10+ Variance Analysis Examples to Download

The literal meaning of variance is the quality of being different and divergent. And the analysis of variance or variance analysis refers to the study of the difference between the actual and expected or planned data in business. This calculation reads all the sales and profit details to gives a clear understanding of the business of a particular time. This accounting study can give you ideas on how the variance is impacting your financial management.

The two most important aspects of variance analysis are the sales budget and data and the actual budget data. When your sale budget is gained less than what has been expected to get due to the loss of some customers the difference between the two is required for variance analysis.

10+ Variance Analysis Examples

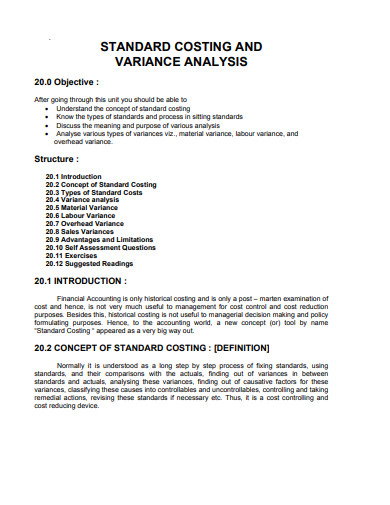

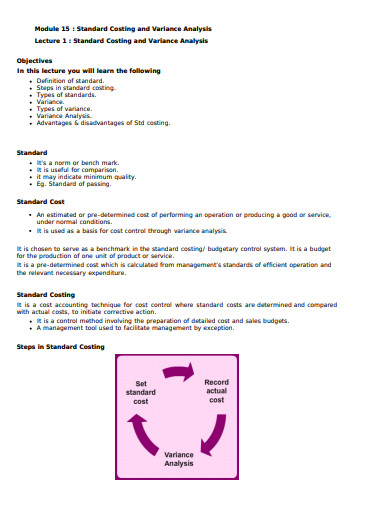

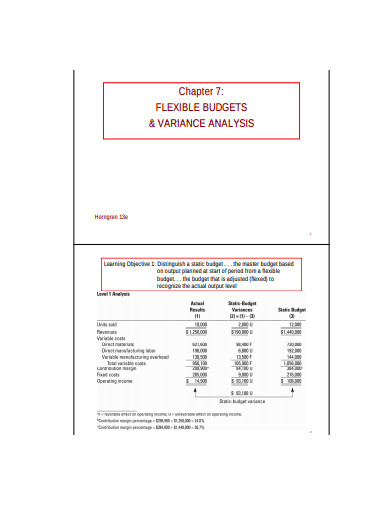

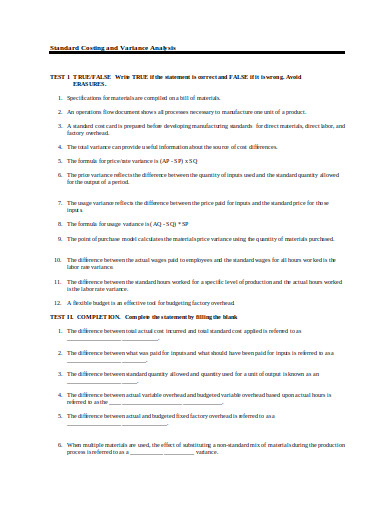

1. Standard Costing and Variance Analysis

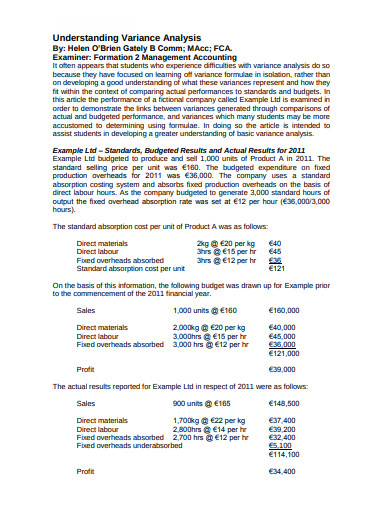

2. Understanding Variance Analysis Example

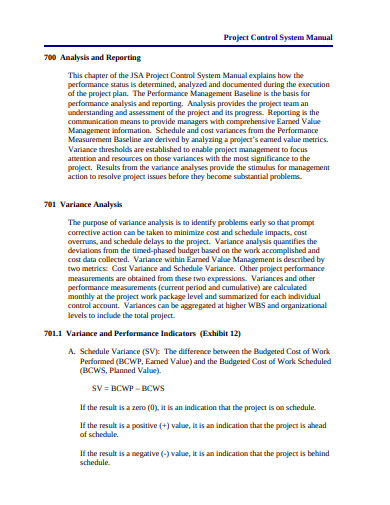

3. 700 Analysis and Reporting

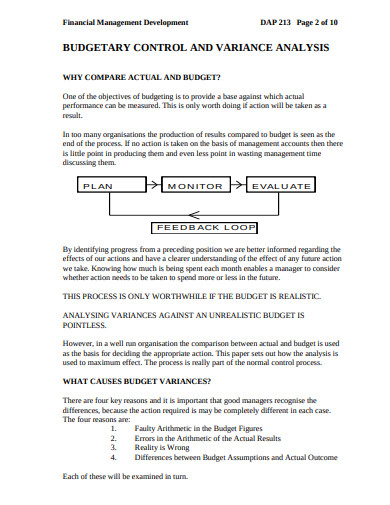

4. Budgetary Control and Variance Analysis

5. Standard Costing and Variance Analysis Example

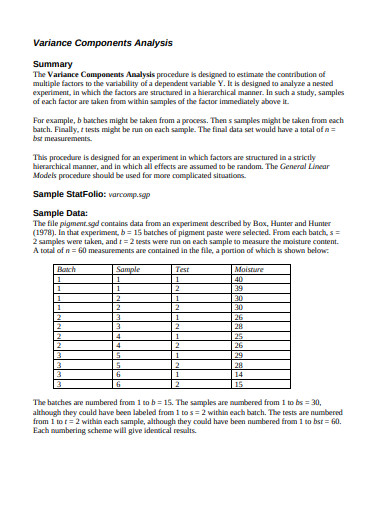

6. Variance Components Analysis

7. Multivariate Variance Components Analysis

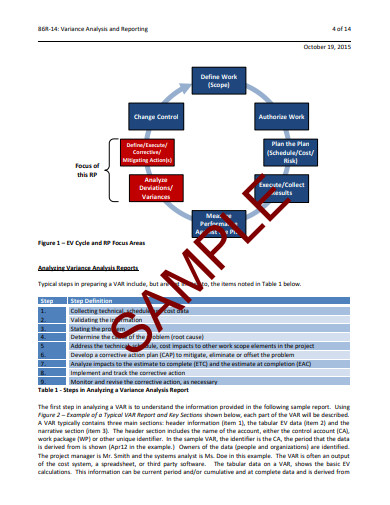

8. Sample Variance Analysis and Reporting

9. Fixable Budget and Variance Analysis

10. Product Variance Analysis Example

11. Standard Costing and Variance Analysis Questionnaire

What are the Different Types of Variances?

- Sales Quantity- The smallest aspect of the sales process.

- Sales Mix- Portion of the products sold especially during the change in the demand curve.

- Sales Price- A set price the products would be sold at.

- Raw Material Price- Actual cost of the raw material used in the production.

- Raw Material Usage- The number of raw materials used in production.

- Raw Material Mix- The cost of the standard raw material.

- Labor Rate- Price paid to the labors for their service in the production.

- Labor Efficiency- The time labor served the company during the production process.

- Fixed Overhead Expenditure- This counts the fixed liabilities for the production like, rent, machinery, etc.

- Variable Overhead Expenditure- Indirect charges.

What are the different Formulas of Variant Analysis?

- To calculate the purchase price variance, specify the actual price by deducting the standard cost and multiply it with the units.

-

To calculate the labour rate, but the actual amount paid to them deduct the standard cost and multiply it by the units used.

- To calculate the variable over spending, deduct the standard variable spendings according to each unit used from the actual price and multiply the rest balance by the total output units.

- Fixed overhead spending variance is the sum of fixed costs that exceed their standard cost on or before the reporting time.

- To calculate the selling budget variance, but the actual selling budget deduct the standard costs and multiply it by the units sold.

- To calculate the material budget variance, take the standard materials and costs in hand. Deduct the standard units of material from the actual budget and multiply the rest balance by the standard units.

- To calculate the labor efficiency variance, deduct the standard units of labor consumed from the actual budget and multiply the rest balance by the standard labor rate hourwise.

- To calculate fluctuating overhead efficiency variance, minus the budget units from the actual units and multiply the rest by the standard fluctuating overhead price unit wise.

What are the Reasons for Variance Analysis?

- A change in the business smoothness or marketing which raise the issues underrating of the stocks.

- Shortage in the supply of the raw materials for product production.

- If the planning of the budgeting goes wrong and the business looks unbalanced.

- Demand and supply services might not be reflecting the results as expected.

- Difference between actual ground condition and planned situations.

- If planning is done without any accurate basis.

What are the Importance and Limitations of Variance Analysis?

Importance-

- To avoid deviations or reduce a detailed long term business budget plan is required. and the variance analysis helps in making that budget planning efficiently.

- Variance planning also helps in a perfect management planning of the budgeting and smoothing the business functions.

- Variance analysis can give space to control and manage the high rates of deviations in the business.

- This process gives an idea about the reasons for and causes of certain business situations and it also helps to find out the ways how to avoid such negative situations.

- Variance analysis gives ideas about the efficiency level of different works. It can also help to assign a particular responsibility to a particular department according to the suiting conditions. By doing so you can have proper control over your business.

Limitations-

- The practice of variance analysis is a financial accounting post the marketing.

- The time gaps after the release may affect the remedial actions.

- All the data of variance analysis are not always available suitable for accounting structure.

- The deviation from the actual budget may take place if the budgeting is not done considering the analysis details of all the aspects.

- A badly framed budgeting exercise may make you liable to what you should not be.

Tips for Variance Analysis

1. Analysis means a detailed study or research so dig up to the bottoms of the details and situation you have faced in your study to know why certain variances took place.

2. Positive variances also might take place at a certain point in time so stay patient and react accordingly.

3. Understand the difference between the good and the bad variance as compared to your business requirements.