54+ Statement Examples to Download

Your statements are considered as your gateway to everything. If you want to apply for a job and get a one step ahead of everyone, you can write a personal statement and resume summary statement. If you want to express yourself as an artist, then you should write an artist statement.

That being said, what you write in your statement is crucial and critical for the path you chose. Writing a statement may not be easy but as long you know your objectives and your purpose, writing it may not be impossible. And to better assist you with that, feel free to browse our wide variety of income statement examples here.

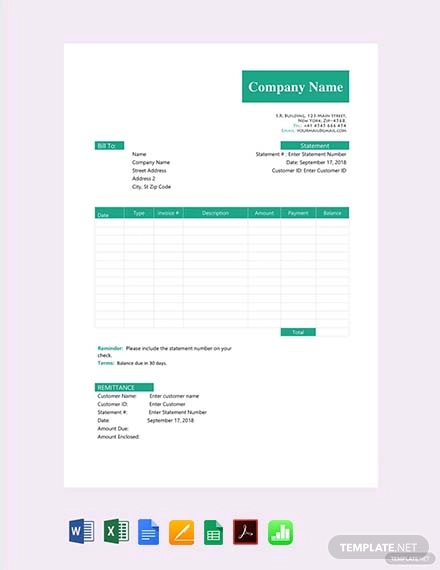

Free Sample Statement Template

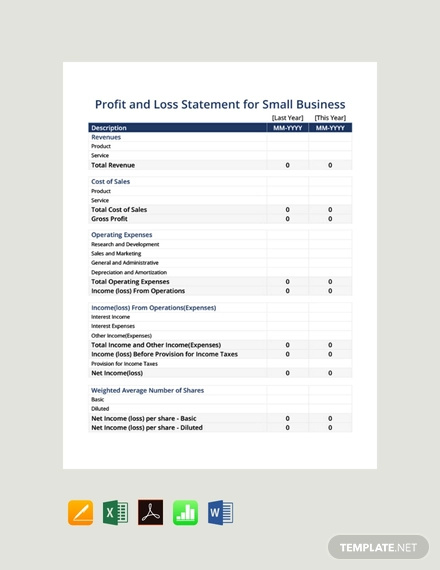

Free Profit and Loss Statement For Small Business Template

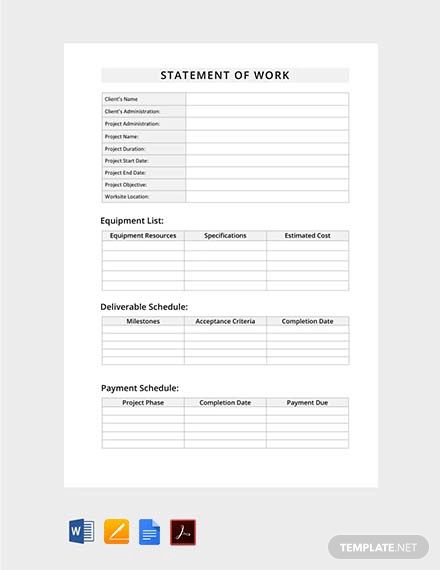

Free Statement of Work Template

Personal Statements

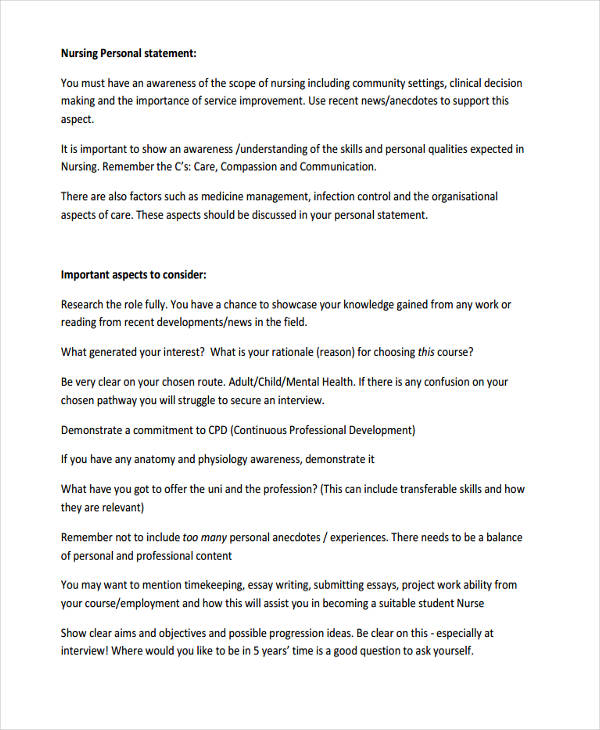

Nursing Personal Statement

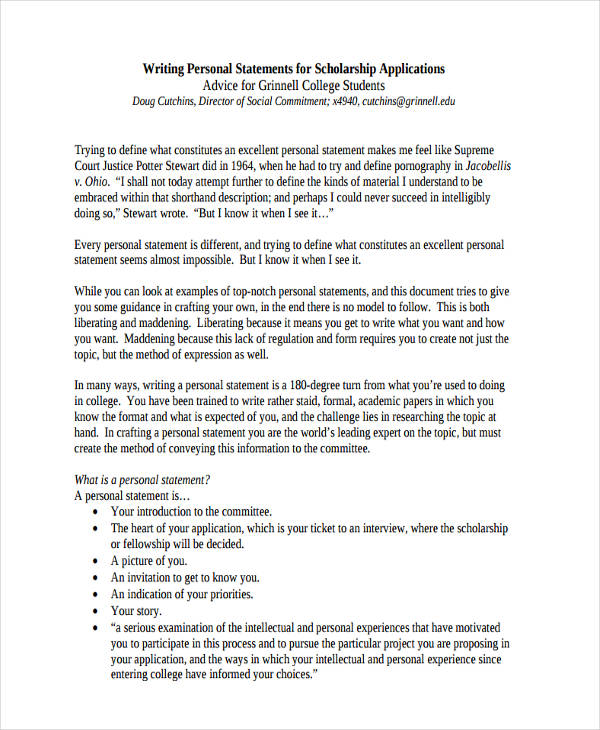

Personal Statement for Scholarship

Thesis Statement Examples

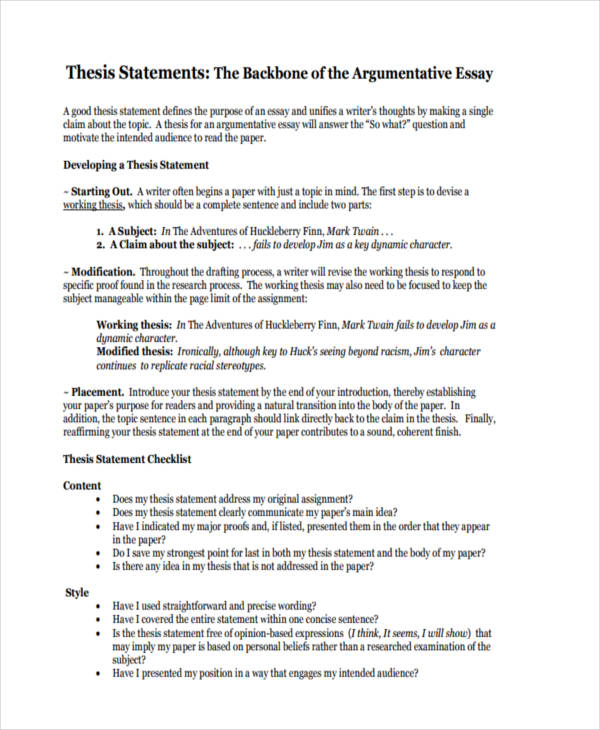

Argumentative Thesis Statement

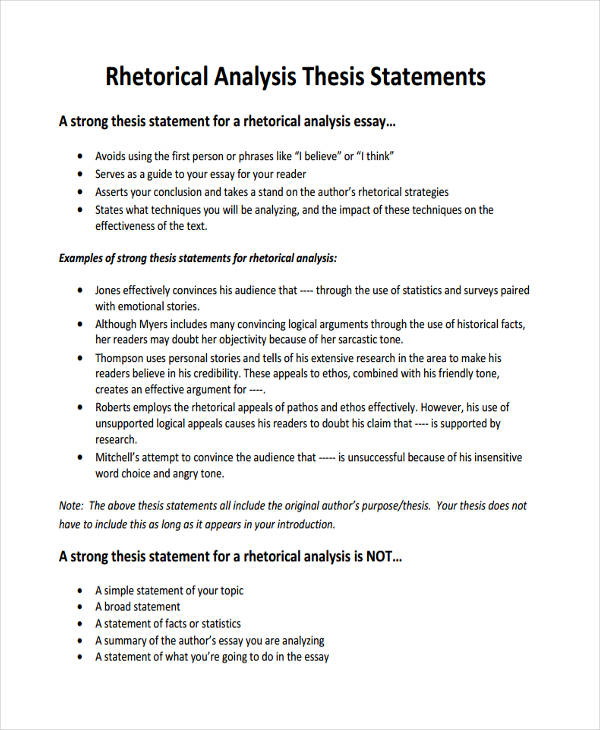

Analysis Thesis Statement

Mission Statements in PDF

Personal Mission Statement

Company Mission Statement

Internal Audit Mission Statement

Team Mission Statement

What Is a Statement?

A statement, as defined by most website dictionary is:

- a communication of something or declaration is a speech or writing

- a written account of facts and opinions.

- a formal presentation of circumstances, events, facts, or a state of affairs.

In general, a statement is used to express our ideas and emotions through speech or writing. However, statements are not only used or applicable to convey our message or to express our ideas, statements can also be used in business such as financial statement and accounting statement. It is used to evaluate company’s financial performance and to provide a chronological summary of all their transactions

What Is a Mission Statement and How to Write a Mission Statement?

A mission statement is a short paragraph that contains the long-term goals, fundamental purpose, and values of company and organization. This statement is used to help the employees as well as the superiors to remain focus on the goals of the company.

To create a mission statement for your company, consider the following:

- The purpose of your business statement and why does it exist.

- Define the ultimate goal of your business.

- Determine how you can make the life of your customer better.

- The image of your company you want to convey.

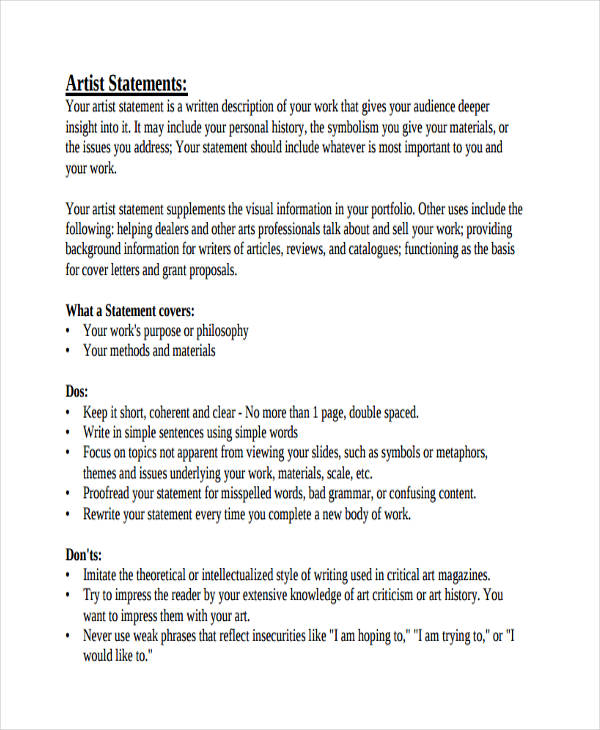

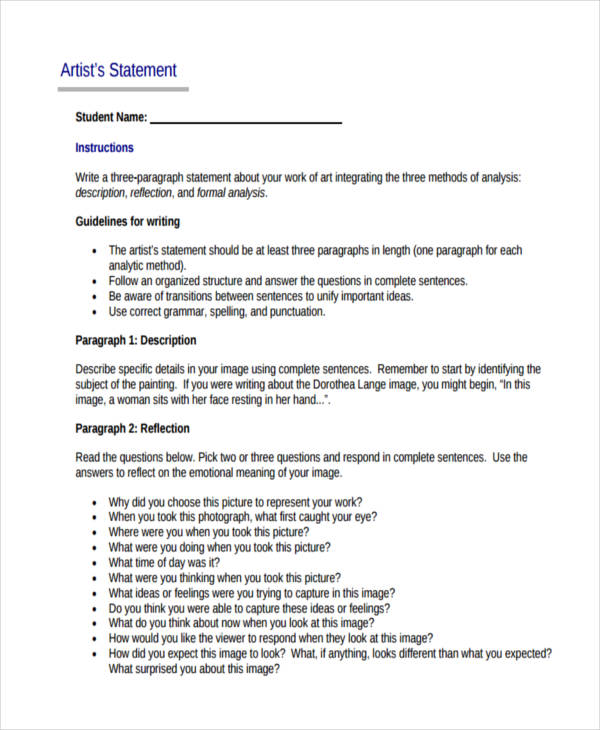

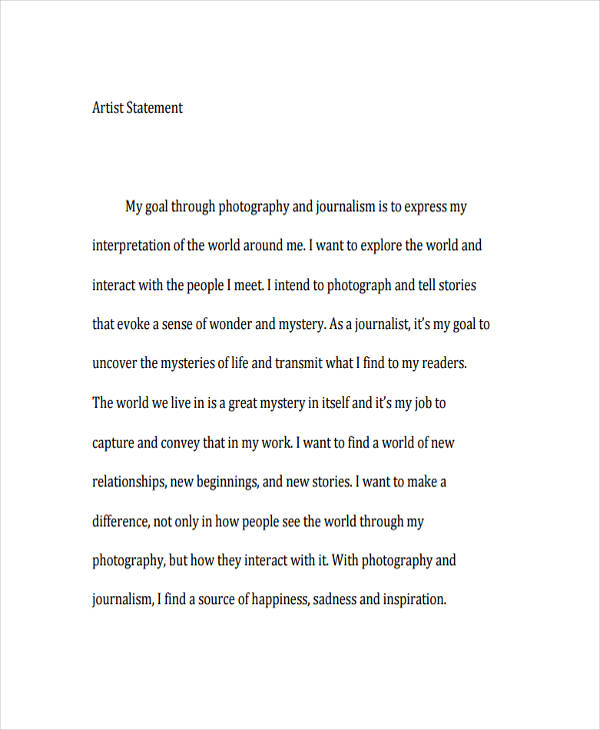

Artist Statement Samples

Short Artist Statement

Student Artist Statement

Photography Artist Statement

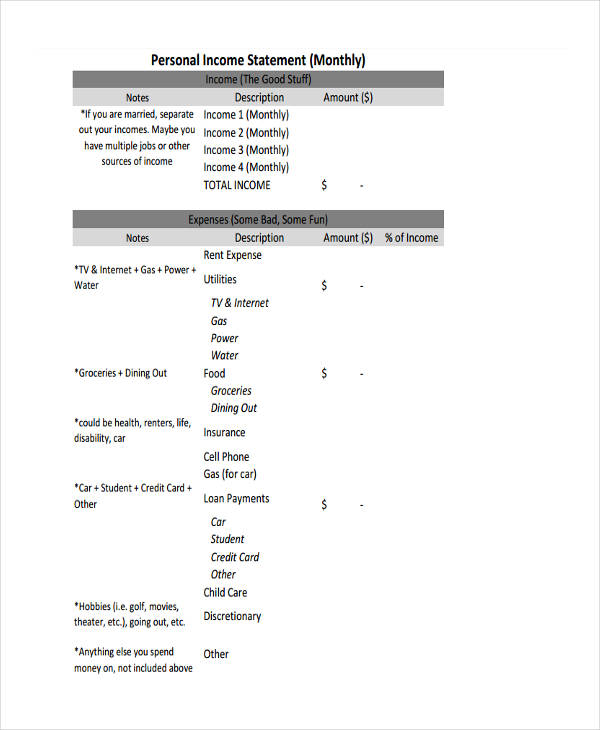

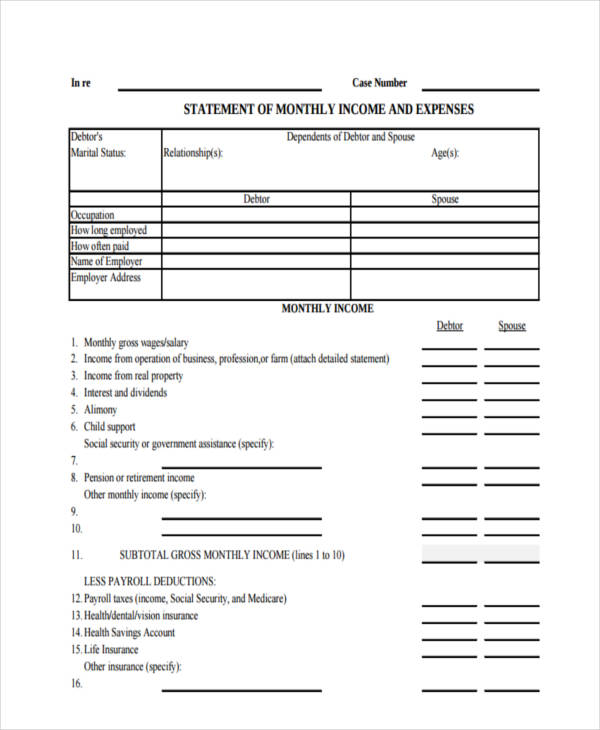

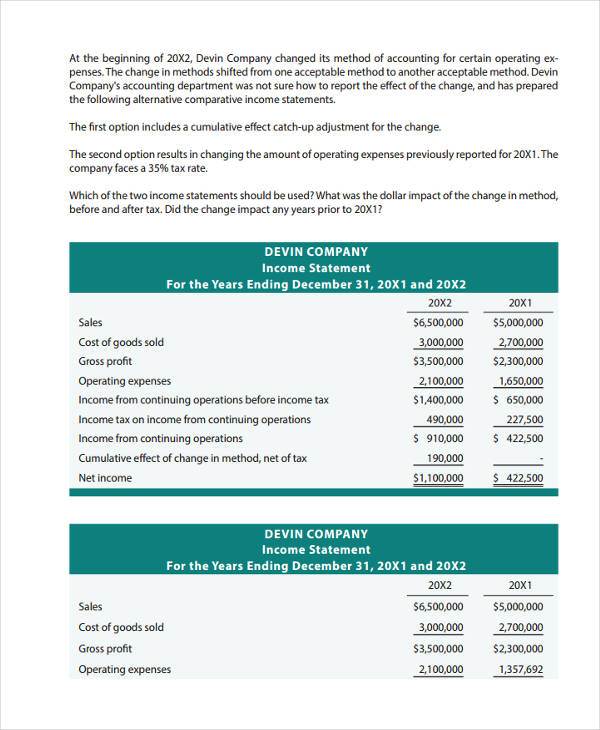

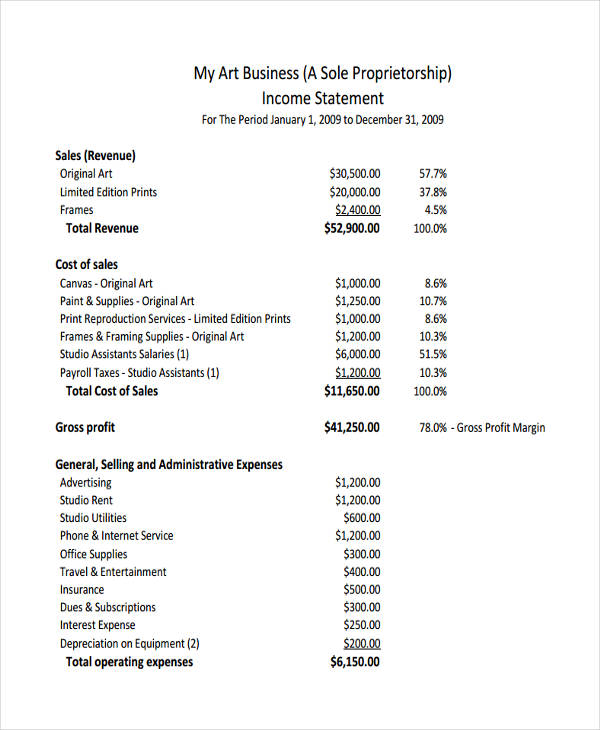

Income Statements in PDF

Personal Income Statement

Monthly Income Statement

Company Income Statement

Business Income Statement

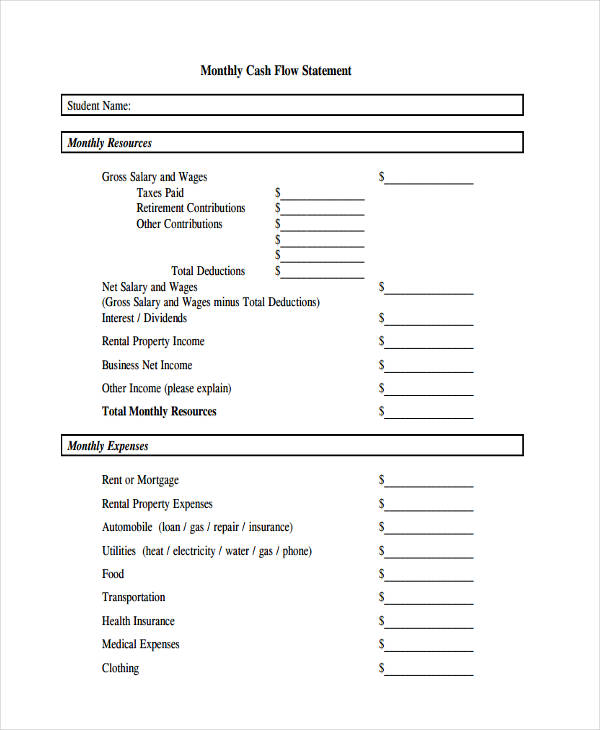

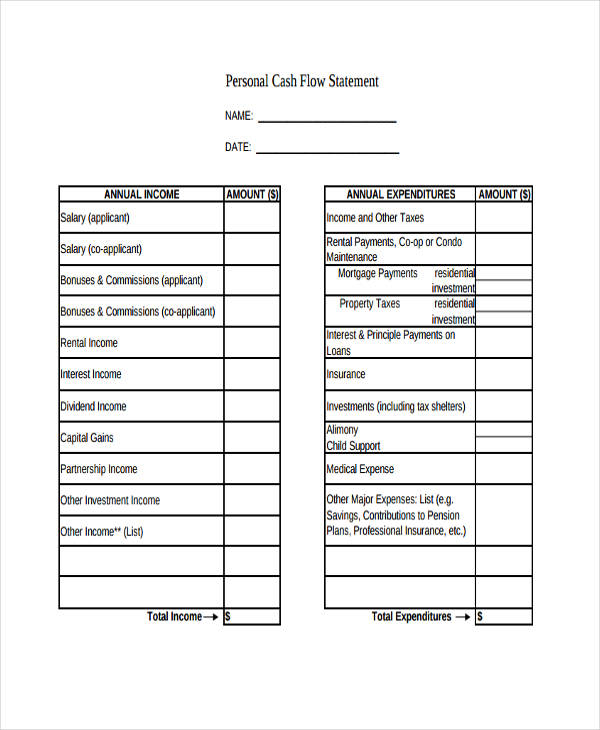

Cash Flow Statements

Monthly Cash Flow Statement

Personal Cash Flow Statement

Tips for Creating a Statement

Statement are not just a piece of paper with information. It is a formal document that is treated professionally. This is the reason why creating a good statement can have a huge impact to yourself or to an organization. Writing a statement may be hard, but with these tips, you can create a good and effective statement.

- Be honest in creating your statement. In personal statements, artist statement, and in the statement of purpose, what you write about yourself is the basic foundation of writing this statement. Do not try to cover up your weaknesses, instead, write the things you do to overcome those weaknesses. This way, it will truly show who you are.

- Keep your statement concise. Especially in creating a mission and vision statement. Write only the things that will clearly define and sum up your entire business. Write a statement that is easy to remember and a statement that is memorable. This way, the readers will easily comprehend your statement.

- Keep it simple and easy to understand. This is very important especially in a statement that involves statistics such financial statements and cash-flow statement. Those statements are full of complex matters and what your include in those statements can matter the most. Keep it simple and use simple language and terminologies. After all, you are creating statements for everyone can understand.

- Proofread your statement. This tip must always be present every time you write a statement. Even financial and cash-flow statement needs proofreading. The purpose of this is to eliminate and/or reduce typing errors, grammatical errors, and spelling mistakes. Proofreading also provides correct use of punctuation and omit awkward sentences in creating a personal and purpose statements.

- Get an opinion from an editor or critics. This will improve your statement and make it more coherent, comprehensible and effective.

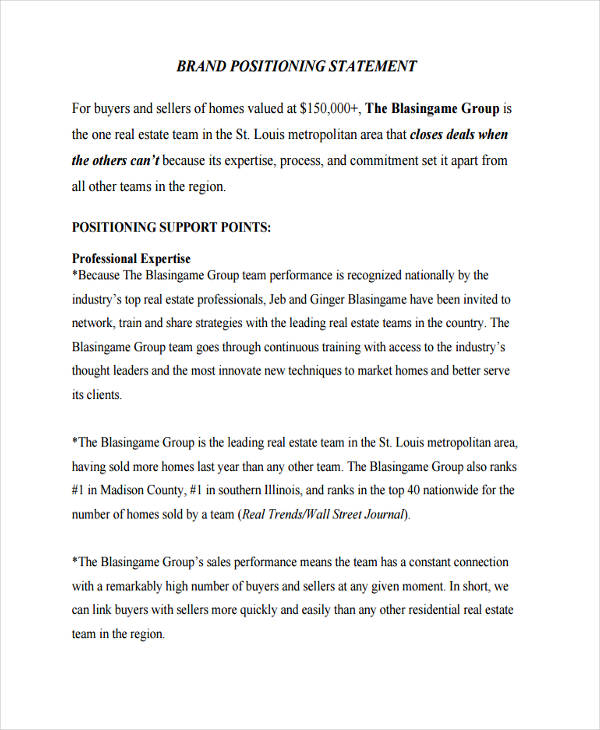

Positioning Statement Examples

Brand Positioning Statement

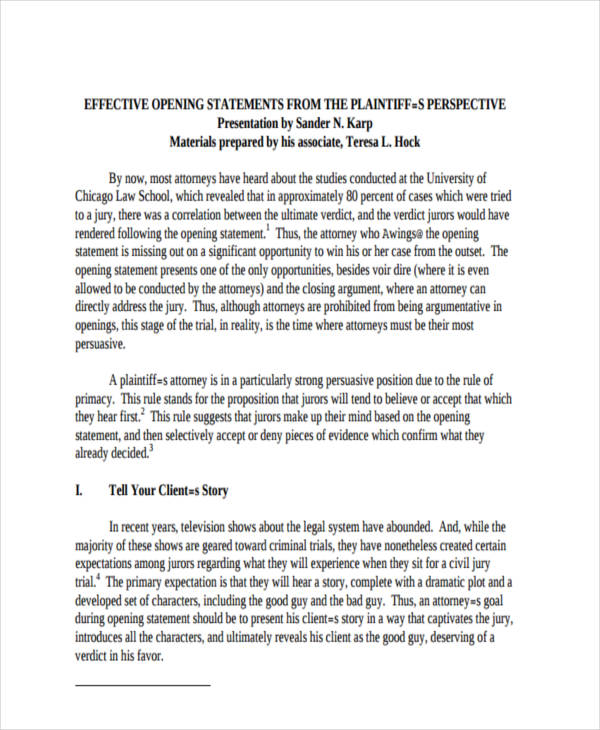

Opening Statement Sample

Effective Opening Statement

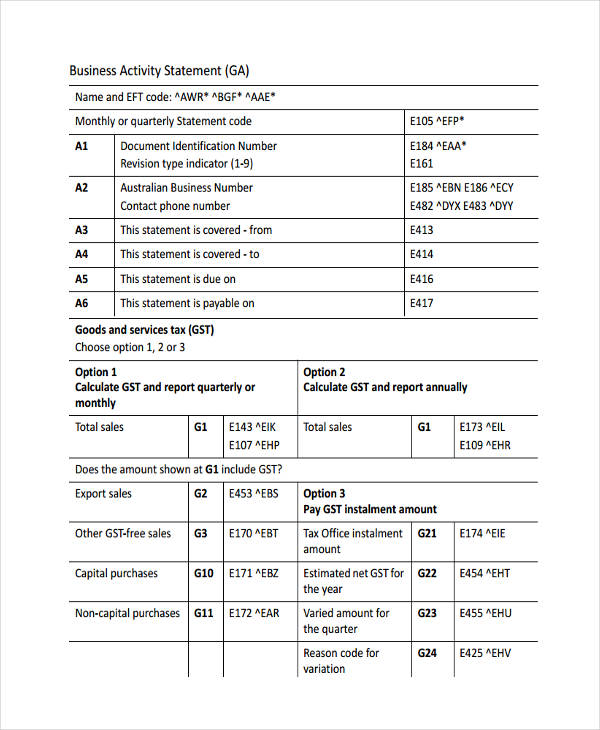

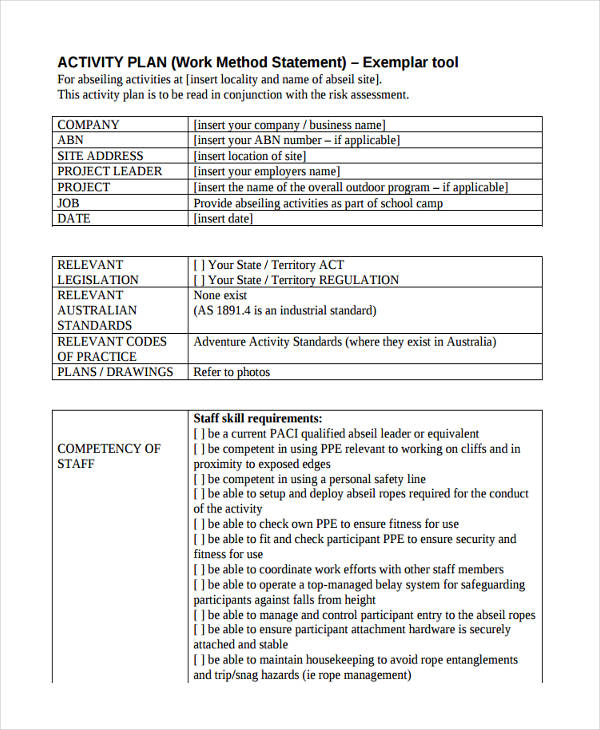

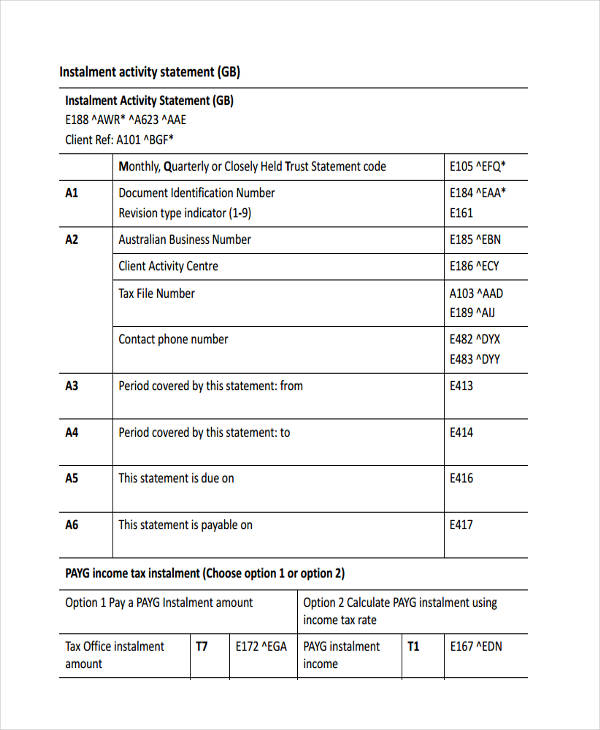

Activity Statements in PDF

Business Activity Statement

Plan Activity Statement

Instalment Activity Statement

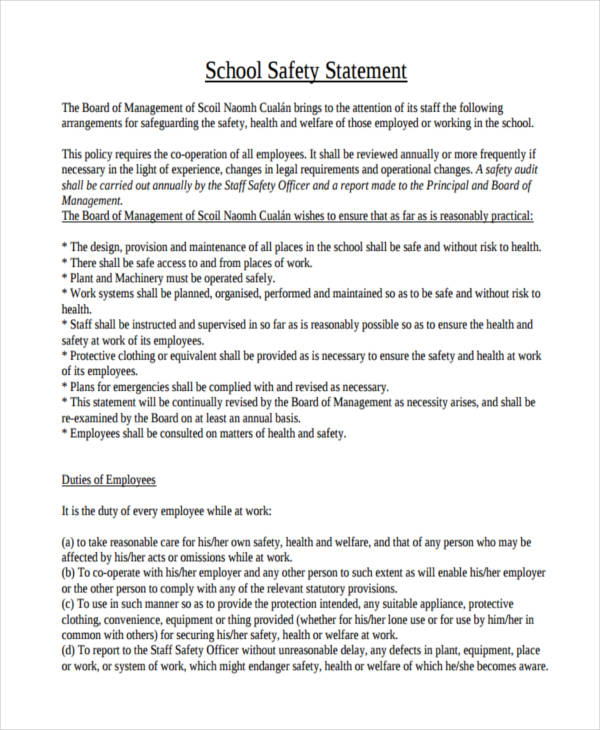

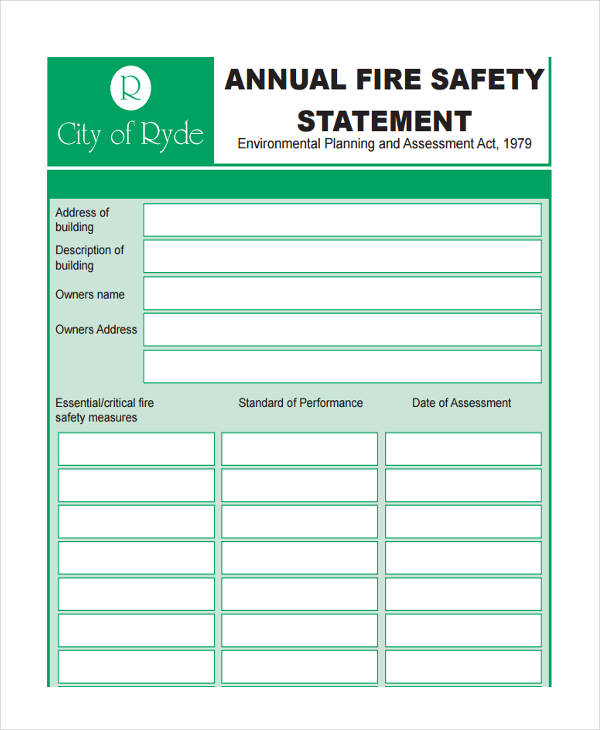

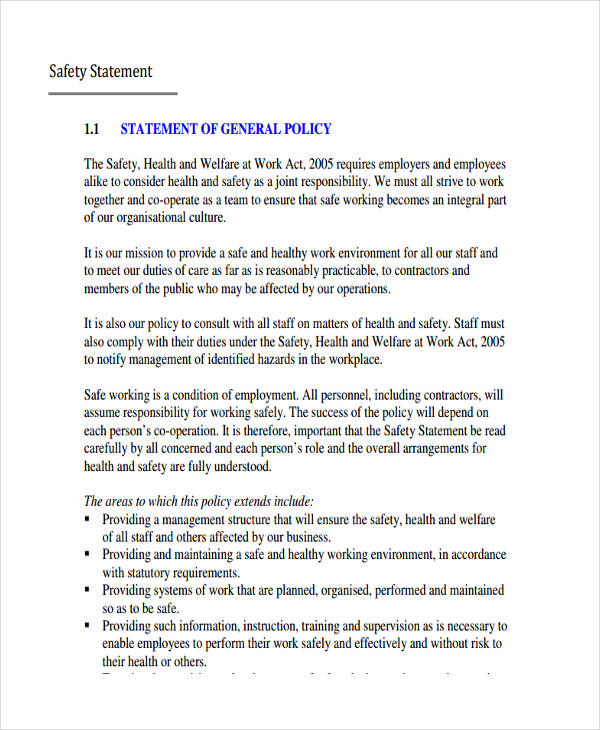

Safety Statement Examples

School Safety Statement

Annual Fire Safety Statement

General Safety Statement

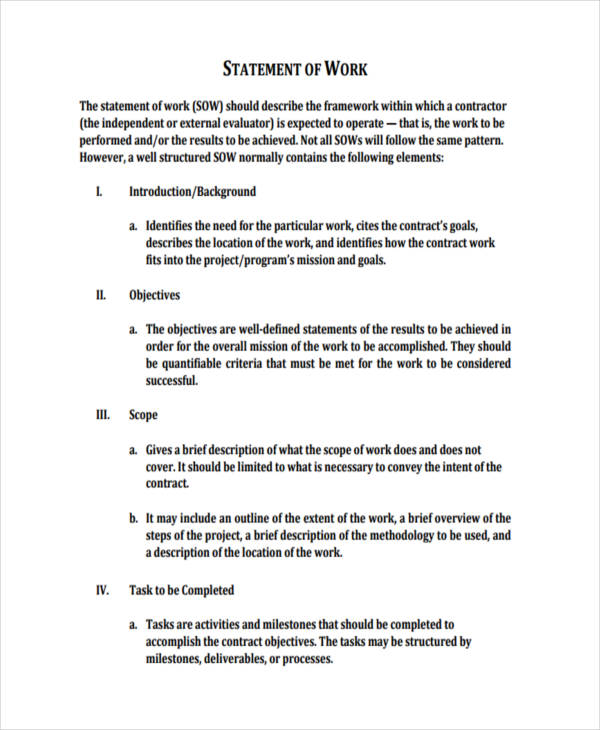

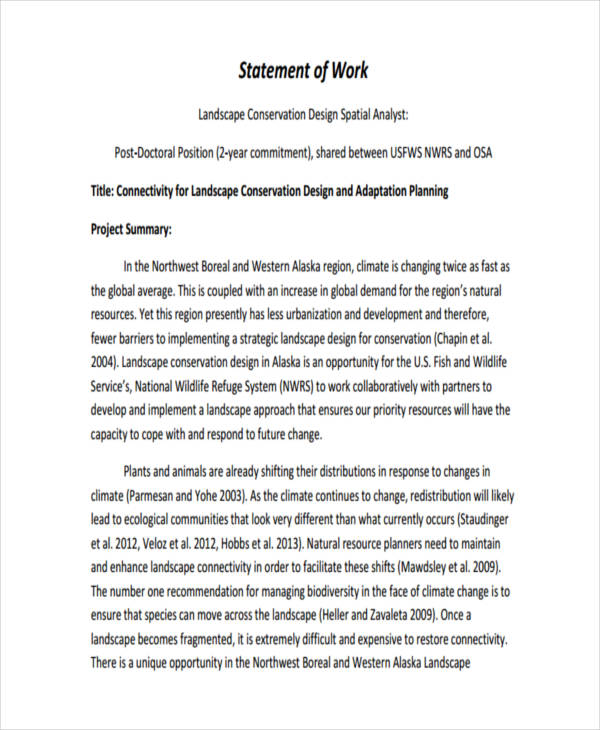

Statement Of Works

Free Statement Of Work

Statement Of Work Example

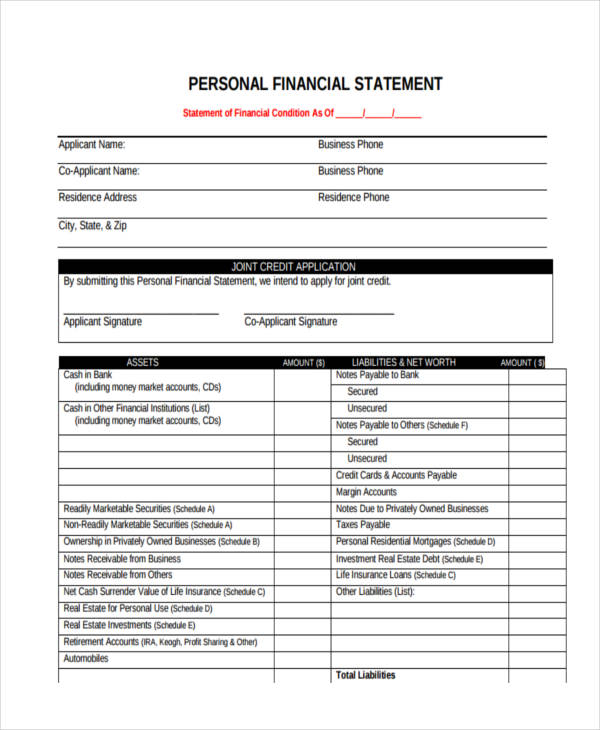

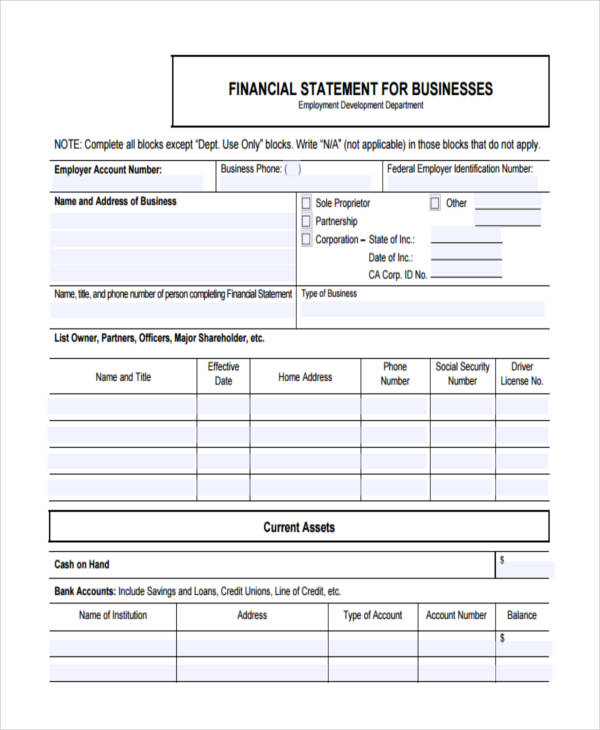

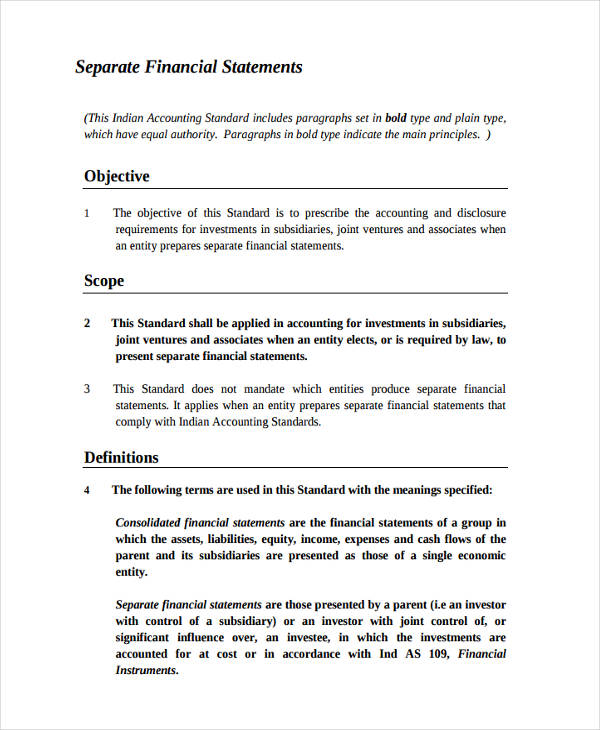

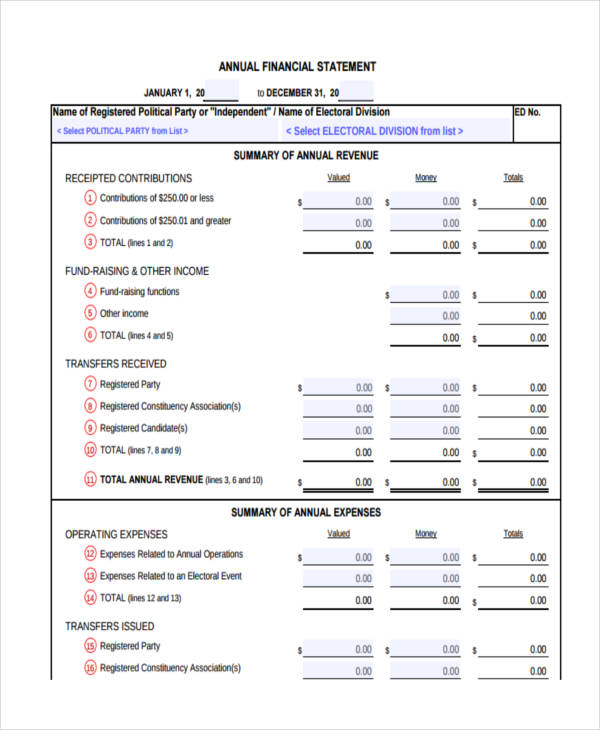

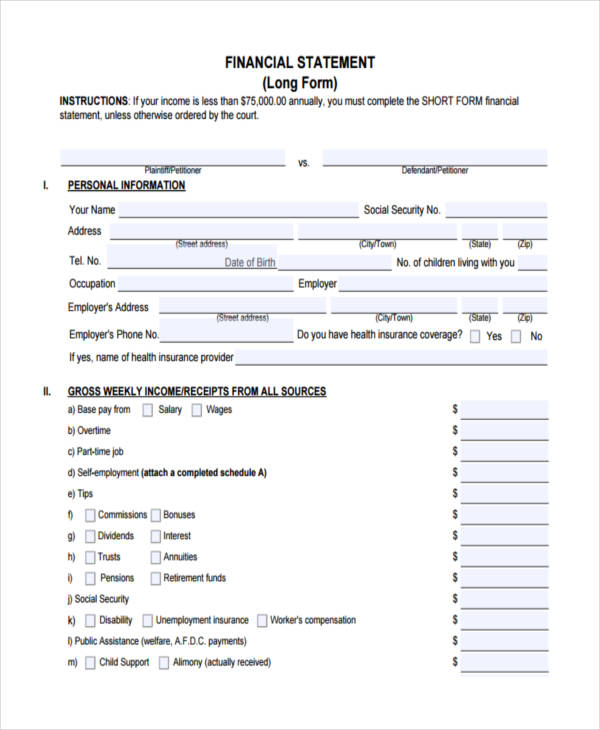

Financial Statement Samples

Personal Financial Statement

Financial Statement for Businesses

Separate Financial Statement

Annual Financial Statement

Standard Financial Statement

Account Statement Examples

Electronic Account Statement

Personal Account Statement

What Is a Personal Statement?

A personal statement is a written description of who you really are. It is a statement that contains your achievement, interests, strengths, career aspiration, etc. Your personal statement should convince the company you are applying for or the educational program you are interested in that you are the best applicant among the rest, and that they should make you an offer directly.

Your personal statement should be a concise and brief representation of yourself. Although it is short, it should sell you to the readers. In this case, experts suggested that your personal statement should only have at least 200 words.

How to Write a Good Statement of Purpose?

A statement of purpose is your personal statement of who you really are, what influenced you choosing your career path, and your personal interest. This statement is the most important part of your application and that it should be written with professionalism.

To write a good statement of purpose, follow these simple tips.

- Create a statement of purpose like you are creating your own story. Most committee who will evaluate your application prefers a statement of purpose that involves a storyline.

- Be specific. Whatever you write in your statement of purpose, be sure that you are specific about it.

- Customize your statement of purpose. Don’t just follow a basic template, create your own and put a personal touch on it.

Research Statements

Statement of Research Interest

Preparing Statement

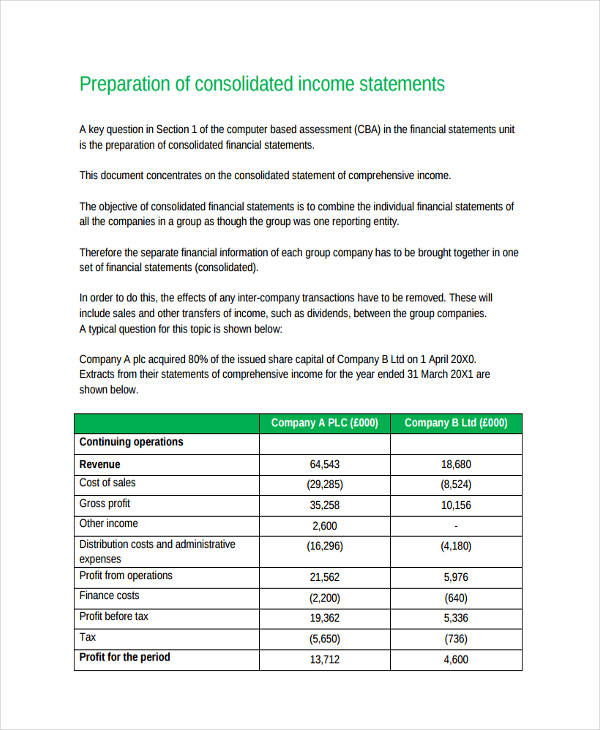

Preparing Consolidated Statement

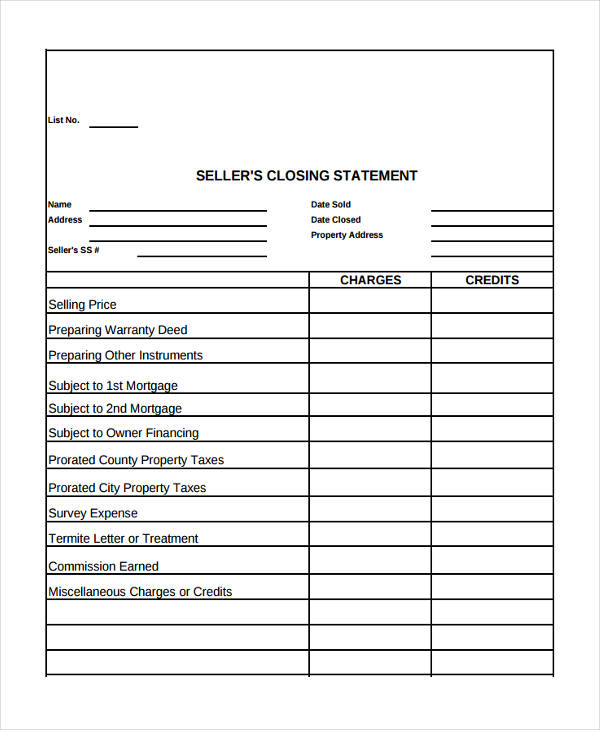

Closing Statement Example

Seller Closing Statement

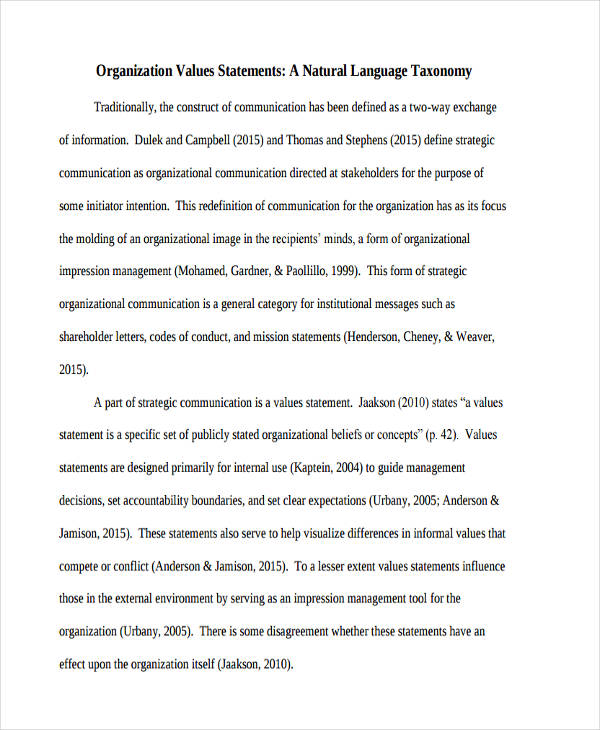

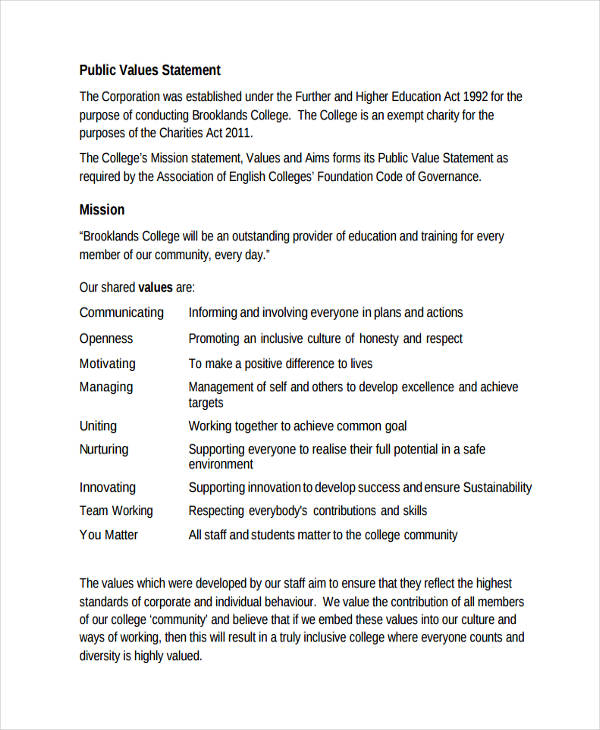

Values Statements in PDF

Organizational Values Statement

Public Values Statement

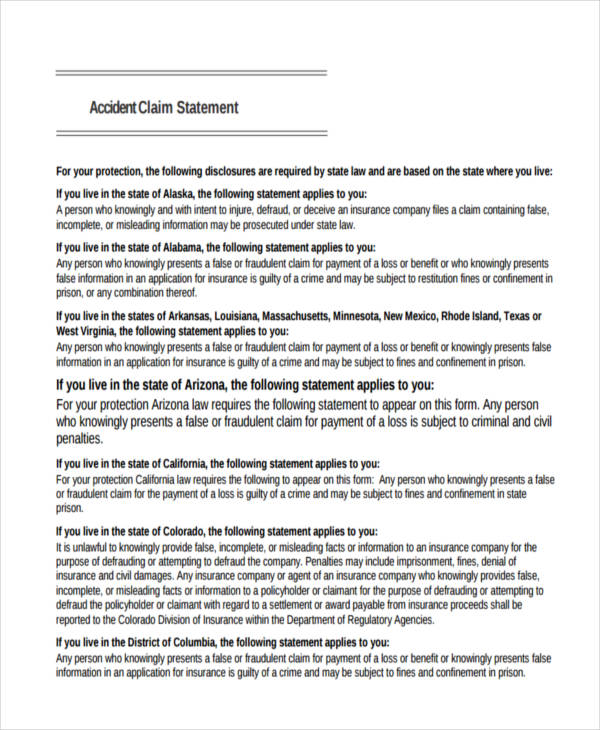

Claim Statement Samples

Accident Claim Statement

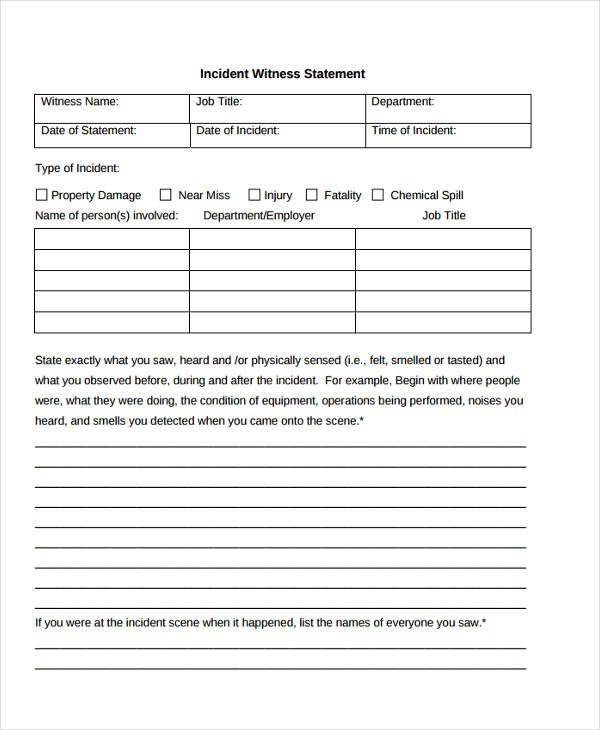

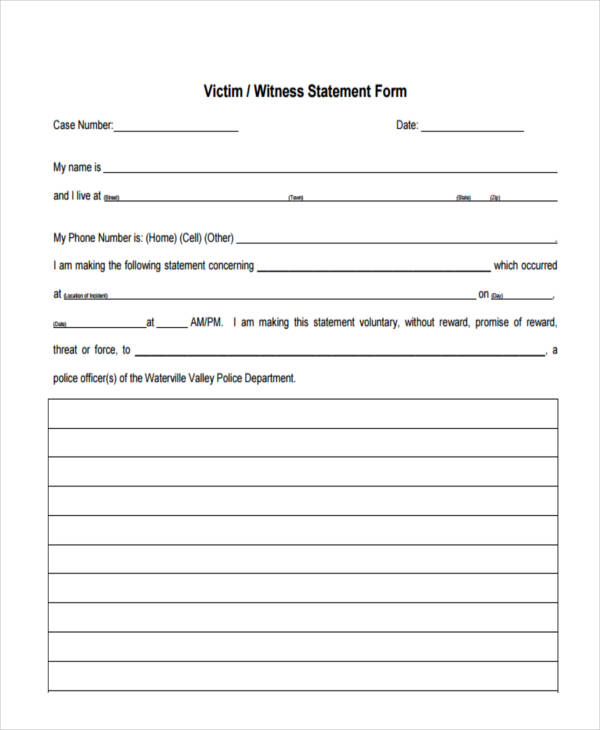

Witness Statement in PDF

Incident Witness Statement

Victim Witness Statement

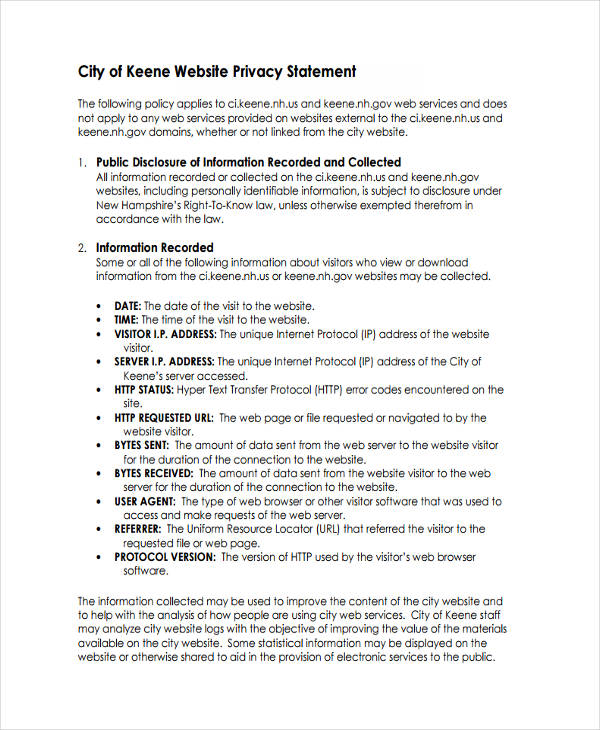

Privacy Statement Samples

Website Privacy Statement

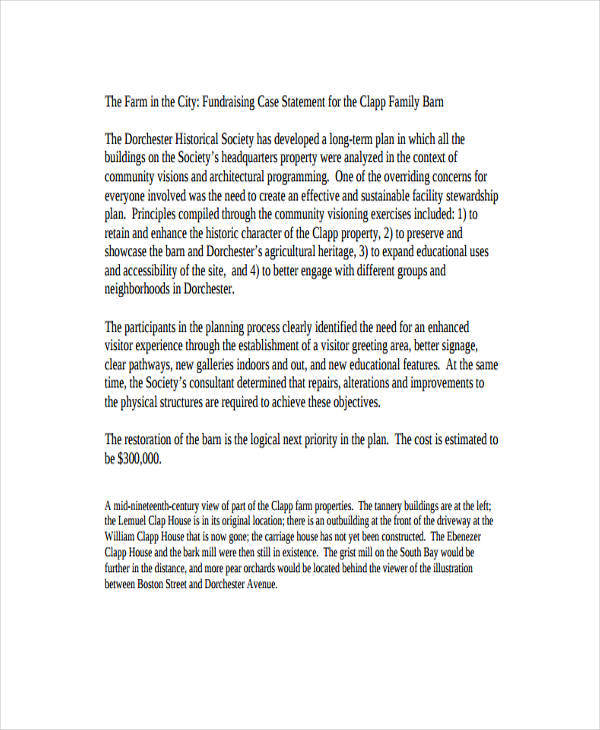

Case Statement in PDF

Fundraising Case Statement

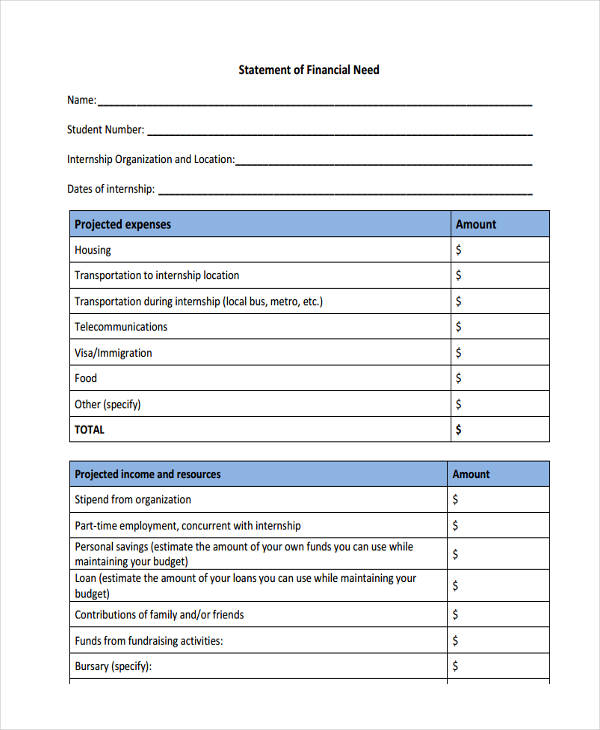

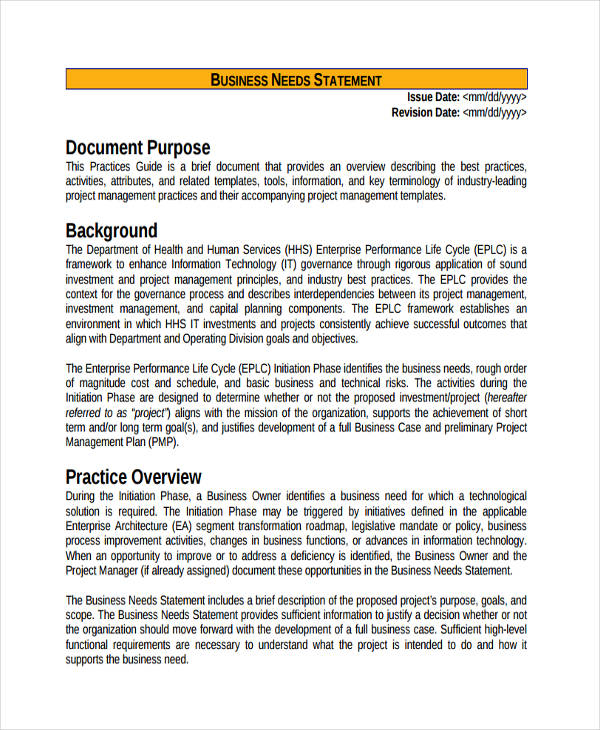

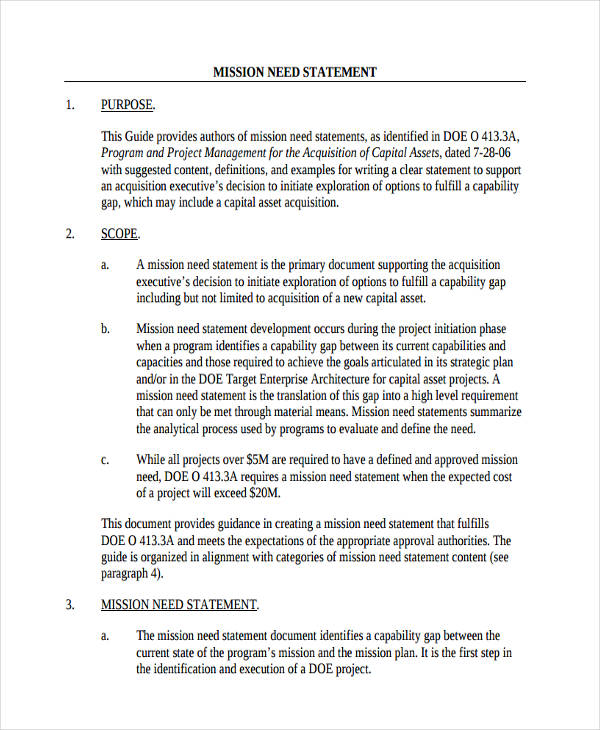

Need Statement Samples

Financial Need Statement

Business Need Statement

Mission Need Statement

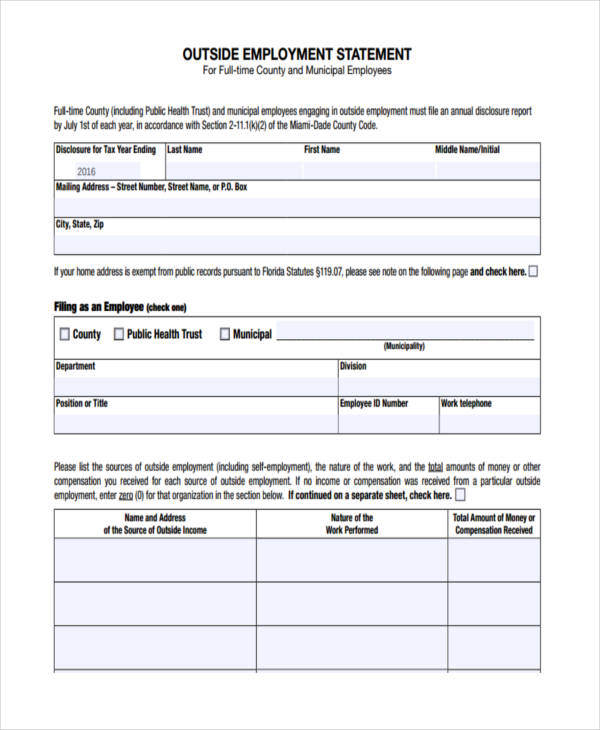

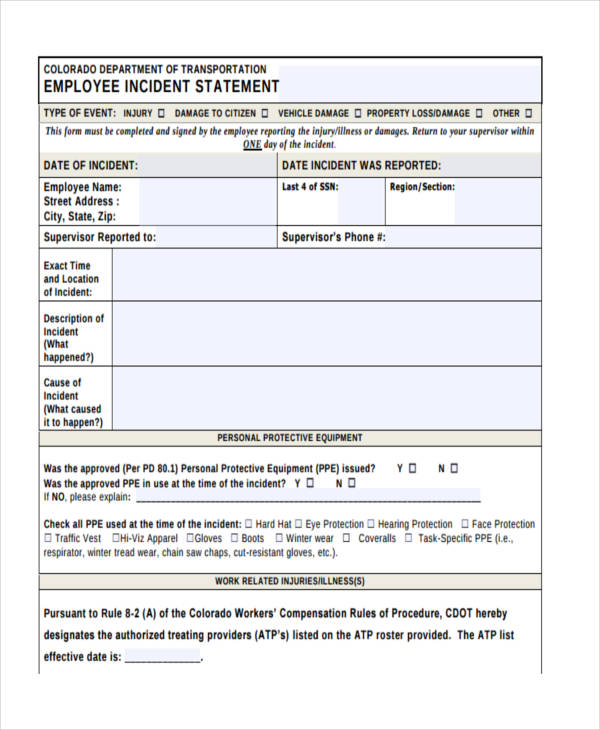

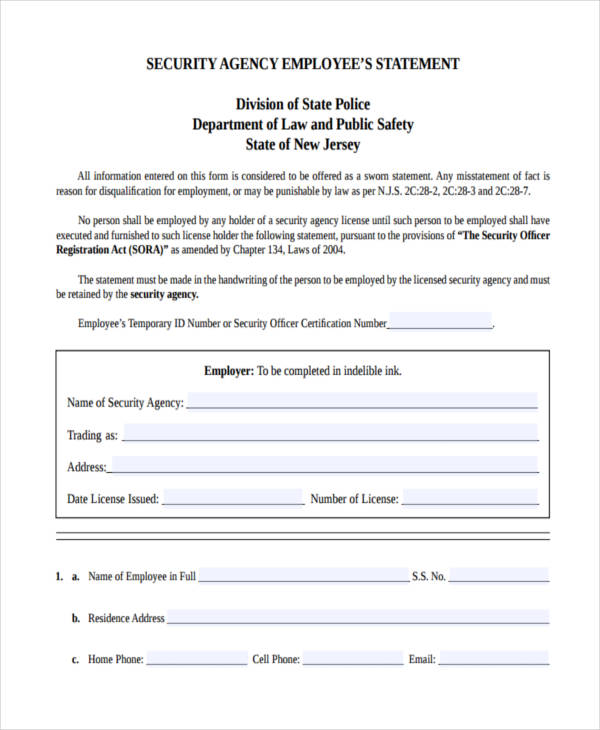

Employee Statement Example

Outside Employment Statement

Employee Incident Statement

Security Agency Employee Statement

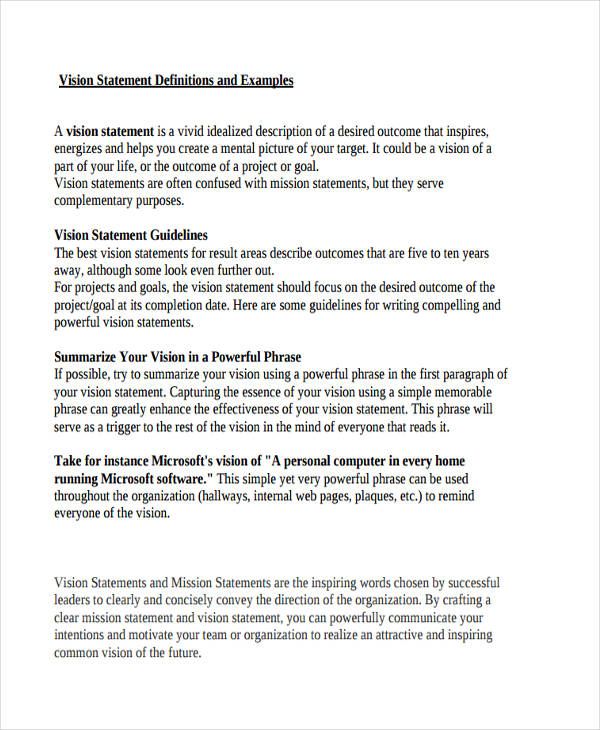

Vision Statement in PDF

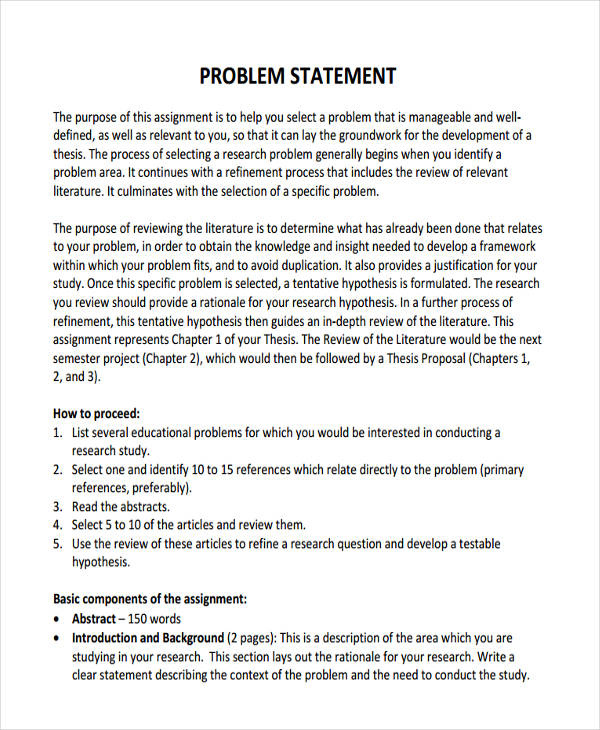

Problem Statement in PDF

Advantages of Using These Statement Examples

Writing a statement for yourself or to an organization can be very hard to do. There are many things to consider especially in writing a income statement for a business. You may fear that you are not writing enough to properly define yourself or an organization or you may have the fear of missing out important details to suffice a good statement.

Luckily, you came to the right place.

As you can see, this article provide different statement examples in word that are available for download. And if you use these examples, you can get plenty of advantages.

If you are still uncertain, here are the advantages of using these statement examples:

- You can save a huge amount of time by downloading these examples. The download is easy and faster. You don’t have to manually create the template of your statement. You can download and use our examples here as a reference in creating your own.

- These statements are already outlined. So you can’t miss out important information that is necessary for creating your own statement.

- Professional-looking statement examples. Our examples here are made by our finest developer that uses a high-end technology and software to create these statement examples templates.