11+ Secured Promissory Note Examples to Download

Have you guaranteed someone to pay off your debts in the corporate world? In case yes, at that point, they would have certainly requested a promissory note from you. In this litigious industry, a verbal assurance is not considered solid; thus, they ask for a composed promissory note guaranteeing the payment of the said debts. Moreover, if they are incapable of paying off the obligations, the promissory note can be a source to record litigation against the indebted person.

11+ Secured Promissory Note Examples

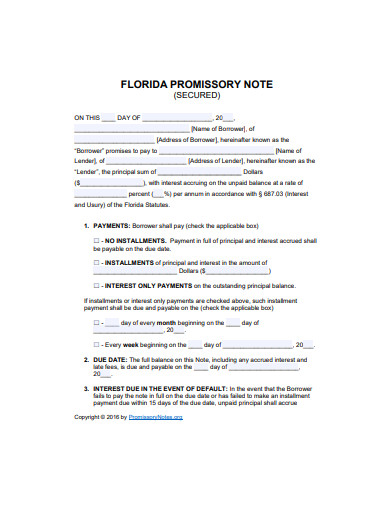

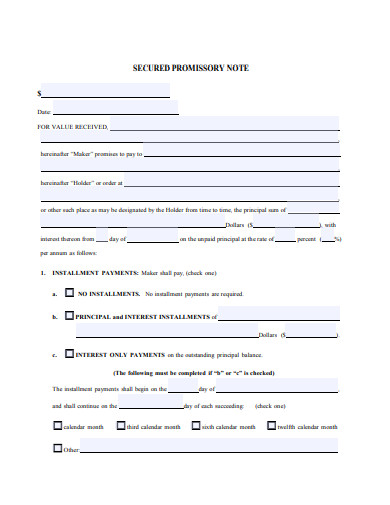

1. Florida Secured Promissory Note

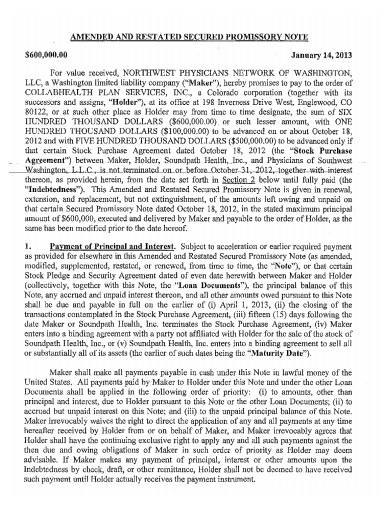

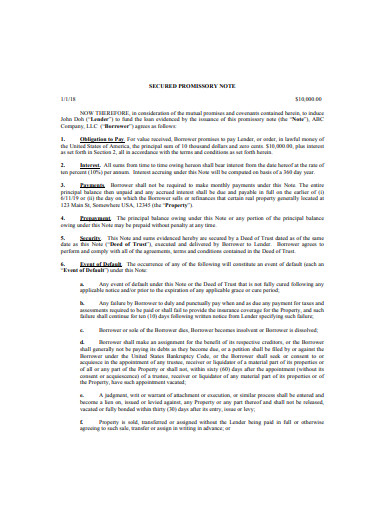

2. Amended and Restated Secured Promissory Note

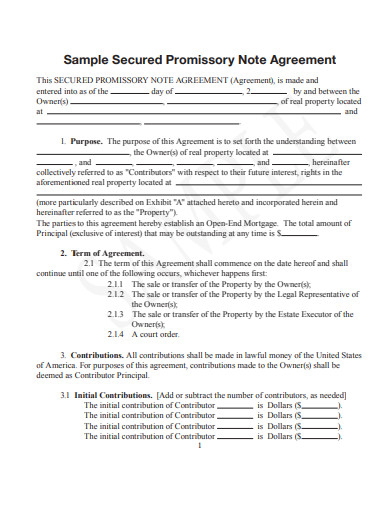

3. Sample Secured Promissory Note Agreement

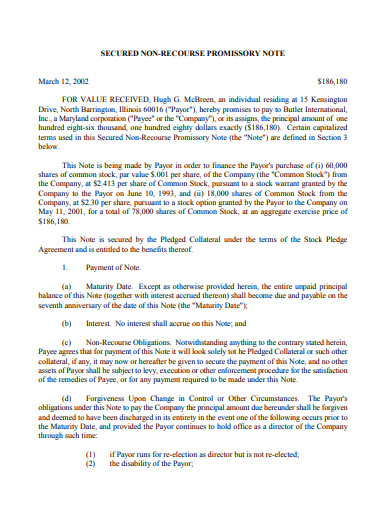

4. Secured Non-Recourse Promissory Note

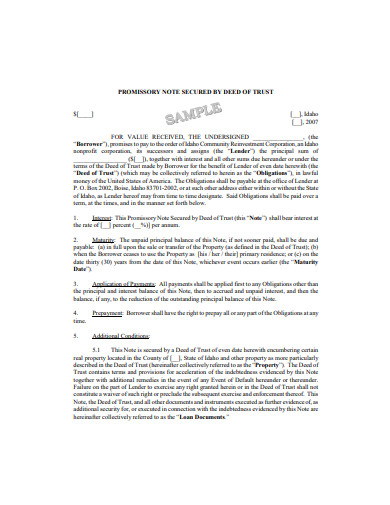

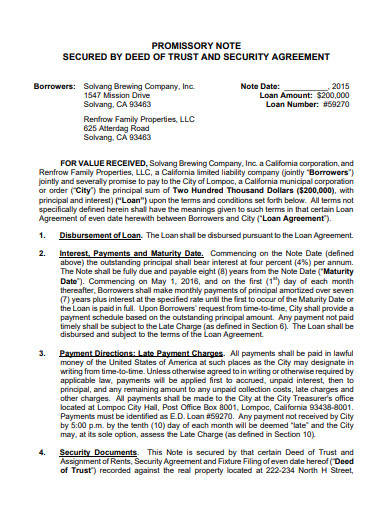

5. Promissory Note Secured by Deed of Trust

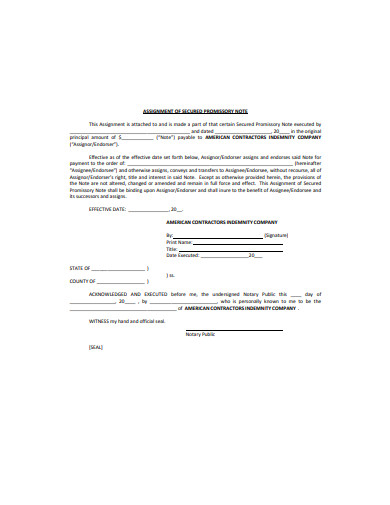

6. Assignment of Secured Promissory Note

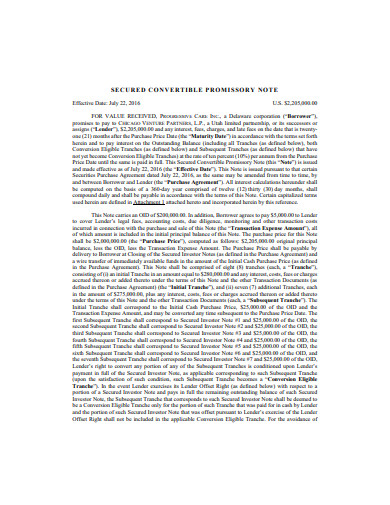

7. Secured Convertible Promissory Note

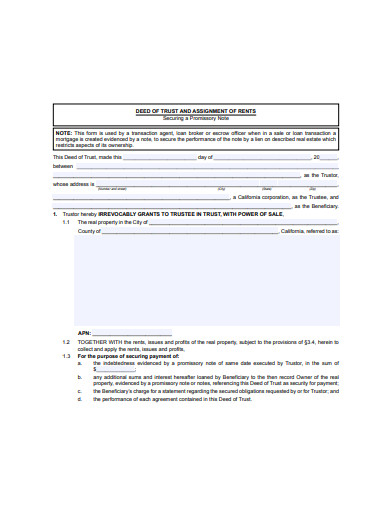

8. Assignment of Secured Promissory Note Example

9. Secured Promissory Note Format

10. Sample Secured Promissory Note

11. Basic Secured Promissory Note

12. Secured Promissory Note Example

What Is a Promissory Note?

A promissory note is just a basic guarantee made by the indebted person to the creditor to pay off the obligations or credit they have taken. This agreement contains a payer, the promissory note producer, and the payee, who lends the money. Generally, promissory notes are treated as financial instruments having a composed promise by one party to another. The note includes the total borrowed money and the indicated future date of payment. Also, it has all the terms of obligation by the guarantor to the note’s payee, counting the intrigued rate, sum, date, and put of the issuance and the issuer’s signature.

How To Write a Secured Promissory Note?

Whereas it is best to work with a lawyer when making a secured promissory note, you, as the lender, can make a promissory note yourself. To direct you all through the method, take after the easy-to-follow steps below to guarantee that you simply are making a viable and lawfully authoritative secured promissory note.

1. Use templates

Consider utilizing a secured promissory note format that you can download and customize. Not all templates can be discovered over the net that would meet your preferences?seek for one that has the perfect substance you’re looking for in a promissory note. Once you’ve downloaded a format, you’ll be able to customize the report to form assist alterations that fit your needs. You can also check the Time Note template and Installment Promissory Note.

2. State the terms and conditions

Since it could be a secured promissory note, it must have a security agreement that states the borrower’s desired resource or property as his or her collateral. As the loan specialist, you can seize and offer the collateral if the borrower defaults. This part of the promissory also incorporates other terms and arrangements, and the borrower has concurred upon covering each of the said fundamental components. You can also check the Promissory Note Extension Template.

3. Indicate the schedule of repayment

When plotting the repayment schedule, see that the secured promissory note shows the particular due dates, particularly on the off chance that there will be weekly or monthly installments. You will also demonstrate if there’s a grace period before the primary installment’s due date. You can also check the Loan Notes examples.

4. List the names of the people involved

Indicate your name as the individual making the credit and the borrower who is the person with the commitment to reimburse the advanced amount. In doing so, be beyond any doubt to type in the complete names of both parties and home addresses. By composing it, you make sense of responsibility among those who are included.

5. Proofread the note

Before a record gets considered complete, it has called to be proofread first. As soon as you’ve incorporated all the specified components into the promissory note, be beyond any doubt to require time to check and edit everything. Look out for syntactic botches and spelling blunders, and don’t forget to redress all these. Besides that, see to it that it has checked the precision and completeness of the subtle elements you input within the secured promissory note.

FAQS

Is utilizing a promissory note ilegal?

Promissory notes are an essential legitimate tool that any person can utilize to lawfully tie another person to an assertion for acquiring merchandise or borrowing cash. A well-executed promissory note has the full impact of law behind it and is legitimately official on both parties.

Who holds a promissory note?

The lender holds the promissory note as the loan is being reimbursed. At that point, the note is stamped as paid and returned to the borrower when the loan is fulfilled. Promissory notes aren’t the same as contracts, but the two regularly go hand in hand when buying a residential.

What happens if you can’t commit to a promissory note?

Promissory notes are legally official records. Somebody who fails to reimburse an advance detailed in a promissory note can lose a resource that secures the credit, such as a home or confront other activities.

Individuals take out loans for numerous reasons—lodging, education, transportation, contract, and countless more. It will help if you supply financing with the most extreme security that serves your interface as the lender on the off chance that you run your loaning commerce. With a Promissory Note, you’ll spell out the agreements you have set between you and the borrower, together with the lawful activities that you can carry out in case they default. This article learns more secured promissory notes, its definition, significance, components, and tips for coming up with one. Moreover, we have included high-quality, secured promissory note layouts that can download and customize for any reason it can serve you.