12+ Credit Card Authorization Form Examples to Download

Most of us are very aware of how credit cards work. It can be used as a cashless payment to business transactions, hotel stays, restaurant dinners, medical purposes, and many more. However, not all can get ahold of this type of card. Corporate entities have encountered many instances where they are paid using credit cards by non-owners. For standard security and legal purposes, these companies require written authorization documents that verify the permission or consent grants. In line with this, credit card authorization forms have been created to lessen the inconvenience. Familiarize yourself with such forms by checking out these credit card authorization form templates.

12+ Credit Card Authorization Form Examples in PDF | Google Docs | Excel | MS Word | Numbers | Pages

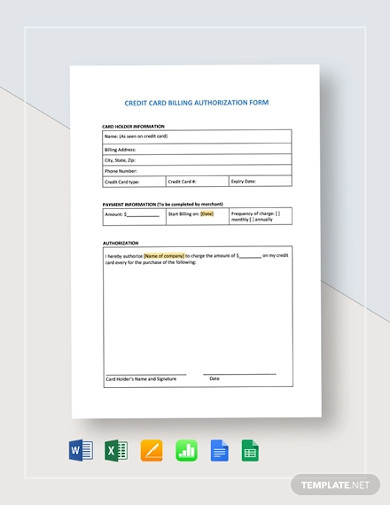

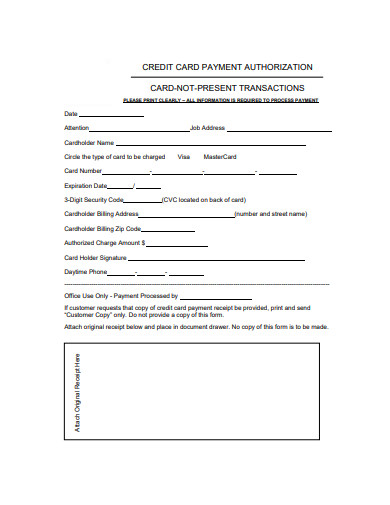

1. Credit Card Billing Authorization Form Template

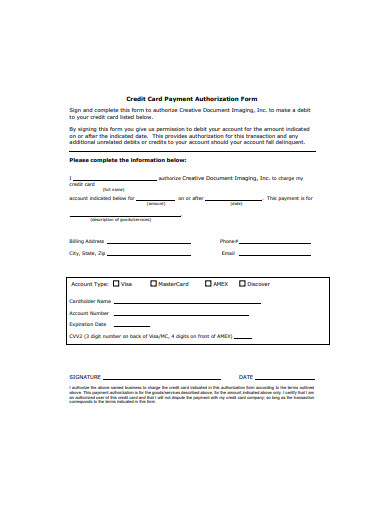

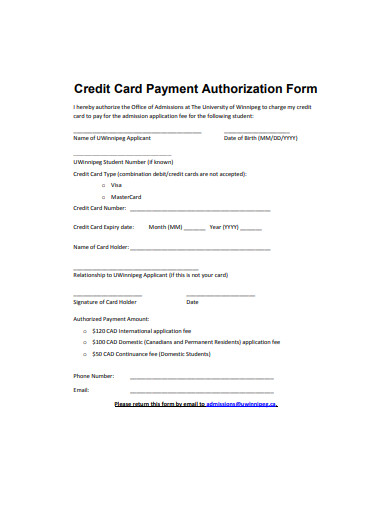

2. Credit Card Payment Authorization Form

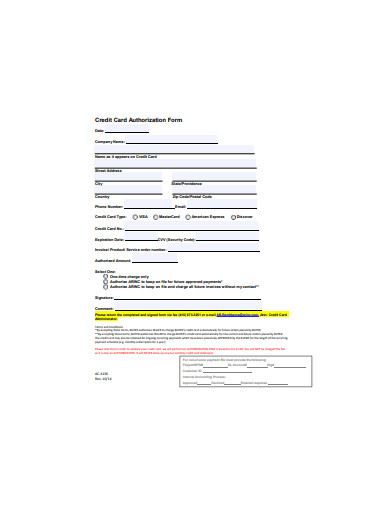

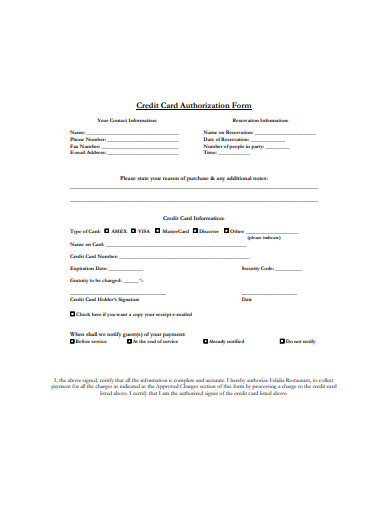

3. Sample Credit Card Authorization Form

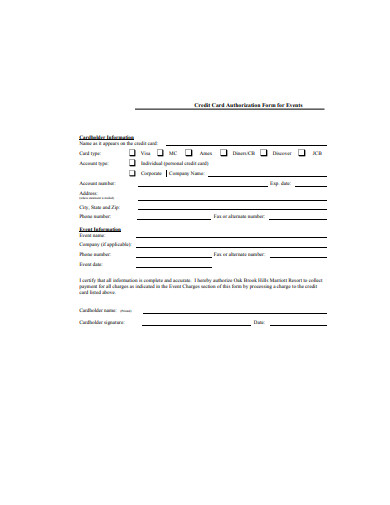

4. Credit Card Authorization Form for Events

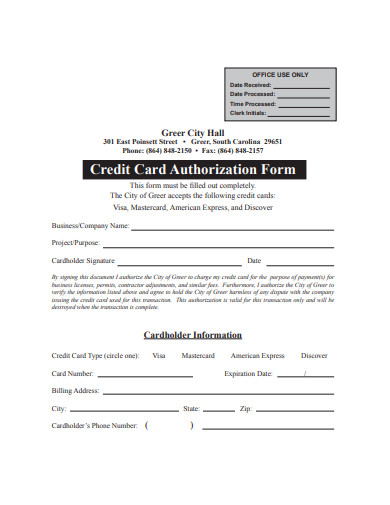

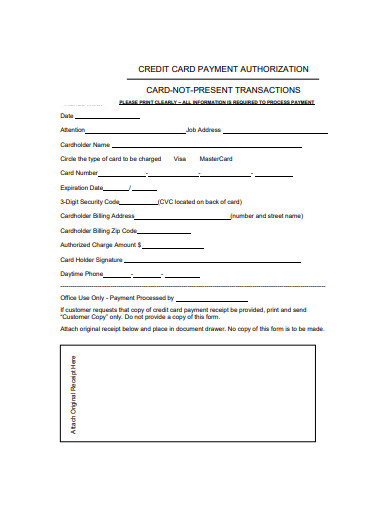

5. Credit Card Authorization Form Example

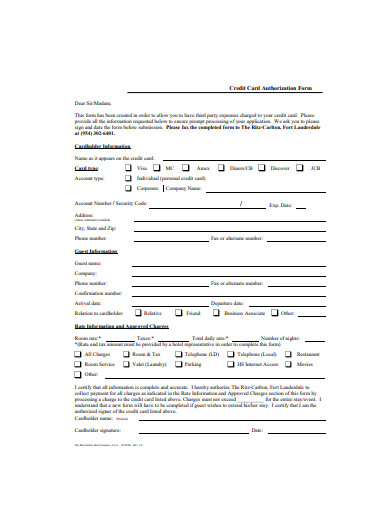

6. Basic Credit Card Authorization Form

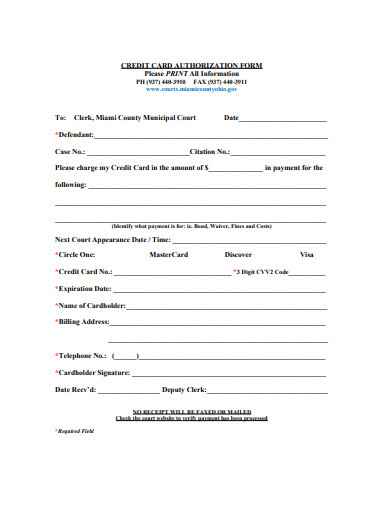

7. Sample Credit Card Authorization Form Example

8. Basic Credit Card Authorization Form Example

9. Credit Card Payment Authorization Form Sample

10. Printable Credit Card Authorization Form

11. Basic Credit Card Payment Authorization Form

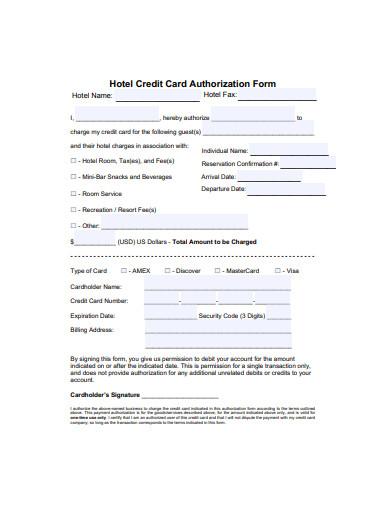

12. Hotel Credit Card Authorization Form

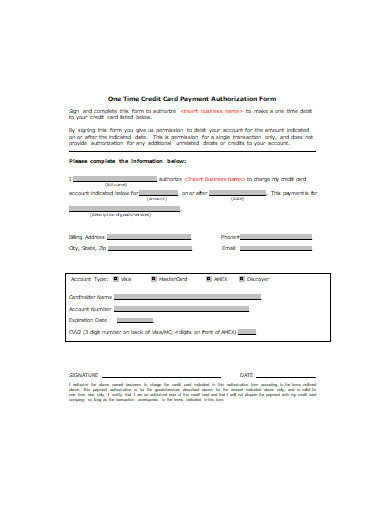

13. One Time Credit Card Payment Authorization Form

What Is a Credit Card Authorization Form?

Credit card authorization forms are fillable documents that are signed by cardholders and are given to their respective representatives, giving them the authority to use the cards on any transaction. These forms are beneficial for recurring business transactions. Another benefit of such forms, according to Square, takes place in situations when an individual leases a piece of expensive equipment. The credit card authorization form is used to constrain card activity until the said equipment is returned to the lessor.

A Limit for Your Credit

Anybody can’t just go around handing out his or her credit card. Imagine the results if every individual can do the opposite, then both issuers and cardholders are at high risk of becoming broke. This is why, for every credit card, there is a corresponding credit limit. Investopedia states that the borrowers’ credit limit is based on the pieces of information they put in their credit card application. Usually, the main factor that influences the restriction is the individuals’ capability to pay off their loans. For organizations, the main determinant is their cash flows.

How To Easily Prepare a Credit Card Authorization Form

In creating a credit card authorization form, you have to bear in mind that the details you will be asking for are all important. Moreover, they play vital roles in authenticating individuals, as well as to protect the identities and finances of your clients. Consequently, there is a need for companies to prepare such forms comprehensively. Don’t hassle yourself in preparing the forms and take heed of the list of guidelines and insights that can walk you through in making extensive credit card authorization forms.

1. Inquire on Credit Card Type

There are many types of credit cards. These include gold, silver, low interest, business, balance transfer, cashback, and premium credit cards. Moreover, there are financial service companies that offer payment networks, like Visa and MasterCard. It is with utmost importance to determine these pieces of information for your convenience in inputting the transactions to the appropriate system.

2. Get Credit Card Information

For the same reason above, details like the cardholder’s name, billing address, card number, expiration date, and cardholder ZIP code must be gathered. These details also act as proof that the cardholder and his or her representative have shared the aforementioned payment card specifics.

3. Write Down Consent Statements

To serve the purpose of the authorization form, you should set the consent statements in a formal manner. The statement should include the name of the cardholder, representative, and general credit card authorization stipulations, may it be about product purchases or rentals.

4. Allot Space for Credit Card Owner Signature

In a November 2015 article for TheNews International entitled “The Importance of a Signature,” it was pointed out that many transactions that involve finances require signatures. Good examples of these financial transactions are money withdrawals via cheques and purchases done with credit or debit cards. Though digital means have another way of authenticating individuals, such as a pin number, signatures that are inscribed personally by cardholders are most preferred in a credit card authorization form. Also, never forget to allot an additional space for the date when the form got signed.

FAQs

What is a grace period?

Grace period refers to the length of time beyond the due date that is set by credit card issuers, like banks and credit unions, to borrowers. During this period, payments will be free of charge from late fees or delayed payment complications, such as loan cancellation. The typical length of the grace period is 15 days.

How much is the average credit card interest rate in the U.S.?

In a CreditCards.com April 2020 rate report, the average credit card interest rate is 16.14%. The report shows that this is the lowest average interest rate ever since December 2017.

What should I do if my credit card gets lost or stolen?

In case your credit card goes missing, the first thing you need to do is to call your credit card issuer and inform them of your current situation. As they respond, issuers will be verifying your identity before enacting their standard procedures. Be prepared with all the necessary information, including your name, address, and social security number. Furthermore, always check your credit card statements to see to it that there are no purchases made after your credit card got lost. If anything suspicious comes up, conduct a follow-up on your issuer and inform them about your findings.

Many risks come in entrusting your credit card to someone else. And, credit card authorization forms are the perfect tools to prevent those risks from taking place. One major process that could occur concerning your credit card transactions is chargebacks. These processes help credit cardholders dispute a particular credit card activity that may be categorized as fraudulent. Needless to say, a credit card authorization form is the first line of defense to avoid these criminal activities. Therefore, it is safe to say that such forms play a very crucial role in the authentication and authorization procedures and policies of companies.