8+ Printable Checkbook Register Examples to Download

In the simplest definition, a checkbook register records all of the financial transactions of an individual, an organization, or a corporate entity. It is a personal record of all the withdrawals and deposits that occurred within a certain span of time in a particular checking account. You may also see slip templates & examples.

Keeping a good checkbook account will help you identify where your funds were spent, which can also help you identify should there be any miscalculation that a bank commits.

A checkbook register is an informal tool that you can use to monitor the exact number of checks you wrote and the money that each one held so that you can determine how much money is left in your account. It is a helpful tool in balancing your expenses and keep your finances at a minimum. You may also like salary slip examples.

It works like a journal but instead of recording your day-to-day activities, you list down your expenses instead.

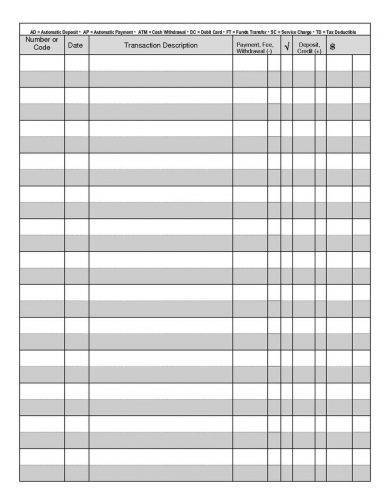

A checkbook register is also known as a check ledger or a transaction register. For business settings, the company’s bookkeepers are usually the ones who record the transactions in the checkbook register before transferring the data into the general ledger and other ledgers that may be associated with the transaction. You may also check out exit slip examples.

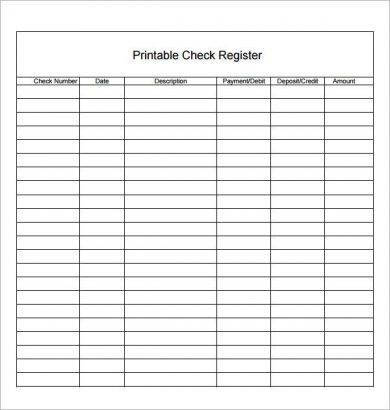

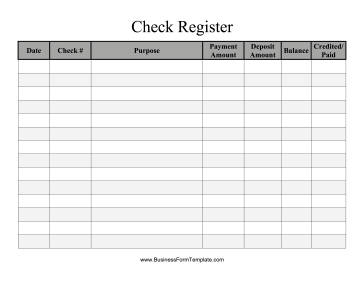

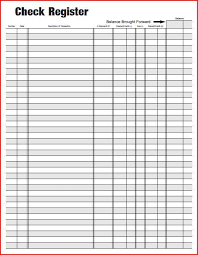

Plain Printable Checkbook Register Example

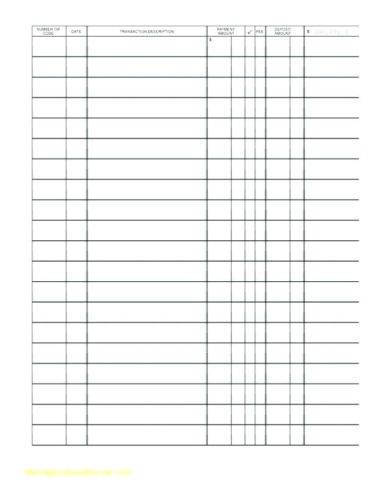

Blank Checkbook Register Template

Printable Checkbook Register Template

Importance of Keeping a Checkbook Register

Checkbook registers are not exactly the most popular tools nowadays. In fact, it’s possible that a lot of people don’t know how to use one. With the emergence of so many online applications and mobile banking as an option, checkbook registers are, sadly, as with so many other things, now a thing of the past. However, here are a couple of reasons why we must not abandon the service of a good old checkbook:

Keeping a checkbook helps you monitor your bank.

By doing your own calculation of the money in your personal account, you can rest assured that you are not losing even a penny to mistakes that your bank could make. Irregardless of how reliable and trustworthy your bank is, they are bound to commit an error at some point. If they do, you can easily correct them since you have kept your own records as well.

Banks only give their customers at least 60 days to catch a banking error, if there is one. If you regularly balance your account, this won’t be an issue. If you don’t, well, you can just say goodbye to the money you’ve lost out of sheer miscalculation.

To keep your overdraft fees at a minimum.

Overdrafts can be quite costly. They can reach up to $25 for every transaction. By keeping a checkbook register, you will be kept informed of the present amount that your account currently holds so that you will not spend more than you have.

It is a strong reference should problems arise.

If ever you face a banking discrepancy, you may not always be able to effectively pinpoint the problem, especially if you have not balanced your checkbook for a couple of months, or ever. So it will make the investigation of the problem a little more difficult since you wouldn’t know exactly where to start.

If you keep a checkbook, not to mention a well-maintained one, you can easily recognize where the inconsistency began since you have kept a record of that month’s transactions. Once you determined its roots, it will be easier for the bank to amend the mistake.

Even your favorite stores make mistakes too.

We can only rely on an establishment’s work integrity to be confident that they are honest with their customers. But, even so, we must still not be overly dependent on that since they may make mistakes too. By keeping a checkbook register, you can verify that the amount you have been charged with for a product you have purchased or a service that has been rendered is according to your expectations.

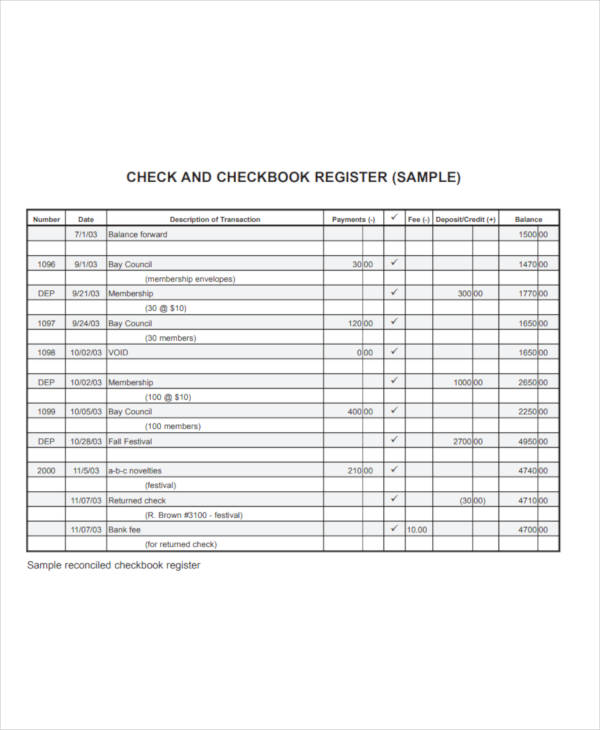

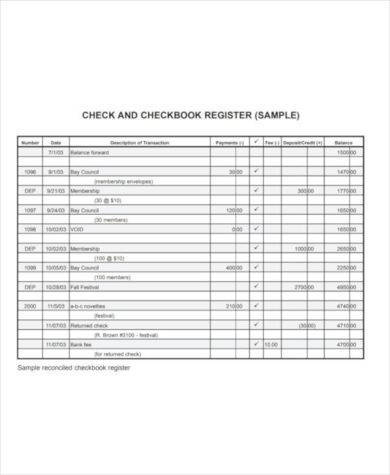

Large Check Register Sample

There is always the chance of fraudulent activities.

You may already be aware of the many, many payment options that are now within our reach. We have debit cards, online banking, and ATM withdrawals. The ways in which we can spend money has gravely increased, and, although this is an infinitely good thing, it also brings so many disadvantages with it.

For one, having different payment methods could also increase the opportunity of hacking into one of your accounts and stealing your identity. By keeping track of your expenses through a checkbook register, you can easily recognize any strange activity in your account, such as a purchase you didn’t make, or a withdrawal you didn’t do.

It can help you budget.

Of course, since you are continually keeping track of your expenses and the amount of money that is currently in your account, you can have a better grasp of your current balance so that you can control your cash flow and minimize your expenses.

Instead of simply spending money as if you have an unlimited yearly supply of it, you can regulate your spending to maximize your money longer, and for more important purchases. Analyzing your income and expenses is the key to proper budgeting and a checkbook register is your best hope for that.

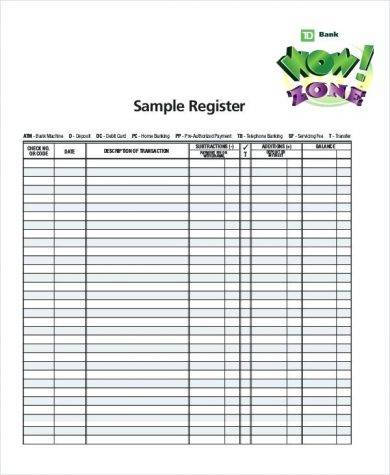

Checkbook Register Format

Sample Checkbook Register

Parts of a Checkbook Register

Another great thing about this financial tool is that you can create one yourself (or print out from the great examples we’ve posted along with this article). It’s completely free and you can personalize it to your heart’s content.

So if you’ve already been convinced of the absolute necessity of this particular device and decide that you want to create one for yourself, let us discuss the columns that every basic checkbook register contains.

- Date. You should fill this column with the exact date when you made the transactions. These transactions may be in the form of a withdrawal, a transfer, a purchase, and basically anything that happens that involves your account.

- Description. A little side note where you will have to describe what you bought or deposited, etc., so that you can recall it in the future. If you really want to keep track of your spending, it will help to be annoyingly specific.

- Debit or Withdrawal. You should create a separate column specially for the transactions that involve money coming out of your account.

- Credit or Deposit. These are the transactions that involve money being deposited into your account. There should also be a separate column for it.

- Balance. To help you keep track of the dwindling or adding of your balance, create a separate section where you can update the current amount in your account after every spending or deposit.

Just five easy columns to fill. You see, keeping a checkbook register is not as difficult as you may have initially thought. Yes, it can be a little wearisome since you have to update it after every transaction, but if you look at the bigger picture, the benefits that you will reap for exerting this little effort can help you go a long way in making sure that your money is safe.

Sample Checkbook Register

What Is the Most Common Mistake When Keeping a Checkbook?

This one’s a no-brainer. The most common mistake that people who keep checkbooks make is forgetting to record every single transaction at the time it happens, or at least not more than a day later. It’s silly since, if you think about it, there’s nothing difficult about the act. And it probably wouldn’t take more than a few minutes. But we still fail to do it regularly.

If you simply keep your money inside your account, then we really don’t have any problems here. But if you spend them, and end up with a low balance at the end of the month, then you should be motivated enough to keep track of how much money you actually have.

Once your bank statement comes in, you can compare it to your checkbook register to look for faults in the calculations. But if this is just too much work for you, you can just trust that the bank will not make any errors in computing your money and leave the rest to the wind. If you are a cynic, which, in terms of money, you should be, keep a record of your financial activities for your own peace of mind.

Simple Checkbook Register

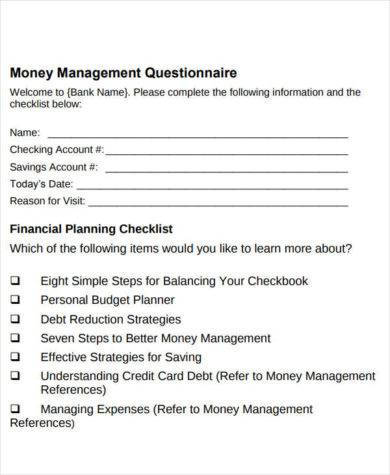

Financial Planning Check List for Checkbook

When Should You Use Your Checkbook Register?

- For every transaction or, at least, those you are aware of.

- When you write a check.

- When you use your debit card (but still don’t forget to keep the receipt).

- Every time you get a bank statement.

- When you pay bank fees.

- When you pay interests.

- Even for automatic transactions, such as the depositing of your paycheck into your account or the bills that your account automatically pays.

If you’ve had problems with insufficient funds or inadequacies in the past, the more often you should check and update your checkbook register.