9+ Tax Exemption Examples to Download

There are many perks and benefits an individual or person can levy to their advantage. One of those perks is a tax deduction, which eliminates a portion of the tax that one has to pay. Another perk is that of a tax exemption, which exempts a person from paying tax in the first place.

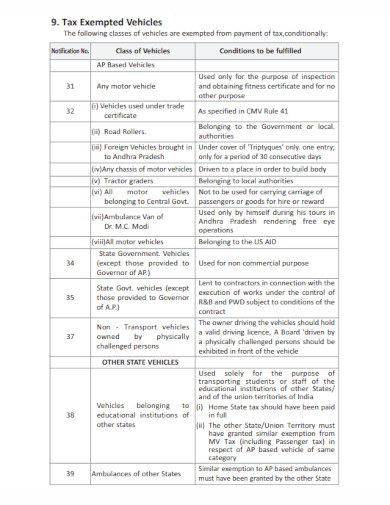

1. Tax Exempted Vehicles

2. Tax Exempted Devices

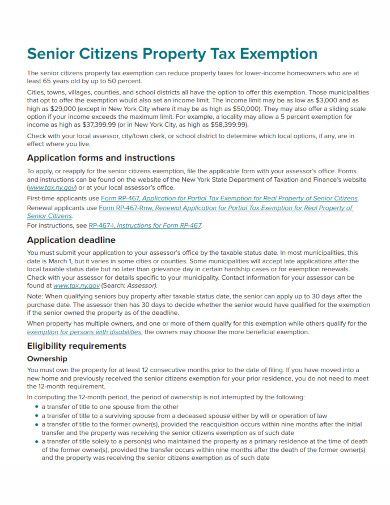

3. Senior Citizens Property Tax Exemption

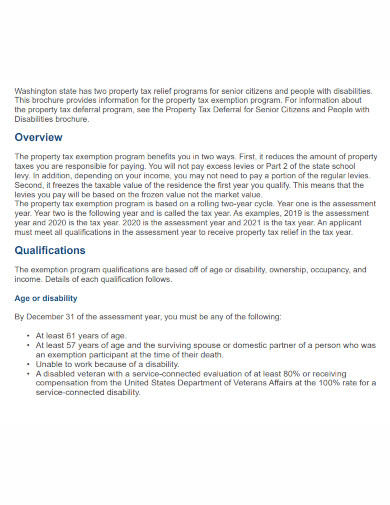

4. Property Tax Exemption for Senior Citizens

5. Sales Tax Exemption Administration

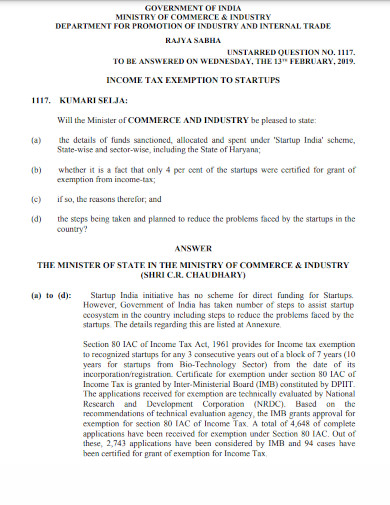

6. Income Tax Exemption to Startups

7. Sales and Use Tax Exemption Certificate

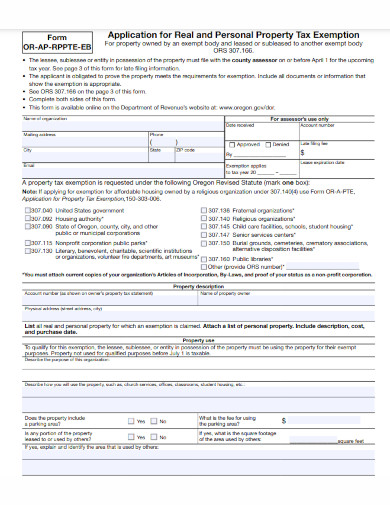

8. Application for Real Property Tax Exemption

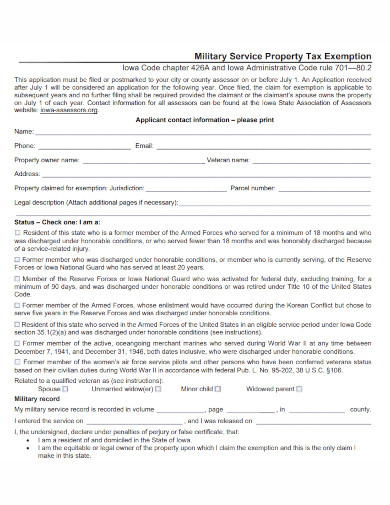

9. Military Service Tax Exemption Application

10. Tax Exemption Budget Template

What Is Tax Exemption

A tax exemption is an individual or an organization’s ability to be exempt from paying a specific amount of tax to the government. This tax can come in the form of income tax and the like. Tax exemptions are not a juxtaposition of tax deductions as this type of perk wholly exempts the citizen from paying their taxes.

A lot of charities and NGOs can avail of a tax exemption to help out the organization do their advocacy and core values. There are also many elements one needs to keep watch like the current culture or base economy of the country. To avail of this tax exemption perk, the charity or NGO must go through their local government. Begin by looking for the correct form to apply to the charity or organization for a tax exemption. Just note that you will need the correct form to apply and avail of the tax exemption in the context of an NGO or charity, so be sure to read all of the instructions properly on the IRS website. When you have obtained the correct forms and have printed them out, you must fill out the fields needed in the forms. Be sure to input the most recent available information for those fields as IRS will need up-to-date information for the filing of the tax exemption. After you have finished creating the forms, you must submit them online on the pay.gov website. Be sure to pass all the forms required at the same time, so that there won’t be any hangups during the bureaucratic process. When you have finished sending the appropriate forms to the website, you must wait for their responses. Note that this will take some time for the government office to file and approve.How To Avail of Tax Exemption for A Charity or NGO

Step 1: Select the Right Form from IRS

Step 2: Fill in the Designated Fields

Step 3: Submit the Forms Online

Step 4: Wait for a Response

FAQs

The limit for income tax is highly dependent on the current status of the person filing for the tax exemption and the various contexts, race, subculture, ethnicity, and ethnic group exemptions that may be present. For married couples, there is an AMT exemption amount that caps at 114,600 USD when they are filing for a joint return for the tax exemption. But if the couple files a single tax exemption for themselves then the individual will only gain a tax exemption for half the amount. If the person is just a regular taxpayer that does not have any exemptions or trusts then the max amount of tax exemption they can avail is 73,600 USD.What is the exemption limit for income tax?

Income and deals that aren’t subject to civil, state, or external levies are appertained to as duty-pure. People who are associated with non-profit organizations and charities, who are compliant with the Internal Revenue Code Section 501(c)(3), can file for a tax exemption. Due to their status, the groups are suitable to abate their donations from their duty returns. still, unless you work for a charitable association, your income isn’t tested if it’s lower than or equal to the standard deduction. For case, you might not need to submit a duty return if you are under 65, single, and made lower than$,000 per time.Who are eligible for tax exemption?

Some taxpayers may be eligible for both exemptions and credits on specific tax returns. Both have various mechanisms for helping the filer but are typical to the taxpayer’s advantage. The amount of income you owe in taxes is decreased through tax exemptions. You are permitted to deduct certain amounts from this sum to arrive at an adjusted gross income in place of having to pay taxes on your gross earnings.What is the benefit of tax exemption?

Tax exemption is a perk an individual taxpayer may avail of at any time. This perk allows the individual to be exempted from paying a certain amount of income tax. Not only will this perk allow the individual to save more money, but the individual can also relegate their extra earnings from this perk to invest in other ways of earning more money or to improve the individual’s quality of life.