10+ Cash Flow Statement Examples to Download

As a requisite to your company’s financial reports and financial statements, accountants must prepare a statement of cash flow to complement other financial statements that include the balance sheet and income statement. Cash flows record any and all possible amounts coming in and out of a company’s finances.

Simply put, the cash flow statement is a summary statement containing all cash movements within the company at a given time of the statement. You will find examples of cash flow statements here, all available for download. Simply click on the download button to access the file of your choice.

Cash Flow Statement

Cash Flow Statement Sample

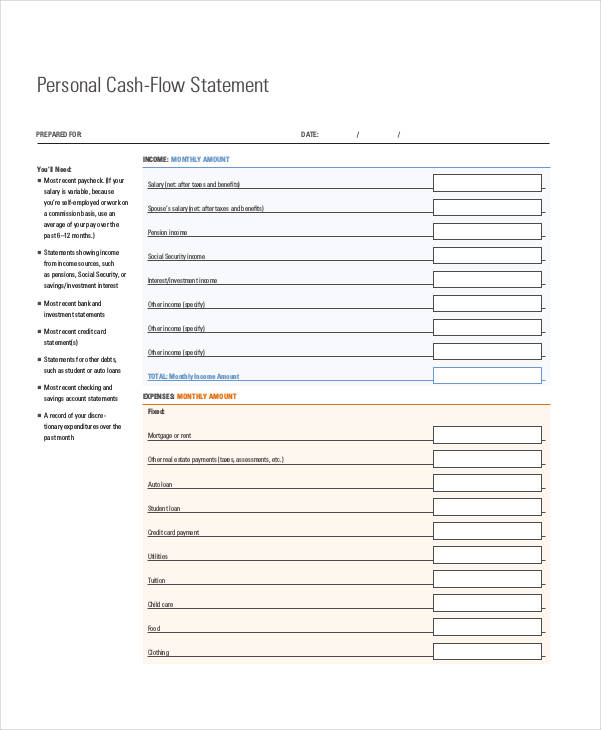

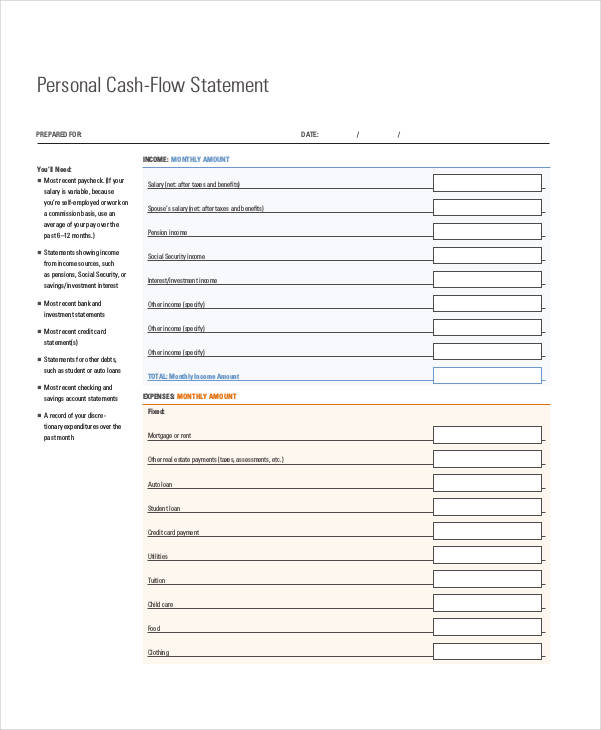

Personal Cash Flow Statements

Simple Personal Cash Flow Statement

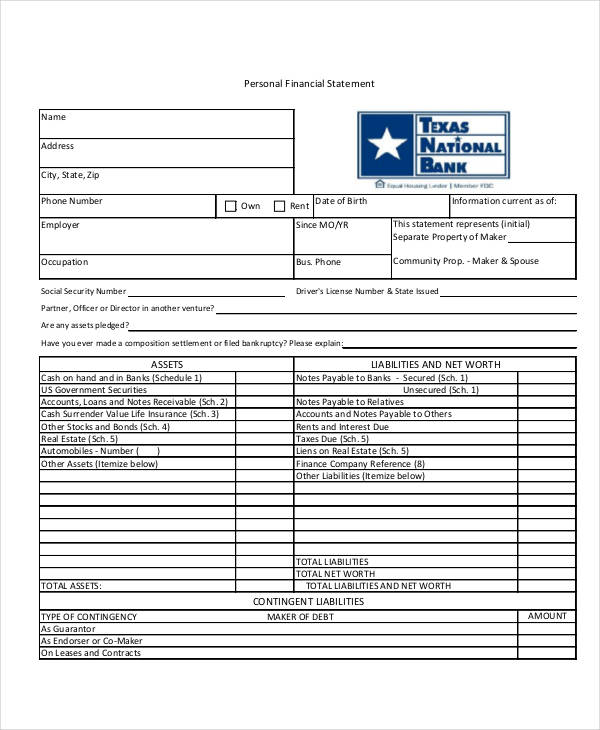

Texas National Bank Personal Financial Statement

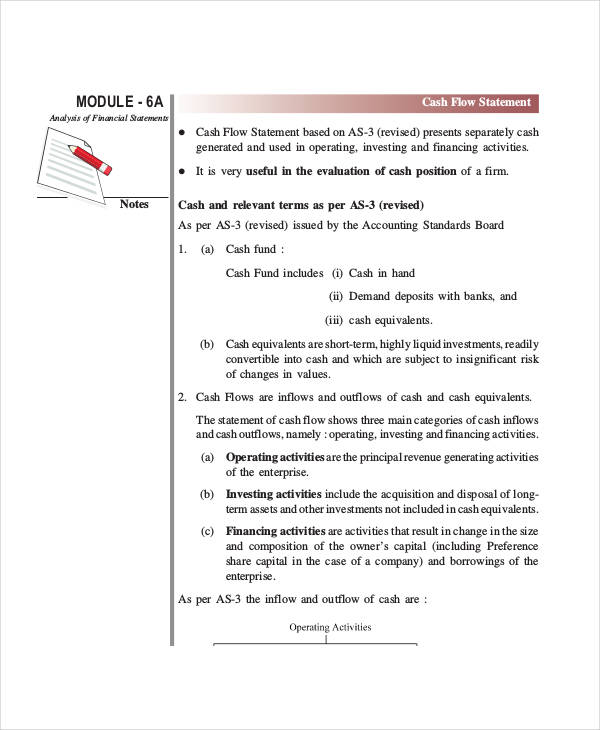

Cash Flow Statement Module (PDF)

Personal Monthly Cash Flow Statement

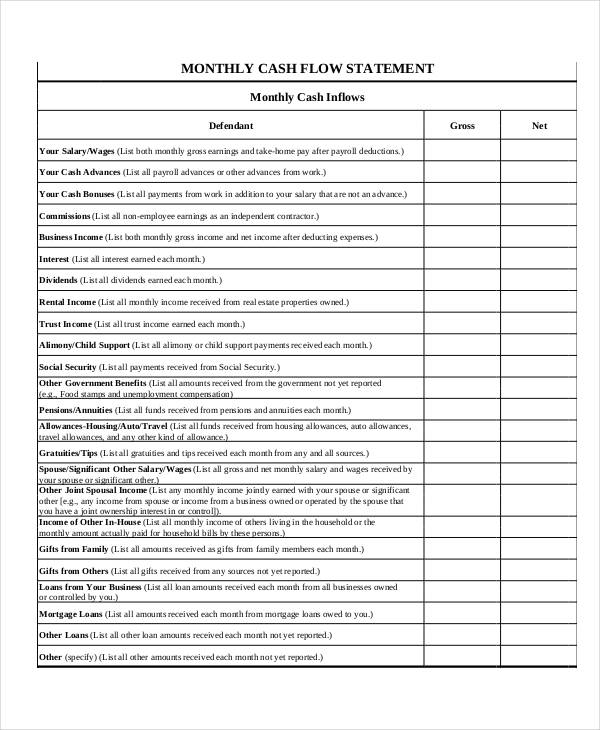

Monthly Cash Flow Statements

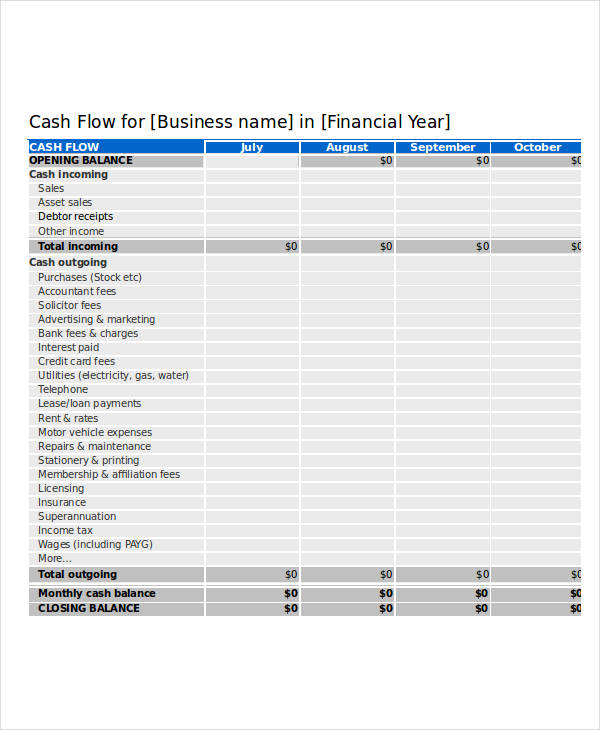

Sample Monthly Statement

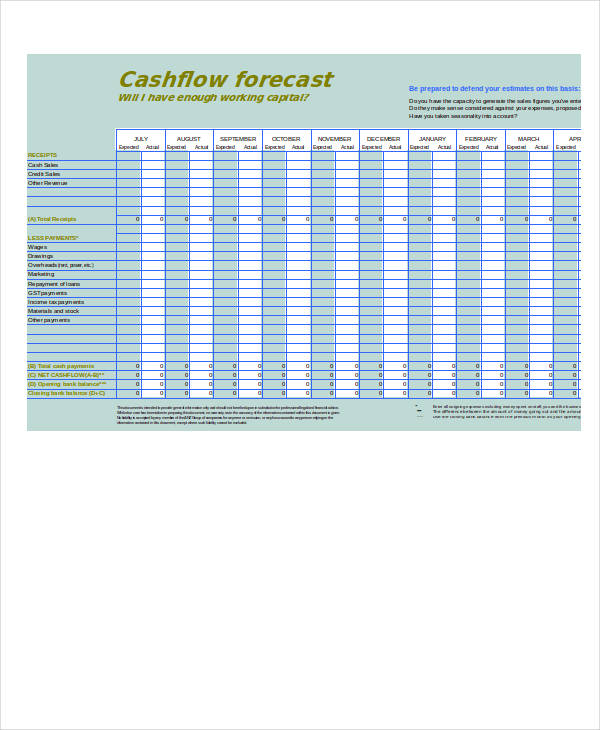

Small Business Projected Monthly Cash Flow

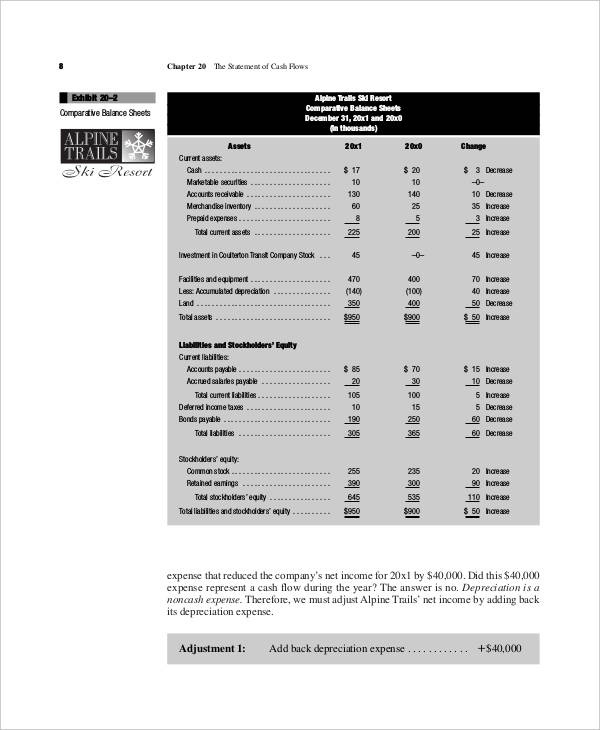

Statement of Cash Flows

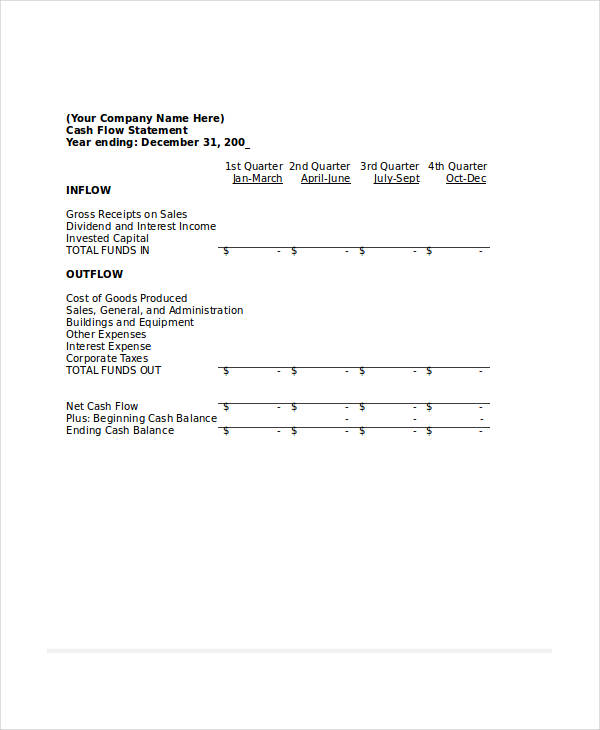

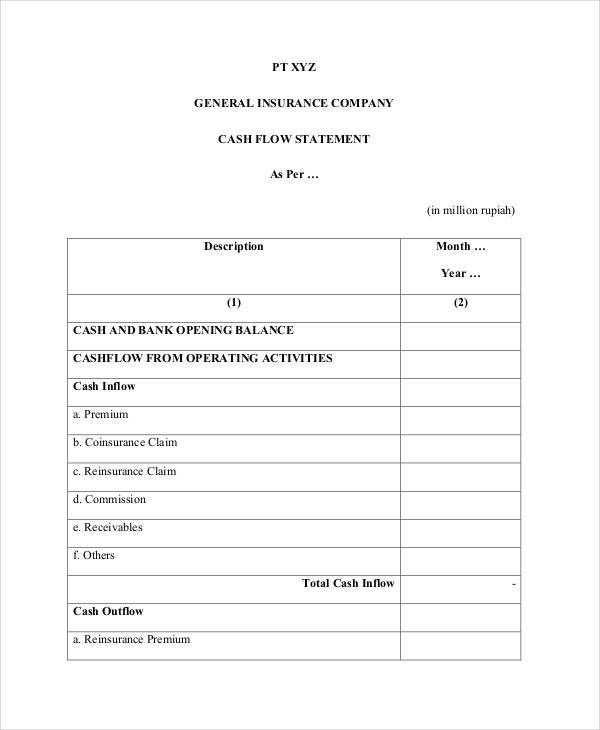

The statement of cash flows form part of the financial statements submitted by a business. It depicts how cash flows in and out of the business or organization. It may either be issued via a monthly statement or annual statement. (A sample monthly cash flow statement can be seen above.)

Cash flow statements are generally used by business analysis in understanding trends in the business that are not immediately seen in other financial statements. Usually, analysts or investors look for the differences in terms of the cash coming into the company in terms of net profits from operations and the actual reported amounts in the cash flow statements.

Making a Cash Flow Statement

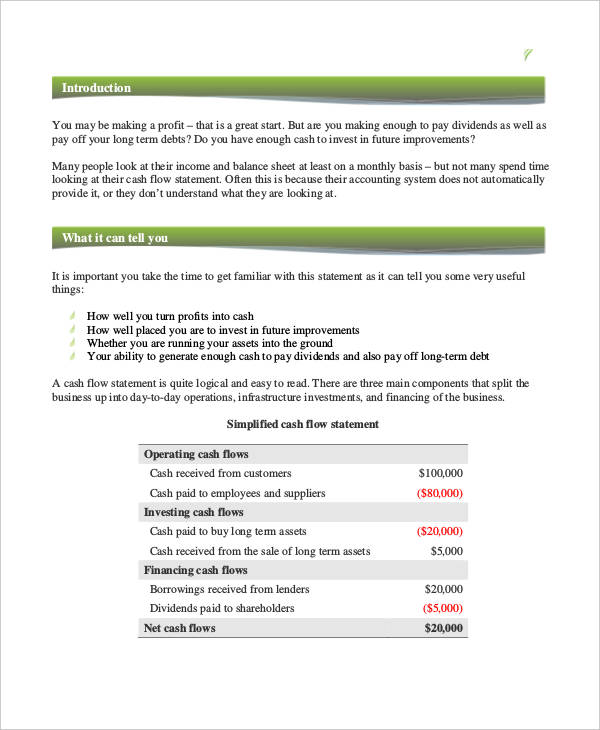

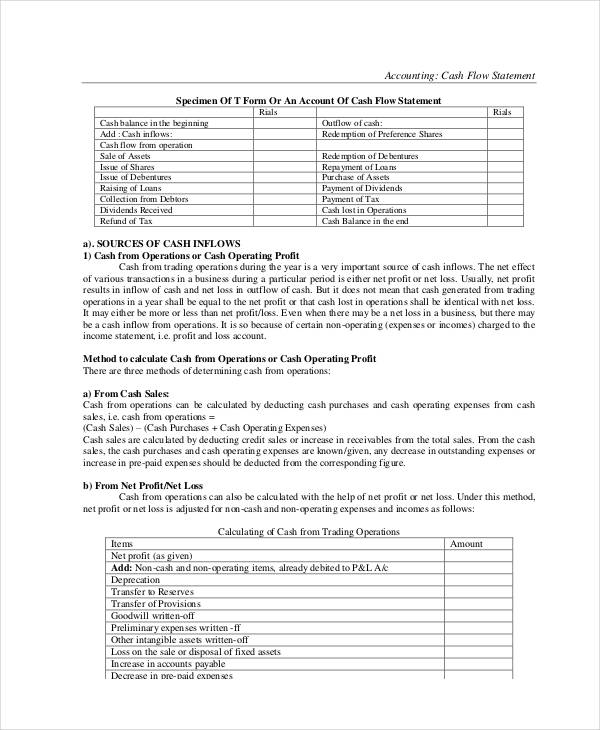

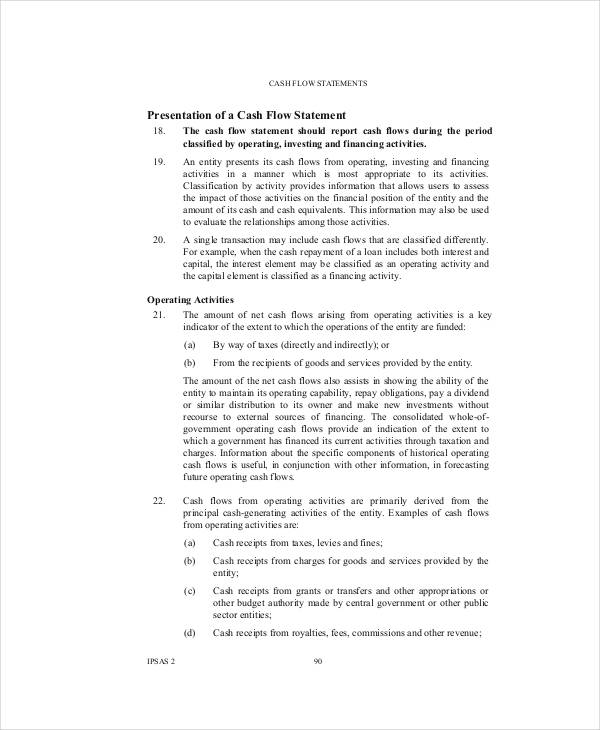

In making a cash flow statement for cash flows or any business statement of cash flows, vital information pertaining to cash flow items must be collected from operating activities, investing activities, and financing activities using two distinct methods.

- Direct Method – uses information from:

- Cash collected from customers

- Received interests and dividends

- Cash payments made to employees and suppliers

- Paid interests and taxes

- Indirect Method – uses the company’s net profit or loss as reflected in the income statement or profit and loss statement of the company and uses those figures as basis to reach the amount of net cash provided by the operating activities.

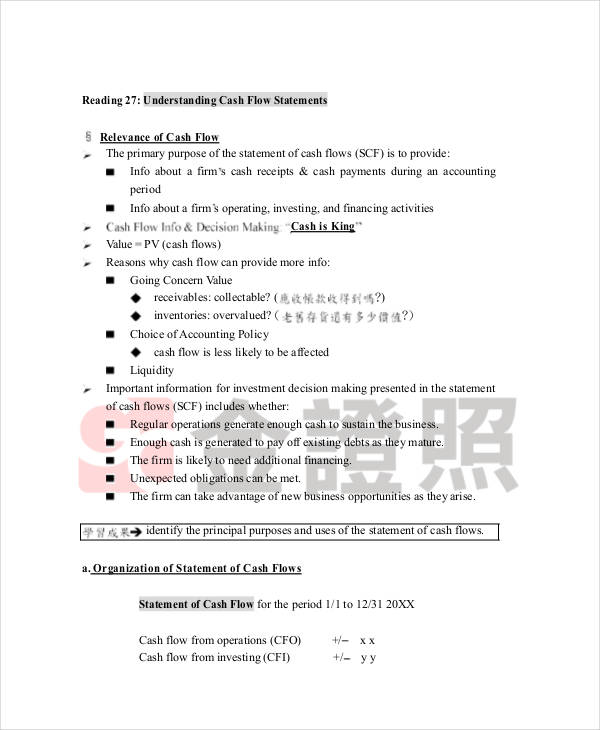

Understanding Cash Flow Statements

Understanding Cash Flow Statements (PDF)

Understanding the Cash Flow Statement Sample (PDF)

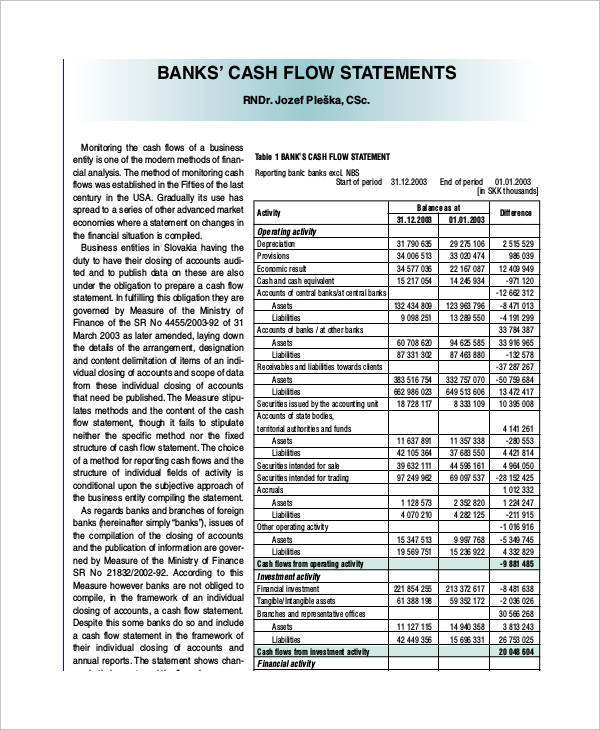

Bank Cash Flow Statements

Bank Loan Cash Flow Sample

Bank Statement Example

Free Bank Cash Flow Statement

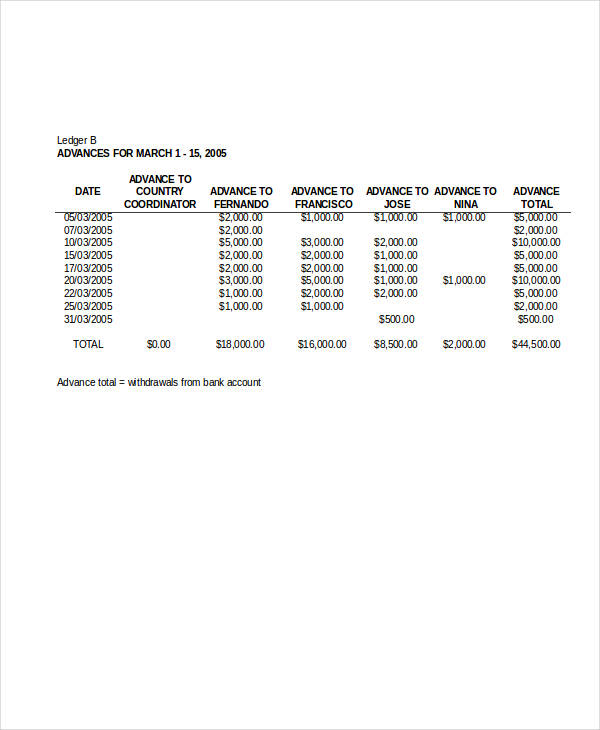

Inflow Sources for Cash Flow Statements

Cash coming in or out of a company has three general sources, as follows:

Operations

Cash generated from operational business activities can also be reflected in your income statement. Cash flow comes from net income and follows through to the reconciliation of non-cash items to cash items involved in the business operations. Items in this source include accounts payable, amortization, depreciation, and other prepaid items booked as revenue items without actual cash flow.

- The examples Restaurant Monthly Cash Flow Sample, Basic Personal Cash Flow, Understanding the Cash Flow Statement Sample, Personal Monthly Cash Flow, and indeed most of the examples on this page all show cash flow coming from operations.

Investments

This is the cash spent on acquiring property or equipment. Normally, movements from this source are results of strategic plans or part of a work plan and are considered “cash in items” since the company invests in a new equipment or property. However, it is considered cashing in if the company decides to divest in an asset.

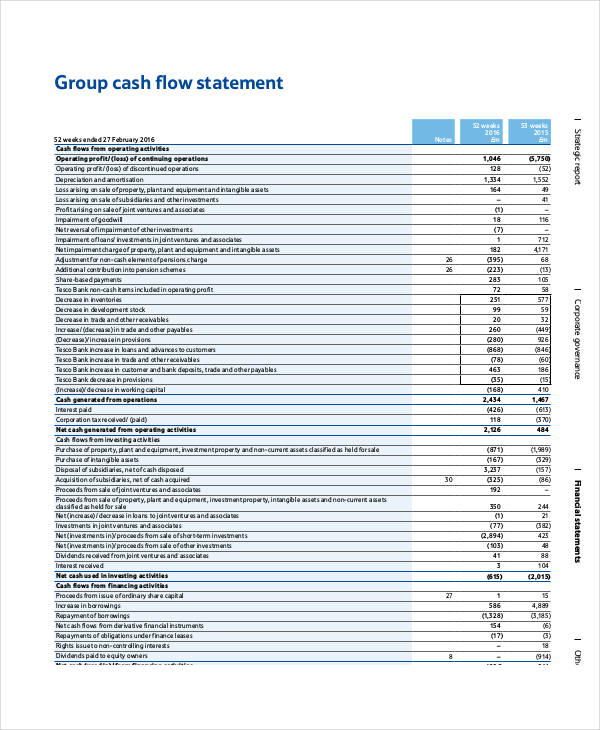

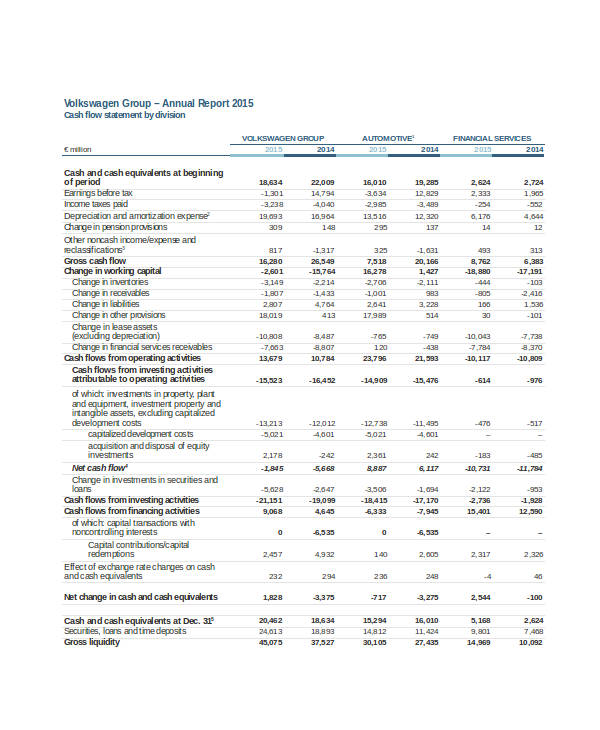

- The Annual Report Cash Flow, Basic Accounting, and Group Cash Flow Statement examples show this as one of the sources.

Financing

This comes from cash being used in business financing. Cash flows from this source generally involve amounts paid out in dividends and share buybacks. Meaning: financing activities include any issuance or repurchase of a company’s bonds or stocks with the inclusion of short- and long-term borrowing and repayments.

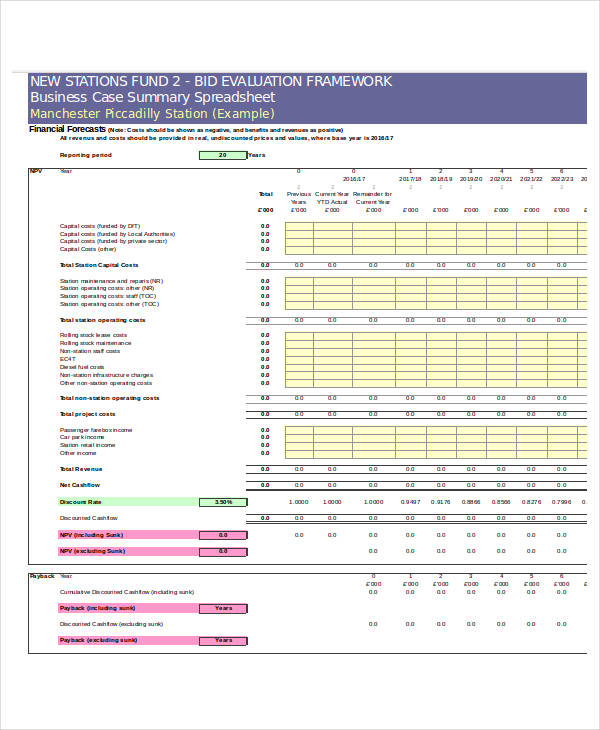

- The Sample Group Cash Flow, Small Business Cash Flow, Annual Report Cash Flow, and Business Case Cash Flow statement examples show sources of this type.

Business Cash Flow Statements

Small Business Cash Flow

Business Plan Cash Flow Statement

Business Case Cash Flow Example

Retail Business Cash Flow Forecast

Basic Cash Flow Statement

Accounting Cash Flow Statement (PDF)

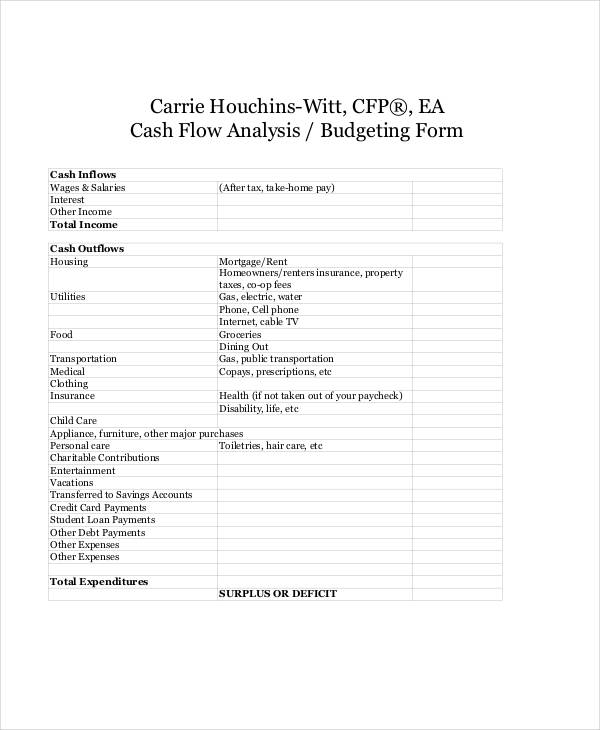

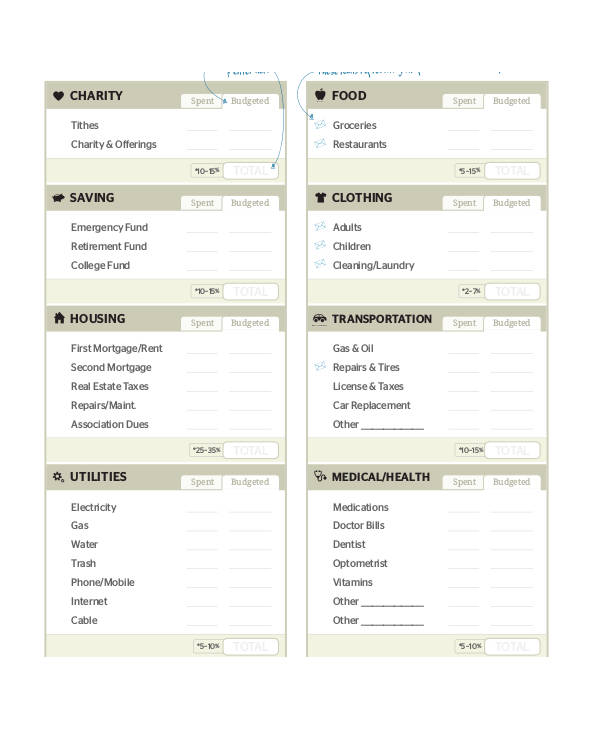

Basic Cash Flow Analysis and Budgeting Form

Company Cash Flow Statements

Insurance Company Sample Statement

Importance of a Cash Flow Statement

A company’s statement of cash flows is of vital importance as it serves as an immediate indication of how the business is doing. Investors often refer to the cash flow statement rather than the income statement of a company since it reflects the actual activities at the time of the statement. This is considered a major factor for any following strategic plan.

Generally, investors would be looking at favorable conditions of cash coming in rather than cash going out. This would mean that the company is earning more than it is spending on operations or material assets.

Cash Flow from Financial Activities

Cash coming in or out of financial activities mentioned to prepare an income statement consists mainly of involvements with the company’s stocks or bonds or any activity involving borrowing and repayment from company finances.

Specific examples of such involve any and all of the following:

- Notes payable

- Bonds payable

- Deferred income taxes

- Preferred stocks

- Common stocks

- Paid-in capital excess of par-preferred stock

- Paid-in capital in excess of par-common stock

- Paid-in capital from treasury stock

- Retained earnings

- Treasury stocks

In more ways than one, cash flow statements (or “statement of cash flow”) of a company certainly can reflect the state or condition that company is in. Knowing how to react to these indications would greatly help in future decisions of the company and of its investors.

Free Cash Flow Statements

Free Cash Flow Income Statement Public Standard (PDF)

Restaurant Cash Flow Statements

Restaurant Monthly Cash Flow Sample

Free Statement of Cash Flows with Restaurant Example (PDF Chapter)

Group Cash Flow Statements

Sample Group Cash Flow

Group Statement in PDF

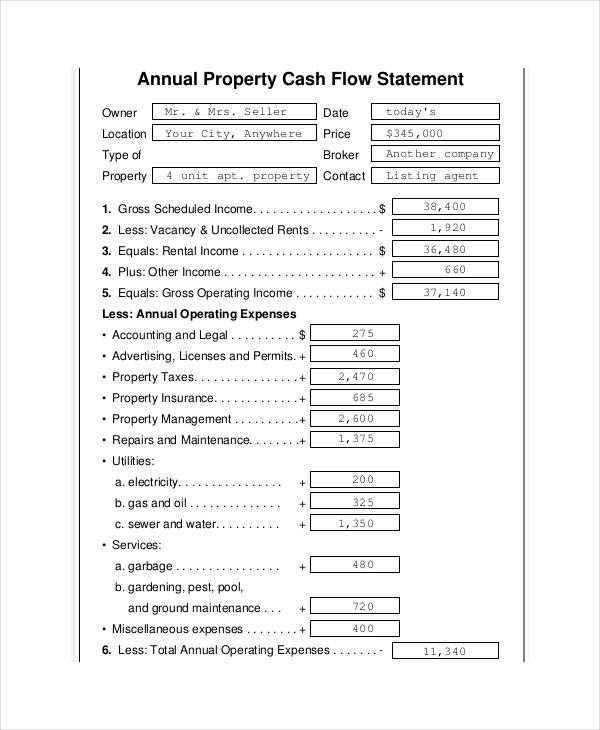

Annual Cash Flow Statements

Annual Report Cash Flow Statement by Division

Annual Property Cash Flow Example

Positive Cash Flow

Positive cash flow happens when cash flowing into the business (“cash inflows”) are greater than the cash going out (“cash outflows”) in a particular time period as reflected on the income statement or indeed any financial statements. That would mean that the company is able to settle debts, return money to shareholders, pay operational expenses, and such.

Positive cash flows reflected on your business statements don’t necessarily mean you are profitable. It may also be, for example, that the company is having sales but has not yet accounted for future expenses on delivery and shipping charges. An important note to be taken into consideration in any strategic plan.

Negative cash flow, on the other hand, is the opposite; meaning outflow of cash is greater than what is coming in. Some companies have positive cash flows at the start resulting from outright sales of products but somehow end up having negative cash flows when costs for operation are deducted (bill payments, etc.).

In the long run, having a positive cash flow to read a income statement certainly is an indicator of a profitable business. Companies that are able to manage their cash flows properly even though they seem unprofitable would stay longer in business compared to businesses that are outright profitable at the start but are unable to pay bills and expenses when they are due.