14+ Investment Memo Examples

The sustainability of some businesses, most especially start-ups, relies heavily on the investments made by wealthy companies or venture capital firms. The financial resources that have been provided to selected emerging companies are also referred to as by the investors. This means that there is a high potential that these investors can buy their funded businesses if the current owners can no longer keep up with the growth.

If you turn the process upside down, it is clear that the deal is nothing but benefits for the shareholders, employees, and entrepreneurs. However, any investment or acquisition must be made right after the acknowledgment of a memorandum for due diligence. Know more about the document by looking at our Free 14+ Investment Memo Examples in PDF, Microsoft Word, Google Docs, and Apple Pages file formats!

14+ Investment Memo Examples

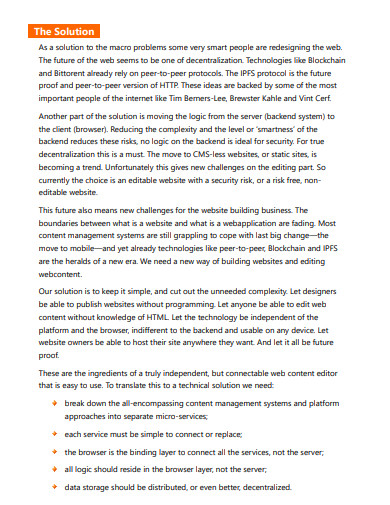

1. Investment Memo Example

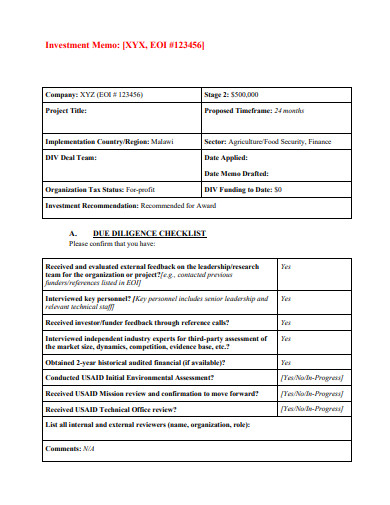

2. Private Equity Investment Memo

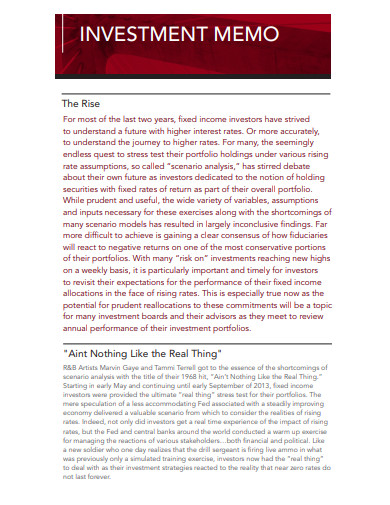

3. Investment Committee Memo

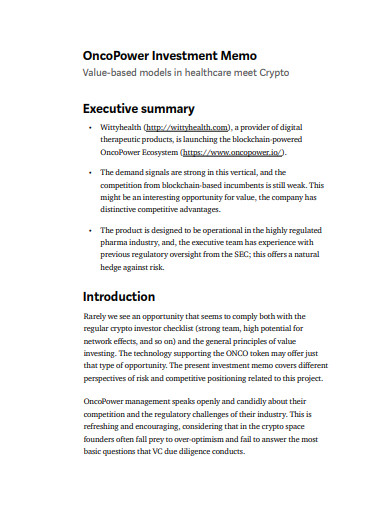

4. Investment Memorandum

5. Investment Memo Example

6. Private Equity Investment Memo Example

7. Internal Investment Memo

8. Investment Committee Memo Example

9. Business Investment Memo

10. Logistics Investment Memo

11. Basic Investment Memo

12. Formal Investment Memo

13. Retail Investment Memo

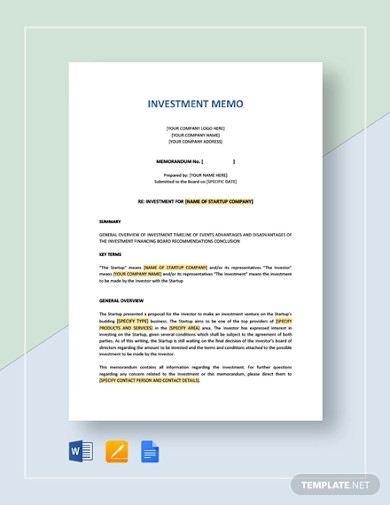

14. Professional Investment Memo

15. Printable Investment Memo

What Is an Investment Memo?

An investment memo is a legalized document that contains a summary of an investment plan. It can either be presented by strapped or start-up companies to potential investors or the other way around. The memorandum covers areas that give off detailed overviews of the parties’ businesses or organizations, as well as the planned underwriting. In the blog site, NextView Blog, David Beisel outlines the purposes of the investment memo into two. First, it sharpens the decision-making capability of the investors by identifying and describing the key components of investing and applying it to the factors that target companies present. Second, it records all the important points that influence the made decision, making it a good reference in future actions.

Ways of the Rich

American business executive and writer, Jack Welch, once gave entrepreneurs important reminders that go, “Number one, cash is king. Number two, communicate. Number three, buy or bury the competition.” It is as bad as it sounds. However, many of the wealthy individuals and organizations live up to the quote’s thought and get wealthier. If you try to reflect on the quote, it is as if you are reading the metaphorical description of private equity investments. The said funding has two investment strategies, namely the leveraged buyouts and venture capital.

The former strategy talks about the presenting of the investor’s money as debt that can only be paid by the target company’s operations and assets. Venture capital refers to the targeting of needy companies in a growing industry. If the target company shows a high potential of becoming big, it will be offered help through the investment. As the target business shows consistency in recovering and growing, so is the money invested.

How To Create an Investment Memo

Investments have become prevalent in today’s generation, especially to younger adults. In line with that, investors who fall under the adult and adolescent age categories have very little knowledge about investment memos, particularly about the advantages they bring and how to make one. To help you create such a document, we have prepared thorough guidelines below.

1. State the Goals and Objectives

Begin your investment memo by stating the main point of creating it. Back it up with the alignment of your technical objectives of its corresponding activities. Whether you are appealing to a target company or to an investor, sharing what your intentions give the recipients ideas about what the subsequent details will be. Thus, it helps the recipient prepare relevant questions about one’s company or investment portfolio.

2. Provide Portfolio

If you are an investor, you have to present your investment history to the representatives of your target company. This will help them decide whether or not your company can suffice their long-term financial necessities. If you are a company representative who is looking for an investor, then your portfolio must consist of your latest financial statements, as well as specifics that prove your company’s viability.

3. Define Potential Risks

Do not be afraid of giving out the potential risks of your investment offer. Every professional already knows that there are risks in investing, and failure to present one may bring up doubts about your motives. Identifying the risks clearly helps them prepare for what challenges they will be up against. Consequently, both of you can develop strategies via financial risk management to make sure that the chances of those risks from happening are low.

4. Set Terms and Conditions

Once your target starts taking an interest in your propositions even with the risks, don’t waste time and set your terms and conditions straight away! This section should highlight the legal structure that both of you will be adopting, fees, financial assumptions, and dispute resolutions.

5. Review and Polish

Once everything is set and done, always take time to double-check if there are any errors. Technical writing is a little bit tricky, so make sure to keep your eyes wide open. Finally, end your memo by eliminating the mistakes.

FAQs

1. Are investment memorandums required when investing?

Investment memorandums are required for expert investors who are under private placement deals. Expert investors know very well how these documents can help in their due diligence.

2. What are the best private equity firms in the United States?

As of November 2019, Eric Rosenberg listed The Blackstone Group, The Carlyle Group, Kohlberg Kravis Roberts, TPG Capital, and Apollo Global Management as the top five private equity firms in the United States, respective from the highest rank to the lower ranks.

3. Is investing better than saving?

Investing is way better than saving. When saving, you only set your money aside for future usage. While when investing, you provide your money to reliable entities for it to grow as time passes. Though investing is riskier than saving, the money grows multiple folds if managed properly.

A large amount of money is at stake when an individual decides to engage in investment. This is the very reason why that specific individual should obtain the right references, particularly an investment memo, that guide their decisions to the more profitable path. Moreover, the document is not only for investors but also for investor-seekers, as well, for them to present their current portfolio in a structured and formal way. Therefore, such a document is essential in the aspects of investment analysis and portfolio management.