18+ General Partnership Agreement Examples

There are some things that we cannot do without the participation of others such as playing a seesaw. No matter how we try to do it on our own, they are best played when someone would be lending a hand and joining our play. You may also see business agreement examples.

Similarly, in the business world, there are times when we need someone in putting up and running a business for we cannot do it alone because we are insufficient of either finances or intelligence. That is when we enter into a contract of partnership. You may also like management agreement examples & samples.

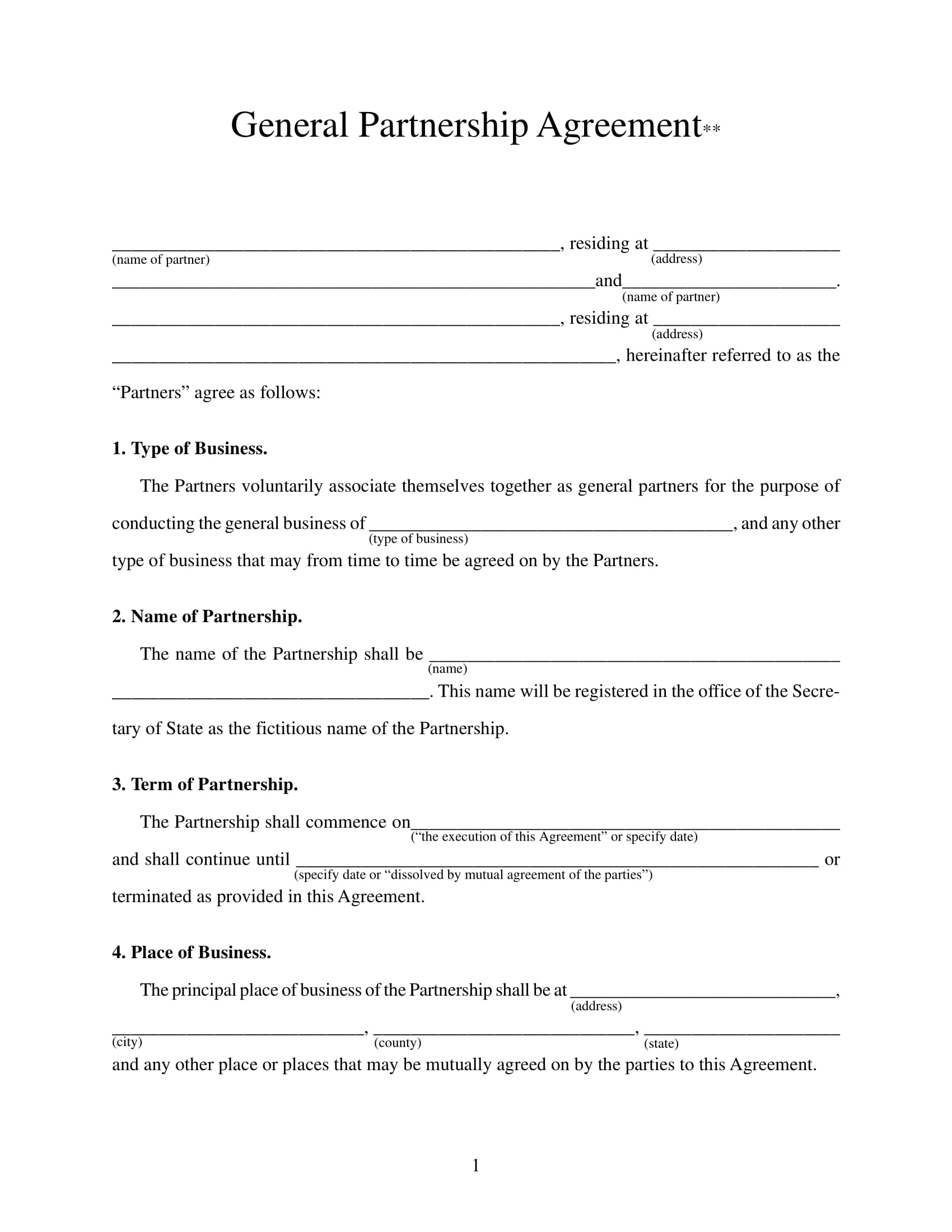

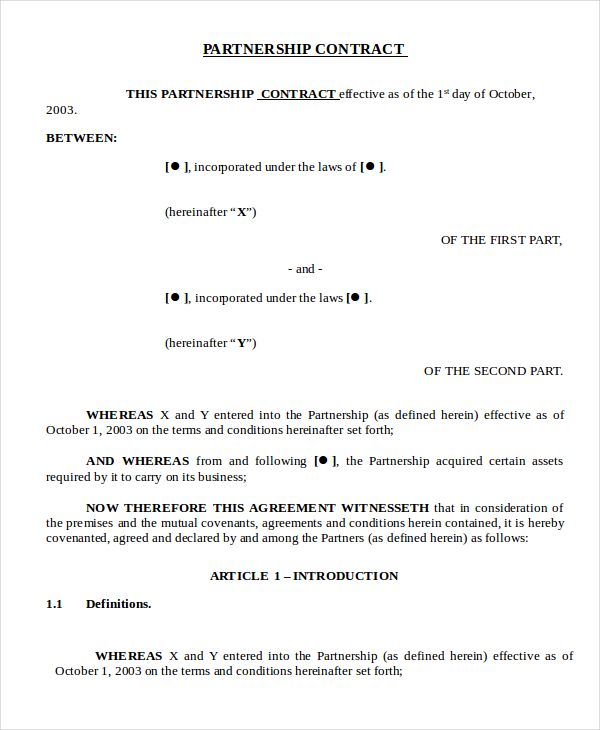

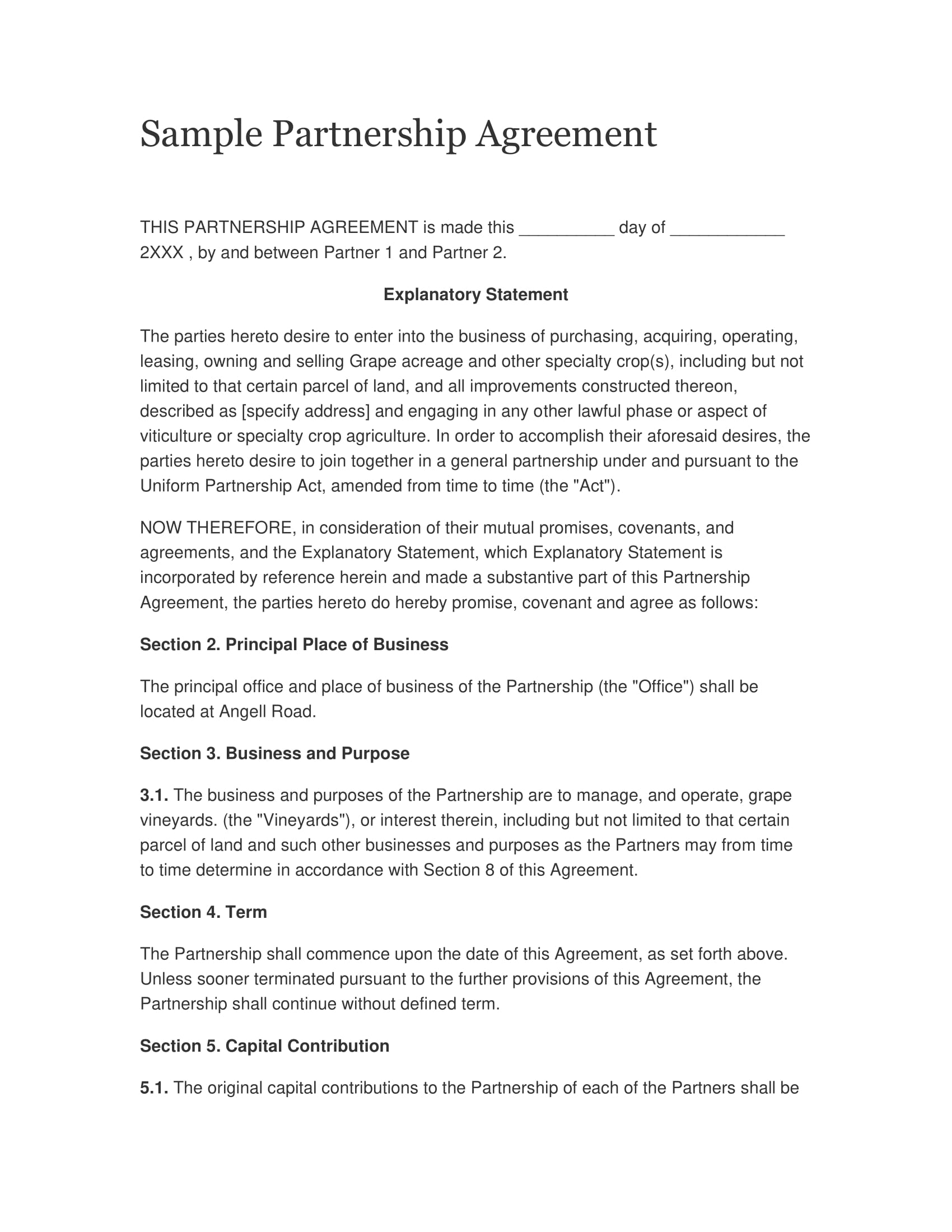

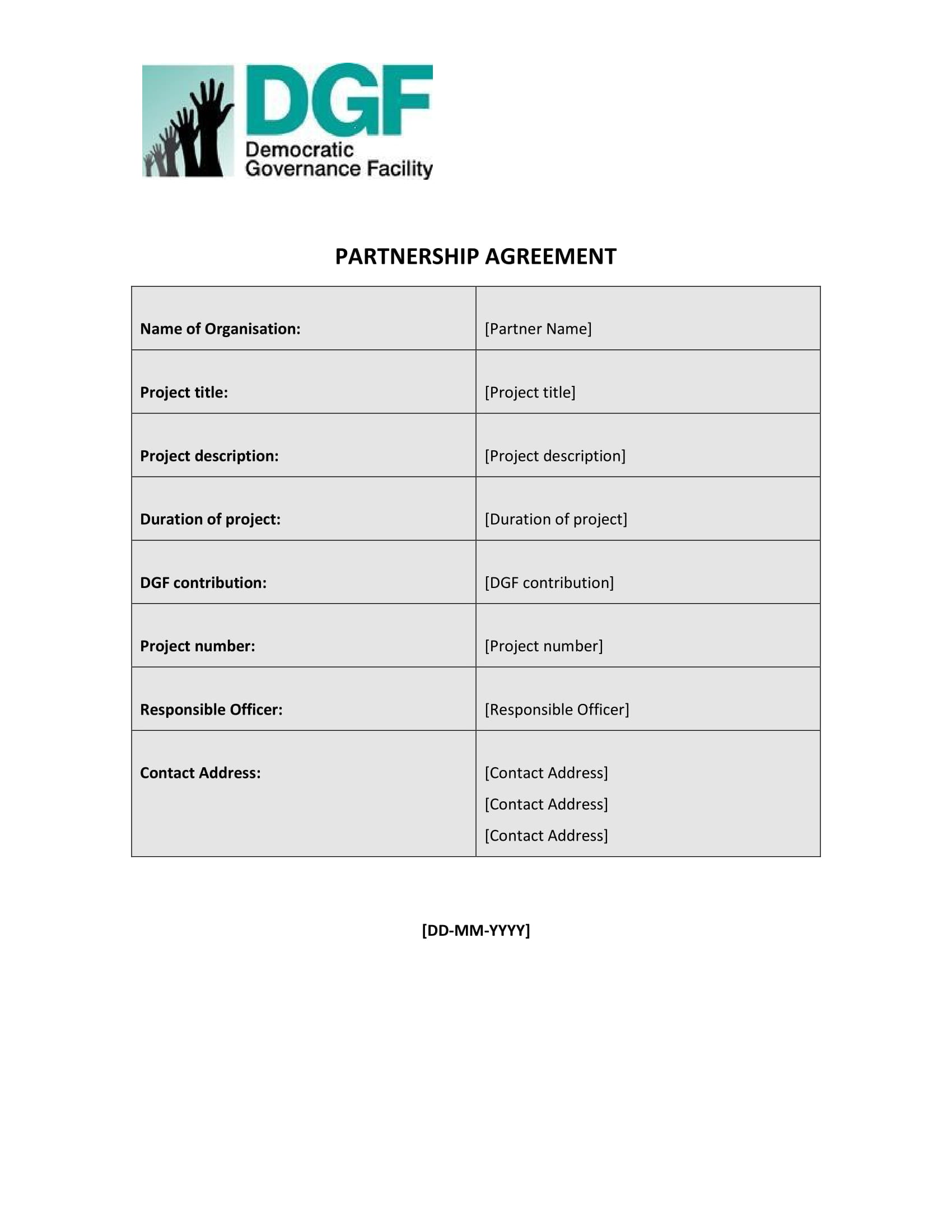

Partnership Agreement Example

Limited Partnership Agreement

Simple Limited Partnership Agreement Example

Web Content Partnership Agreement Example

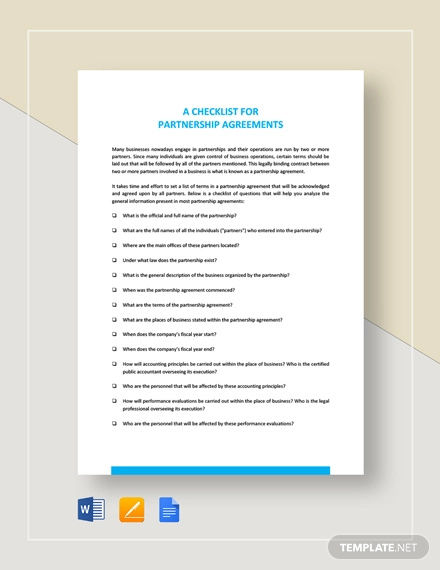

Checklist Partnership Agreement

Restaurant Partnership Agreement Example

Checklist Partnership Agreement Example

Real Estate Partnership Agreement Example

Commonly, when we say “partnership,” this often means “general partnership,” the discussions of which can be found in the later section of this article.

When we enter into a contractual agreement of partnership, there must be a written contract or agreement binding the parties with the terms in which both parties consented. There must be a clear and comprehensive agreement for the parties to understand the terms and conditions of the partnership.

Want to have an agreement that is presentable, concise, clear, and comprehensive? Below are several examples and templates that you can use for your partnership agreement. There are also other agreements that you might also be interested in such as the following:

Limited Partnership Agreement Example

Custom Software Business Partnership Agreement Example

What Is a General Partnership?

General partnership, or simply partnership, is a contract whereby two or more persons contribute money, property, or industry with the intention of dividing the profits among themselves. This means that two or more persons consented to be a part of a business and expect to gain profit or divide the losses among themselves. The division of profits and losses is to be agreed upon by all the partners. You may also see letter of agreement examples.

Basic Features

- Voluntary agreement

- Division of profit

- Mutual contribution to a common fund

- Lawful object

- Mutual agency

- Articles must not be kept secret

- Separate juridical personality

What Is a General Partner?

A general partner is a partner in a general or limited partnership with unlimited personal liability, which means that the partner is indebted up to his personal assets. He also manages and exercises control over the company. You may also like service agreement examples.

Advantages of a General Partnership

Below are several advantages of a general partnership:

1. Easy to establish.

A general partnership is easy to establish as it is simpler, cheaper, and requires less paperwork than forming a corporation.

2. Simplified taxes.

In general partnerships, they do not pay income tax at all for all the profits and losses are passed through to the individual partners. You may also check out purchase agreement examples.

3. Easy to dissolve.

General partnerships can be dissolved at any time at the discretion of the partners.

Disadvantages of a General Partnership

On the other side of a coin, there are certain disadvantages of a general partnership, and they are as follows:

1. Unlimited liability.

A general partnership does not establish itself as a separate business entity from the partners. As a result, the partners are unprotected from any claims, lawsuits, demands, and damages against the business. They are liable to the extent of their personal assets, which can be seized at any time to cover unmet obligations. You might be interested in simple agreement letter examples.

2. Partners are liable for each other’s action.

Each partner is liable for the actions of the others in such a manner that if one partner executes an agreement without the knowledge of the other partners, the other partners would be liable to the simple agreement.

Basic Partnership Agreement Example

Business Partnership Agreement Example

Clear Partnership Agreement Example

Comprehensive General Partnership Agreement

Things to Include in a Business Partnership Agreement

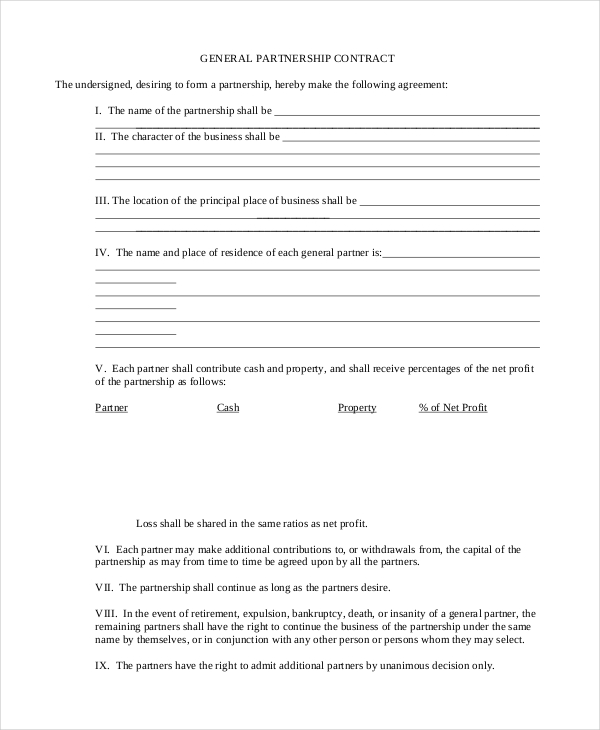

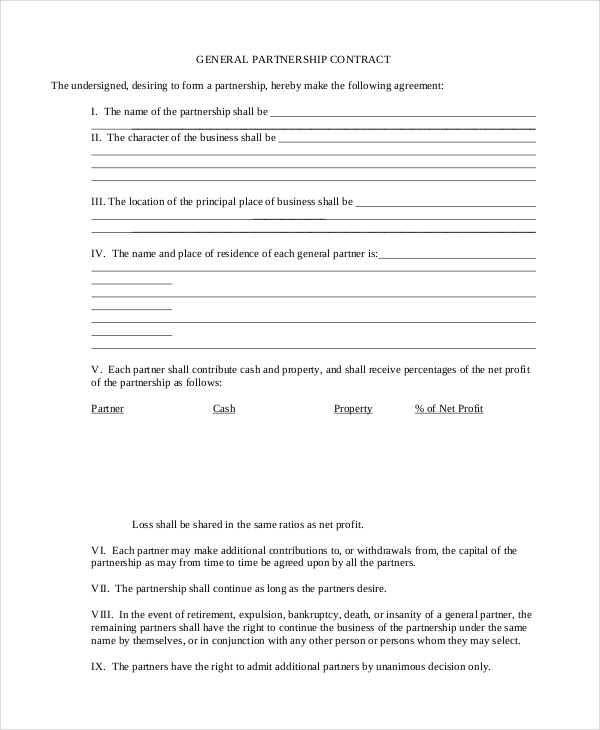

1. Business Name and Purpose

A partnership agreement should include the name of the company, and if your company will use a fictitious business name, it must also be mentioned in the agreement.

Additionally, a statement of the company’s purpose must also be included. The purpose must be broad so that you can have the flexibility to adapt the commercial agreement when you will incur any changes and you do not have to revise the entire partnership agreement.

2. Partner Areas of Responsibilities

You must also decide on who is going to be responsible for which parts of the business which includes but is not limited to the following:

- General partnership business strategy

- Hiring and HR in general

- Sales and marketing

- Partnerships with other companies

- Financial management

- Day-to-day management

3. The Time Each Partner Will Commit

You must also decide on how much time each partner must commit to the partnership and they must cover the following questions:

- Are the partners expected to work set hours?

- Does one partner plan on working more or less than the other partners? How much will be his compensation?

- How much vacation will be allowed for each partner?

- Will the partners render full time or are they allowed to conduct other types of businesses outside of the partnership? You may also see business agreement letter examples.

4. Contributions

You must also determine what each partner is contributing to the business in terms of cash investment, physical property, and intellectual property. Once you have listed everything, you must also determine on how property will be owned and used as well as how the profit relating to the asset will be distributed. You may also like subcontractor agreement examples.

5. Ownership Split

Once you have decided the responsibilities, workload, and contributions for each partner, you now have to come to an agreement on how ownership is going to be shared in the business. Although 50-50 is an easy way to divide the share of a business, there are some instances in which one partner has contributed to a significantly larger amount of property or cash to the business. You may also check out sales agreement samples.

Below are examples in which it is said that a partner can get a larger ownership share in the business:

- A partner has contributed a significantly larger amount of property or cash to the business as compared to the other partners.

- A partner has provided intellectual property by his original business concept and/or by developing a beta product or securing a patent. You might be interested in contractor agreement examples.

- A partner is working full time while other partners are working part time.

- A partner has successfully raised venture capital funding.

Domestic General Partnership Agreement Example

General Partnership Agreement Example

Public-Private Partnership Agreement Example

Real Estate Partnership Agreement Example

Simple General Partnership Agreement Example

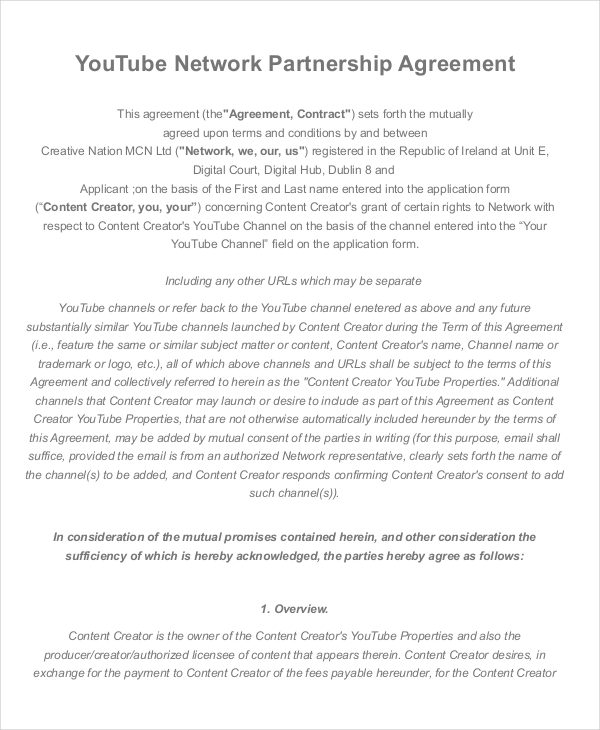

YouTube Partnership Agreement Example

6. Profit and Loss Distribution

Partners do not receive salaries because they are considered to be self-employed and, instead, receive distributions from the profits of the business. Hence, if the business has no profits, generally, there are no distributions. However, there are also called guaranteed payments in which a partner can receive a distribution without regard to the profits and losses of a partnership. This may take the form of an interest or a bonus. You may also see agreement letter for payment examples.

You can specify in the profit and loss section of your partnership agreement the following questions:

- At what point do you plan on taking out profits and distributing them to the partners?

- Do you have plans on reinvesting the profit back into the business? If so, how much?

- How and when will profits and losses be divided up among the owners? Will it be based on original contribution? Or will it be based on a certain percentage? You may also like how to write a separation agreement.

- Are there any guaranteed payments? If so, to whom, when, and how much?

7. Partner Disputes

In order to move forward and grow in a business, the partners must discuss and come to a general agreement with regard to the differences of opinion, and collaboration and solving issues must be one of the top priorities. However, there are really instances where disputes are inevitable. It is good to give each partner an equal say regarding the business, but there should also be a tie breaker.

There are also ways to handle disputes such as the following:

- The CEO has the final say.

- A partner, one who is in charge of a specific field, has the final say on that particular part of the business.

- Vote based on ownership and can be in any form—verbal, written, or something else.

- Majority vote for businesses with an odd number of partners.

- Outside mentor may be consulted, and this must be specified in the partnership agreement.

- Outside advisory board may also be consulted and must be compensated fairly enough, and this must be specified in the partnership agreement. You may also see professional services agreement examples.

You may also opt for a more formal way to handle dispute such as as follows:

- Mediation. A professional mediator can help partners come to an agreement on issues that cannot be easily resolved among themselves. However, all parties must agree for the mediator cannot force a basic agreement.

- Arbitration. If issues are still not resolved through mediation, arbitration may be implemented. It binds the partners to the decision made by the arbitrator.

- Litigation. Lastly, if arbitration cannot resolved the issue and things become too contentious, you can sue your business partner. Although this might be a long and tedious process, this will surely solve the disputes among the partners. You may also like marketing agreement templates and examples.

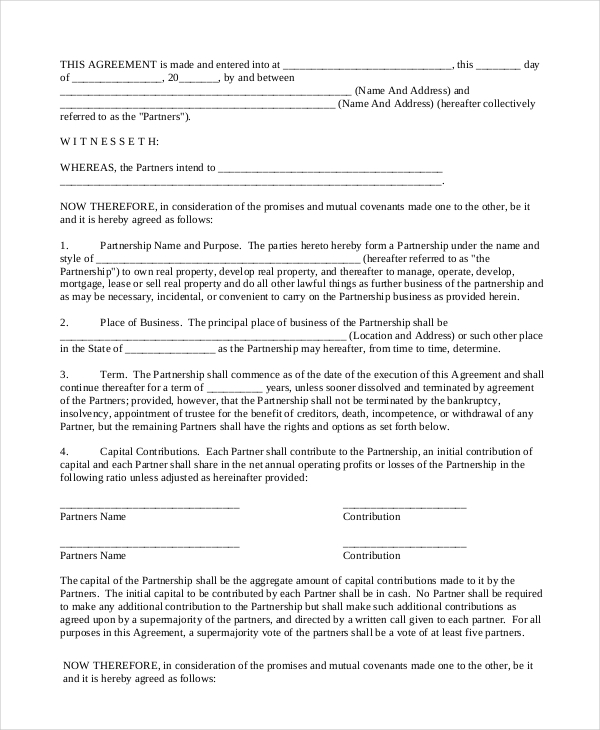

8. Power of Each Partner to Commit the Partnership

For partnerships, a partner may be responsible for any financial or legal obligation by the partnership; hence, the power of each partner to commit to the partnership must be clearly defined. The following questions may serve as a guide for determining each partner’s commitments. You may also check out roommate agreement examples.

- Contracts. Does each partner have the authority to sign contracts on behalf of the business? If so, those contracts will bind all partners.

- Debt. Is the business going to have a credit card, credit line, a loan? Keep in mind here that, depending on the business structure that you choose, each partner may be personally liable for any unpaid business debt.

- Spending. Does a partner have the ability to make purchases without consulting the other partners? Generally, there is a limit that is set in the agreement above which point the partner must obtain permission from the other partners. You may also see what is a business agreement?

9. Changes in Partnership

Sometimes, issues regarding death or disability of a partner may also arise. This should also be clearly specified in the partnership agreement, and actions must be taken; for example, the remaining partners are allowed to buy the portion or share in the partnership of the disabled or deceased partner, usually in the form of a buy sell standard agreement. Furthermore, the remaining partners must also look into key person insurance which enables the business to survive the loss of a key person.

There are also circumstances when a partner must exit the partnership either voluntarily or involuntarily. Actions to be taken regarding this case must also be specified in the partnership agreement. To address this issue, these questions might help:

- Voluntary exit. What happens if a partner wants to exit in the partnership?

- Involuntary exit. In what instances can a partner be forced to leave the business?

- Death or incapacity. What happens when a partner is incapacitated or dies?