10+ Equity Research Report Examples to Download

They say money can’t buy happiness but hey, what’s the use of a million bucks if it’s just going to sit there? There’s nothing wrong with spending money as long as you do it wisely. You could even make it grow by investing. The worth of something is always subjective, what may be worth it for you, might not be said for another person. And when it comes to the corporate world, the financial statement of a company can make or break its future. That’s what equity research is for. It helps company heads and investors formulate business forecasts and decisions regarding their investments.

Shareholders and investors need a way to communicate with an analyst about the company’s finances. This is where equity research reports come in. Analyst record and present forecast, valuation, management overview, and recommendations in equity research reports for investors to further analyze and discuss. These reports also include industry research that contains the trends and competition in the given field. These also come as lengthy industry reports that cover the holistic update of corporations in the same area, quarterly reports that talk about the company’s quarterly finances, and flash reports that comment on the company’s fresh releases and other various updates.

Equity Research VS Investment Banking

Misconceptions are present in all fields and industries. This is true when it comes to investments. Some people might assume that equity research and investment baking are the same since they both focus on finances and investments. There are actually key differences between these two.

For one thing, equity researchers require comprehensive mathematical skills, while investment bankers focus on client relationships. Another is the visibility, the analyst gets recognition for their research reports and are sought out by major companies while investment bankers spend a lot of time in obscurity. If your career path leads you to these two professions, you should learn more about equity research vs. investment banking.

Examples

Equity Research is a lot of work, for your convience here are 10+ equity research report examples and templates for you!

1. Financial Analysis Report Template

2. Financial Analysis Template

3. Business Research Report Template

4. Company Financial Analysis Template

5. Financial Report Template

6. Free Financial Report Template

7. Free Research Report Cover Page Template

8. Free Financial Management Report Template

9. Free Company Expense Report Template

10. Free Finance Internal Audit Report Template

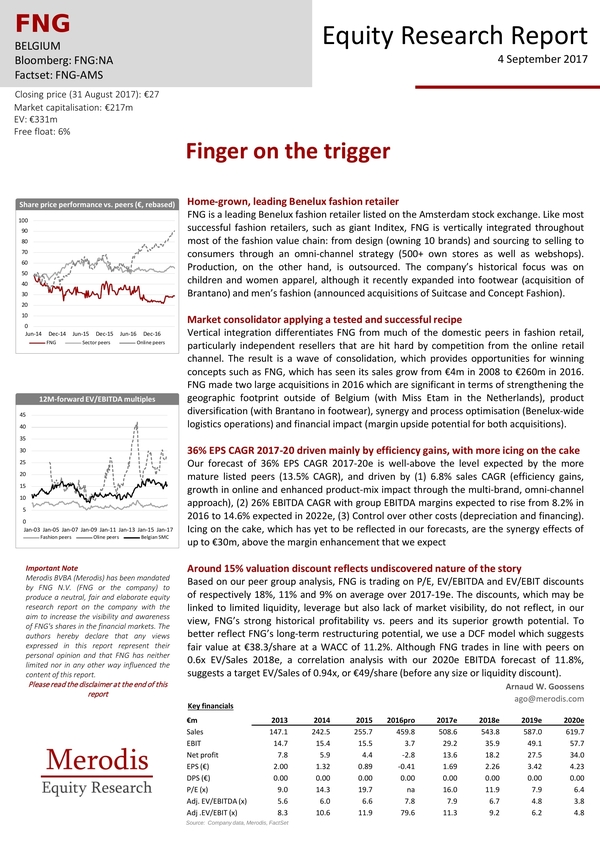

11. Equity Research Report

What Makes a Good Analyst

In a song by Dillion, there’s a line that goes, “if your dreams don’t scare you, they’re not big enough.” As with any profession, it’s not so hard to believe that people want to be the best. There is nothing wrong with wanting to be renowned for something you’re passionate about. Whether you want to be a business mogul, graphic designer, or even professional dog walker, greatness is always a goal. This also applies to equity research analyst. But there are things you need to attain to achieve prominence. Before you become an acclaimed analyst, you first need to encompass these traits for your career.

1. How the Land Lies

Before you venture into any industry, you must first understand how it works. Not knowing the basics and marketing trends of the industry is like going to battle unarmed – you are going to get killed. Once you understand the field you are in, you can also figure out the best strategies to use and what to recommend to your investors. But you can’t just focus on the trends within a certain market; your insights must be universal. This way, you can compare patterns, styles, and inner workings from various corporate environments that involve your field.

2. Chill for a Sec

In a line of work that is usually situated in a fast-paced world, you need to learn to take your time. Patience is required to be part of the major league. Do you think Michael Phelps swam once and became a champion overnight? Take a moment to listen and learn from the master. Sit down and look through all the details of the information you gathered to make sure you don’t miss anything out. Your patience is required for many aspects, from writing reports to making financial modeling structure. So just chill for a sec.

3. Knowledge is Power

What you think you know is never enough. Just when you thought you’ve got all the tricks in making financial analysis up your sleeve, a new technique comes rolling in. That’s why you should always be open to learning something new. As time moves and trends change, a new and better way to do is bound to arise. If you let yourself take in all the knowledge presented to you, you are sure to have an edge against others. So go ahead and read a book, watch a video, smash your head, whatever. Sharpen that mind kiddo.

4. Get Your Facts Straight!

Inaccurate data is never acceptable. It could mean you aren’t doing your job right, or you are making up information to make your report believable. Like with any business reports, accuracy is extremely important. Any wrong information can cause a giant mess. That’s why when making your equity research reports, your data must be valid. You need to do an intensive examination to figure out if the data you gathered is reliable. Any inconsistencies might throw the buy-side off. So get a grip, get it right, and get your facts straight!

5. All the Bits and Bobs

As an equity research analyst, your report has to be detailed. You need to make sure anyone can read your business document without missing any information. What if the sell-side reads your work and can’t keep up with its content because it’s missing some vital parts? Even if you think it’s common knowledge, you need to include all the essential organizational knowledge to keep your report consistent and flawless. Your report shouldn’t leave investors asking questions. You must keep your research report comprehensive and holistic. Every bit of data counts.

6. Keep it Simple

Technical writing doesn’t always need fancy words; it just needs to be understandable. Using simple language in your executive summary keeps your readers away from confusion. There is really no need for you to require readers to look up every word in your report. You’re just making all our lives harder. Complex sentences tend to complicate things. This could lead to misunderstandings that could lead to even bigger chaos. The best thing to do is to keep things simple, concise, and clean.

Dealing with financial management are always stressful. But when done right, they can also lead to great success. Remember, she who leaves a trail of glitter is never forgotten.