Retirement Planning Questionnaire Examples

The Internet is a wondrous learning resource, but it can also be a root of panic and anxiety. And financial advice from Internet articles will fit people like a medical consultation of signs and symptoms on WebMD would. “Set aside 10 percent of your paycheck. No, save 15 percent. Scratch that, go all-in with 25 percent.” The general idea of saving for the rainy days is there, but the rest of the advice is void of the notion that people don’t fit in a singular mold. Chances are, people following cookie-cutter financial help on the Internet may find themselves one day with only a few dollars left in their retirement fund, long after the last paycheck stopped coming.

[bb_toc content=”][bb_toc]

How much should I save?—The question of subsistence is core to your career as a financial planner. It is this worry that likely convinced your clients to seek for your help. It is a valid worry. How does one make sure that what he or she is setting aside is enough to support a comfortable life in the next 30 or so paycheck-less years? As long as we live, we still have to pay for food and the bills. Not to mention, we would have our own bucket lists for when we retire. A person’s life goals are tied to his or her financial capacity and the decisions he or she makes towards them.

Whether the person’s retirement goals involve a month-long cruise in the Bahamas, buying a mansion with the best view of the Californian sunset, or having enough money to spoil grandkids, a person’s finances will be crucial to making his or her dreams come true. Accounting for your clients’ life goals and evaluating their financial position from today until retirement is, in essence, retirement planning.

Retirement planning is a client-centric process that requires the use of questionnaires. We need to have a good picture of our clients’ goals and financial position. This requires knowledge of the persons’ assets and liabilities. We have to know who they are, what they have, what they want, and what it takes for them to get to where they want to be. In our strive to help our clients achieve financial stability and the aspired retirement life, we have to supplement our financial foresight with questionnaires. These documents will help us sketch and customize a person’s map towards their dream retirement.

Our Safety-Net Has Holes

Generally, there are three pillars of our retirement chest that hold up a person’s dream retirement. One, there are employers who provide their employees with retirement plans as a benefit for working in the company or institution. Two, people can also collect social security after contributing an amount per month of their working life. Then, there are the person’s personal savings and investments. When we take one away, we can still manage to live by with the remaining two, provided that these aren’t already crumbly on their own.

Suppose the retirement package offered by the company is only available after a certain length of service. Or the person lost this benefit after a certain incident. There are also cases when the institution does not offer such a package to its employees. That is one less pillar for that person. And what if the person failed to consistently give an amount for social security. Maybe, his or her current situation does not make it possible to contribute an amount every month. We can’t discount the possibility that the rules in the future might have changed, and social security is no longer accorded to the citizens of the state. Now, there is a lone pillar that keeps the retirement dream up. What if that can’t hold the weight of the dream?

The point is, the three safety-nets of retirement have that will provide people sustenance aren’t definite and certain. A person can’t be completely reliant on the first two, so he or she has to fortify the third: the savings and investments.

Should You Save More?

Given the scenario, does that mean that we should save more and more? If you’re a billionaire who can cash in more than enough for a person’s lifetime, that may be possible. But for people with a finite earnings every month, saving more than 50 percent of their paycheck can’t be done. They may still have to support the lifestyle of four other people under their roof. However, this doesn’t mean that they can’t have a comfortable retirement life. They still can, if they plan for it early on, and they consult the right people.

In answer to the question, the person should save more but only to the extent that they can. That is why retirement planning should be a conversation between a knowledgeable financial adviser and the client. The plan has to be tailored to the person’s goals and financial capacity, among others. And these factors are different from person to person.

4+ Retirement Planning Questionnaire Examples & Templates

The following are examples of retirement planning questionnaires that you can prepare before consulting with your clients.

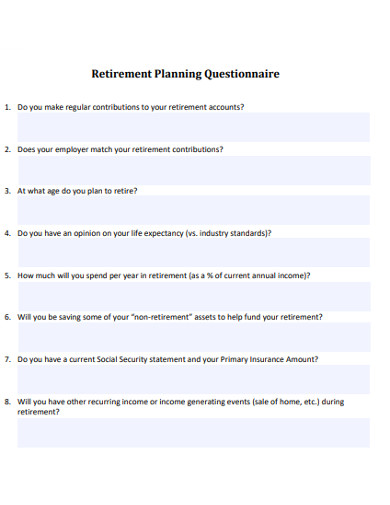

1. Sample Retirement Planning Questionnaire Example

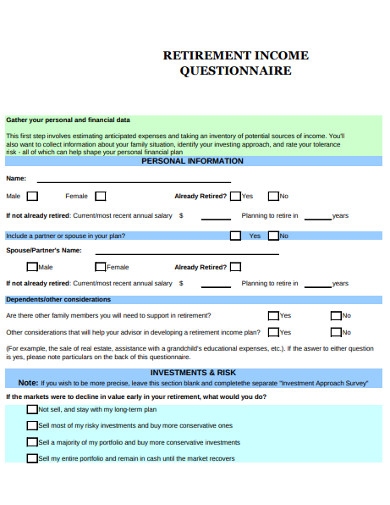

2. Retirement Income Planning Questionnaire Example

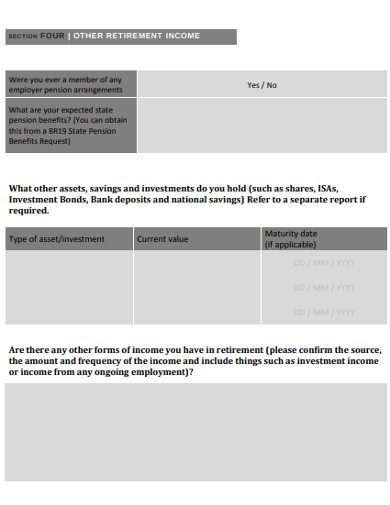

3. Basic Retirement Planning Questionnaire Example

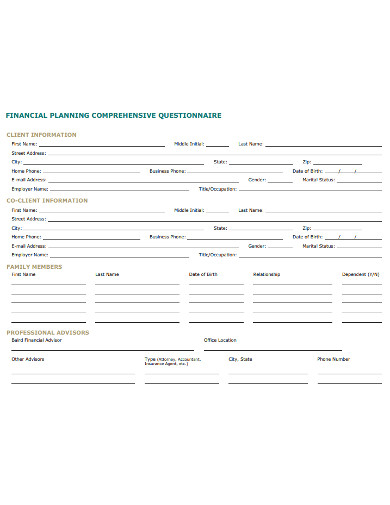

4. Retirement Financial Planning Questionnaire Example

Getting To Know Your Clients

Your client consultation itself may not always give you the necessary answers on how to prepare their financial roadmap. You should have given your clients a questionnaire that they can fill in before you meet them for a discussion on their future. An exhaustive questionnaire with all the important information will save you a lot of time and errors along the way. Although these documents can come in different forms, the good and useful ones are sewn from the same thread. Look through your questionnaire and see if it will yield the following details.

1. Who They Are

This page will answer who our clients are. Of course, we can discern a lot from our interactions with the clients. However, this is just a facet of our client’s profile. We have to know their goals and aspirations in life. And their profile will speak about this. Naturally, if they have a family, their goals might be centered around their family life. If they are diagnosed with a disease, these would affect their retirement goals. Your clients’ profile will influence their financial and retirement targets.

2. What They Have And Owe

The person’s property, possessions, and obligations will determine if his or her retirement dream is realistic and how it would take for him or her to achieve such a goal. The information will show how much of the person’s money can be set aside for retirement fund and how much investment risk is right for him or her. By assessing the person’s finances, you can also check how much should their retirement fund be to sustain their lifestyle.

3. What They Want

What kind of retirement does your client envision for himself or herself? Is it realistic for their financial place today? Although you think that it not the best part of your job, you might have to be the one who will perform a reality check for your clients. Remember, though, that what they want is not permanent. They may change their minds, or their situation may change in the future. Therefore, your estimates and plans should be responsive to such changes.

4. What They Need

From the information that you obtained from your interaction with the clients, can you design a financial roadmap for them? If you still can’t determine this, maybe your questionnaire should be improved or expounded. You should be able to identify how much they would need to save from their paycheck and invest in order to achieve their retirement dream. Although the future is riddled with uncertainty, the retirement plan should still save your clients from potential losses when they don’t have one.

People spend their days conforming to the monotony of a 9-to-5 job for the promise of a pleasant and peaceful retirement. They cling on to travel goals and bucket lists that they were sure they would do the moment they hand in that retirement letter. What some of us might have failed to consider is that if we don’t plan this stage of our lives early on, all the images of our dream retirement tucked in our Pinterest boards will just be images; an alternate reality that we can only wish for now. Unless we plan to still work on the side for a steady income, we should have saved enough to finance a comfortable life after the paycheck stops coming.