10+ Unearned Income Examples to Download

The term unearned income was first used by Henry George when it meant the income or capital gained by any monopoly or ownership of land. But at the present date, this is used to mean the capital gained by the ownership of any property or inheritance. It also includes pensions and public welfare payments. It is also termed as passive income sometimes.

What are the different types of Unearned Income?

There are three major unearned income forms rent, interest, and profit.

1. Rent comes from ownership of different types of properties.

2. Interest comes by owning some financial assets. It comes while checking or savings deposit accounts, providing loans and providing the certificate of deposit.

3. The profit comes if you own or process any capital equipment. Dividends may be taxed but profit you with reards on your investment. Investments’ rewards have to be shared with the shareholders on a regular basis, either on monthly, quarterly or annually.

There are some other sources too that yields capital without mich efforts like:

- Pensions

- Public Welfare Benefit

- Lottery

- Offerings

- Veteran’s Benefit (VA)

- Inheritances

- Property Income

What is the Difference between Unearned vs Earned Income?

1. Earned income refers to the gains that you have achieved by engaging in some works or activity to make money. On the other hand, unearned income comes from having done no service or performed any work.

2. Unearned income consists of several income sources like pensions, distribution from the retirement accounts, interest income, dividends, passive income, annuity payments, etc. Whereas after retirement, you hardly stay fit enough, economically, to contribute to your retirement accounts because you generate earned income to make an IRA or Roth IRA.

3. For your earned income you might have to pay two main taxes, which are Social Security and Medicare taxes and federal and state income taxes. The social security taxes include 12.4% of taxes on the income from which 6.2 % tax is cut down from the employee’s payroll and the other 6.2% is taken from the employers. Whereas unearned income is not supposed to pay any sort of payroll taxes. But the sources it comes from, are subjected to Adjusted Gross Income (AGI) for federal income tax.

10+ Unearned Income Examples & Templates

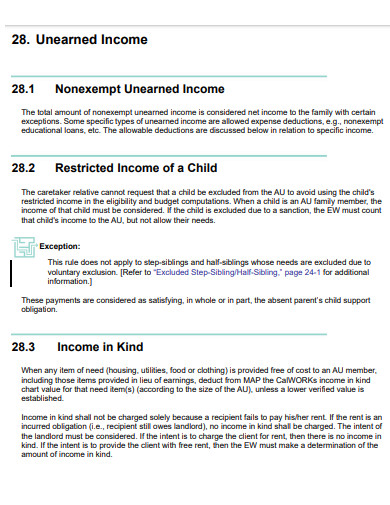

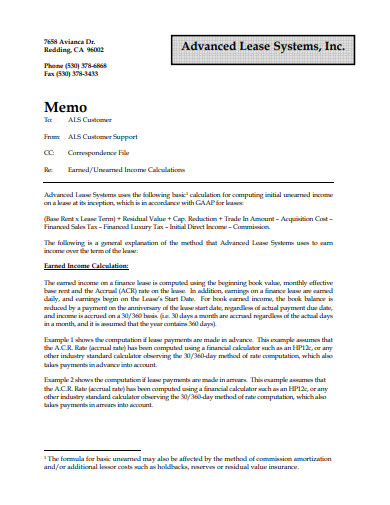

1. Unearned Income Template

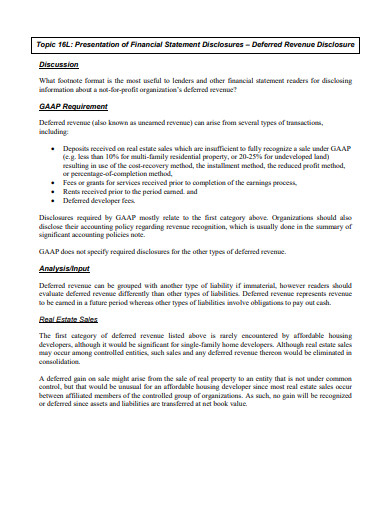

There is a huge difference between the process of earning earned and unearned income. As seen normally earned income can be understood as the income generated by doing a job or any business and activities. But unearned income sources do not resemble, in any way, with the earned income sources. You can have a detailed idea of the concept and its meaning by referring to this template which highlights the different aspects of the process and its different sources. So, have a look at this template today!

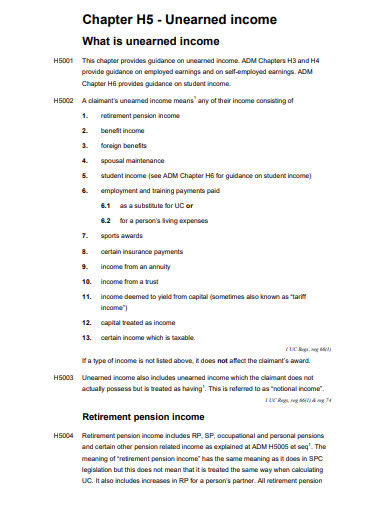

2. What is Unearned Income Example

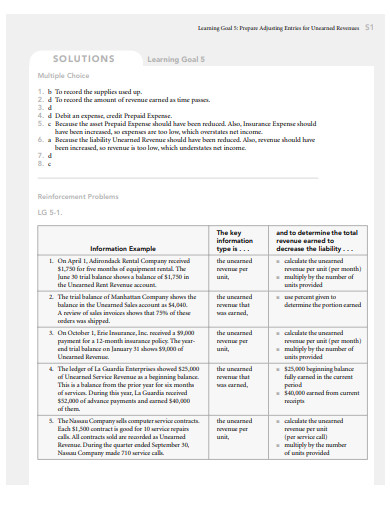

Unearned income is a type of passive income that comes from some indirect sources of income. The income sources are mostly the interest, rents, bonds and other gains that do not require any effort or much commitment. You can have a more vivid idea about the unearned interest income by having look at this template and its different point wise definition. So, check out this template today and get your work done simply.

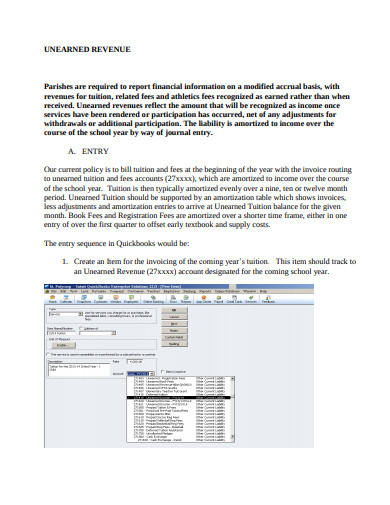

3. The Perils of Unearned Income

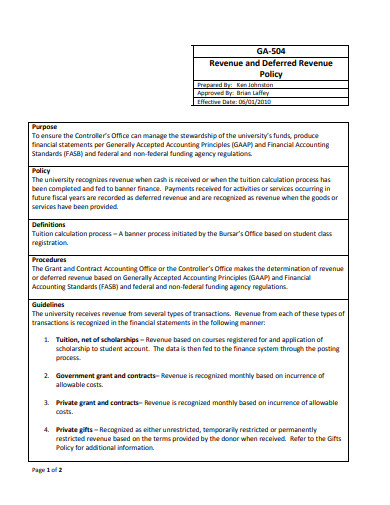

Unearned finance is the sort of income that you do not need to pay any direct tax for. Which is always applied on earned income payrolls. The given sample of template finely frames the description of unearned income specifically. Choosing this template might help you to strategize your assets properly to gain more value from them and add them to your retirement accounts. So, read the template once.

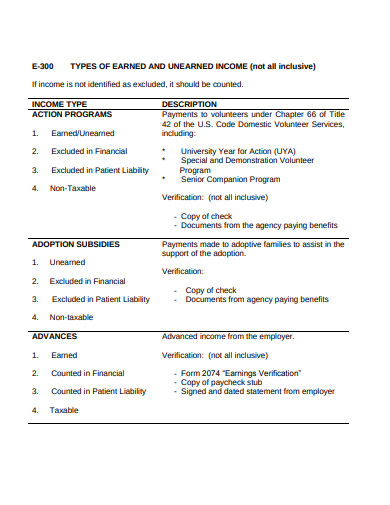

4. Types of Earned and Unearned Income

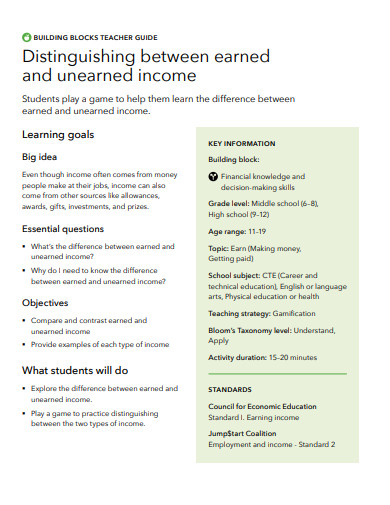

If you are a businessman who is relying on unearned assets as the main source of income, this template might be of great use to you. Framing a clear description of different aspects of unearned income sources this template specifies its four main types. It also focuses on earned income types. Choosing this example would help you to understand and the process for framing an unearned income statement. So, have a look at this template today!