16+ Indirect Cost Examples to Download

One of the basic concepts of a business is the relationship between needing to use one’s money to obtain more money in the end. This is very clear when people examine the relationship between costs and businesses, and why these costs are essential to the survival of a business. One of these costs comes in the form of an indirect cost, which will take some semblance of skills and hard skills to analyze.

1. Indirect Costs Template

2. Indirect Cost Rate Proposal Tool Kit

3. Indirect Cost Rate Proposal Submission Procedures

4. Guide for Indirect Cost Rate Determination

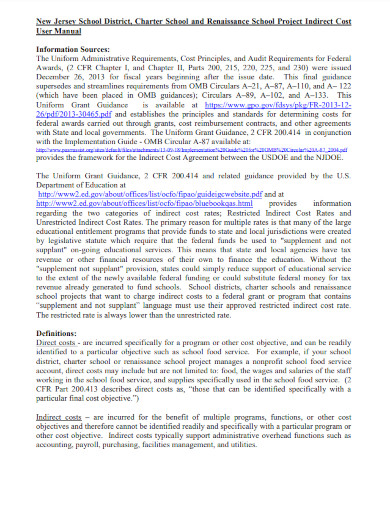

5. Indirect Cost Rate User Manual

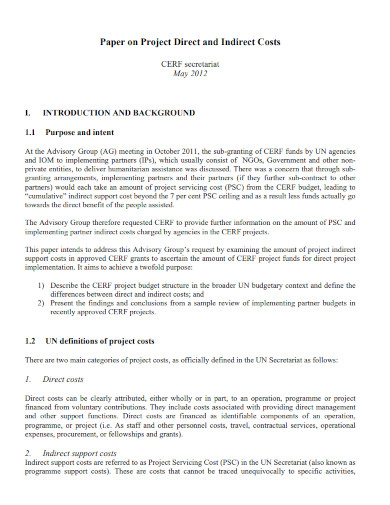

6. Paper on Project Direct and Indirect Costs

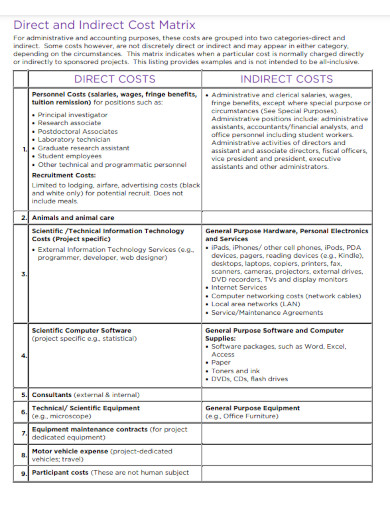

7. Direct And Indirect Cost Matrix

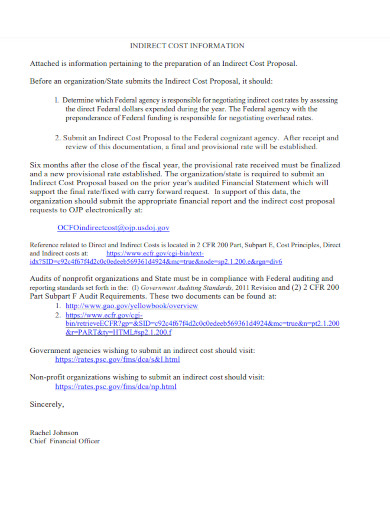

8. Indirect Cost Information

9. Indirect Cost Policy

10. Indirect Cost Guidance Note

11. Indirect Cost Recovery

12. Indirect Cost Guidelines

13. Understanding Indirect Costs

14. Indirect Costs and Cost-Effectiveness Analysis

15. Indirect Cost Rate Negotiation Services

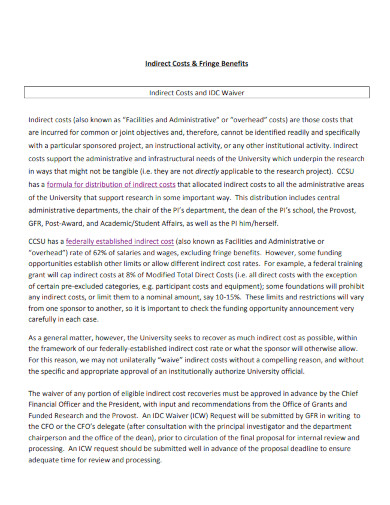

16. Indirect Costs & Fringe Benefits

17. Indirect Costs of Research Procedure

What Is an Indirect Cost?

An indirect cost is a type of cost that does not have a direct impact or effect on the quality or quantity of the final product, commodity, or service. These costs instead affect specific elements and characteristics of the produce or service business.

A lot of business has a working space that allows their employees to work in comfort and safety, To maintain these spaces and the employee’s quality of life, the employers will have to pay overhead costs to keep the current quality of life. Should the quality of life be reduced, then it will affect any performance-related aspects, themes, and contexts in the workplace. Begin by taking stock of all the business expenses so that specific sections or portions of the business will not impact the production of the main output, product, or service of the business. These business expenses can include rent for the building, maintenance of specific machines, utilities, and more, which should be collated in a single piece of document. After collating all of the data on one document, you must now obtain the summation of all the indirect costs. You can do this by adding up all of the indirect costs. When you have finished adding up all the costs you must then compare the overhead cost to the sales of the business or company. This is done through the formula of (Overhead Cost of the month/ Sales of the month) x 100. The result will be a percentage that will determine how much of the revenue will be allocated to pay for the overhead cost. After obtaining the percentage and comparing both the overhead costs and the sales, you must examine whether the overhead costs are worth its cost. Analyze whether the overhead cost either takes too much or too little of the sales and center one of your meetings around that.How To Calculate an Indirect Overhead Cost

1.) Take Stock of All the Business Expenses That Do Not Impact the Production

2.) Obtain the Summation of All the Business Expenses

3.) Equate the Percentage of the Overhead Cost and Sales

4.) Examine the Percentage

FAQs

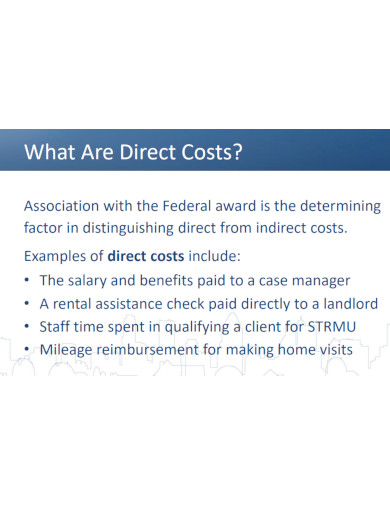

Direct cost is a type of cost incurred by the production of a specific product or service. This type of cost often manifests as the maintenance cost and the upkeep of both the workers and the machines. Indirect cost is a type of cost that is not related to the production of a specific company but is a direct result of a specific availed quality of life. This means that a direct cost is a result of a need of a specific organization, business, or company, whilst an indirect cost is a result of a want of a specific organization, business, or company.Direct vs indirect costs; what are the differences between direct and indirect costs?

An indirect and overhead cost is the same type of cost as it refers to a specific cost that is not necessary for the production or creation of a specific product or service. This means that when a business or company uses something that incurs an overhead cost it might not outright improve the quality of the product or service. Instead, most overhead costs improve the quality of the working environment, and the worker’s satisfaction and productivity.Indirect vs overhead costs; what are the differences between indirect and overhead costs?

Depreciation refers to the quality of a specific tool or object and its ability to lower in quality as time passes. This means that depreciation cost is a cost that a company has to pay to maintain the quality of its tools and objects. But depreciation does not directly impact or affect the production of a specific product or service and instead affects the productivity of the people using said tool or object. Because of this, depreciation can be considered an indirect cost.Is depreciation an indirect cost?

Indirect costs are one of the types of costs that an accountant will need to take down and note for the business to check its overall income and revenue. For a business to succeed the people heading and managing the finance team will need to know the basic concept and context of an indirect cost. Any person who wants to work in finance will need to know and understand the various types of costs like indirect and opportunity costs.