10+ Corporate Bond Examples to Download

Corporations issue bonds to issue raise capital as support to their different ongoing projects like some operations and for expanding the business. Corporations normally follow two ways for raising capital that is either by debt or equity investment. Corporations mostly prefer debt as it looks safer than equity for it doesn’t affect the shareholders directly.

What is the Difference Between Corporate Bonds and Stocks?

Stocks and bonds in corporate firms refer to two different ideas in a corporate business. Both the entities are meant to do the business but in different ways.

- While a corporation or company issues stock, they are selling some portion of their total share of business for capital gains. Whereas when it issues a bond, it issues debt which is bind in an agreement that reads the commitment of the issuer to pay the interest on the issued money timely.

- Stocks are comprised of the shares of the company, and bonds are pure debts.

- Stocks are sold to expand the business and its operations with the capital that belongs to the company itself. Bond, on the other hand, also helps in expanding the business but on the cost of the payment of the interest within a signed agreement.

- While buying stocks of any company you become a small partner owner of the business. But this is not in case of the bonds as the investors or the lenders are paid their money back after the maturity of the bond.

What is the Importance and Purpose of Corporate Bond?

- Corporate bonds are one of the most preferred choices of corporations to do the business as it is a safer way of liquidating your operations. But its management and repayment need to be well-maintained to keep your stocks rise in the market. Its worth and benefits depend on the income, investor’s patience to tolerate the risks, investment horizon, etc.

- Corporate bonds might expose you to higher risks but it offers greater returns.

- Debts are held greater than equity and the bondholders often get repaid on priority liquidated bu the issuer.

- The seniority of the bonds provides another level of security to the shareholders and for this reason, it is considered safer than stocks.

Purpose

Corporate bonds are such instruments that help in raising or getting capital for business. To the investors and the lenders, it is a good source of income as it continuously pays them a satisfying amount of interest regularly. And this is the reason this is also known as fixed-income securities.

If you are planning to use corporate bonds in your business having the knowledge of some of the common terminologies of it is important.

- The bond refers to a loan agreement.

- The principal refers to the complete borrowed amount.

- Maturity refers to the last date of paying the debt back to the investor.

- Bond maturities are signed between the investor and the debt issuer which can be either of a long term or short term timeframe.

- The note is also a term used in corporate business to refer to the bonds that last less than ten years.

- The term face value refers to the amount that needs to be repaid at the time of the maturity to the investor.

- Coupon rate refers to the face value percentage that the issuer pays to the bondholder annually.

10+ Corporate Bond Examples

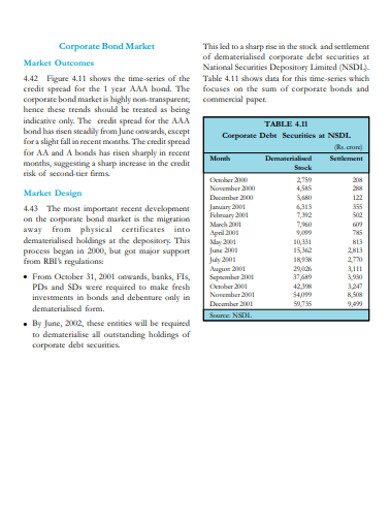

1. Corporate Bond Market Example

If you want to invest in corporate bonds have a proper understanding of the process and its different aspects first. Business is more like an adventurous venture in which you have to plan before taking every step. Unless you can anytime get shocked by any sudden change in trend and price in the market. If you want to be certain about your setps this example template can also help you. Because the frame is concluded with description on different market conditions and concepts. It might help you to know the corporate bond market structure and the way it processes. So, have a look at this template and download it if it looks useful to you.

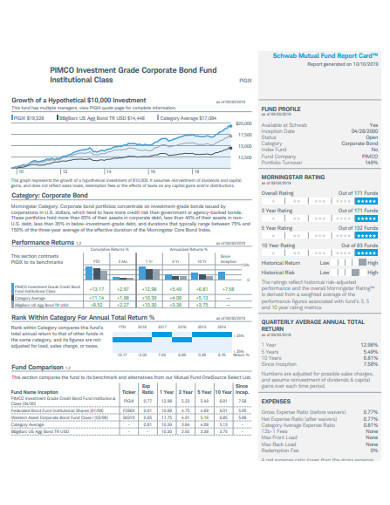

2. Investment Grade Corporate Bond Fund Example

Funding or investing in a corporate bond helps you to get higher refunds and safer business comparatively. But it doesn’t mean that it doesn’t give any sort of risks in business. Thus it is important that your investor has faith in your business and have the patience for the returns. You can refer to the given example to simplify your task as it is framed with the grade graph that your investors might like to have a look at. So, grab this template today!

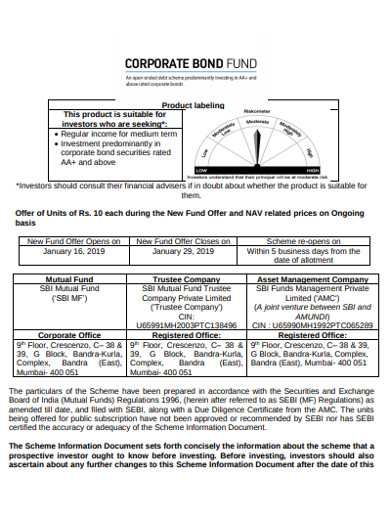

3. Sample Corporate Bond Example

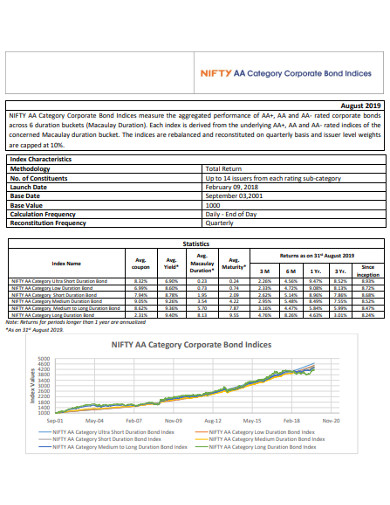

4. Simple Corporate Bond Example

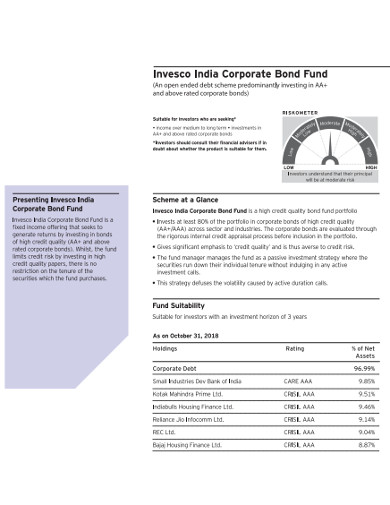

5. Corporate Bond Fund Example

6. Printable Corporate Bond Example

7. Basic Corporate Bond Market Example

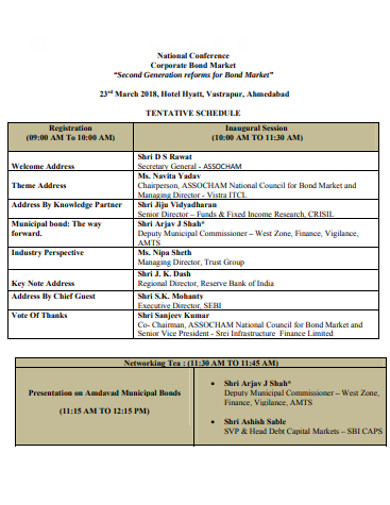

8. National Conference Corporate Bond Example

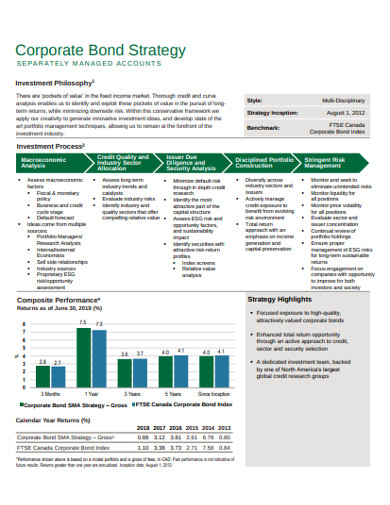

9. Corporate Bond Strategy Example

10. Corporate Investment Bond Example

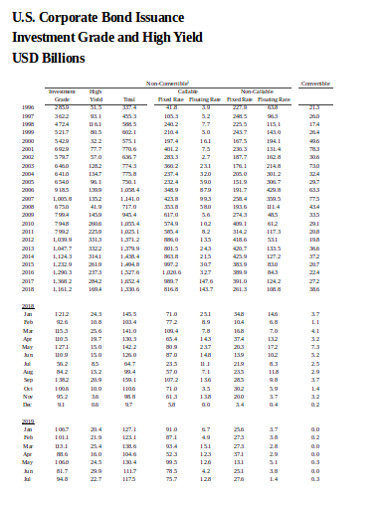

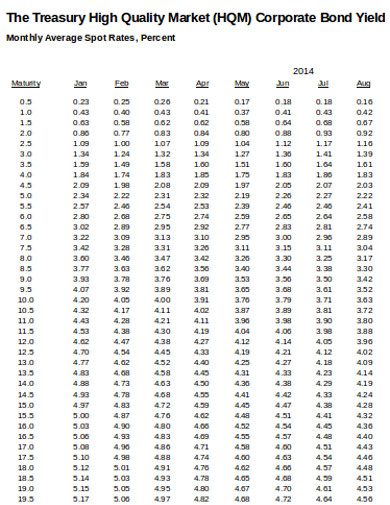

11. Corporate High Quality Market Bond Example

10+ Corporate Bond Examples to Download

Corporations issue bonds to issue raise capital as support to their different ongoing projects like some operations and for expanding the business. Corporations normally follow two ways for raising capital that is either by debt or equity investment. Corporations mostly prefer debt as it looks safer than equity for it doesn’t affect the shareholders directly.

What is the Difference Between Corporate Bonds and Stocks?

Stocks and bonds in corporate firms refer to two different ideas in a corporate business. Both the entities are meant to do the business but in different ways.

While a corporation or company issues stock, they are selling some portion of their total share of business for capital gains. Whereas when it issues a bond, it issues debt which is bind in an agreement that reads the commitment of the issuer to pay the interest on the issued money timely.

Stocks are comprised of the shares of the company, and bonds are pure debts.

Stocks are sold to expand the business and its operations with the capital that belongs to the company itself. Bond, on the other hand, also helps in expanding the business but on the cost of the payment of the interest within a signed agreement.

While buying stocks of any company you become a small partner owner of the business. But this is not in case of the bonds as the investors or the lenders are paid their money back after the maturity of the bond.

What is the Importance and Purpose of Corporate Bond?

Corporate bonds are one of the most preferred choices of corporations to do the business as it is a safer way of liquidating your operations. But its management and repayment need to be well-maintained to keep your stocks rise in the market. Its worth and benefits depend on the income, investor’s patience to tolerate the risks, investment horizon, etc.

Corporate bonds might expose you to higher risks but it offers greater returns.

Debts are held greater than equity and the bondholders often get repaid on priority liquidated bu the issuer.

The seniority of the bonds provides another level of security to the shareholders and for this reason, it is considered safer than stocks.

Purpose

Corporate bonds are such instruments that help in raising or getting capital for business. To the investors and the lenders, it is a good source of income as it continuously pays them a satisfying amount of interest regularly. And this is the reason this is also known as fixed-income securities.

If you are planning to use corporate bonds in your business having the knowledge of some of the common terminologies of it is important.

The bond refers to a loan agreement.

The principal refers to the complete borrowed amount.

Maturity refers to the last date of paying the debt back to the investor.

Bond maturities are signed between the investor and the debt issuer which can be either of a long term or short term timeframe.

The note is also a term used in corporate business to refer to the bonds that last less than ten years.

The term face value refers to the amount that needs to be repaid at the time of the maturity to the investor.

Coupon rate refers to the face value percentage that the issuer pays to the bondholder annually.

10+ Corporate Bond Examples

1. Corporate Bond Market Example

indiabudget.gov.in

Details

File Format

PDF

Size: 106 KB

If you want to invest in corporate bonds have a proper understanding of the process and its different aspects first. Business is more like an adventurous venture in which you have to plan before taking every step. Unless you can anytime get shocked by any sudden change in trend and price in the market. If you want to be certain about your setps this example template can also help you. Because the frame is concluded with description on different market conditions and concepts. It might help you to know the corporate bond market structure and the way it processes. So, have a look at this template and download it if it looks useful to you.

2. Investment Grade Corporate Bond Fund Example

schwab.wallst.com

Details

File Format

PDF

Size: 74 KB

Funding or investing in a corporate bond helps you to get higher refunds and safer business comparatively. But it doesn’t mean that it doesn’t give any sort of risks in business. Thus it is important that your investor has faith in your business and have the patience for the returns. You can refer to the given example to simplify your task as it is framed with the grade graph that your investors might like to have a look at. So, grab this template today!

3. Sample Corporate Bond Example

sbimf.com

Details

File Format

PDF

Size: 1 MB

4. Simple Corporate Bond Example

nseindia.com

Details

File Format

PDF

Size: 979 KB

5. Corporate Bond Fund Example

invescomutualfund.com

Details

File Format

PDF

Size: 414 KB

6. Printable Corporate Bond Example

careratings.com

Details

File Format

PDF

Size: 604 KB

7. Basic Corporate Bond Market Example

ccilindia.com

Details

File Format

PDF

Size: 112 KB

8. National Conference Corporate Bond Example

icsi.edu

Details

File Format

PDF

Size: 175 KB

9. Corporate Bond Strategy Example

manulifeam.com

Details

File Format

PDF

Size: 237 KB

10. Corporate Investment Bond Example

sifma.org

Details

File Format

EXCEL

Size: 57 KB

11. Corporate High Quality Market Bond Example

treasury.gov

Details

File Format

EXCEL

Size: 41 KB