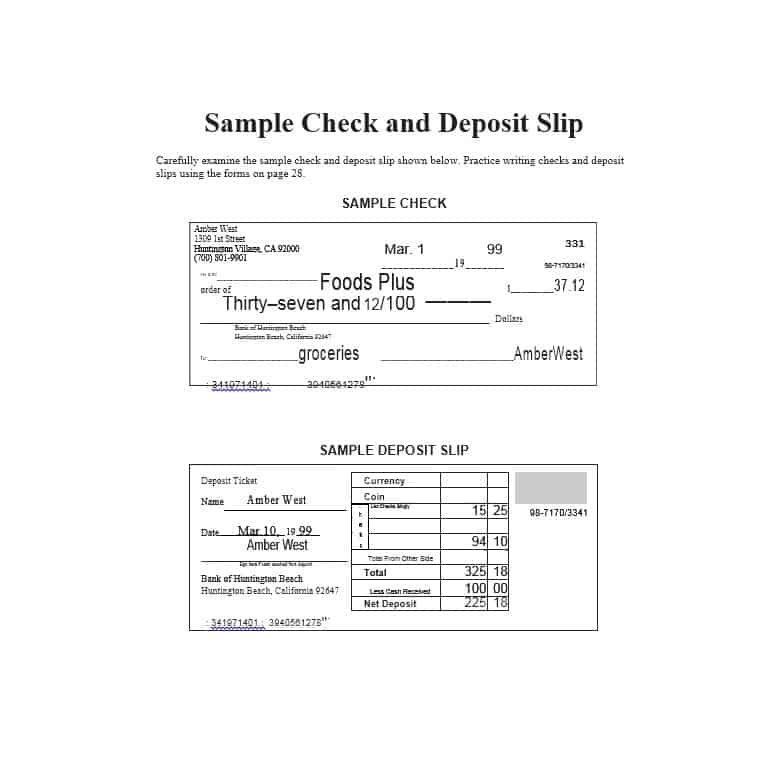

Classic Deposit Slip Example

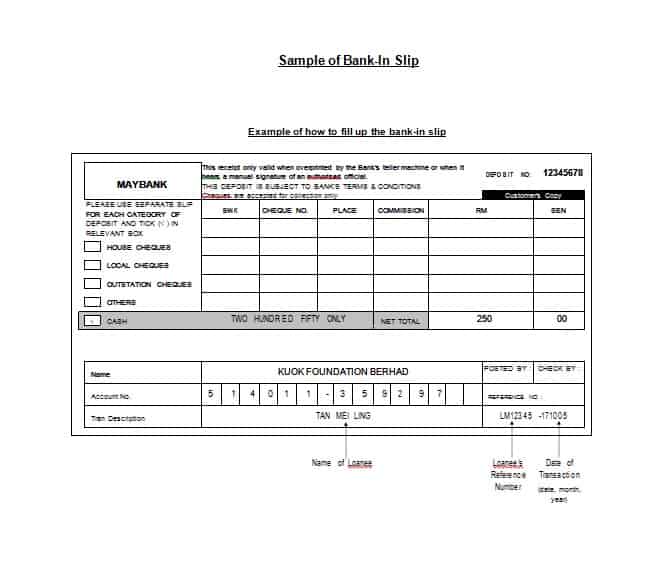

Clean Deposit Slip Example

What Is a Deposit Slip?

If you are making a deposit, you are given a deposit slip in which you have to fill out and be kept by the teller in the bank. So basically, what is a deposit slip?

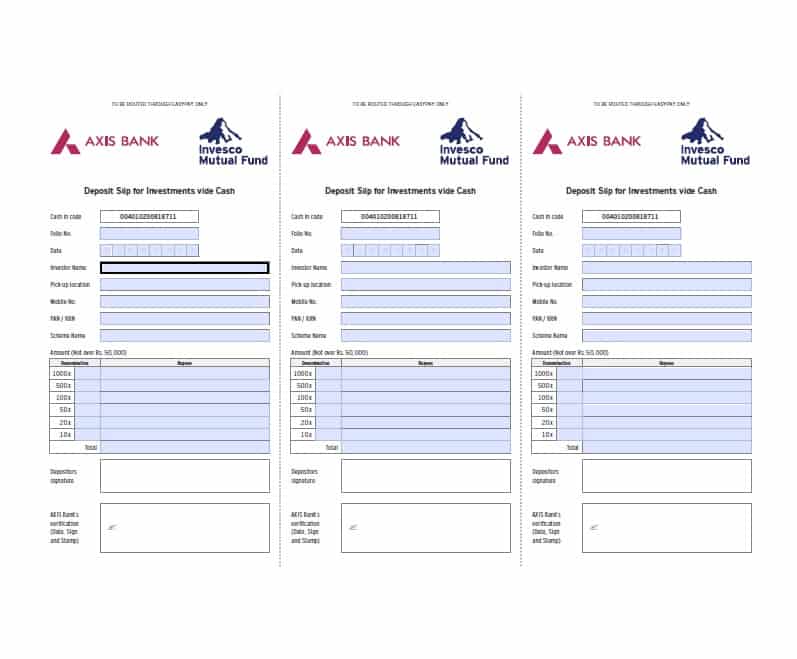

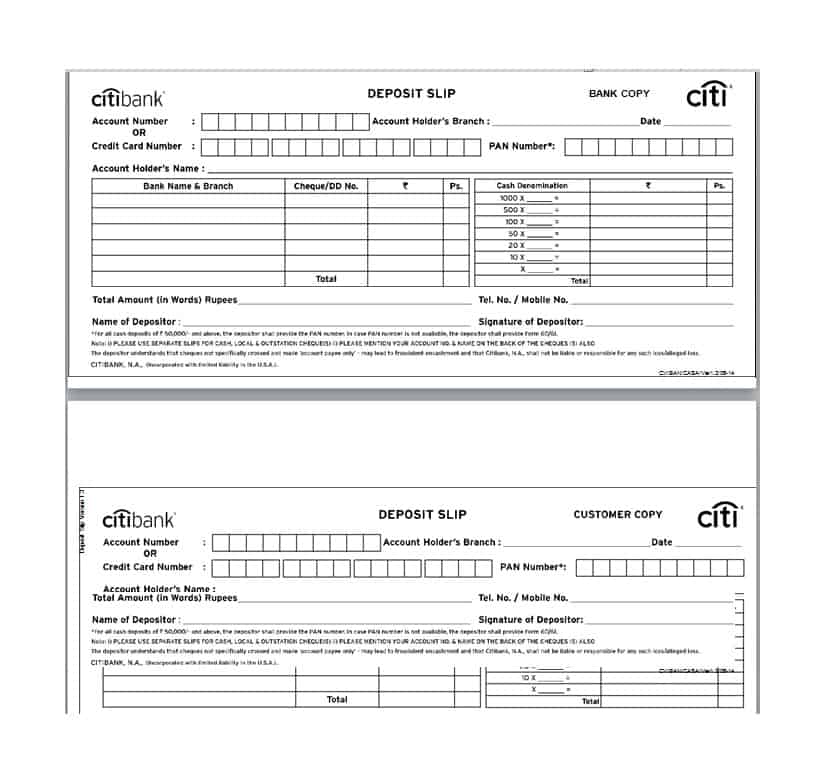

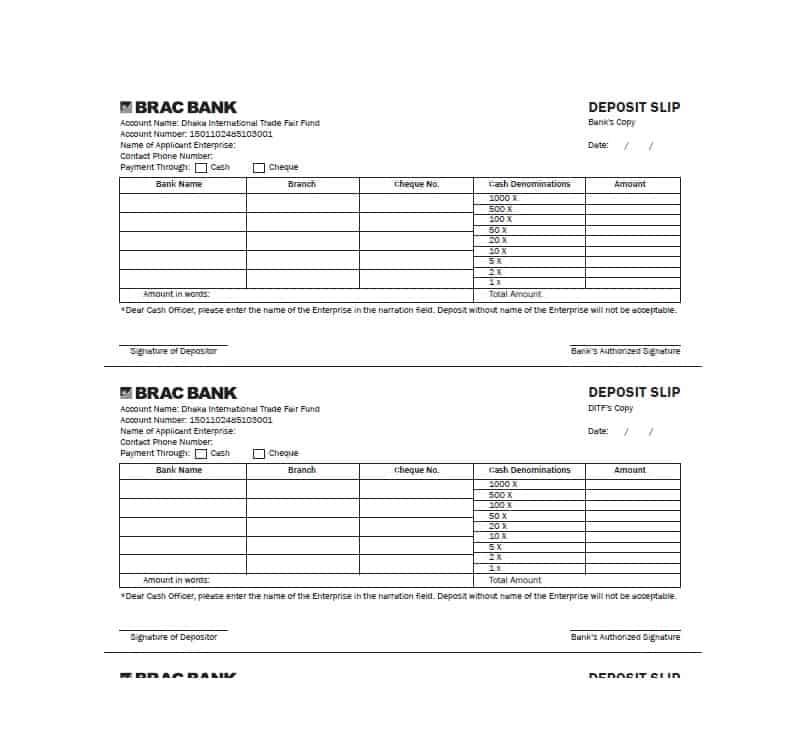

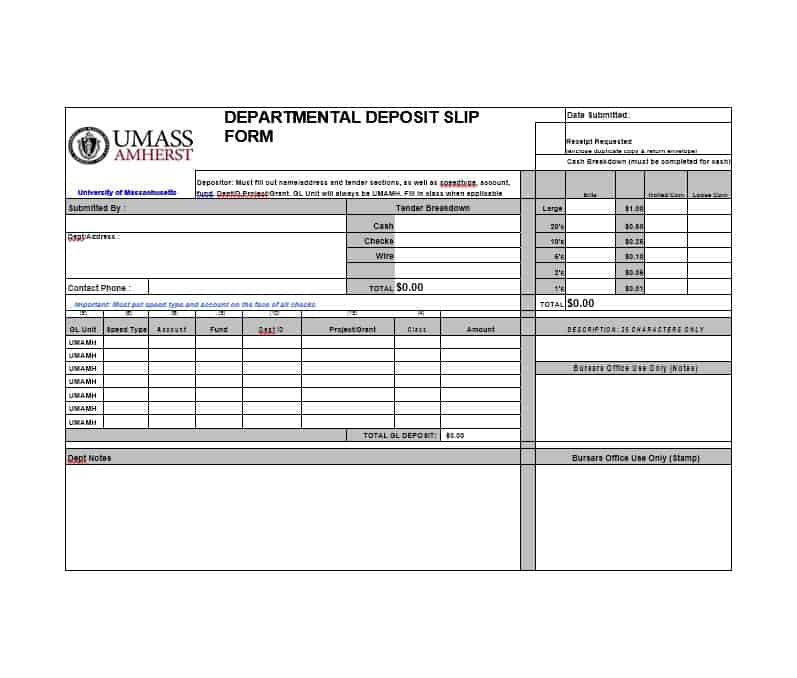

A deposit slip, in general, is a form provided by the bank to be filled out by the depositor, documenting the items in a deposit transaction. The items are being categorized according to the type of item and, if it is a check, the source of the check such as a local bank or a state. You may also see payslip templates and examples.

Upon receiving the deposit slip along with the cash or check, the teller provides the depositor with a receipt of the transaction. If the depositor is cashing some of the checks and depositing the rest, the deposit slips are signed by the depositor. Also called deposit tickets, deposit slips come in a variety of designs like the ones provided in the examples above. You may also like packing slip examples.

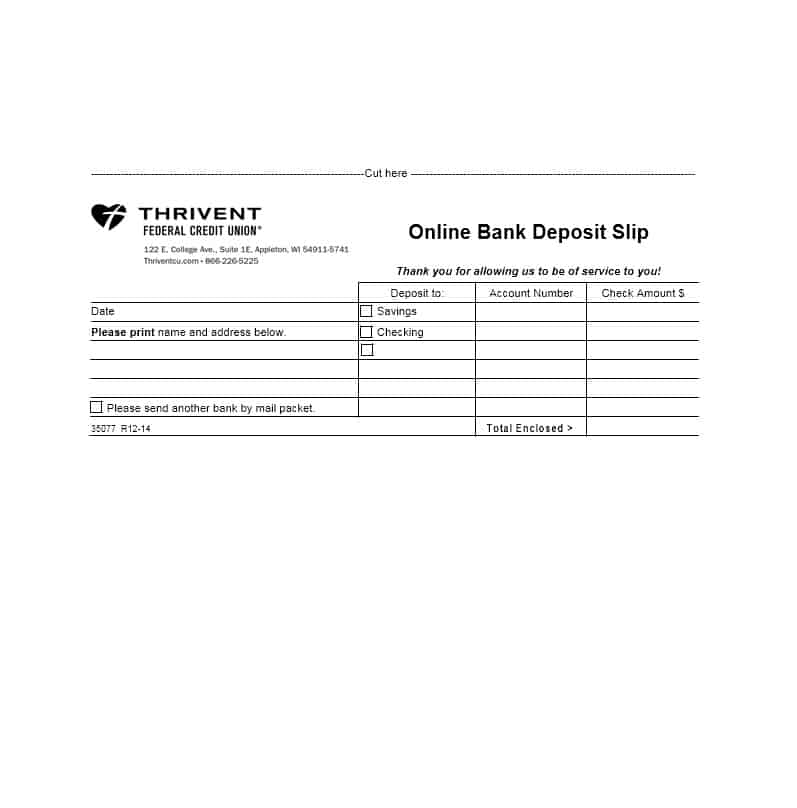

Clear Deposit Slip Example

Common Deposit Slip Example

Elegant Deposit Slip Example

Deposit Slip Types, Purpose, Location

1. Types.

Deposit slips can be for savings accounts and checking accounts. Generic deposit slips require you to write your account number on them, whereas you may have deposit slips for your accounts that have your account number on them. You may also see payment receipt examples & samples.

2. Purpose.

Banks use deposit slips to verify deposits made by the depositor and see to it that the amounts on the checks match the deposit slip and the total is added correctly, ensuring that the correct amount is added to your account.

3. Location.

Deposit slips are used when you make a deposit in person at a bank, drop an envelope into an ATM drop box, or mail checks to your bank to be deposited.

Parts of a Deposit Slip

In order for you to know how to fill out a deposit slip, which is to be discussed in the next section of this article, you must first know the different parts of a deposit slip. There might be different types and designs of deposit slips, but there are key parts that should be present in every deposit slip. Here are the different parts of a deposit slip and a brief explanation for each part:

1. Account number.

This is to be filled in with your personal identification number or the number of your account to ensure that the money is deposited in your account. In case you do not have your account number with you, you can ask the bank and they can provide the information to you. You may also like receipt examples in excel.

2. Your name.

This is pre-printed or written in your deposit slip.

3. Date.

The date when you deposit the cash or check is to be written in this space.

4. Cash.

The amount of cash the you will be depositing should be placed correctly in this section.

5. Checks.

For checks or money order deposits, each one must be listed separately on this part and to be continues on the back if more space is needed.

6. Subtotal.

This is the sum total of all the deposits, cash, and checks, which must be written correctly in this section.

7. Less cash received.

This space is where you write the amount of cash you would like to get back from the checks that you are depositing. It is like you are encashing a portion of the check and depositing the remainder. You may also check out cash receipt examples & samples.

8. Total.

This section is the difference between the subtotal amount and the cash received for the check. The difference of the two must be correctly indicated in this section.

9. Signature line.

This is where you will write your signature especially when you are encashing a portion of your check.

Filling Out a Deposit Slip

Some of us, especially for those who have not yet experienced depositing in bank, are hesitant to do so because they do not know how to fill out a deposit slip. For others, they do not want to experience hassle in filing in every information required in a deposit slip. You may also see receipt examples in word.

However, on the contrary, filling out a deposit slip only takes a few minutes as there were only few sections required to be filled in and these are just the basic information just as discussed in the previous section, “Parts of a Deposit Slip.”

To help you fill out a deposit slip with ease as well as get familiarized in the deposit transaction, here is the process and the basic steps.

1. First, you must provide personal information such as your name and your account number. For pre-printed deposit slips from the back of your checkbook, this has already been printed and done for you.

2. Next, fill in additional details such as the date of deposit and, sometimes, the branch information if required. For credit union members using a different credit union’s branch, they need to write the name of their credit union. You may also see company receipt examples & samples.

3. Then, list the cash amount of your deposit, if you are depositing a cash. If not, leave this line blank.

4. For checks, list the checks individually along with their corresponding check number and amount of each check.

5. If you are just depositing a cash without a check, you can immediately proceed to subtotal. If you are depositing both, add up all the cash and check deposits to arrive at the subtotal.

6. If you would like to take a portion of the amount from your deposit, especially when you are depositing a check, write the amount that you want to take. For deposits that consist only of checks, you might want to encash a portion of it now so that you do not have to make a withdrawal later. You may also like official receipt examples & samples.

7. Subsequently, calculate the total deposit, which is the difference between the subtotal of all your deposits and the amount you would like to take.

8. Lastly, if you are taking cash from your deposit.

Formal Deposit Slip Example

Plain Deposit Slip Example

Professional Deposit Slip Example

Ways to Make Deposits

There are many ways in which you can make deposit in your bank. They are as follows:

1. Personally.

You can personally go to a bank branch and hand the cash or checks including the deposit slip to the teller. There are also deposit-enabled ATMs for convenience. You must note that you need to deposit in a branch or ATM that your bank owns. For credit union members, they can use other credit unions to make deposits if that credit union participate a shared branching with their credit union. You may also see catering receipt examples & samples.

2. By mail.

You can also send your paper checks or money orders payable to you through mail. You can ask your bank for the address to be used for the fastest service as well as any other requirements for the deposit. Generally, you really need to fill out a deposit when depositing paper cash or check to record the transaction. You may also like receipt examples in pdf.

Additionally, you need to endorse any checks by signing the back and adding any additional information required by the bank. For deposit-enabled ATMs, there is no need for deposit slips or envelopes when the ATM is equipped with scanning technology that can capture the image of your check.

3. Electronic.

In this digital age, it is expected that almost everything can be transacted electronically. This is also true when it comes to deposits. You may also opt an electronic deposit or you can transfer money from one bank to another. This will save you from the additional work of withdrawal from one account and depositing it to another account. You may also check out service receipt examples & samples.

For bank that uses Zelle in their money transfers, the deposits can be immediately available. In depositing checks, you can take a photo of the check and submit it to your bank. Most of the banks require some time before you can make a withdrawal after your deposit. The waiting period is longer for transactions with personal check than transactions involving those government-issued checks and wire transfers. You might be interested in restaurant receipt examples & samples.

Simple Deposit Slip Example

Sophisticated Deposit Slip Example

Typical Deposit Slip Example

Sum Up

In sum, deposit slips are needed by the bank to have a proof of your transaction and to confirm if they have entered correctly the amount of your deposit. You are given a receipt upon your deposit.

In making a deposit, you must know the parts and the appropriate information to be filled in. First, you must provide your personal information as well as the date of your deposit. Then, you must write the amount that you are going to deposit either in cash or in check. You may also see photography receipt examples & samples.

The subtotal section is the sum of all your cash and deposits. The next line is the cash received line where you must indicate that amount that you would like to take, if there is any. The total section is the difference between the subtotal and the cash received. You may also like transfer receipt examples & samples.

Note that you can make deposits personally, by mail, or through electronic deposits.