13+ Business Financial Plan Examples to Download

A business financial plan is a critical and crucial document for companies and different kinds of business establishments. Whether you are a small start-up or an established corporation, it is necessary for you to create a business financial plan as it can help you achieve your desired financial condition and other strategic objectives. The financial planning process will allow you to identify the key points of your financial needs as well as the ways on how you can let the organization realize its financial goals.

Financial Plan Template

Example Business Financial Plan Template

Micro Finance Business Plan Example

Financial Advisor Business Plan Example

Financial Plan for Start-Up Business Template

We listed a number of business financial plan templates and examples that you can use as document guides and references if you want to start creating your business’s own financial plan document. The examples available in this post can make it easier and faster for you to develop the format and discussion flow of your business plans.

Financial Plan Template Example

Financial Planning Template Guideline Example

Financial Planning for Small Businesses

Importance of a Well-Formulated Business Financial Plan

A financial adviser marketing plan can help you select the best financial adviser that you can work with so that you can better the financial standing of your business. However, having a professional help you is not enough to maintain the efficiency and effectiveness of your financial actions. One of the documents that you can use to sustain your financial processes is a business financial plan. This document can also help you a lot if you want to grow as a business in terms of your finances. A few of the reasons why it is important for you to have a well-formulated business financial plan include the following:

- Having a business financial plan at hand can help your organization determine and focus on your financial goals may they be short-term or long-term. Being able to identify your objectives and goals can help you to balance and look into all the elements and factors that can affect your financial growth as a business. You may also see annual plans.

- Creating a business financial plan can promote communication between different business departments. This can ensure the management that all the stakeholders who are involved in the implementation of the business financial plan are fully aware of their tasks and obligations. Through this, ownership of responsibilities can be established.

- Developing a business financial plan can help you better manage your corporate finances. Some companies are not that sure where to start when it comes to financial planning. Having a business financial plan can help you have an easier time when dealing with the factors and elements that are needed to be put together so you can come up with strategies and tactics aligned with your financial vision and ability to execute call to actions. You may also see event budget examples.

- Making a business financial plan can give your business an idea about the expertise and skills that you need to look for when executing your financial plan. However, you have to remember that working with experts should not start in the processes of implementation as you need professional opinion and guidance from the very beginning of your financial planning undertaking. You may also see advertising plans.

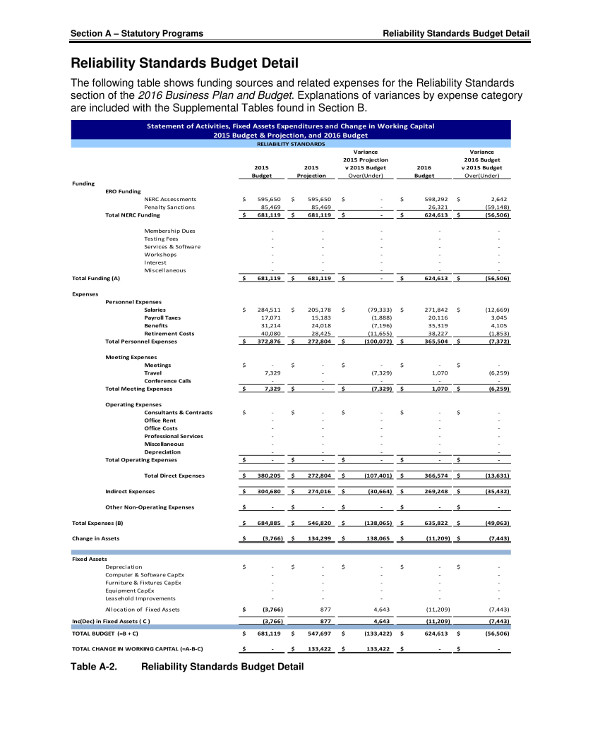

Financial Business Plan and Budget Example

Financial Plan Format Example

Steps in Making a Business Financial Plan

Bridging the gap between your current financial condition and your financial aspiration can be overwhelming and intimidating. This is why you need to be well-guided in the implementation of your action plans that involve your finances and how you use them for your business operations. Here are the steps that you can follow when developing a simple and basic business financial plan:

- Create a team of professionals that can help you make a business financial plan appropriately. It is important for you to work with people who can add value to the planning processes of your finances. List down all the deliverable that are needed for the financial planning of your business so you can identify the people who are fit for the job.

- Identify your corporate goals. The objectives of your business financial plan must be aligned with the things that you also would like to achieve as a business entity. Ensure that the vision of your business can be reflected in your business financial plan so that the successes of the document and its implementation can benefit the entire organization. You may also see company plan examples.

- Assess the current financial condition of your business. This can help you identify the financial processes and decisions that can either positively or negatively impact your business. This will allow you to retain the activities that work to your advantage and remove the processes that can only ruin the financial sustainability of the business. You may also see strategic plan examples.

- List down your strengths so you can resort to them whenever needed. More so, present all the weak spots of your financial condition so you can work on them. Knowing your strengths and weaknesses can help your business financial plan to discuss the opportunities that you can take and the threats that you need to look into and prepare for. You may also see network marketing business plan examples.

- Put together all the business financial plans that you would like to realize based on your goals and objectives. Focus on the concerns that you would like to address and the plan of actions that you want to execute for the betterment of the business. Create call to actions that can be achieved with the help of your workforce and other stakeholders. You may also see business plan executive summary examples.

- Develop an immediate plan that will allow you to know how you can budget or use your finances. You can create a short-term, medium-term, and long-term plan depending on the attainability level of your vision and the realistic implementation of your desired actions.

- Review the entire business financial plan and incorporate adjustments or any other changes when necessary. Develop and update the document as you progress in your business financial planning and action plan implementation so you can maintain its relevance. You may also see business plan outline examples.

Business Plan with Financial Updating and Forecasting Guide

Comprehensive Financial Plan for Business

Do You Really Need a Business Financial Plan?

Have you ever asked yourself on why a business financial plan is still used nowadays in various industries even if businesses can resort to the usage of other documents and/or processes when evaluating their financial decisions? The underlying reason behind this is most likely the effectiveness of the document which can be observed in the improvement of a company’s financial condition. Listed below are some of the reasons why it is essential for you to come up with a business financial plan:

- A business financial plan can allow you to list down all the realistic and measurable call to actions that your business can follow. Developing a document that can make it easier for you to implement the things that are necessary for the achievement of your financial goals can positively impact your business and the way it functions as a corporate entity. You may also see importance of business plan examples.

- A business financial plan can make you become more aware of the current financial status of your business and the analysis of your current condition as a corporate entity in terms of your finances. Moreover, it can give you an idea on where your money is going and whether you are efficient enough when it comes to allocating, using, and saving your financial resources. Understanding the flow of money within your business can make it more efficient for you to think of ways on how you can maximize the amount that you spend for particular undertakings. You may also see bar business plan examples.

- A business financial plan showcases the direction that you can follow so you can take care of your financial future. It is crucial for you to have a document that can serve as your guide whenever you execute action steps involving the finances of your business. Mapping your financial plan can make your business operations become more sustainable which in turn can allow you to better your professional relationships with your stakeholders. You may also see market analysis business plan examples.

- A business financial plan can teach you what you should know about financial analysis for small business plans and even for bigger-scale business planning documents. With the presence of this document, you can make sure that there is a proper assessment of your financial actions, strategies, tactics, and plans. This can help you execute necessary adjustments so that you can potentially reach your goals and objectives as well as realize your financial vision for the organization.

Financial Planning and Business Management Discussion Example

Business Planning and Financial Forecasting Start-Up

Business Financial Planning Example

Tips in Making a Business Financial Plan

As a business document, a financial plan promotes awareness of your current corporate financial condition while ensuring that the gathered information can be used to improve the financial standing of the business. This document deals with the programs and activities that are needed for financial growth as well as the resources that the business needs to execute its action plans. A few of the tips that can help you make a highly functional business financial plan include the following:

- Establish a goal and a purpose. Your business financial plan should be guided by a vision so you can make sure that you will develop a relevant and measurable plan for your organization. It is important for you to be aware of what you would like to achieve so you can be focused with the things that you need to prioritize. You may also see hotel operational business plan examples.

- Just like when creating a financial consulting business plan, you need to give importance to the clarity of your discussion within a business financial plan. Create an understandable and organized document that contains an in-depth discussion of your financial condition, goals, and plans.

- Be aware of the factors that can affect the effective usage of your business financial plan as well as the elements that are needed to be present and at hand so that your business can achieve its organizational and financial objectives. You have to study the different areas of the business and the trends that are present in various financial reports so you can thoroughly identify how particular activities impact your profitability and financial sustainability. You may also see implementation plan examples.

- Properly set the timeline of your business financial plan. For your goals to be attainable, you need to ensure that the time frame that you will follow is feasible. Knowing the time duration for each plan of action as well as the dates where milestones must be achieved and/or results are expected to show up can help you assess the success of your business financial plan accordingly. You may also see risk plan examples.

- Remember that business financial planning is a continuous process. You have to ensure that you will not just look into the output that you would like to have. You need to work in all the phases or areas of your business’s financial planning processes so you can ensure that you can come up with a useful document. You may also see bookkeeping business plan examples.

- Identify the financial barriers and hindrances for growth that the business is currently facing. In this way, you can also list down different activities and programs that can help you be prepared when facing risks and threats. Knowing the things that stop your business from growing financially can also make it easier for you to implement counteractions in a timely manner. You may also see lawn care business plan examples.

If you do not know where to start when making a business financial plan, make sure to check out the examples that we have provided you with in this post. Browse through these examples and identify the ones that you can use as your content and formatting guides so you can develop a business financial plan with ease. You may also see network marketing business plan examples.