9+ Expense Sheet Examples to Download

Imagine this scenario: it’s payday and you have the feeling that you are the richest person in the world. It’s also a Friday and your co-workers are inviting you out to a party. Since you just got your pay, you agreed and you spent almost a quarter of your total pay. The next day is Saturday— a weekend —you were then again invited for a weekend away. You went and after spending your pay on pointless things, you spent nearly half of what’s left of your pay after your Friday night out. You now have a quarter left of your pay and you finally start to question how you are going to make it until your next day with the money you are left with. You might also start to question your choices in life. You may also see training sheet examples & samples.

The cited situation above might sound familiar because you could be among the guilty ones who do the same thing during and a day after your payday. While you could be doing various kinds of splurging, such as mindless shopping, it’s still the same thing; you are carelessly spending your money on irrelevant things. Sure, you could use some relaxation and reward after a fifteen days worth of work but if you are just going to blow all your money in one go, you will surely not feel relaxed at all for the rest of the days before your next payday. You may also like job sheet examples & samples.

Now you might ask: how can you stop yourself from all those mindless spendings and have enough money to pay for all the things you need to pay and enough money to put on your savings or emergency fund? It’s actually pretty simple and all you need to do is just one simple thing— through tracking your expenses. You may also check out monthly sheet examples & samples.

You might ask again: what’s the point of tracking your expenses when it is like counting the money you no longer own? Tracking your expenses the best way to track where all your money goes at the end of the day. Every single person, especially young adults who are still new to this, can greatly benefit from expense tracking. It also gives you the overview of the things you usually spend on and from that, you can draw out a budget that can help you save and live until your next payday. In short; it helps you look at your financial reality. You might be interested in score sheet examples & samples.

Tracking your expenses is an activity that you will never ever regret doing. There are many ways you can track your expenses but one of the best things you can do is with the use of an expense sheet. With that, we have provided ten expense sheets that can help you track all of your expenses and we have also provided some expenses-related discussions. You may also see task sheet examples & samples.

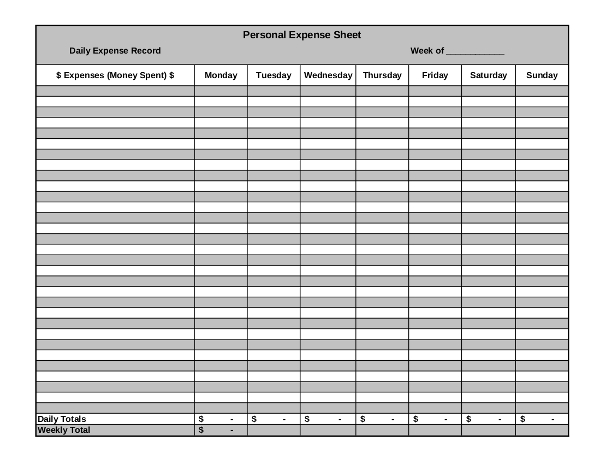

Expense Tracking Sheet Example

Personal Expense Sheet Example

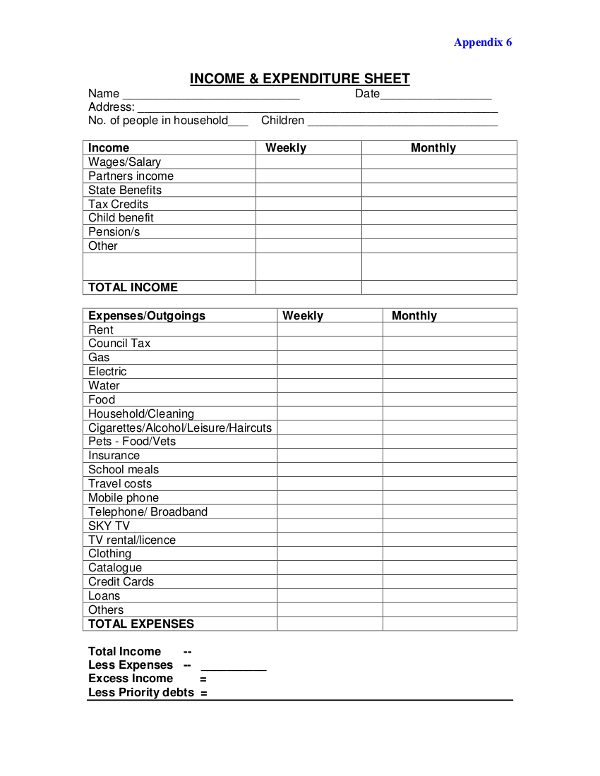

Income and Expenditure Sheet Example

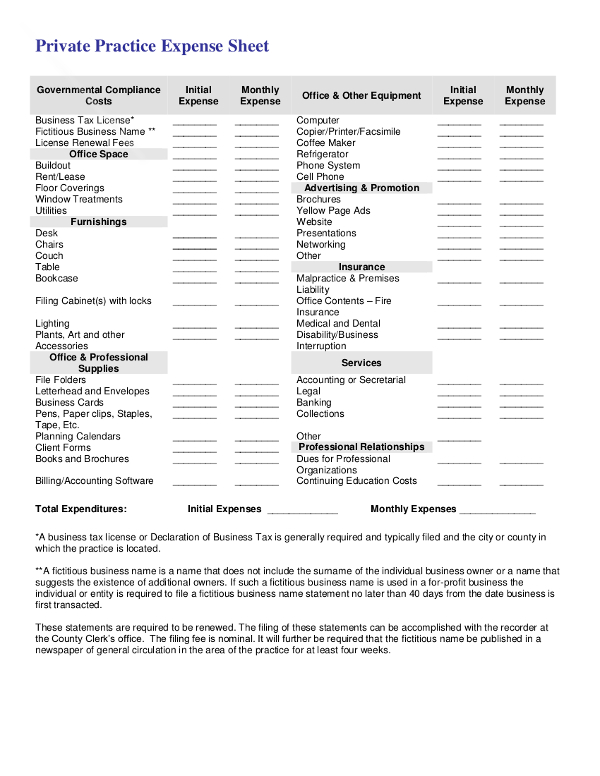

Private Practice Expense Sheet Example

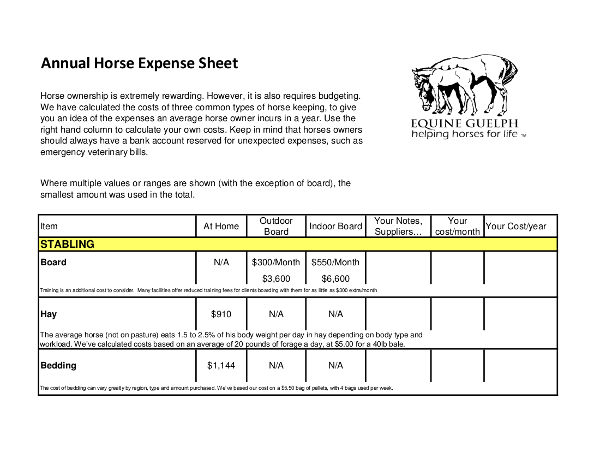

Annual Horse Expense Sheet Example

Tips on How to Keep Track of Your Expenses

Here are some tips you can make use of to track your expenses effectively:

1.Divide your expenses into three categories to make it easier for you to track them. The three categories are Fixed Expenses, Variable Expenses, and Periodic Expenses.

- Your Fixed Expenses are the things that are set to pay for every month such as your rent, loan payments, car insurance, and the like. Your Variable Expenses consists of your expenses that vary from week to week, or from month to month. It also occurs on a daily basis and among its examples are your grocery bills, utility bills, and the like. Your Periodic Expenses can either be Fixed Expenses or a Variable Expenses but unlike Fixed Expenses, Periodic Expenses does not occur on a regular basis. Your Periodic Expenses includes the things you buy on an impulse, clothing, gifts, and the like. You may also see 7+ Travel Expense Policy Examples.

2. Download a smartphone application or have a pocket-sized notepad that can help you track your expenses on the go that wherever you are and whatever you are spending on, you will still be able to track it as soon as possible. There are smartphone apps that you can personalize according to the kinds of expenses that you have. You may also see Expense Worksheet Examples

3. Keep every single receipt from your every single purchase. Also, keep your ATM receipts, bank and credit card statements, and all of the bills that you have. It’s like having a documented record of your spendings and you might have them for future reference. You may also see Vehicle Expense Reimbursement Policy Letter.

4. Record even the smallest purchase you make– even if it’s just a piece of candy, you have to make sure that you have tracked it. Keep in mind that when these little things would be added all up, it might amount to something that is bigger than you have expected. You may also see Expense Report Examples & Samples.

5. At the end of the day, enter and record your daily spendings on your expense sheet. Expense sheets are helpful especially in helping you see your financial reality. And by the end of the month, you can easily total everything that you have spent on for the entire month with the help of your expense sheet. You may also see Expense Report Examples & Samples.

6. Do not just rely on the default feature of your smartphone expense tracking application. Make your own categories and make sure that you have organized all your expenses well. If you are more of the traditional type and would prefer paper and pen over screens, you can still organize your expenses by means of having folders with labels or tables where you will be able to organize the categories of your expenses in a logical and effective manner. You may also see Expense Receipt Examples & Samples.

Guidelines for Making an Expense Sheet

Like any other sheets, making expense sheet requires focus because one mistake could make the entire sheet go wrong. Here are some guidelines that can help you create an expense sheet that is perfect and effective for you:

1. Start with a clean sheet.

If you are starting from zero or just starting to create an expense sheet, it is advised that you should use a clean sheet, to begin with. Aside from the fact that it could help you have a clear mind when creating your expense sheet, it will also help you to personalize it according to the kind of expenses that you have. You may also see instruction sheet examples & samples.

2. List down all of your expenses.

Listing down your expenses can be helpful when you will be already adding categories to your expense sheet.

3. Sort expenses into categories.

Remember the big three: Fixed Expenses, Variable Expenses, and Periodic Expenses.

4. Be honest when tracking down expenses.

By being honest with yourself, do not fool yourself into excluding some purchases. It’s all right to overspend sometimes it is because when you do, you will be able to determine what you should work on the next time. You may also like sheet examples in doc.

Weekly Expenses Tracking Sheet Example

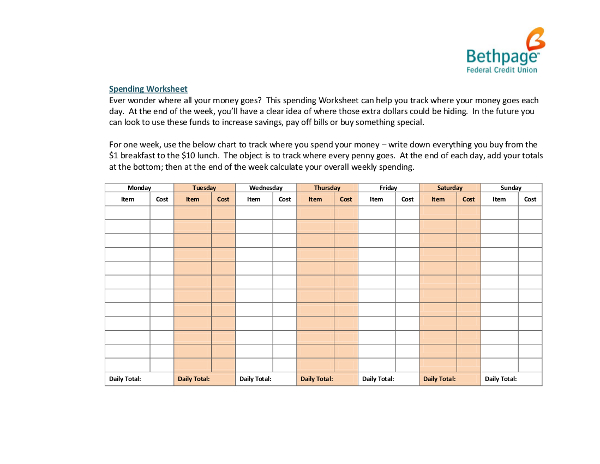

Spending Worksheet Example

Weekly Expense Tracking Sheet Example

Budget and Expense Sheet Example

Monthly Expense Tracking Sheet Example

Reasons Why You Should Track Your Expenses

If you still need a little more convincing for you to start tracking your expenses, here are some reasons why you really should start tracking your expenses starting now:

1. You will know where your money is going

Won’t it feel good when you would know where all your money goes? It makes you realize that you are spending too much money on irrelevant things. It is good to spend your money only on things that you need or value first. If you would not keep track where your money goes, there is a big possibility that you will be spent on useless things instead of putting it into your emergency fund or savings. You may also see Budget Sheet Examples

Do not ever make the mistake of living beyond your means because this is a ticket to your downfall. Debts can be a pretty heavy burden and once you acquire a lot of them, it will be quite difficult to carry such burden.

2. You will be forced to spend on your priorities

If you will track your expenses, it gives you the sense of accountability on where your money goes. You will then be motivated to focus on the things that you should prioritize instead of splurging your money on things that you can live without. You may also see Attendance Sheet Examples in PDF.

Tracking your expenses will enable you to keep temptations at bay because it will make you more aware of your priorities which could also be your responsibilities.

3. Your bad habits will be revealed to you

By tracking your expenses and finally knowing what you have been spending your money on, you will also discover your bad spending habits. But do not worry because your bad spending habits can definitely be worked on and corrected.

When you notice and accept the existence of your flaws, the easier it will be to deal with all those. Similar to acknowledging your spending habits, it will be easier to deal and correct it rather than keeping a blind eye on the reality that you have bad spending habits. You may also see fact sheet examples & samples.

In your future purchases, you will then make wise decisions because you will also become motivated by ending your bad spending habits.

4. You will be able to control your finances and your own self

Don’t you want your finances to be under control? Under YOUR control? You will be able to control where your money goes. If you are just starting out, things will be hard for you but there is an assurance that it will work out in the end.

Once you will be able to start controlling your finances it also means that you are capable of controlling your own self from doing irresponsible purchases. Even the simple act of tracking your expenses can already help you in disciplining yourself. Having self-discipline also means that you can already get rid of all your bad spending habits. You may also like assignment sheet examples & samples.

5. You will be able to reach your financial goals

Let’s talk about your goals, especially your financial goals— how bad do you want it? If you are not willing enough to start tracking your expenses then you are nowhere near to achieving your financial goals in life. Tracking your expenses can empower you to do more than what you could do.

If one of your financial goals is to save up a thousand dollars in a year, you can start achieving that goal by tracking your daily, monthly, and yearly expenses. You will be able to resist impulse shopping, it helps you cut all those purchases that you do not need in the first place, it keeps debt at bay that it can no longer give burden you, it helps you manage all of your finances, and most of all, it helps you focus on the endpoint and that is to reach your ultimate financial goal. You may also see sheet examples in pdf.

6. You will be able to stop stressing about money

No one likes to spend time stressing about money. Money is not even worth the stress. If you would be tracking your expenses, you would already know how much accountable you are to your own finances. You will no longer worry if you have enough money in the bank to pay the bills and all those debts will be eventually paid off plus, you will no longer incur more in the future. You can skip all the financial dramas because there is no need anymore for that. You may also check out reference sheet examples & samples.

Importance of Tracking Your Expenses

Tracking how you spend your money is actually the first step in fully understanding how you can manage and control your finances. It can get overwhelming during the first stages of your tracking but you will soon catch up in the long and in the long run, it will be worth it. You might be interested in bid sheet examples & samples.

Tracking your expenses can help you in having financial awareness. Through tracking your goals, you will be able to know where your money goes and where you spend your money on. You will then be able to discipline yourself and stop yourself from making irrelevant purchases. You may also see activity sheet examples & samples.

Tracking your expenses can also help you in addressing your unhealthy spending habits. If you can already track your expense, you might notice some of your expenses that are not important at all. And since you have already acknowledged it, it is then that you can end such habits. How can you end a habit that does not exist in the first place?

Tracking your expenses can help you when you are trying to create a budget and can also help you in sticking to it. One of the best feelings in the world is that you will be able to stick to your budget because it means that you were able to maintain self-discipline and self-control. These characteristics can help you in having and maintaining financial stability. You may also like medication sheet examples & samples.

We hope that this article has been of great help to you and your expense tracking. Have fun tracking your expenses!