6+ Quantitative Analysis Examples to Download

Quantitative analysis is the process of using math and statistical methods in order to evaluate investments and other business opportunities in order to make decisions. It works by offering a mathematical approach for determining when to buy or sell certain securities. You may also see business analysis examples.

For example, you have considered whether to purchase shares of ABC Company. Performing quantitative analysis to help you arrive at a final decision would mean that you will be calculating the company’s cost of the capital percentage change in sales over time, or examine trends in their net income as a percentage of sales or other ratios. This objective, not to mention technical, perspective are the telltale signs of the use of quantitative analysis. You may also see analysis examples.

Quantitative Risk Analysis Example

5 Stages of Quantitative Data Analysis

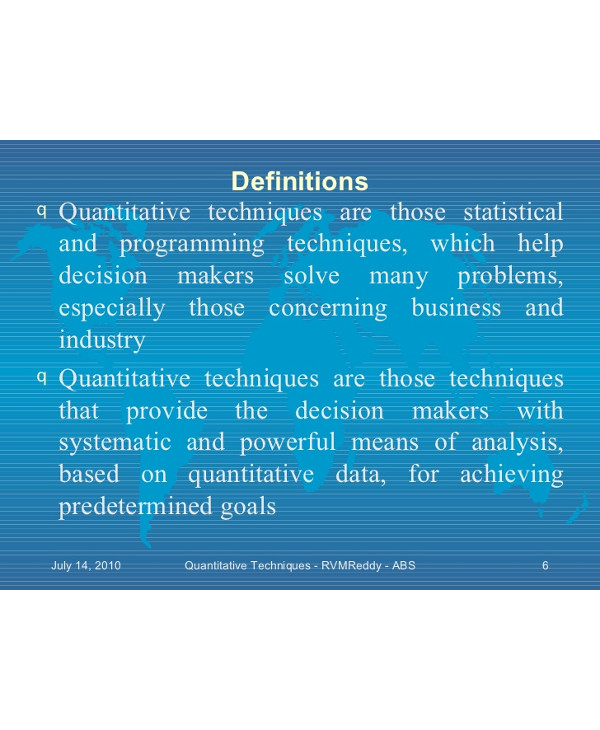

Understanding Quantitative Techniques

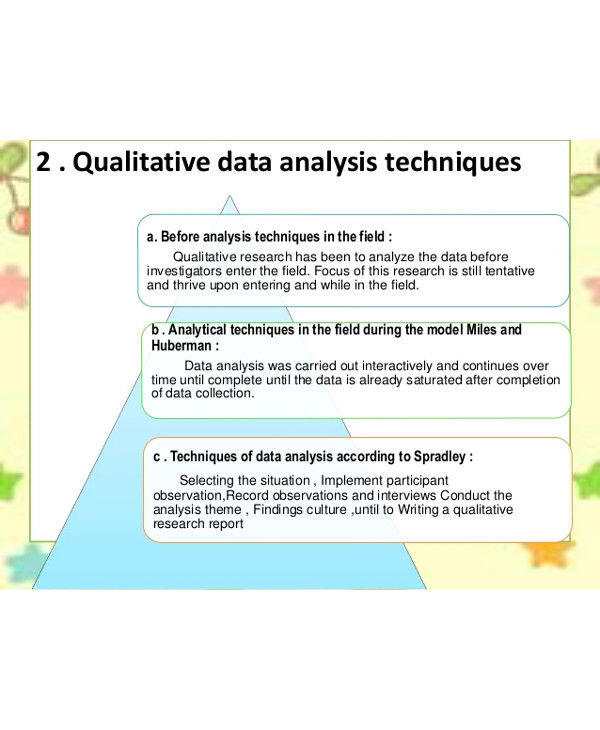

Qualitative Data Analysis Technique

Quantitative analysis is a mathematical and statistical method of studying behavior and predicting certain outcomes that investors use in their decision-making process. By using financial research and analysis, quantitative analysis seeks to assess every investment opportunity, as well as try to estimate a change in macroeconomic value. You may also see literacy analysis examples.

Quantitative analysis is the foundation of many investments and financial decision-making methods. Sound business judgment will inevitably involve a combination of analytical methods. Without it, many important factors may remain unseen, thus resulting in making decisions that will not produce positive results for you. You may also see risk analysis examples.

Using the Quantitative Analysis

By using complex financial and statistical models, quantitative analysis can objectively quantify business data and determine the effects of a decision on the business operations. This approach will follow patterns and strategies of high-frequency trading in order to identify the correlation between the variables present to be able to determine if an investment will truly be worth it. You may also see data analysis examples.

In an industry where every tiny decision will have massive repercussions, and where every wrong move will mean massive financial consequences, the ability to somehow predict and foresee the products of a future investment is an indispensable skill that can save its user from many regrettable choices. You may also check out here earned value analysis examples.

Quantitative analysis, at the end of the day, is an economic tool that is used by management and investors in analyzing financial events and making investments and business decisions. Due to its objective approach using only reliable data, it is a trustworthy partner for any businessman who seeks to grow in the industry. You may also check out here functional behavioral analysis examples.

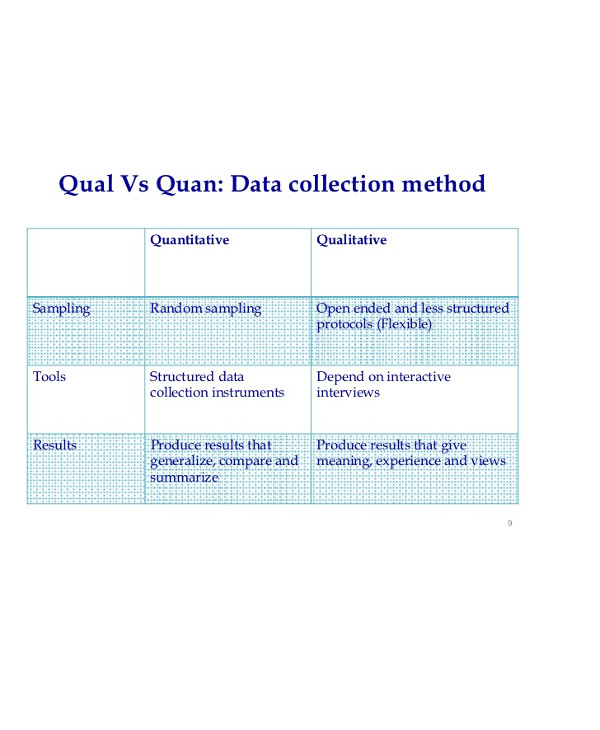

Quantitative vs. Qualitative Analysis

Although the quantitative analysis is a useful tool in itself, it is still often paired with the complementary research and evaluation tool known as the qualitative analysis. Where a company can make use of the former in evaluating figures such as sales revenue, profit margins, and return on assets, analysts still try to evaluate information that is not easily quantifiable or reduced to a numeric value in order to get a better picture of the company’s performance. You may also see bowtie risk analysis examples.

After all, even if numbers are important, they are not the only factor to consider when trying to understand the success of a firm. Reputation and employee morale are also elements to consider before one decides to collaborate with a certain company.

The qualitative analysis focuses on meanings where quantitative analysis looks at numbers and statistics. It involves a sort of sensitivity to context rather than the desire to obtain universal generalizations. Its main goal is to establish rich descriptions rather than quantifiable metrics. The qualitative analysis seeks to answer the whys and hows of human behavior. You may also check out here business case analysis examples.

By combing these two techniques, a company or an investor can evaluate the true strength of a product, not only through its profit and shares but also through the values that it possesses. Qualitative tools in analyzing a project can include customer surveys and panel discussions. It can be initiated through the examination of data regarding numbers of repeat customers, customer complaints, and the number of warranty claims over a given period. You may also see hazard analysis examples.

However, where the one deals with numbers and the other with words, quantitative analysis and qualitative analysis are not opposites. They simply follow different philosophies. They don’t necessarily oppose each other. You may also see failure analysis examples.

Which is why when both approaches are used together, they can provide useful information that will be unspeakably helpful in making informed decisions that can promote a better society in the company, improve financial positions, and enhance business operations. You may also see business systems analysis examples.

Quantitative Analysis Examples

The act of examining the performance of a business, or the results of one of your choices, or researching the impacts of possible business actions you can take is called making an analysis. You are trying to gain a deeper perspective into whatever current dealing it is you are engaged in, instead of simply looking at things the way they are presented. You may also see vendor analysis examples.

Analyzing only the objective results will help you compare the data against qualitative results. If the quantitative results don’t justify the action, you can simply skip going any further to determine what the intangible effects will be.

For example, if you raise the prices of your products or services, it might result in the downfall of your sales percentage. A quantitative analysis will help you determine the net decrease in the sales, the effects on profit margins of the revenue increase, and the net increase or decrease in your profits. You may also see training needs analysis examples.

This quantitative analysis will provide you with an objective look at the effects of the price increase you just applied. By comparing your quarterly expenses to your project budget, you are providing a quantitative analysis of your own performance. You will also get the same result if you compare sales projections to actual sales. You may also see product gap analysis examples.

Qualitative Analysis Examples

When you are analyzing the subjective results of an action you take, you will be able to determine its overall value to your business. If you look at the intangible effects, you will see the total benefit of the actions to your business beyond the face of dollars and profits. You may also see situation analysis examples.

For example, if you apply a decrease in the prices of your products and services, you may also suffer from a decrease in your net profits. But you are also simultaneously putting pressure on your competitors to do the same—reduce their prices—or lose their marketing share, because, of course, people will prefer you now that you offer the same products for less money. You may also see cost analysis examples.

This can result in your competitors being forced to lower their prices, which could also mean that they are decreasing the quality of their products to match the decrease. They may even have to minimize their advertising or reduce their customer service. All these byproducts can’t be seen through numbers and money, but they are obviously providing you with many qualitative benefits for simply being more competitive. You may also see market analysis examples.

Although lowering your prices can hurt your profits, it can also prevent a competitor from entering the marketing, which means that you have successfully protected your sales, revenues, and profits.

By conducting a quantitative analysis of your business, you can see that your business is making a specific amount of profits in each year, or this percent of return on your investment, but it will never be able to show the goodwill you have accumulated over the same period of time. It won’t be able to bear witness to your entry into long-term growth potential based on a growing target customer base. You may also see fault tree analysis examples.

Qualitative vs. Quantitative Analysis

Quantitative Data Analysis

Four Main Types of Quantitative Research

The four main types of quantitative research only have one major difference between them: the degree the researcher designs for control of the variables in the experiment. Get to know each one—their comparisons and contrasts—through the following discussions. You may also see research questionnaire examples.

1. Descriptive Design

This type of quantitative research describes the current status of a variable or a phenomenon. The researcher does not begin with a hypothesis, but he would rather develop one only after the data is collected. Data collection is mostly observational in nature. You may also see sales analysis examples.

2. Correlational Design

Correlational design explores the relationship between variables using statistical analyses. But it does not only look for a cause and effect in the scenario, which is why it can also be considered as observational in terms of data collection. You may also see industry analysis examples.

3. Quasi-Experimental Design

Also referred to as causal-comparative, this type seeks to establish a cause-effect relationship between two or more variables. The researcher does not assign groups or try to manipulate the independent variable. Control groups are identified and exposed to the variable. Results are compared with results from groups not exposed to the variable. You may also see investment analysis examples.

4. Experimental Design

Experimental design, which is also known as true experimentation, uses the scientific method to establish a cause-effect relationship amount a group of variables in a research study. Researchers make an effort to control for all variables except the one being manipulated, which is the independent variable. The effects of the independent variable on the dependent variable will be collected and analyzed to find a relationship between them. You may also see SWOT analysis examples.

Although you can boasts of years of experience and immersion in the industry, and even if you have a long list of people whose suggestions and pieces of advice about the investments you make are the only opinions that matter to you, taking the time to look at things through the honest perspective of study-accumulated data through a quantitative analysis will help you develop a more unique insight before you make an important decision. You may also see project analysis examples.