10+ Internal Service Fund Examples to Download

Internal service funds are the self-insurance or other funds that belong to the worker or employee only but not in their hands but an account maintained by the institution. This fund is used to report any sort of activity to track the services or goods provided to other departments or agencies or to the schools. This activity is done on the basis of the cost of reimbursement. Its main purpose is to keep track of the records of the provided goods and services.

What is District’s Internal Service Fund?

Internal service fund operated activities are removed sometimes to avoid the revenue overstatement. Following certain sort of activities mentioned below, you can identify the activities happening in the district’s internal service fund.

- This fund is used to account for or record all the financial goods and services that one agency or the department is providing to the other of the same district or to other governments. But the activity is done on a cost-reimbursement basis.

- Internal service fund balances are often removed against the expenses and revenues from the Governmental Statements of Activities, no matter if it is positive or negative.

- State internal service fund activities have the capacity to give facilities and management of different state-owned properties, state employees’ health care program, vehicle and equipment maintenance and supplies, computing and telecommunication services, self-insurance, etc.

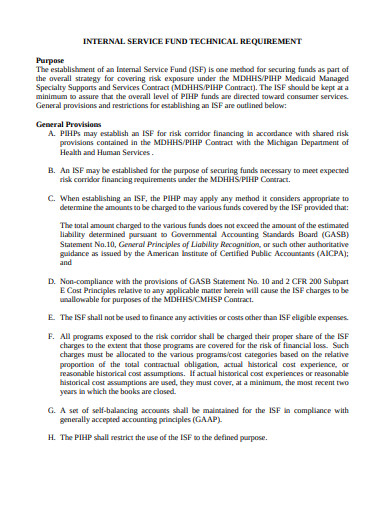

What is the Provision and Restrictions of ISF?

Citing some provision and calling them the ultimate ones will not be appropriate as different departments and agencies might adopt some specific provisions peculiar to them. Thus the points added below are some of the general provisions and restrictions applicable to ISFs.

Provisions

- Prepaid Inpatient Health Plans, to record and maintain all the financial risks, may establish some ISFs according to the shared risk provisions of MDHHS/PIHP contract with the department of Michigan Health and Human Services.

- ISFs are established to secure funds that is important to meet expected risk corridors.

- the establishment of the ISF requires the PIHP to apply an appropriate method to determine the chargeable amount from different funds that ISF covers. It also follows a regulation of the GASB while charging money that states that the charges can not exceed the defined limit of the liability determined pursuant to GASB.

- ISF charges can’t be allowed for the purposes of the MDHHS/CMHSP Contract due to the cost principals are relative to any applicable matter.

- ISFs should only be eligible to finance their expenses.

- It is the responsibility of PIHP to restrict the ISF defined purposes.

- A set of self-balancing accounts need to be maintained for the ISF In compliance with the GAAP.

Apart from the mentioned provisions, there are many other provisions that are commonly seen followed in maintaining all sorts of ISF.

Restrictions

While using the funds held in account ISFs are restricted to some activities.

- The PIHP has to restrict the use of ISF to its different defined purposes because its purposes are to secure funds to meet probable future risk corridors requirements according to the MDHHS/PIHP contract.

- It should restrict the PIHP’s risk corridor obligation.

- According to the statutes of investments, PIHP can invest in ISF funds.

- State funds paid to ISF can retain its character and form as state funds according to the Mental Health Code and should not be treated as local funds.

10+ Internal Service Fund Examples

1. Internal Service Fund Stabilises Budgeting for Vehicle

If you are utilizing or investing in internal service funds then it is better for you to first understand it than preparing a budget for it. Internal service fund budget needs to be preceded by a proper understanding of the different provisions, activities, and restrictions of ISFs. If you want to have that understanding, you can refer to this template. Framed with descriptions on its different aspects, this template talks about fund stabilized budgeting for vehicles. So, have a look at this template and if it suits your work download it today!