9+ Salary Verification Letter Examples to Download

A Salary Verification Letter is an essential document used by employees to confirm their income details when applying for loans, renting properties, or undergoing other financial assessments. This letter, typically issued by an employer, outlines an employee’s job position, tenure, and compensation details, including any bonuses or allowances. Easy to draft, the letter serves as a reliable proof of income, ensuring smooth transactions and credibility in financial dealings.

What is Salary Verification Letter?

Salary Verification Letter Examples Bundle

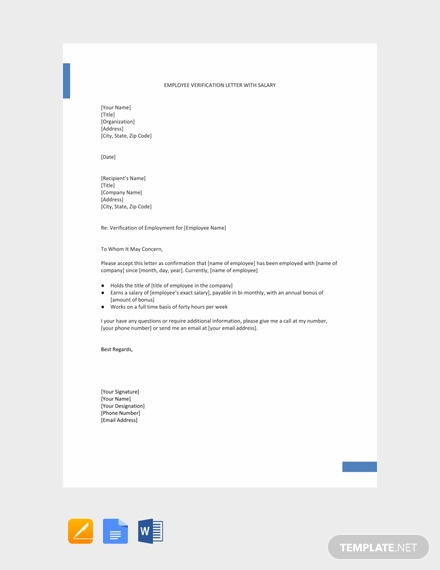

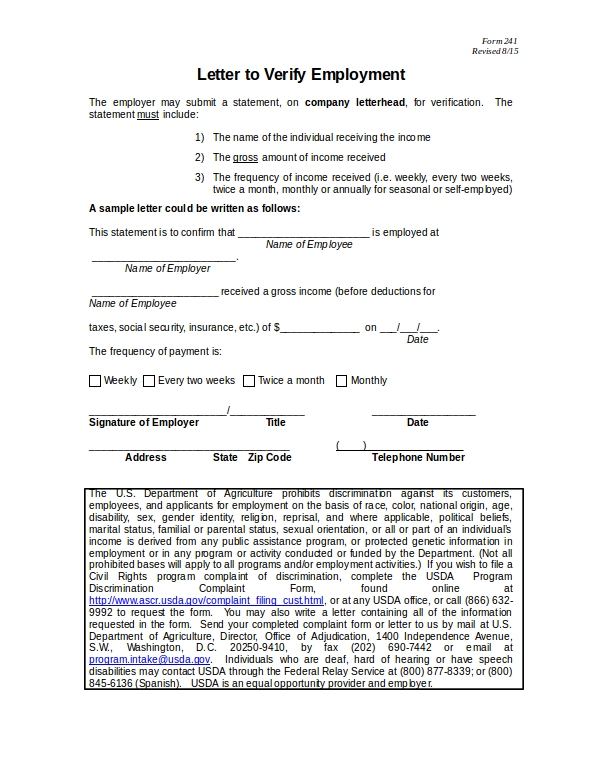

Salary Verification Letter Format

Employee Information

Employee’s Name

Employee’s Address

City, State, Zip Code

Date

Recipient Information

Recipient’s Name

Recipient’s Title

Recipient’s Organization

Recipient’s Address

City, State, Zip Code

Letter Body

Dear [Recipient’s Name],

I am writing to confirm the employment and salary details of [Employee’s Name], who is currently employed with [Your Company Name] in the capacity of [Employee’s Position]. [He/She/They] has been employed since [Start Date] and currently holds a [full-time/part-time] position.

As of [Date], [Employee’s Name]’s salary is as follows:

- Annual Gross Salary: $[amount]

- Monthly Gross Salary: $[amount]

- Frequency of Payment: [Weekly/Bi-weekly/Monthly]

[Optional: Include any additional compensation details such as bonuses, commissions, or allowances.]

Closing

Please feel free to contact me at [Your Contact Information] if you require any further information.

Thank you for your attention to this matter.

Signature

[Your Name]

[Your Position]

[Your Company Name]

[Your Contact Information]

Salary Verification Letter Example

John Doe

1234 Maple Street

Anytown, State, 12345

March 3, 2025

Jane Smith

Loan Officer

Anytown Bank

5678 Bank Lane

Anytown, State, 12345

Dear Ms. Smith,

I am writing to verify the employment and salary details of Mr. John Doe, who is currently employed with ABC Corporation in the capacity of Marketing Manager. Mr. Doe has been with us since January 10, 2020, and holds a full-time position.

As of the date of this letter, Mr. John Doe’s salary details are as follows:

Annual Gross Salary: $75,000

Monthly Gross Salary: $6,250

Frequency of Payment: Bi-weekly

Additionally, Mr. Doe is eligible for annual performance bonuses which vary based on company profitability and individual performance metrics.

Please feel free to contact me at (123) 456-7890 or via email at hr@abccorp.com if you require any further information.

Thank you for your attention to this matter.

Samantha Right

Human Resources Manager

ABC Corporation

hr@abccorp.com

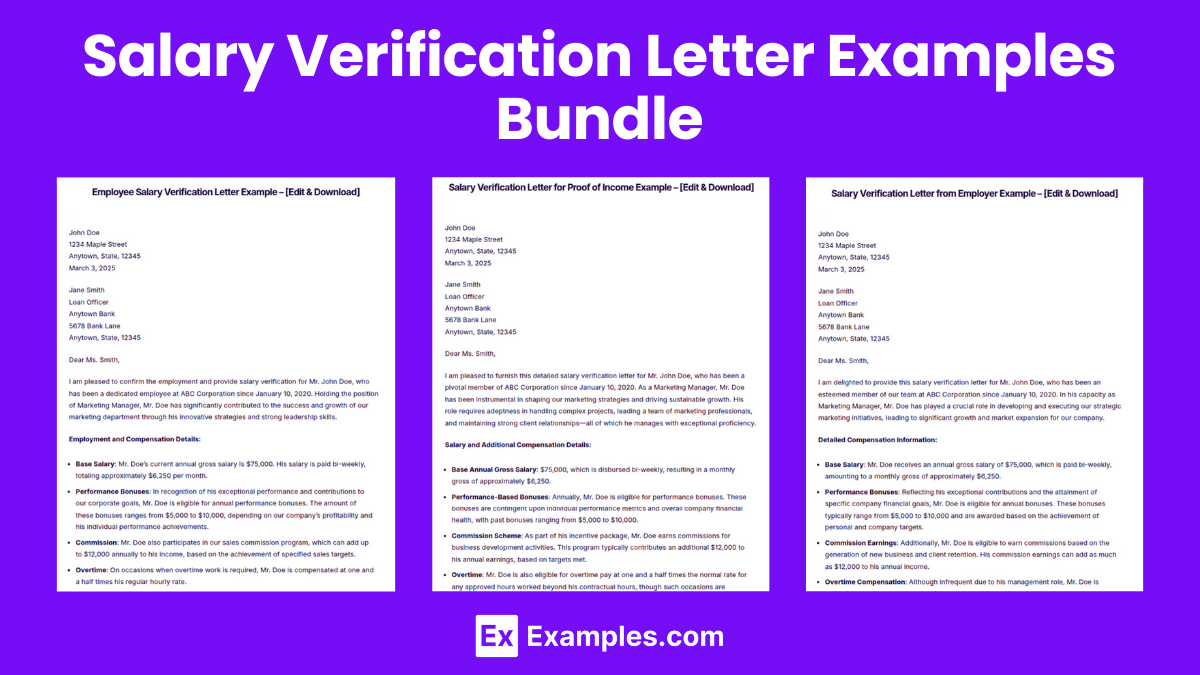

Salary Verification Letter Examples

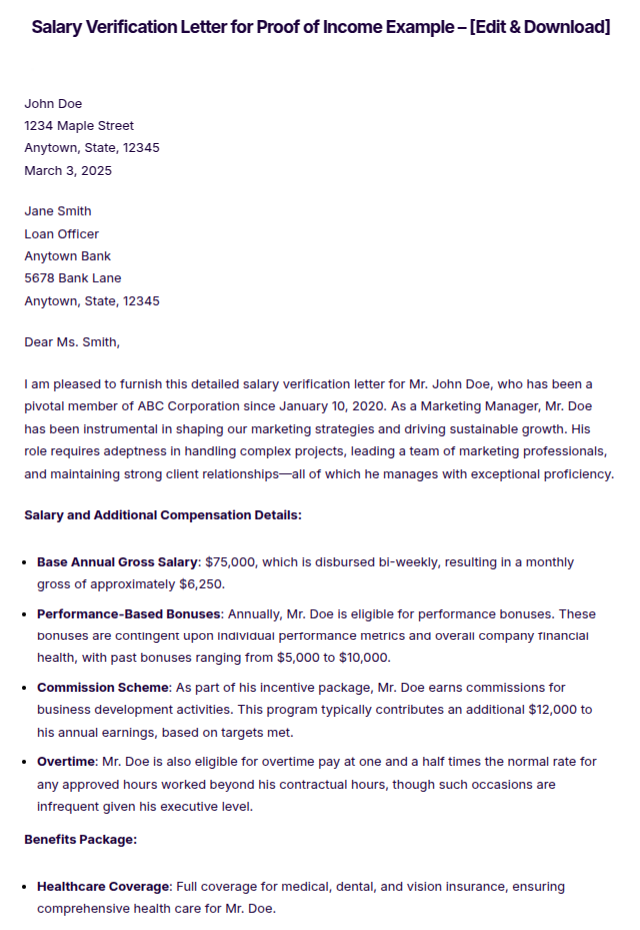

Salary Verification Letter for Proof of Income

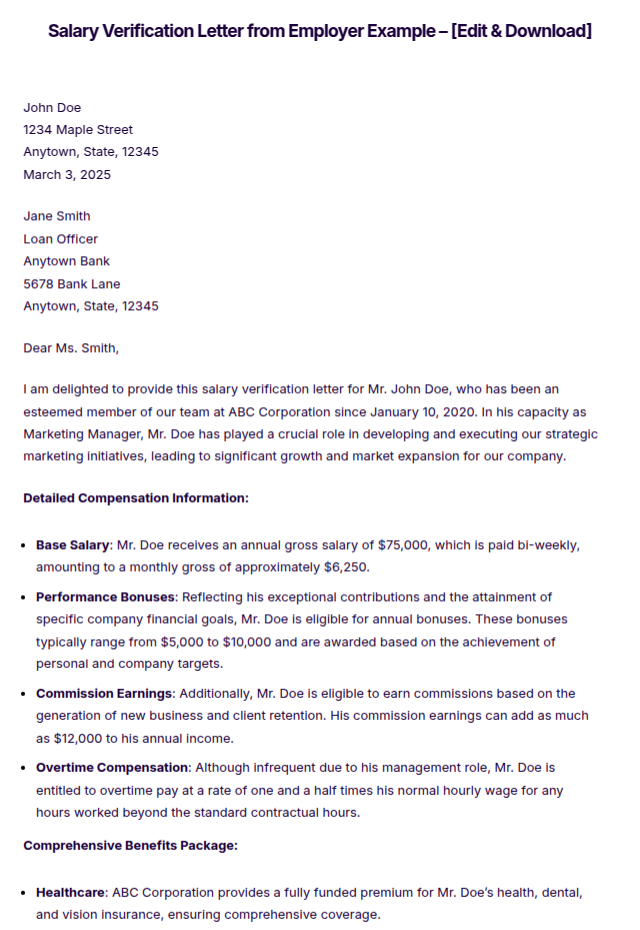

Salary Verification Letter from Employer

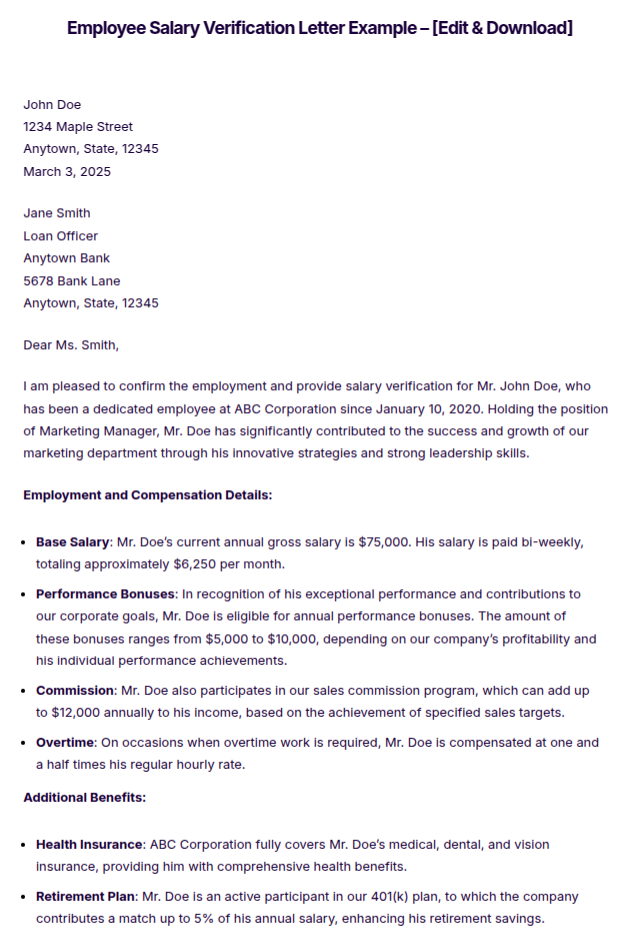

Employee Salary Verification Letter

Salary Verification Letter Samples

Free Employment Verification Letter With Salary

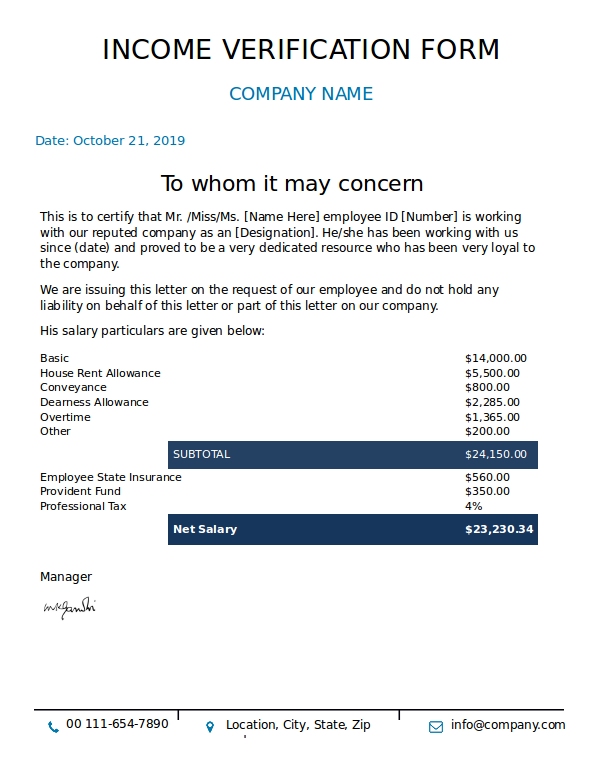

Income Verification Form Example

Self-Employed Verification Letter Example

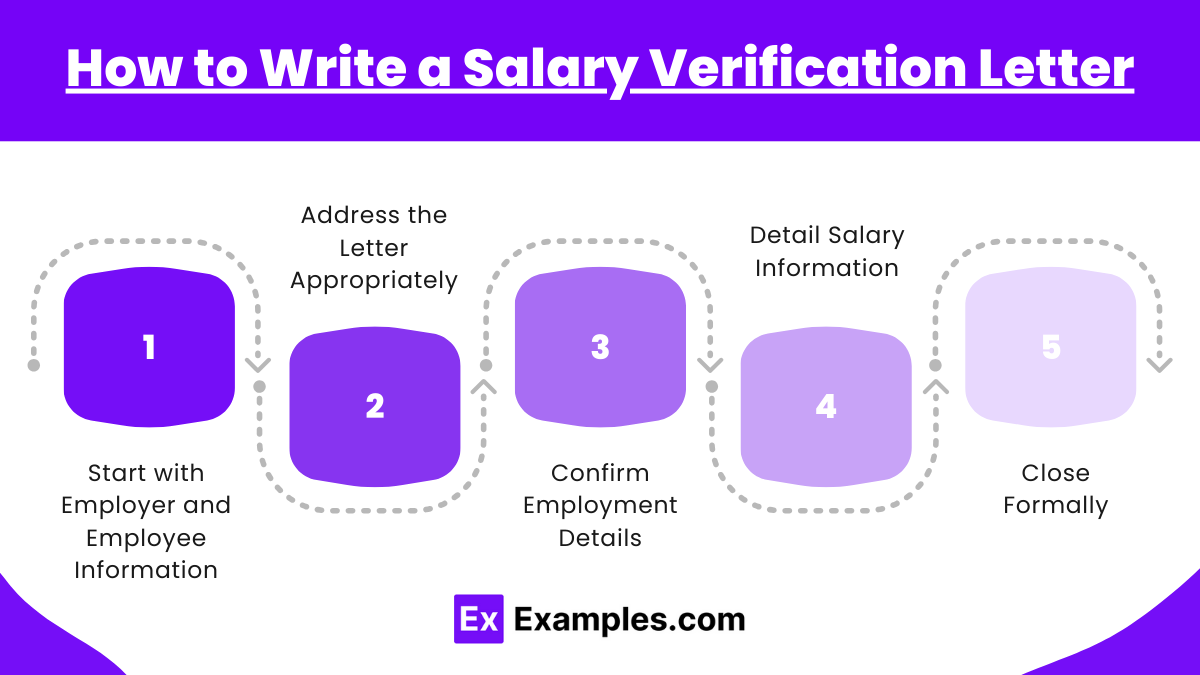

How to Write a Salary Verification Letter

- Start with Employer and Employee Information: Include the employer’s name, address, and contact details at the top of the letter, followed by the date. Directly below, list the employee’s name and their personal contact information.

- Address the Letter Appropriately: Direct the letter to the specific recipient whenever possible. Use a formal salutation, such as “Dear [Recipient’s Name],”.

- Confirm Employment Details: Clearly state the employee’s current position, date of hire, and employment status (full-time, part-time, etc.). Confirm that the employee is actively employed at your organization.

- Detail Salary Information: Provide comprehensive details about the employee’s salary, including gross annual salary, payment frequency, and any additional compensation like bonuses or commissions. Optionally, you can also mention benefits that complement the salary.

- Close Formally: Offer to provide further verification if necessary. Close with a formal salutation, such as “Sincerely,” followed by your name, title, and contact information.

Tips for Writing a Salary Verification Letter

- Be Clear and Concise: Keep the letter straightforward and to the point. Clearly state the purpose of the letter and include all relevant details without unnecessary elaboration.

- Verify the Facts: Before drafting the letter, double-check the employee’s salary details, employment status, and other relevant information to ensure accuracy.

- Maintain Professionalism: Use formal language and a professional tone throughout the letter. Even though the content is factual, the presentation should be respectful and polished.

- Include Contact Information: Always provide your contact information and invite the recipient to contact you if they need any further information. This shows openness and facilitates easy verification.

- Protect Privacy: Handle the employee’s information with confidentiality. Share only the information that is necessary and requested, ensuring that you respect the privacy of the employee.

Common Concerns

Can a company, whether current or past, disclose your salary to other institution or party? Yes, as long as it is done in a respectful manner, without harming the employee. Salary disclosure is very important as it gives two parties the gauge on how to continue in on-going transactions.

Is it necessary that a loan agency should know my salary? When you apply for a loan, car loan, a house or an apartment loan, the agency usually needs to know the employee’s capacity to pay as having a mere employment would not guarantee. If you insist on not showing them your salary verification letter, then by no means you were to convince them to approve your loan application. It is just a standard operating procedure.

Who should compose the content of the salary verification letter, the employee or the manager or HR? Usually, it should be coming from the company. They have been doing this to many employees, so creating one document would just be a flick of a finger to them. But if the employee has a template already, he or she may only need to ask the manager to fill in the necessary information to complete the letter. Of course, with the signature as well.

Should I need to write a letter when requesting for a salary verification letter? You do not have to. In most cases, it is done orally and does not need to be documented. But if you do, it would add points to your character. It may say a good thing about you. But that is up to you because you can just simply tell your boss while you two are inside the washing area.

Who should I ask, the HR staff or the manager? You may ask any of the two. It is unwritten in any company code of conduct. But the HR would be the most convenient as they always handle the documents needed in whatever transactions. And the manager may only do the signature.

FAQs

Who should issue a Salary Verification Letter?

This letter should be issued by an employer or the HR department upon request by the employee or a third party.

What information is included in a Salary Verification Letter?

The letter includes the employee’s job title, salary amount, employment status, and sometimes benefits and bonuses.

How do I request a Salary Verification Letter?

Request this letter from your HR department or direct supervisor, specifying the required details and recipient information.

Is a Salary Verification Letter confidential?

Yes, it contains confidential information and should be handled with care to protect the employee’s privacy.

Can I write my own Salary Verification Letter?

No, it must be issued by your employer to ensure authenticity and acceptance by the requesting party.