6+ Financial Analysis for Business Evaluation Examples to Download

Corporate Finance includes the capital management of any corporate company that also consists of the funding and other actions that the management takes for the raise of the value of the company. It can be applied in the products, services, management, etc. The ultimate goal of corporate finance is to increase the value of any company.

What is Business Evaluation?

A business evaluation is an entire process of evaluating and analysing the process of the business. Before it is sold to any interested buyer by the owner it is evaluated to check the standing and the operation of the business. That will help to know the atmosphere on which the business is running and flowing. The economic value that is determined by the business evaluation helps the owner to know the worth of the business and accordingly establish a business partnership.

6+ Financial Analysis for Business Evaluation Examples

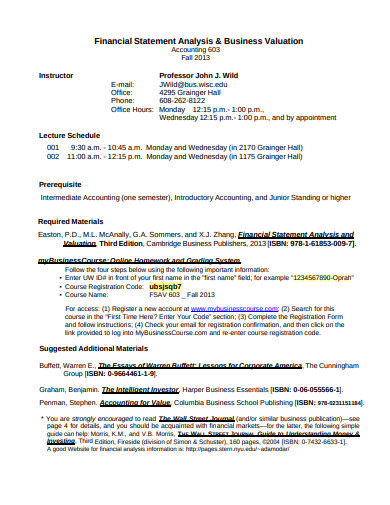

1. Financial Statement Analysis and Business Valuation

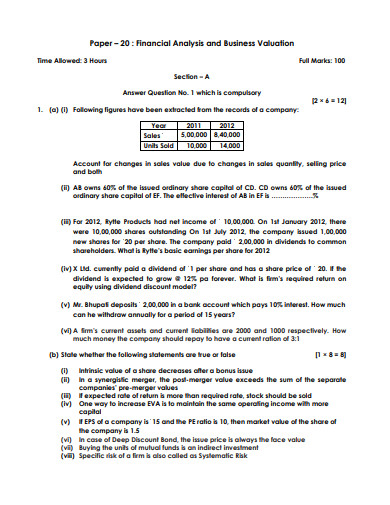

2. Financial Analysis and Business Valuation Example

3. Financial Performance Evaluation in Contraction Business

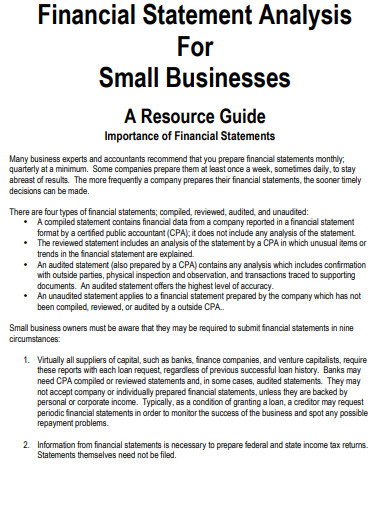

4. Financial Statement Analysis for Small Business

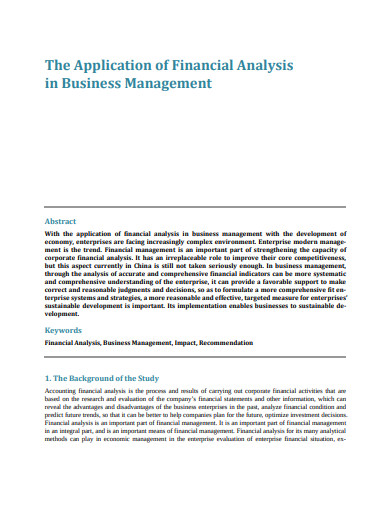

5. Application of Financial Analysis in Business Management

6. Sample Financial Analysis and Business Valuation

7. Financial Statement Analysis Course for Business

What is a strategic financial analysis?

Strategic financial analysis is a structure through which the senior executives to assess and analyse the strategies, evaluate the performance.

Techniques of Financial Statement Analysis

-

Comparative Financial Statement

This technique helps to compare two financial statements. This technique helps to also review the operations and to also draw conclusions. It is a horizontal analysis, used by both the income statement and the balance sheet. That helps to compare the financial statements easily.

-

Statement of Changes in Working Capital

The major motive of this technique is to collect information related to the working capital. If you deduct the total liabilities from the total assets, you will get the value of the working capital. The information of the working capital that is collected in the statement lets one know the changes that have occurred between two financial periods.

-

Common Size Balance Sheets

The figures for the financial statements need to be converted into percentages. It is done by taking the total balance sheet as 100.

-

Trend Analysis

It is a very significant tool for horizontal analysis. According to this analysis, the ratios of various items of the financial statements for various periods are calculated and the comparison is made accordingly. The analysis gives a track of the prior performances.

-

Ratio Analysis

Ratio analysis is the most common way of analysing financial statements. It performs the analysis in a manner that the comprehension of the financial statements becomes easier.