25+ Liquid Assets Examples

Financial stability and sound money management are vital aspects of personal and business finances. One key component of financial health is understanding your liquid assets. In this article, we will explore the concept of liquid assets, provide a step-by-step guide on how to determine and compute them, and offer a diverse range of 25+ examples to help you assess your financial liquidity effectively.

1. Balance Sheet Example

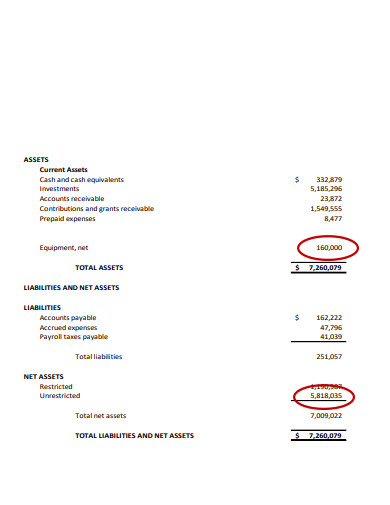

2. Balance Sheet Liquid Assets

wabankers.com

3. Liquid Assets Bank

static1.squarespace.com

4. Current Asset Liquid Assets

ciet.nic.in

5. Liquid Assets Ratio

is.muni.cz

6. Total Liquid Assets

tmb.in

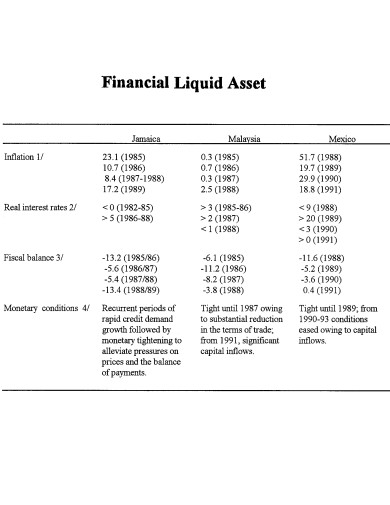

7. Financial Liquid Assets

imf.org

8. Net Liquid Assets

sandiego.gov

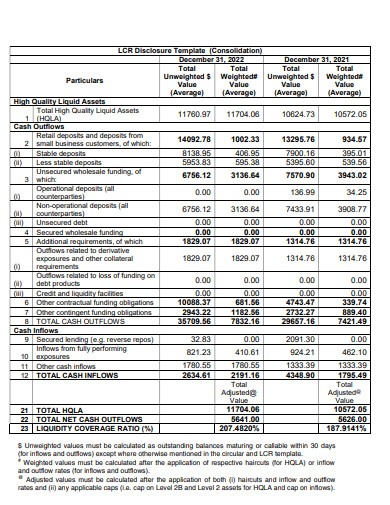

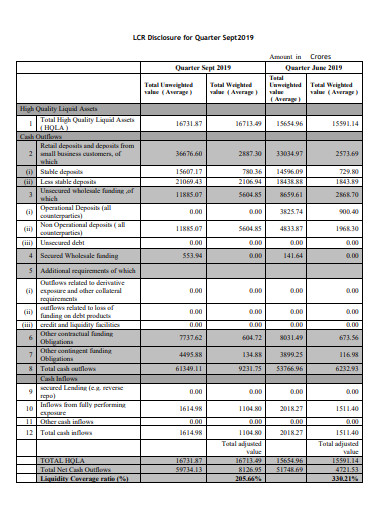

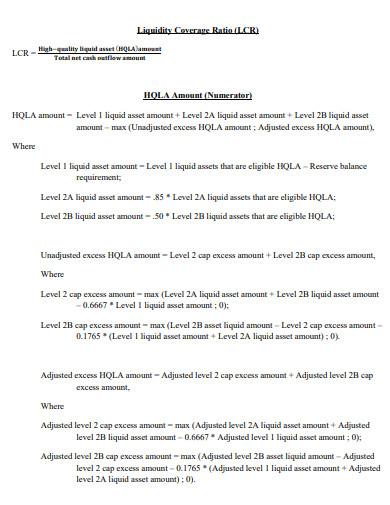

9. High Quality Liquid Assets

jkbank.com

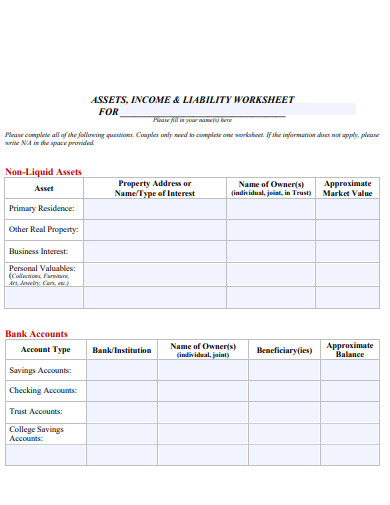

10. Non Liquid Assets

burkecasserly.com

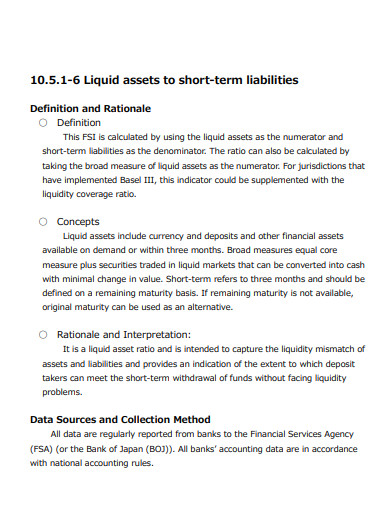

11. Short Term Liabilities Liquid Assets

mofa.go.jp

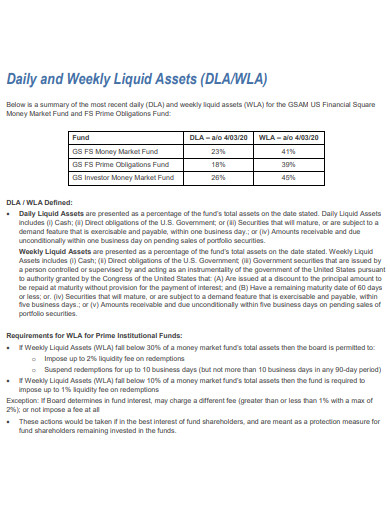

12. Daily and Weekly Liquid Assets

gsam.com

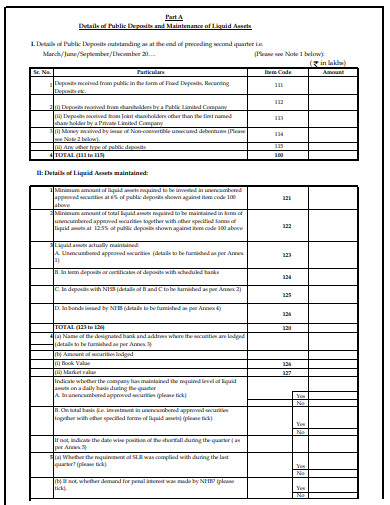

13. Determined Liquid Assets

nhb.org.in

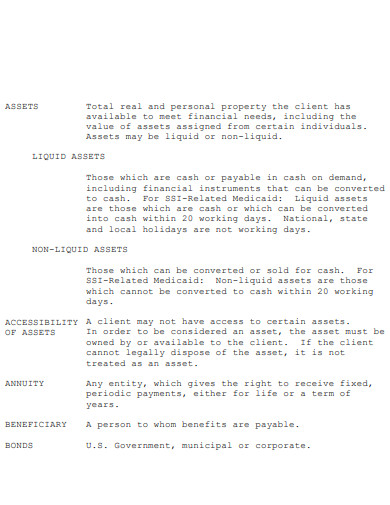

14. Personal Liquid Assets

wvdhhr.org

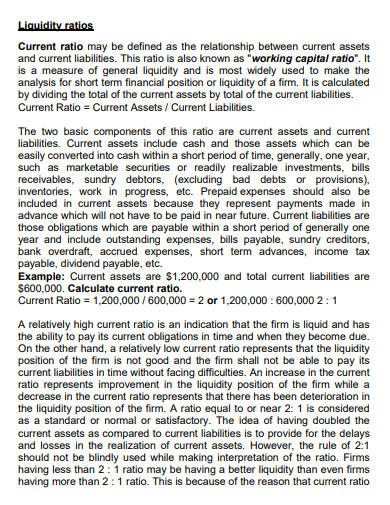

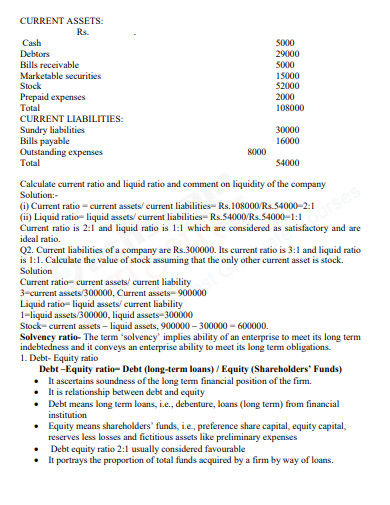

15. Current Ratio Liquid Assets

universe.bits-pilani.ac.in

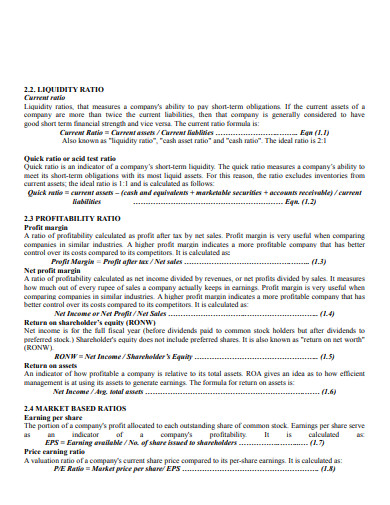

16. Ratio Formula Liquid Assets

core.ac.uk

17. Current Liabilities Liquid Assets

http://epgp.inflibnet.ac.in/

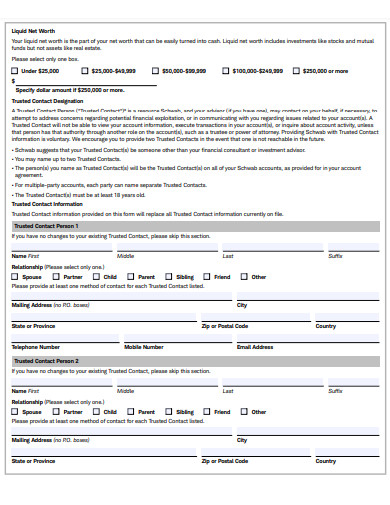

18. Liquid Net Worth

schwab.com

19. Liquidity Coverage

occ.gov

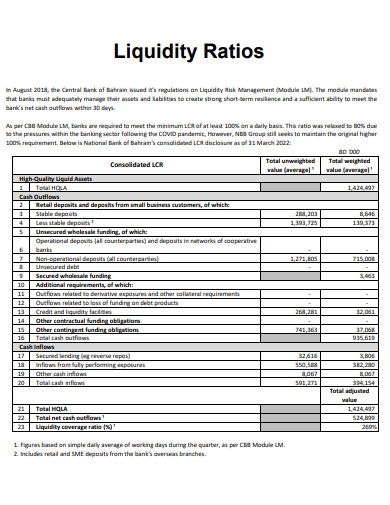

20. Liquidity Ratios

nbbonline.com

21. Liquid Private Assets

cdn.pficdn.com

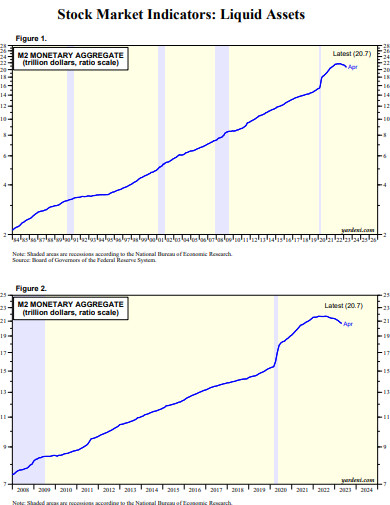

22. Stock Liquid Assets

yardeni.com

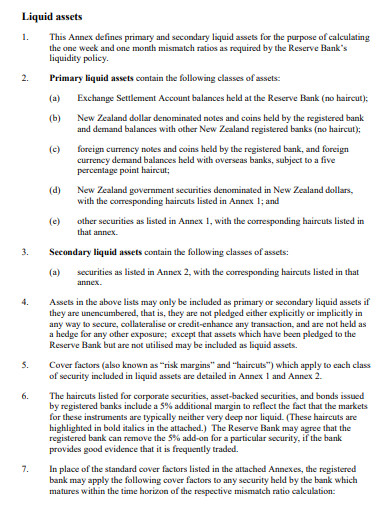

23. Primary Liquid Assets

rbnz.govt.nz

24. Basic Liquid Assets

gov.nl.ca

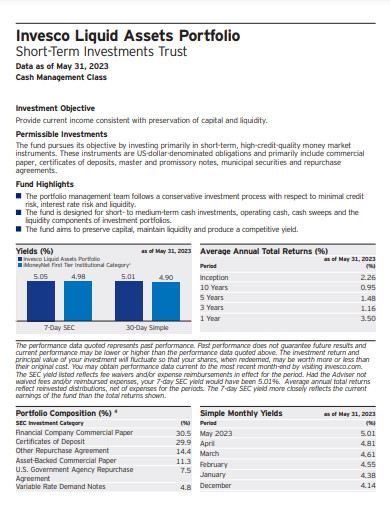

25. Liquid Assets Portfolio

invesco.com

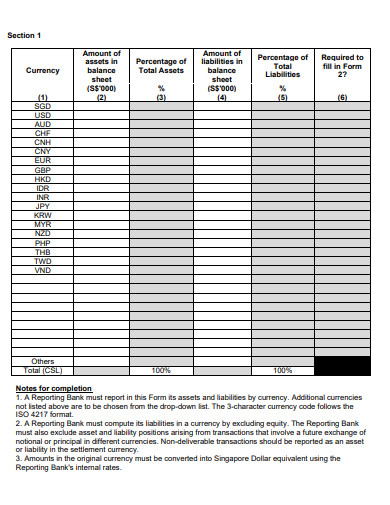

26. Minimum Liquid Assets

mas.gov.sg

What is a Liquid Asset?

Liquid assets refer to assets that can be easily converted into cash without significant loss in value, time, or transaction costs. These assets are readily accessible, providing individuals and businesses with the ability to meet their short-term financial obligations promptly. Liquid assets typically include cash, bank deposits, marketable securities, and other highly liquid investments.

How to Determine and Compute Your Liquid Assets

Knowing your liquid assets is crucial for maintaining financial stability and making informed financial decisions. By following this step-by-step guide, you can accurately determine and compute your liquid assets, providing valuable insights into your financial liquidity.

Step 1: Identify Your Cash and Cash Equivalents:

Begin by compiling all your cash and cash equivalents, including the money you have in checking and savings accounts, money market funds, certificates of deposit (CDs), and any other highly liquid accounts or instruments.

Step 2: Assess Your Marketable Securities:

Consider the marketable securities you hold, such as stocks, bonds, and mutual funds that can be easily sold on a public exchange or liquidated with minimal time and cost. Include the current market value of these securities in your liquid asset calculation.

Step 3: Evaluate Other Highly Liquid Assets:

Identify any other assets that can be quickly converted into cash without significant loss or transaction costs. Examples may include short-term government or corporate bonds, Treasury bills, or high-quality commercial papers.

Step 4: Exclude Illiquid or Long-Term Investments:

Exclude illiquid assets or investments that are not readily convertible into cash without incurring substantial costs or time delays. These may include real estate, retirement accounts, certain types of annuities, or long-term certificates of deposit.

FAQs

Why are liquid assets important?

Liquid assets provide financial flexibility and act as a safety net during emergencies or unforeseen expenses. They ensure you have the means to meet short-term financial obligations promptly, maintain financial stability, and take advantage of investment opportunities that may arise.

How do I calculate my liquid assets?

To calculate your liquid assets, sum up the value of cash, cash equivalents, marketable securities, and other highly liquid assets you possess. Exclude illiquid or long-term investments that cannot be easily converted into cash without significant costs or delays.

How much should I aim to have in liquid assets?

The ideal amount of liquid assets varies depending on individual circumstances, financial goals, and risk tolerance. As a general guideline, having enough liquid assets to cover three to six months’ worth of living expenses is recommended to handle unexpected events or income disruptions.

Understanding your liquid assets is a crucial step toward maintaining financial stability and making informed financial decisions. By accurately determining and computing your liquid assets, you gain valuable insights into your financial liquidity, ensuring you can meet short-term obligations promptly and seize opportunities as they arise.