9+ Financial Health Analysis Examples to Download

If you are running a business for quite some time now, you must have known that you must constantly check on the financial health of your business; otherwise, the money, effort, and time you spent on it would be meaningless. You must see to it that the company is running well, there is an improvement to your operations, there is a constant and timely upgrade in your system, and you are confident that your business will get through to the inflation and deflation in the economy. These are just some things that you need to be aware of in your business. You must constantly examine the stand of your business for you to stay on top of the market. But how can you check whether your business is running well or not? What would be the basis for your analysis? In this article, we will discuss everything about the analysis of your financial health.

Additionally, presented in the next section are examples of financial health analysis.

Adidas AG Financial Health Analysis Example

Financial Condition and Health Analysis Example

Financial Health Analysis and Business Valuation Example

What Is Financial Analysis?

This refers to the assessment of the viability, stability, and profitability of a business and the process of identifying financial strengths and weaknesses of the firm through a careful and systematic examination of the items in the balance sheet and income statement. It also pertains to the examination and assessment of a business from different perspectives to understand the overall stand or financial situation of the business.

Financial analysis is performed by professionals who prepare reports through the information taken from financial statements and other reports. The reports are then presented to the top management or any other key personnel for it to be used as a basis in making business decisions. The decisions may be about the things concerning the following:

- Investing or lending capital

- Make or buy certain materials to be used for manufacturing

- Buy or rent or lease equipment and machinery for the production of goods

- Invest or lend a capital

- Negotiate for a bank loan to increase the company’s working capital and to issue stocks

- Continue or discontinue the business

You Are Considered Financially Healthy When You…

- Plan ahead for expenses

- Pay bills on time and in full

- Have sufficient expenses in liquid savings

- Have long-term savings

- Have long-term assets

- Spend less than your income

- Have appropriate insurance

- Have a prime credit score

Elements Assessed in a Financial Analysis

There are certain areas in the financial statement that are focused in the assessment of its financial health. These areas are the usual items that would change in case of a change in the company’s operations. Knowing these would help the company know which areas are their weaknesses and which areas need improvements.

The elements to be assessed in a financial analysis are as follows:

- Profitability. This pertains to the ability of the company to earn income and sustain growth in both the short- and long-term business transactions. Usually, this is based on the income statement which presents the company’s results of operations. The income statement reports the sales, cost of sales, expenses, taxes, insurances, and the net profit of the company.

- Solvency. This refers to the ability of the company to pay its obligation to creditors and other third parties in the long-term. Typically, this is based on the company’s balance sheet which presents the financial condition of a business at a given point of time. The balance sheet contains the list of all the assets, current and non-current, and their totals, all its liabilities, current and non-current, and their totals, as well the items contained in the equity.

- Liquidity. This relates to the ability of the company to maintain a positive cash flow, while satisfying immediate obligations. Commonly, this is based on the company’s balance sheet which indicates the financial condition of a business at a given point of time and the company’s cash flow which presents the company’s status with regard to the company’s cash transaction in their operating, financing, and investing activities.

- Stability. This pertains to the ability of the company to remain in business in the long run, without having to sustain significant losses in the conduct of its business. This can be measured through their balance sheet specifically in their investment and turnover such as receivable turnover, inventory turnover, and sales turnover.

Financial Health Analysis Sample Report Example

Government Financial Health Analysis Example

Hong Kong Corporations Financial Health Analysis Example

Users of Financial Statement Analysis

There are a lot of people who need the information from the financial statement analysis for this may affect their decisions toward their dealings with the company. These users can be categorized as follows:

- Management. Primarily, the management is concerned with the information in the financial statement analysis for this is their basis in making sound business decisions. The company controller prepares an analysis of the company’s financial results other than those that are presented to the general public.

- Creditors. The creditors of the company are also interested in the company’s ability to pay back the debt; hence, they will focus on analyzing the cash flow of the company.

- Investors. The investors of the company, both current and prospective, would like to examine financial statements to know more about a company’s ability to continue issuing dividends or to generate cash flow.

- Regulatory authorities. The financial statements of a company are examined by the Securities and Exchange Commission if it is publicly held to see if it conforms to the accounting standards.

Types of Financial Statement Analysis

Horizontal and Vertical Analysis

Also referred to as trend analysis, horizontal analysis is the comparison of financial information over a series of reporting periods, allowing you to see how each item has changed in relationship to the changes in other items. Horizontal analysis is also referred to as trend analysis.

On the other hand, vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item, in which typically, the sales item is 100% and all others are a certain percentage based on sales. Hence, vertical analysis is the review of the proportion of accounts to each other within a single period.

Ratio Analysis

Another method for analyzing financial statements is the use of many kinds of ratios to calculate the relative size of one number in relation to another and then compare it to the same ratio calculated for a prior period or those that are based on an industry average. This is to see if the company is performing in accordance with expectations.

Importance of Financial Statement Analysis

Decisions and Plans

Financial statement analysis is useful in making economic decision formulating plans and policies for the future. It is needed by the management of the company in order to evaluate its performance and effectiveness of their action to realize the company’s goal in the past.

Holding of Share

Moreover, financial statement analysis is also useful for shareholders in their decisions whether they have to continue with the holdings of the company’s share or sell them out.

Extension of Credit

In order to make decisions as to whether they would extend their loans to the company or demand for higher rates, the creditors would need the information provided through financial statement analysis.

Investment Decision

Current investors need the result of the financial statement analysis in order to make a decision to continue their investment in the company or remove their share from the company. This is also useful for prospective investors in their decision whether or not to invest their capital in the company’s share or not.

Problems with Financial Statement Analysis

There are several issues that you must be aware of that may interfere with your interpretation of the analysis results. These include but are not limited to the following:

- Comparability between periods. The company may have changed the accounts in which it stores financial information, so the results may differ from period to period.

- Comparability between companies. In comparing with other companies, each of the companies may aggregate financial information differently, so the results of their ratios are not really comparable, incorrect conclusions may be drawn.

- Operational information. Other key indicators of future performance might not be seen such as the size of the order backlog or changes in warranty claims because it is only concerned about the company’s financial information, not operational information.

Local Government Financial Health Analysis Example

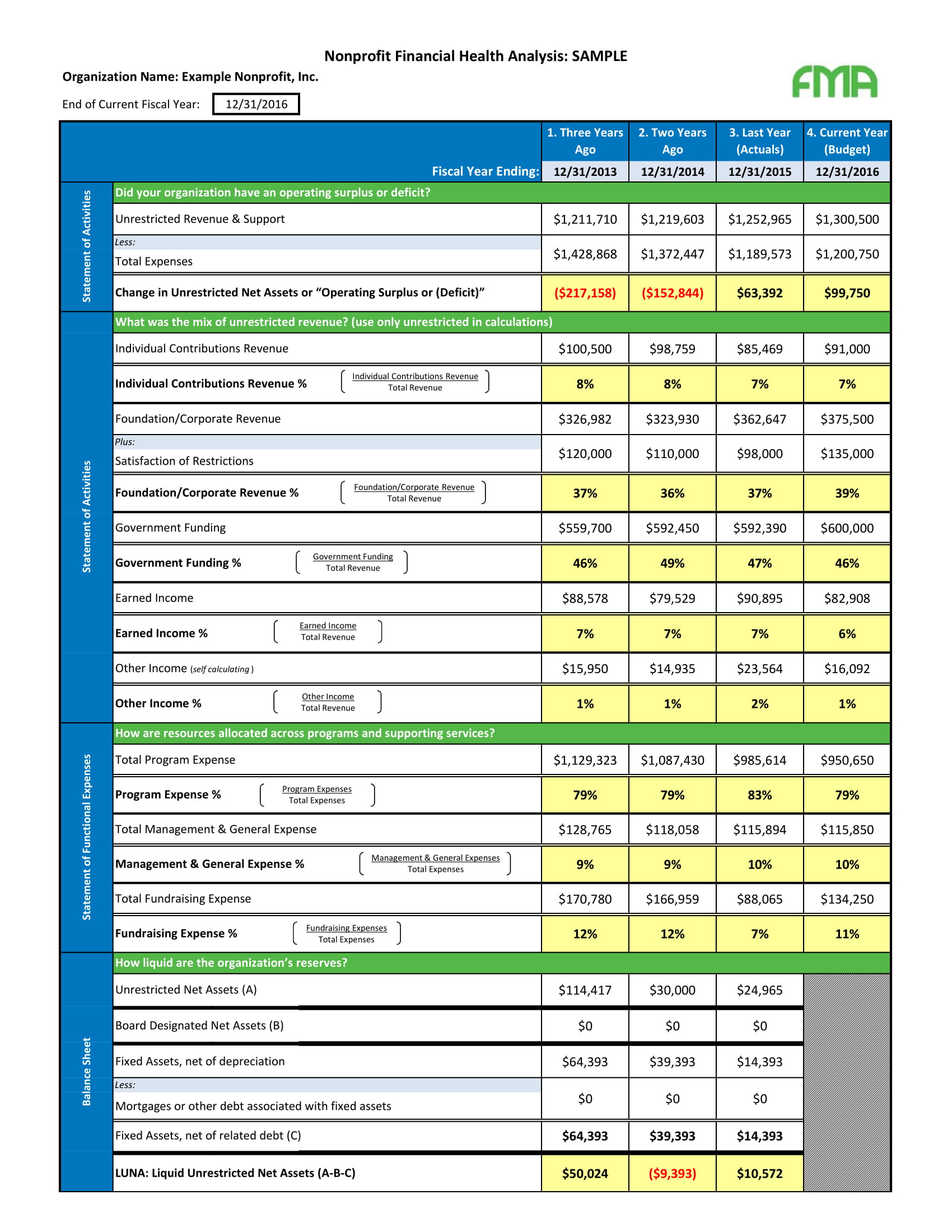

Nonprofit Financial Health Analysis Example

Small Business Financial Health Analysis Example

University of Illinois Financial Health Analysis Example

Limitations of Financial Statement Analysis

Financial statement analysis is indeed important in obtaining relevant information that is useful for making economic decisions and formulating plans. However, there are certain limitations of this analysis, and they are as follows:

- Misleading to the user. Financial statement analysis may mislead the user if there is an error in the preparation of the financial statement. This is because the accuracy of financial information largely depends on how accurately financial statements are prepared.

- Not useful for planning. Financial statements are prepared by using historical financial data. So, if the previous situation does not prevail, the information may not useful for planning.

- Only quantitative information. Financial statement analysis provides only quantitative information about the company’s financial affairs and not the qualitative information such as management labor relation, customer’s satisfaction, and management’s skills which are also equally important in making decisions.

- Comparison not possible. Inflation may distort the view presented by the financial statement of different years; hence, comparison may not be possible. The financial statements are based on historical data. Therefore comparative analysis of financial statements of different years cannot be done as inflation distorts the view presented by the statements of different years.

- Incorrect judgment. The assessment of biased or unskilled analyst may lead to incorrect judgment and conclusion.

Quick Recap

Financial health analysis is important in a business in order to assess the financial situation of a company through its financial statement and other reports. The elements to be assessed in a financial analysis are profitability, solvency, liquidity, and stability.

Financial statement analysis is intended for various users such as the management, creditors, investors, and regulatory authorities for the analysis would give information and is important in making decisions and plans, extension of credits, investment decisions, and many others. The type of analysis can be horizontal and/or vertical or ratio analysis.

Although there are few problems and limitations with regard to financial analysis, this can still be helpful especially in the decision-making of the company.