What Is a Profit and Loss Budget?

It’s almost the end of the week, and end of the month at that. You have been itching all week long to bust out of those work boots and get yourself a treat. Weekend arrives and you splurge and indulge to your heart’s content. Monday comes and you suddenly notice the stack of bills on the counter top that scream OVERDUE and beg for your attention. You frantically dig for your wallet and exclaim, “Holy mother of heavens, I’m broke.”

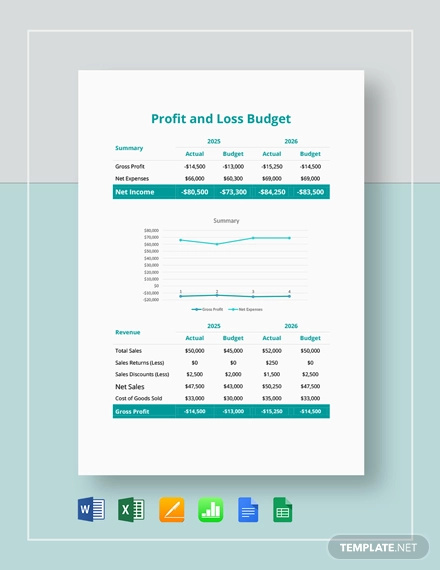

Profit and Loss Budget Template

While this scenario may be all too common for the working man, it may not become a fiction too far out of place for any business owner if finances are not put in check and controlled. Budgets are essential management tools that enable owners to monitor financial impacts of their decisions, strategic plans, and that expensive representation dinner to a client. Budgets are safeguards put in place for owners to track results and see how their business is doing—if it’s reaching its goals and is fluid and profitable.

What Is a Profit and Loss Budget?

Judging by the name itself, a profit and loss budget is a one-page summary of expected income and expenses. Most prepare it monthly and it features a twelve-month duration based on the coming financial year. Profit and loss budgets are prepared with the help of an accountant (who does all the number magic). they usually indicate income and expense information set against the operating plans of a business for that budget period.

The profit and loss budget forms part of unique financial reports contributed to financial planning which enables business owners to better manage opportunities and risks involved in the business. This way business owners are also allowed monitoring of business decisions and outcomes in relation to the prepared budget towards achieving goals set to remain a profitable business.

What Is the Difference between a Profit and Loss Budget and a Profit and Loss Statement (or Income Statement)?

More often than not, profit and loss budgets are often confused and interchanged with profit and loss statements. Although both relate to measurement of profitability of a business, this misconception can be highly disastrous and could result to financial mismanagement of your business. Each is very much different from the other.

Let us examine closer the fine print that lies between an income statement and a profit and loss budget and how they are also understandably intertwined—whether by fate or by simple deduction.

What Is an Income Statement or Profit and Loss Statement?

An income statement or profit and loss statement (as it is commonly and acceptably interchanged with) features or highlights the different strategies and methods used in a business to make profits and in keeping the company in business and being competitive. All of these consist of the revenue items and expenses resulting to that period’s net income or loss depending on the difference from operating costs to revenue or sales. Operating costs involve equipment, materials, insurance, office supply, and wages.

Simply put, an income statement is a summary of a company’s income and expenses over a designated period of time. It shows how revenue is generated from net income and features the financial operations of that company over a set duration of time.

What Is Profit and Loss Budget, Again?

A profit and loss budget can be coined as a forward-facing budget forecast used for defining income and expenses of a business for the coming financial year. It helps set the targets for a company to support the forecast expenses. It provides an operational platform for a business and the means in attaining it.

Furthermore, a profit and loss budget serves as a guide to the expenditure that can be made for an event or task, sales that need to be reached, and the how in reaching income quotas per department given a month, quarter or a year.

Comparing Profit & Loss Budget and Income Statement

The following present the various areas of difference and similarities between a profit and loss budget and an income statement:

1. Symbiosis

The two common aspects of a profit and loss budget and an income statement is that both are used as a gauge of profitability for a business, and both documents contain revenue streams and related expenses. More importantly, both documents provide a better understanding for a business and control over the finances of the company.

Viewing it from a different perspective tells you that a profit and loss budget is merely a projected income statement. At the end of any period, variances are calculated linking operating activities to a profitability scale—either positive or negative. Results of this determine the effectiveness of such activities, and adjustments will be required to change, retain, or improve results.

2. Purpose

A profit and loss budget is prepared by finance managers and accountants to provide an estimate for future sales or revenue, expenses, and the profits or losses of a company.

Meanwhile, an income statement is a financial report summarizing business transactions and results of operations for a set duration of time.

3. Time

Although both documents are a summary or summarize activities and financial results of a business operation for a specific period of time, each is set at a different framework of time.

Income statements or profit and loss statements depict past business activities to determine income, while profit and loss budgets are geared toward future activities to estimate income. Historical – future. Simple.

4. Beneficiaries

Both documents also differ in who uses the information collected from each document. Management generally uses profit and loss budgets to plan and set targets for future activities of a business and gauge potential profit. Creditors also make use of the profit and loss budget to establish a company’s paying capacity and cash flow in connection to business loan applications.

Income statements otherwise are used by investors, business owners, creditors, and government institutions to see the margin of profit a company earned in the past and whether they actually earned or lost money in the past months or years.

5. Usage

Both documents are classified differently in terms of the way each are made for use. In essence, a profit and loss budget is a plan that serves as a guide to the limits of how much can be spent for a future activity. A profit and loss budget also determines sales goals to provide enough sales to support expenses for a projected time period. An income statement simply is a report summarizing business activities and the results.

6. Significance

Profit and loss budgets are used internally by a company in setting sales goals and expense budgets that will permit them to achieve profit targets. Profit and loss budgets also come in useful in applying for bank loans showing creditors a company’s capacity for payment.

Income statements become the target documents to view for investors and stakeholders in order for them to assess the profitability of a company. Income statements further show the risks in investing with a company and the usual amount of taxes any company pays.

Creating Your Profit and Loss Budget

Having determined a sales budget and projecting it on your profit and loss budget, you are able to deduce how much profit you will be able to make each month going forward to a budget period.

Preparation for a Profit and Loss Budget

The following are the steps recommended in preparation for a profit and loss budget:

1. Understanding your business

It is said that the journey of a thousand miles starts with a single step. The first step before undertaking your journey to profitability is understanding what your business is about. Involving key personnel directly implementing your strategic plans increases your chances of success. This also warrants your budget to be aligned with your goals and also ensures that it is made and reviewed by the proper individuals.

2. Document your process

Make sure to document the process of making the annual budget to set the standards and ensure a correct process will be followed each and every time and improvements can be made where necessary. The processes may include the following:

- Review the previous year’s monthly profit and loss statements.

- Revise as necessary the monthly figures in relation to the changes according to the new plan such as activities, quantities, and prices.

- Identify and properly record suppositions made for the budget period.

- Input and prepare the profit and loss budget using a template. Various financial templates are available online to use. Choose one you are comfortable using.

Monitor and Manage Your Profit and Loss Budget

After having prepared the profit and loss budget, it is important to monitor the budget against actual results which should give you information on how your business is doing and if it is on track to meet your expected goals in your strategic plan.

- Monthly results from your income statement should then be compared to your budget results.

- Any variance, positive or negative, should be taken into consideration and action plans drafted to resolve the issues. Variances should be categorized and classified along with explanations.

- Information from the variance can greatly aid you in revising your plan at crucial times so strategic goals can be achieved.

Determining Cost of Sales

Calculating how much you are making is determined by getting the total revenue from sales minus the total cost of sales. You should be able to arrive to your much anticipated profit.

In determining the cost of sales, you need to follow this process.

- Determine the cost to produce your product. This would include your labor and material costs. Your cost to produce a product is your unit cost. Unit cost is the gross cost you are paying to attain or produce a product. You then should be able to arrive at a cost per unit, which again includes utility bills for equipment, repairs and maintenance, storage, packaging, delivery costs, and staff commissions.

- Costs for individual unit such as utility bills can be made as an average monthly cost divided by your number of units projected to be sold per month. Now you have an average estimated cost per unit.

- Spreading the costs over the months of budget should help you arrive at your total sales cost per month.

- Again from your sales budget, get the predicted number of units per month and divide your sales cost by your number of sales. This gives you the sales cost per unit.

- Adding your unit cost to your sales cost per unit gives you your total cost of sale per unit.

Determining Gross Profit

Gross profit is the resulting amount of money after cost of sales is deducted. In calculating for the gross profit, you need to:

- Get the annual sales value from your sales budget. Sales value is also termed as turnover.

- Get the cost of sales from the previous section.

- Deduct your cost of sales from your turnover to get your gross profit value.

Getting Your Net Profit

Your gross profit is not your real profit. To get what you are really making, deduct other costs indirectly connected to sales and unit production, such as the following.

- Staff salary for employees, which includes government employee contributions like pension and other insurances

- Running costs for office and property including cleaning

- Marketing, public relations, media, advertising, and trade show costs

- Professional fees such as legal, accounting, or consulting fees

- Finance costs that include bank interests and charges

Indirect costs are also called overhead costs or permanent costs. These costs tend to change over time so your budgeting should afford realistic rising costs and the time they are likely to occur. Also take important notice of not double charging costs such as labor or electricity which are usually built in to cost of sales for manufacturing companies.

Calculating Your Cash Flow

Another factor that is largely undervalued in calculating your profit and loss budget is your cash flow. Cash flow refers to the amount of money moving in and out of your company at the beginning of a time period or opening balance in reference to the final amount at the end of that period or the closing balance during the end of the period. Cash flow is either said to be negative or positive.

Positive cash flow happens when the resulting closing balance is higher than the opening balance, which means that your company’s assets are growing or increasing. It is said that you cannot make money unless you spend money. Businesses showing good profits but have negative cash flow may encounter problems in the long run. Cash flow is the ability to pay out cash before actually making anything in return.

Therefore, it is vital in your budget planning to include or list down all cash inflows and outflows of your business and the expected time for each to happen. Being able to control how cash flows in and out of your business affects the ability of your business to be able to pay any debt at any given time. A business should be fluid, like water, just as cash needs to be properly going in and out of your coffers. A good business always has something prepared just in case a good opportunity to make money arises. Being prepared has always its advantages just as it is better to plan then fail than fail to plan at all.

Summary

Having made all of the above, your business should be able to attain favorable results.

- The cost of sales and gross profit together reflect your business’s ability to effectively submit a good quote in relation to getting the sale.

- It reflects that you are able to complete jobs or deliver products in a timely manner and within the specified budget range.

- This also means that proper pricing strategy has been made in accordance to the strategic plan.

- Being able to do all this naturally means that the business is being run by able leaders and a fully functional team of staff deploying effective strategies that meet the demands of customers. Understanding the areas of your business that affect other parts of the business is essential to getting the full results and outcome of your profit and loss budgeting.

All abovementioned items pertain to the information from a good and well-thought-out profit and loss budget. Variances from the forecast material to the actual data are often spotted through the profit and loss budget and can then be easily translated into action plans to address such issues.

Bottom line is, by taking time to make a profit and loss budget, your company will have a basis in which may be used as a road map to your business. Being able to discern and quickly respond to variances seen on the budget vs. actual data prevents any strategic plan from failing to achieve any goal set during strategic planning.

As always, having a budget alone does not guarantee success to your plans and result to big-$ profits. It simply means that safeguards are set in place, and it is up to you to make due diligence and persevere in following the budget in order to actually obtain the desired results.